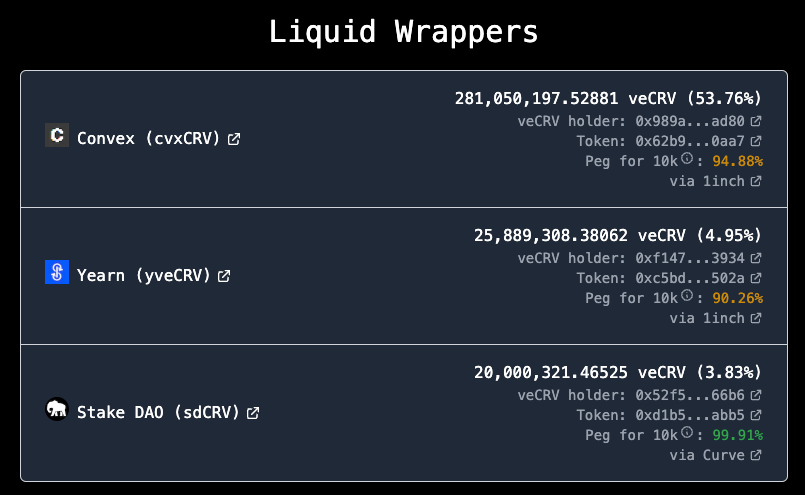

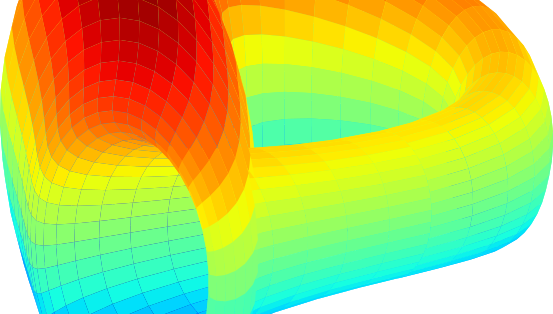

Last week we’d checked in on the wrapped $CRV wars — but as so often happens in DeFi, everything has already been upended. Just hours after publication, a governance proposal dropped teasing $yCRV:

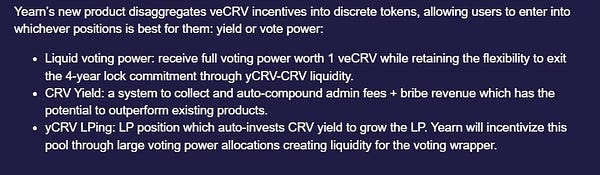

yCRV is the latest generation of Yearn’s liquid veCRV wrapper product. It is an upgrade to the yveCRV/yvBOOST system that exists today, and will feature improved liquidity, yield, and the ability for users to cast votes on gauges.

Yearn’s $yveCRV was among the earliest batch of wrapped $CRV products, featuring a yvBoost system. Yet in the intervening time, simplified offerings like $cvxCRV hit the market and upgraded user expectations. $yCRV appears to be an attempt to modernize this experience.

At the moment, details are scarce, but we have a few clues about what $yCRV will look like. The forum post boasts that “new yCRV tokenomics has a number of clear benefits over the old system which give us confidence that will bring the price closer to peg.”

This has already helped restore the $yveCRV peg, which jumped from 78% to 90% since last week.

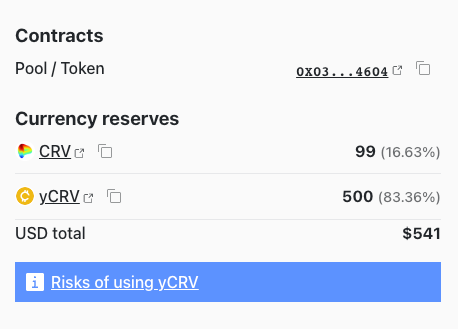

The forum post also links to the new factory pool that was created for $yCRV and seeded with a little $yCRV.

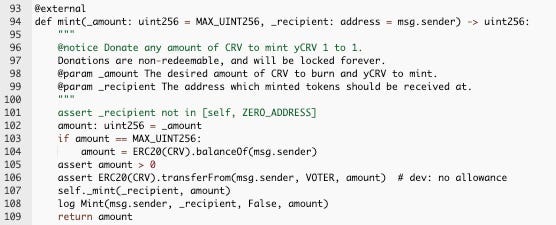

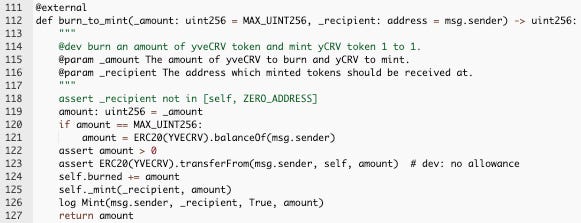

Hopping from here through to the Etherscan page of the $yCRV token, we can see it’s mostly a standard ERC20 token, deployed two weeks ago and written in Vyper 3.6, the most current version. In addition to custom sweep functions which admins can use to collect tokens inadvertently sent to the contract, there are also two custom mint functions.

The standard minting process, which mints $yCRV at a 1:1 rate from $CRV

Function to burn $yveCRV for $yCRV at a 1:1 rate

The contracts here don’t include any redemption mechanisms. From the forum post, we know the Curve is intended to serve as the primary source of liquidity.

The obvious home for yCRV liquidity is on Curve. With CRV incentives, this pool will become the main source of liquidity for yCRV - an improvement over the situation today with yveCRV/yvBOOST where liquidity is split across multiple DEXes.

Also missing in the contract is the promised voting mechanics. This part is apparently still in development or under audit.

this is the only part of the system that isn’t fully completed yet. there is still some final development + audit work to do on the voting system. but it will be fully permissionless + on-chain voting that requires a short-term lock.

docs describing the tokenomics and mechanics of system should be out soon.

The team has also dropped a teaser website. At the moment it’s only showing a label reading “R.I.P. Alpha.”

That said, the repo is public, so we can sniff around here for some more clues. The repo trumpets that yCRV will feature the “Best $CRV yields in DeFi”

The repo is mostly a placeholder, but we can gather a few more clues from the source code of the teaser site’s About page, which is either disabled or not showing correctly on the current frontend.

Promising to “Win the Curve Wars with Yearn,” the help text claims the team has “Completely overhauled our suite of Curve products; refining, improving, and simplifying everything. The result? Our users get the highest yields in the most streamlined way possible. LFG.”

The page describes two associated tokens:

$st-yCRV: staked yCRV

$lp-yCRV: from LP-ing, either the Curve LP token or a Yearn v2 token

The site promises you can swap between these token anytime to whichever is generating better yield. “You get more yield, and a fun swap experience. Win win.”

Yield farming has been overhauled to be more passive: “Whichever option you pick, rewards are auto claimed and auto compound - giving you supercharged yield without you having to lift a finger. After all, lazy yield is the best yield.”

The help text also confirms that $yveCRV and yvBOOST are being deprecated, no longer earning yield but possible to migrate. They also describe protections against slippage and MEV.

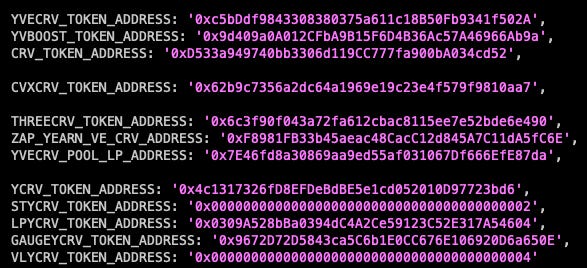

The repository’s config file also includes a list of deployment addresses.

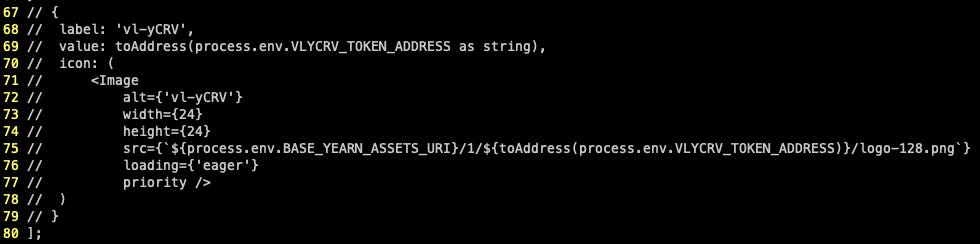

We see that the yCRV addresses correspond to the Curve deployments: the aforementioned pool token and the Curve LP/Gauge tokens. The $st-yCRV is a placeholder address. We also see a cryptic reference to an undeployed vl-yCRV contract whose only reference in the repository is commented out — maybe vote locked yCRV?

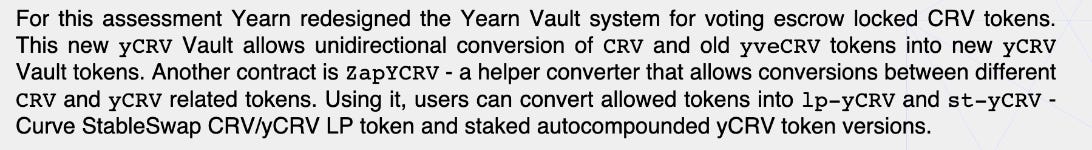

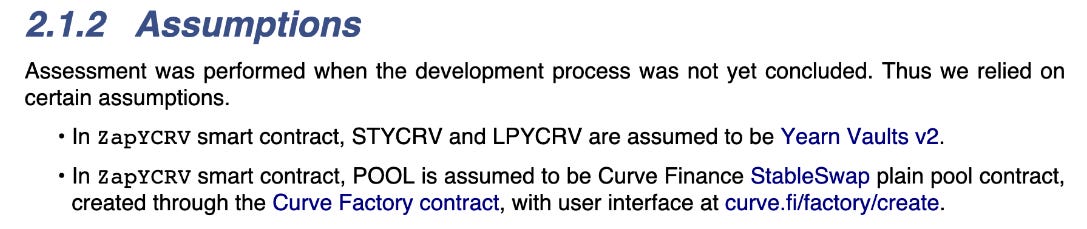

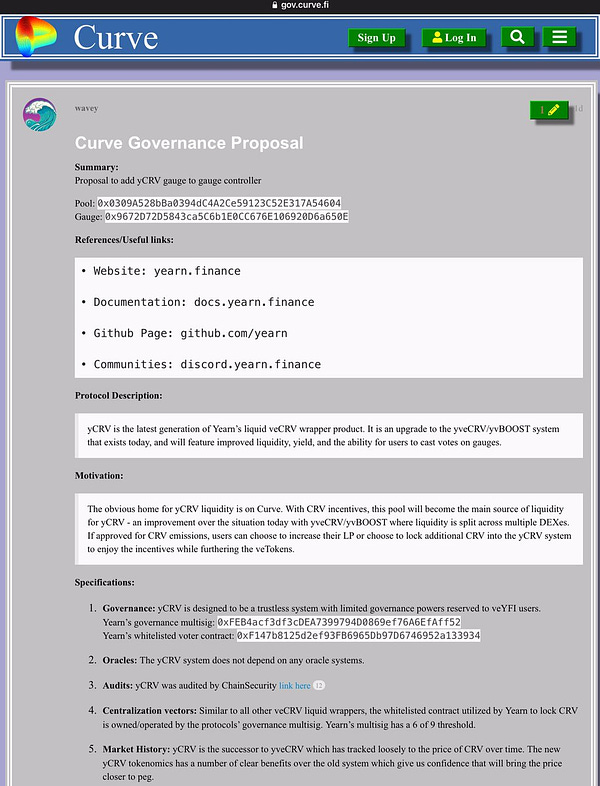

The final clues we have at the moment are via the ChainSecurity audit. The audit covers the yCRV contract along with a zapper contract (we assume this is the ZAP_YEARN_VE_CRV_ADDRESS from the config address, though the address shows no activity so it likely hasn’t yet been deployed yet.

The audit confirms much of what we’ve discussed:

The audit presumes the $lp-yCRV token to be a Yearn v2 vault, though the LPYCRV_TOKEN_ADDRESS from the aforementioned config file points to a Curve LP token directly so there’s some ambiguity.

The Zap contract we haven’t seen is described in more detail in the audit, handling conversions among several tokens:

From the audit we also learn that locking of $CRV for veCRV within the contract is triggered manually to save on gas costs.

Speculation about the token is rampant.

We’d caution the above take… we don’t see any public evidence at the moment that a $crvUSD might have any effect on pool APYs, positively or negatively.

As always, this is not financial advice, and you should consult with a registered financial advisor before aping your net worth into doggy ponzis. Or if you’re just here for wild mass guessing, refer to the Yearn Discord channel for further irresponsible speculation.