Is this the end of an era? A giant in the cryptocurrency space about to change forever?

Yes, yes… the Ethereum merge and all that… but more immediately… will USDN live long enough to see it?

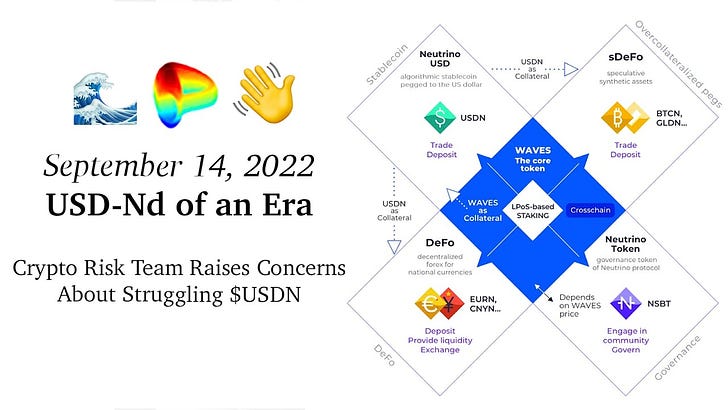

A must-read report by the Crypto Risk Team, headlined by DefiIgnas, pulls zero punches in its exhaustive overview of the USDN ecosystem.

The report is also helpfully summarized in thread form for those who can’t be bothered to leave Twitter:

While the full threads are worth a read, the TL/DR is scathing.

The timely report drops as USDN has been suffering a liquidity crunch in the throes of the bear market. The current backing rate sits at a mere 9.6%, and the pool is 90% imbalanced towards USDN.

The price of the stablecoin has been under sustained pressure recently.

As usual, the WAVES team is glib on the subject.

Nonetheless, discontent is spreading.

In yet another must-read thread on the subject, @WormholeOracle supplements the report by reviewing the storied history of USDN pool on Curve. As he notes, the pool was always something of an “unfortunate accident,” securing unusual and favorable pool conditions in a time when risk assessments were less thorough.

It wasn’t so long ago that the pool was among the largest revenue drivers for Curve.

Yet the bull market is just a distant memory at this point. Amidst the current market woes, the pool’s APYs have reduced from 10-15% at peak to a paltry 0.13%. The pool’s earning $2MM gauge emissions each year, and creating just $11K in revenue. Ser Oracle issues the interesting recommendation of updating the pool to a v2 pool.

Nobody has yet formalized these concerns on the governance forum, but we imagine somebody will grab the free clout and spark a discussion there shortly. Big thanks to the Crypto Risks Team for such a comprehensive review and kicking off this important discussion!

We’re grateful to see more self-policing of the DeFi ecosystem so we need not wait for the real police to Do their jobs.

As a community, we’re drowning in more data than any one person can process. About 80-90% of people are happy to play the role of idle bystander, simply assuming other people are performing due diligence. Yet if everybody plays bystander, then nothing gets done. Blessed are the minority of people who actually ask the tough questions.

In the same vein as this analysis of USDN’s profitability, the great @YettyWapp ran some similar numbers last evening on FRAX.

🧠 quickly fired back and reiterated the symbiotic nature of Frax and Curve: in particular he noted the effect of bribes on these numbers, and argues the recent launch of Fraxlend is likely to cause an uptick in flywheel velocity as it scales.

Whether or not this line of inquiry ultimately topples Frax remains to be seen. Nonetheless, Ser Wapp is demonstrating exactly the level of pugnacious skepticism we need to keep our community safe. Neither friends nor foes should be spared the difficult questions. Not every line of questioning will lead someplace, but the beauty of the internet is that people are always eager to issue corrections to whomever is brave enough to first stick out their neck.

If you want to reward Ser Wapp’s diligence, you may want to check out their Vendor Finance project, which offers non-liquidatable, fixed-rate, perpetual loans on a variety of tokens (including $CRV). The innovative protocol certainly is overdue a longer write-up than this short plug… but sadly not tonight…