Between the current dump, and the last prolonged multi-year dump, maybe you’re just here for a hot minute to see if you missed anything in crypto since the original DeFi Summer.

We can recap for you:

Pendle.

Among the handful of DeFi narratives to emerge and gain traction during the most recent DeFi winter was yield trading, most vividly illustrated by the superlative execution of Pendle Finance. Pendle presently wields a commanding market cap of half a billion dollars and $4.75 billion market cap.

Granting that “yield trading” is undeniably a real phenomenon, the big question is if this will be a “winner-take-most” market, or if we will see dozens of other successful market entrants gobble up a sustainably large piece of the pie?

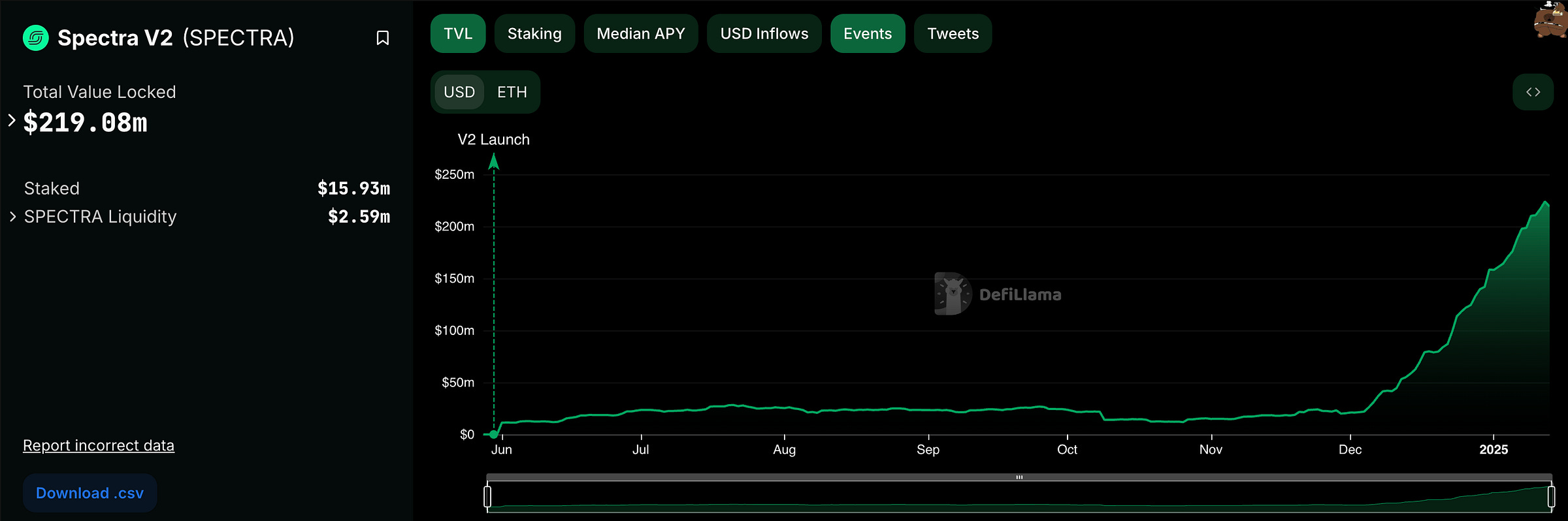

Spectra Finance undoubtedly is hoping for the latter. Spectra has become the breakout protocol of the New Year, posting true hockey stick growth since the start of last December.

At the moment Spectra wields $200MM in TVL and a $27MM market cap.

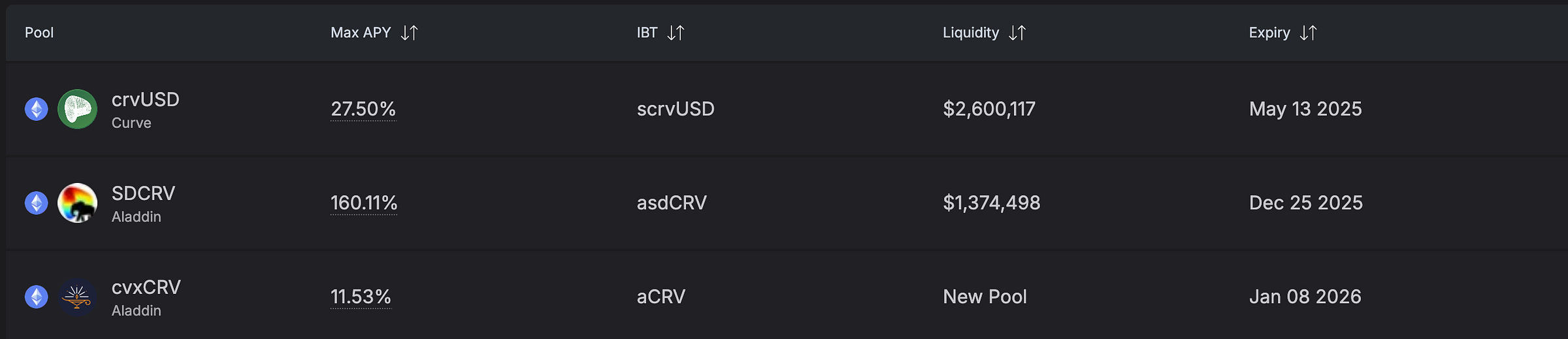

Why might you want to take a closer look at Spectra? One notable difference that readers of this blog might appreciate is the active Curve yield markets. While Pendle historically opened some $crvUSD markets, they never really took off, most gathering just a few thousand dollars in liquidity. The current $scrvUSD market has $140K

In contrast, Spectra boasts several healthy markets for Curve tokens

Is Spectra worth putting on your radar? We took a look under the hood, here are our notes on what we discovered.

Disclaimers! Author holds small bags of $PENDLE, no $SPECTRA yet