Is it too soon to dub this the wrapped BTC Wars? Coinbase has launched $cbBTC

It’s exploded out of the gate, having hit $100MM market cap, primarily on Ethereum, followed closely by Base.

Fans of cbBTC point to the 1:1 fungibility of and ease of minting for Coinbase users:

Opponents point to the centralization concerns of Coinbase, such as the freeze capability in $cbBTC that doesn’t exist in $WBTC or $tBTC

Bitcoiners also pushed back:

As cbBTC flooded to Base, tBTC meanwhile moved to dominate on Arbitrum with native minting.

Should tBTC succeed in their effort to take over WBTC, it might represent a major salvo in the burgeoning wrapped Bitcoin wars. At present, the market cap of the three (in terms of BTC, per CoinGecko):

🥇 $WBTC 152,842

🥈 $tBTC 3,390

🥉 $cbBTC 1,739

The true Kirk wrote an article comparing among the three.

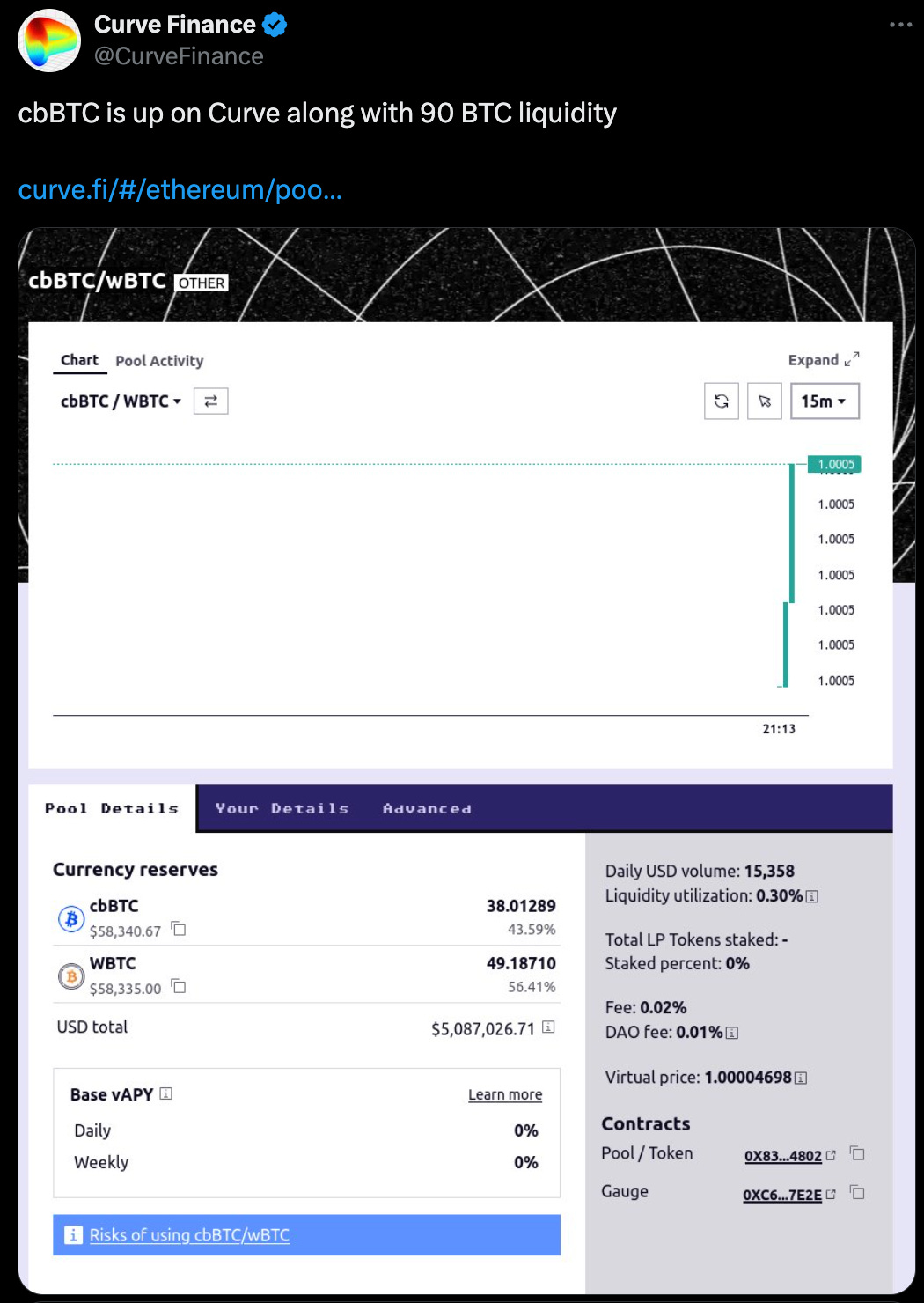

Curve quickly moved to jump on the $cbBTC launch

While simulteanously welcoming any exodus from Sky (formerly Maker) into its LLAMMA powered lending markets.

There’s been plenty of other competitors beyond the top three hoping to make their mark in the wrapped Bitcoin wars. The LBTC (Lombard wrapped BTC) pool on Curve, launched a few days ago, has seen good natural trading volume

For yield farmers on Curve, the Threshold tBTC/stBTC pool remains a good choice

As does the tBTC/WBTC pool

and the BadgerDAO eBTC/tBTC pool

Of course, not Financial Advice!