Is the free market efficient? It’s complicated.

A weekend experiment conducted by Leviathan News offers a curious case study. $20 worth of ETH cleared an auction for just $0.02 — a 1000x discrepancy!

According to the Efficient-Market Hypothesis, asset prices reflect all available market information. In other words, it’s impossible to “beat the market” because everything can be priced into the market.

If this is true, the auction results here have massive and confusing implications. At the moment, 1 SQUID cannot buy much, in the way that the penny is being phased out of circulation. With an implicit market valuation of about two cents, and ETH trading around $2K, a single $SQUID can only purchase 0.00001 ETH, per the Curve pool that serves as the primary source of liquidity.

When .01 ETH was placed up for auction this weekend, it should therefore have cleared for ~2000 $SQUID according to everything we know about markets. Instead, one savvy cryptocurrency tycoon was able to swipe this for a lowball bid of just 1 $SQUID, an instant 2000x.

The implications of this are confusing. If the markets are truly efficient, then some of the following must be true:

If 1 SQUID is truly capable of purchasing 0.01 ETH, then it implies SQUID may be worth significantly more than the market values it — such a purchasing power would put SQUID’s market cap at nearly a billion dollars.

The issue may alternately be that ETH is massively overpriced, and the fair value of 1 ETH may be closer to $1 than $2000.

Both appear absurd to paradoxical, since much more liquid markets exist for both tokens. We have to look instead at the conclusion that markets may not be efficient.

For starters, we have to see if there were hurdles that could have pushed the auction markets into a state of inefficiency. We can posit the following barriers:

Information Failure

Participation Barriers

Rational Abstention

Let’s consider all three:

Information Failure

Is it possible that nobody bid on the auction because potential bidders were simply unaware? Weekends are a time when traditional markets are closed, and much of the crypto community also quiets down.

A failure of communication might explain away any potential paradox, however it does not seem to be a likely explanation. Even during the weekend quiescence, a Telegram post about 12 hours before the auction expiry attracted nearly 1000 views.

A concurrent 𝕏 post received another 300 views.

Similar information distribution succeeded at driving bids to all prior auctions, so we suspect this explanation is unlikely.

Participation Barriers

Another potential explanation is that participation barriers forced the market into a state of inefficiency. Perhaps the auction taking place on the Fraxtal L2 presented an insurmountable barrier to participation, if the chain was somehow too difficult for crypto natives to use.

However, a cursory examination of the Frax homepage would seem to refute this. Bridging assets from Ethereum to Fraxtal is so simple that only a truly debilitating level of mental incapacity would make it too challenging to use:

We conducted a test to confirm the operation of the bridge. We found bridging cost well under $1 and took just minutes, so neither cost nor time would have been prohibitive for an auction open for a full day. With a dozen successful auctions, participation hurdles are an unsatisfactory explanation.

Rational Abstention

Finally, we might consider whether something about the auction mechanics rendered it rational to avoid participation.

To draw a real world parallel, if you are a walking and see a penny on the ground, it may in some cases be more rational to ignore the existence of the penny. With minimum wage at $20 in many municipalities, a delay of around two seconds in picking up the penny would be unprofitable relative to working an extra two seconds at the air frier. Factor in the wear and tear on your trousers, and it can be a losing gamble.

In this case, we have to consider the hurdles in skipping out on picking up a $20 bill. An old joke goes:

Two economists are walking down the street. One says, “Look, a twenty dollar bill!” The other scoffs: “Impossible, if it was a genuine bill, somebody would have picked it up.”

It may be possible that a version of “mass formation psychosis” played out. With a relatively novel auction format, onlookers may have feared the free money could not possibly have existed in the first place and avoided acting out of fear of a trap.

In this case, cognitive biases proved to have played 99.9% of people as fools. The winner already received their WETH with minimal friction. Asked for comment, the winner「Zero2」 confirmed receipt, likely while holding a snifter of brandy and cackling about their free money. The winner provided comment, hinting at their motivations:

“This auction just shows the real value of $SQUID, I didn't think I would win by betting only 1 squid, but it seems the sharks think $SQUID is much more valuable than that, nothing else to say except... let the tentacles take over the world!"

Analysis of the transaction shows what a well-executed heist this was. They placed a bid without even dipping into their $SQUID stash, instead converting 0.00001 ETH into a single $SQUID via a zap contract that traded the Curve pool at spot prices, to net .01 (~$20) of Ethereum in a single trade. With Fraxtal’s minimal gas costs (0.00000003), this was an instant 1000x trade. If they like, they could use this to buy 2 SQUID to double up their investment and still retain almost a full 0.01 profit, positioning the winner as a powerhouse in future auctions.

Inviting Oligarchy

This episode shows off the clearest illustration of how the rich maintain their wealth, while the masses are condemned to poverty. The top 1% are not known for leaving money on the table. If “Rich Dad” always takes a free dollar, while “Poor Dad” always declines, over sufficient iterations the former will become a billionaire.

The Great Man theory of history posits that only a select few are capable of actually altering the flow of history. Perhaps you can just do things. But most cannot or will not. The proletariat are fated to inaction and condemned into the cycle of poverty. From the gutters, they are cursed to castigate their betters who appear to flaunt free will so effortlessly.

And what of the Efficient Market Hypothesis? There is an implicit issue with this hypothesis, which is that it requires an actor to make the markets efficient. That is, whenever new information is generated that creates a mismatch in price, some trader must act to correct this mismatch.

Cryptocurrency in 2025 sheds a plethora of information, more than traditional markets and certainly far more information than can be processed by any one individual. Information asymmetry is extremely commonplace in the long tail of cryptocurrency. It means that free money is in fact available. Great profits can accrue to those who are capable of parsing this information.

Takeaway

In the meantime, Leviathan is happy to spend its money for the pursuit of scientific advancement. Unlike mainstream science, which suffers from a replication crisis, we have already created a new auction under the same terms in an attempt to replicate the experiment. Already, the results for the new auction are different.

Pending the results of this auction, we also plan to conduct additional trials, with efforts to randomize the timing, publication, and value of the package. If 0.01 ETH is overlooked, perhaps a higher number might compel action? Would users jump for 0.1 ETH? 1 ETH? 10 ETH?

If you seek to break out of the cycle of poverty by exercising agency, here are steps for how you can pick up the free money sitting on the table in front of you:

Check https://leviathannews.xyz/auctions frequently for the most up to the minute auction data.

Join the Auction Block Telegram channel for notifications and live auction chatter.

The truly powerful can approve the Auction Bot to bid on their behalf for the lowest friction in auction bidding.

Follow the Leviathan 𝕏 and Telegram feeds for breaking alerts about auction news and all variety of crypto news from the deepest niches of DeFi.

Watch our livestreams on YouTube and Spotify where we often show live auction results.

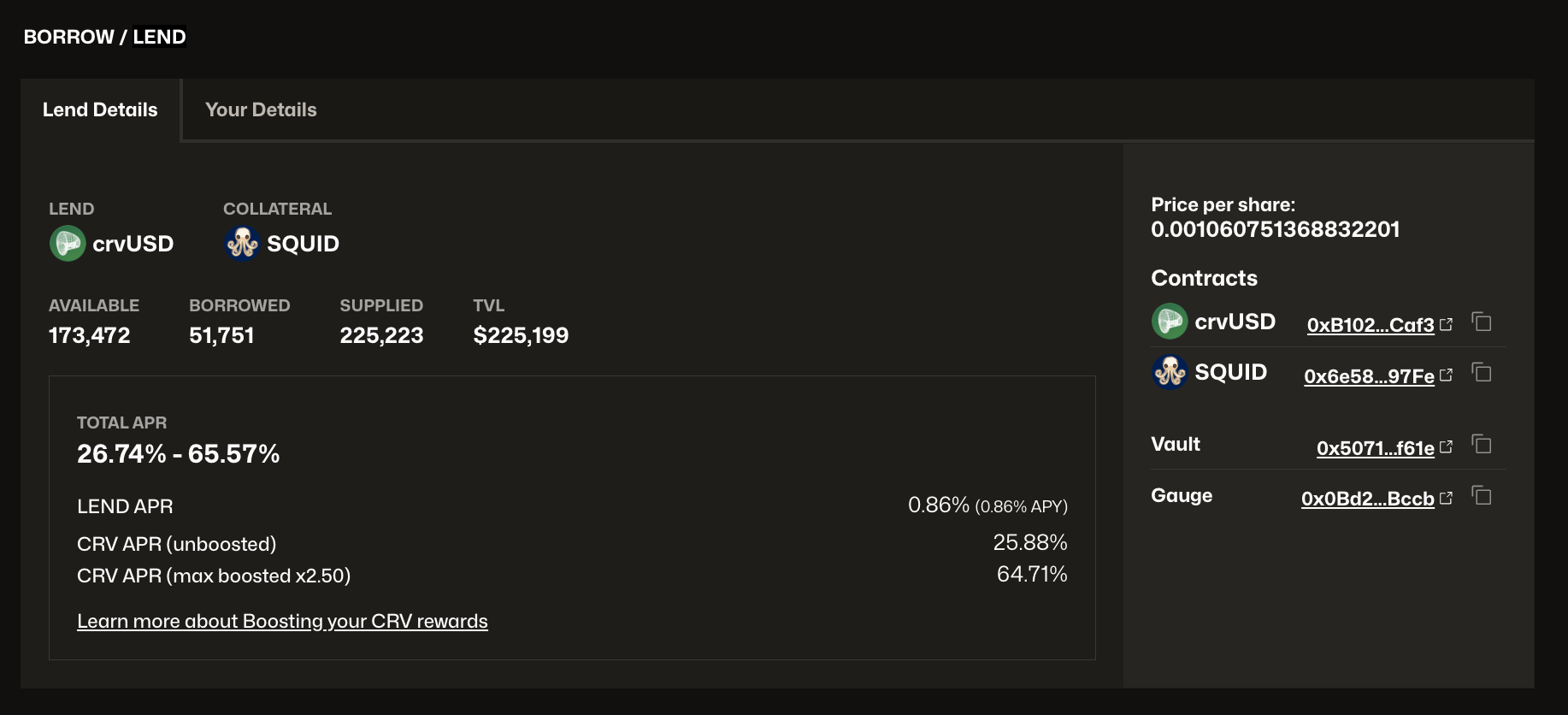

LP into the Curve pool to passively earn a piece of trading fees from users scrambling over the auctions, while concurrently earning rewards in $CRV

Supply $crvUSD into the associated Llama Lend pool to bolster the wider ecosystem:

Any of the above steps will give you more information, and therefore provide you an advantage regarding information asymmetry in crypto.

As we’ve seen, efficient markets suffer from information overload. Leviathan reliably parsing the signal from the noise can be wielded as a powerful tool to potentially attain advantage and therefore profits.

FREE ALFA:

For those who made it to the end… another 0.01 ETH giveaway is scheduled to close in about 3 hours from now… will you be among the fools mocked for ignoring it? Or among the superior caste celebrated by the wealthy for grabbing free money when it presents itself?

Technical Notes: Auction House v2

Whether or not this weekend’s bidding behavior winds up disproving the Efficient Markets Hypothesis, the first generation of the Leviathan Auction House has been a success — over a dozen auctions, with nearly all seeing good bidding behavior for both Leviathan inventory and even some auctions conducted on behalf of partners. If you have auctions you are interested in conducting through our Auction House please drop your suggestions here:

The first month has revealed a lot of demands and limitations of the first version of the Auction House. Based on these issue we upgraded it. The Auction House is contained within the Auction Directory, which uses a flexible architecture to work with multiple instances of the Auction House. This means instances of the auction contract can be upgraded with minimal disruption.

This weekend saw a quiet launch of the newest generation of the Auction House, with the latest ETH giveaway occurring via the new Auction House and serving as a quick stress test of the new contract. This newest contract is designed to be backward compatible with the prior Auction House, so most auctions can (and will likely) use the same prior mechanics without any functionality changes.

However, the newer contract does include a few new bits of functionality, designed to address user comments:

Improved Multisig Support

Scheduling auction end times was a challenge, as auctions were created with “durations” of seconds. Given the difficult in scheduling livestreams, it was already difficult to forecast the exact window of livestreams in advance. Far more difficult to predict when signers of the multisig might execute the final transaction to set up an auction. The practical result was that the first Auction Block never transferred ownership to the Leviathan multisig, relying on an end user to voluntarily forward auction proceeds manually to the multisig upon settlement.

The newer auction contract introduces the role of “auction managers” whom are empowered by the multisig to generate auctions, so ownership can be more easily transferred to the multisig. Additionally, a new function exists to create an auction with a specific end timestamp instead of a fixed duration, to allow for more flexible auction construction.

Early Withdrawals

The first generation of the Auction Block required auctions be settled before withdrawing funds. However, this was judged to be an unnecessarily strict security feature, so the new version relaxes this constraint and funds may be withdrawn upon being outbid. The UI already accommodates early withdrawals.

Instabuy

Auctions may be optionally created with instabuy prices, which immediately end the auction and settle it on behalf of the winner. This feature has not been extensively tested however, so we expect it will require more testing in development before auctions are created with this feature.

Hookers

With the popularity of Uni v4 hooks, we also add support for post-auction settlement hooks. When enabled, an auction set up with a hook will call a set function on an external contract address upon auction settlement. This pushes toward fully trustless auctions, which could be used to, say, instantly receive their ETH upon auction conclusion in the recent series of WETH giveaways. This also benefits the auction managers, who are relieved of the burden of checking OFAC sanctions lists before wiring ETH to avoid the hassle of poisoning their address to fulfill auctions.

veCRV airdrop?

Since you read to the end, some lite alfa…

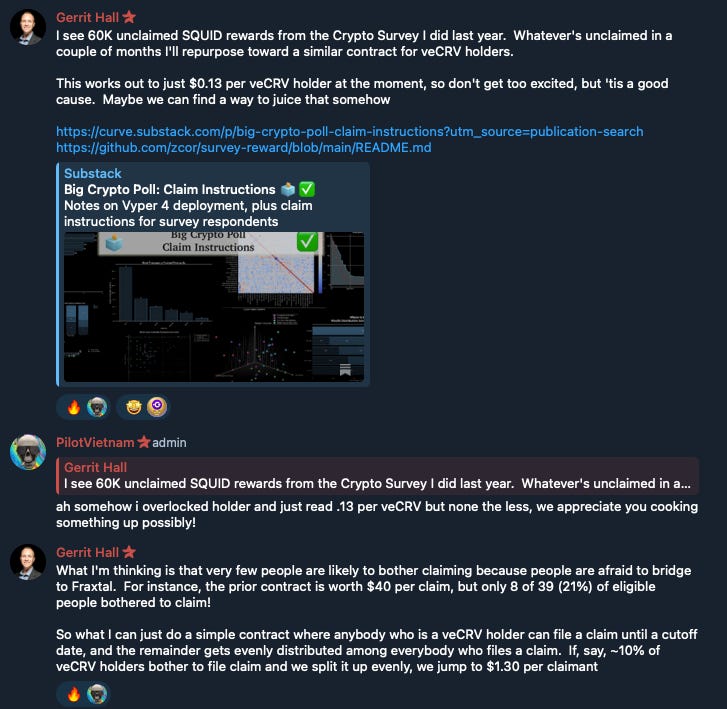

Over the weekend users inquired about a $SQUID airdrop for veCRV holders

There was no such airdrop, but as a $CRV maxi always looking to boost value to the Curve ecosystem, we would like to do so as an individual, if not the Leviathan org. We arrived at the following idea:

In other words, as an individual, we set up an airdrop to respondents of our Big Crypto Poll. Since most people did not pick up the free money (currently worth ~$40, another nail in the coffin of the “efficients market hypothesis"), we can just set a deadline and repurpose the remainder to veCRV holders. This is useful as an instructional exercise, since the veCRV contracts have a nice feature to make it easy to calculate airdrop inclusion. It will take some time to set this up, so who knows when it will happen, but fair warning to anybody who completed the survey and did not claim their airdrop:

Big Crypto Poll: Claim Instructions 🗳️✅

As we’ve begun releasing the results of our Big Crypto Poll, we’re thrilled to also thank everybody who participated with some tokens!