Sept. 22, 2022: Lender's Game 💳🦈

How On-Chain Lending Protocols Thrive + Vendor Finance Deep Dive

As human reverse technical indicator Jim Cramer is fond of saying, “There’s always a bull market somewhere.”

In a 🚮🔥 down-only market, where’s the bull? Naturally, it’s good, old fashioned debt.

Debt is useful not just to buy a box of Twinkies… thanks to the magic of Web3 we can even lend our JPEGs to ape into doggy ponzi schemes.

Cryptocurrency lending is particularly interesting. In TradFi, lenders can undercollateralize loans because there’s such a thing as “reputation” in real life. Lenders can do things like threaten credit scores, drag people through the court system, or send goons to break your kneecaps.

In DeFi, we don’t have a reputation to borrow against, because we can burn goodwill and hop to new wallets with ease. Unless somebody successfully creates a digital reputation to borrow against, loans have to be over-collateralized.

That said, we’re still seeing lending protocols thriving. Devs are innovating rapidly on the formula, particularly finding new ways to improve the experience for borrowers. We’ve observed two popular strategies recently: 0% interest and 0 liquidations. In this article we’re reviewing these strategies, along with a profile of the recently launched Vendor Finance.

0% Interest Loans

It’s not difficult to see why a 0% interest loan would be appealing. If you take out a loan at x%, you have to earn >x% yield on whatever you receive or you’re losing money (to say nothing of price fluctuations among these assets).

Problem is, there’s no surefire way to earn yield on the token you borrowed. DeFi is a risky game. Lower risk dollar yields are worse than US treasury bonds these days. High yield is risky. Pressure’s on to beat the compounding interest on your loan.

A 0% interest rate removes these concerns. You may still have to worry about changes in the underlying asset price, but at least compound interest isn’t working against you. This could give you some time to repay the loan when conditions are more favorable.

True risk-seekers can also use a 0% interest rate for leverage. Use your loan to buy more collateral and keep upping the collateral to whatever degree you feel comfortable. It’s certainly not recommended for beginners of course, but popular among degens nonetheless. (NOTE: Certainly not financial advice)

Liquity proudly offers 0% interest, on the backs of which they’ve built the textbook example of a well decentralized stablecoin. Lending ETH and minting LUSD carries no interest on the loan, which is helpful for borrowers. Instead of interest, the protocol makes money through a dynamic borrowing and redemption fee, which adjusts according to market demand.

Borrowers do need to worry about liquidations, which often comes to bite those who take advantage of the low required collateral rate (110%) to lever up. Unsurprisingly, the market cap of Liquity tends to track the price of ETH, but otherwise Liquity’s mechanics have proven very resilient through multiple market swings.

Given their track record, definitely pay attention to their new Chicken Bonds.

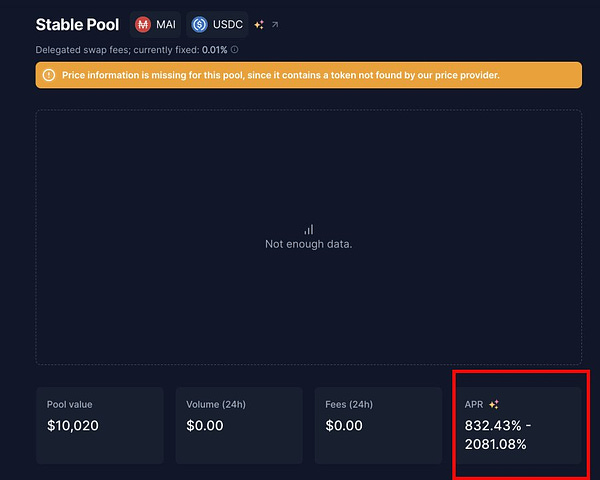

Qi DAO also offers borrowing at 0% interest to mint their Mai dollar pegged token. Similar to Liquity, they charge a repayment fee, in this case a flat 0.5%.

Qi has honed this formula on multiple sidechains, and their move to mainnet is worth looking into for yield farmers.

No Liquidations

The concept of no liquidation loans is also extremely popular. Thanks to the famous volatility of crypto, liquidations are a rough user experience issue for borrowers — an instantaneous wick downward in prices can trigger the hated liquidations.

This was particularly a problem back in the day when ETH was expensive. Even if you had more collateral available, good luck supplying it as gas spikes to 5000 gwei. Instead you find yourself a liquidated deadbeat… not worth the headache for everybody.

Alchemix popularized the concept of no liquidation, self-repaying loans. You give them money, the money is locked and earns yield that goes towards paying the loan off. This is a friendly and passive borrowing option, particularly for users that don’t care to actively manage their positions.

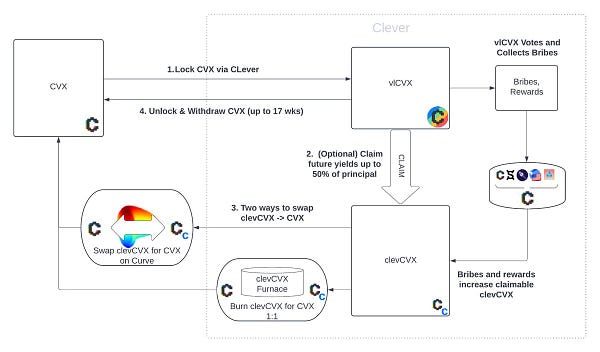

Aladdin DAO’s CLever extended the Alchemix formula to complement Convex yields. No liquidations! CLever manages auto-compounding yields! We reviewed their operation in more depth in our prior writeup, but here’s a quick refresher:

Despite the challenges of launching into a bear market, CLever has thrived in terms of its goal of accumulating Convex tokens.

They’re also continuing to grow their product, expanding into Frax.

Clever is also releasing a $CLEV token soon, if you’re into airdrops.

Lendflare is another protocol with an interesting spin on this. They also offer friendly terms for borrowers: fixed rate, fixed terms, and no liquidations against select Curve LP positions.

They manage this by having all loans occur among like kind assets — ie lend 3pool to borrow USDC, so little risk of price fluctuation. Their vaults are mostly utilized. They had the challenge of launching into the bear market, so we’re pleased to see they’re continuing apace and recently released their v2.

Vendor Finance

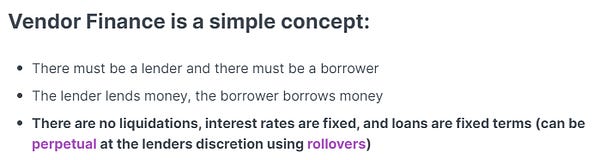

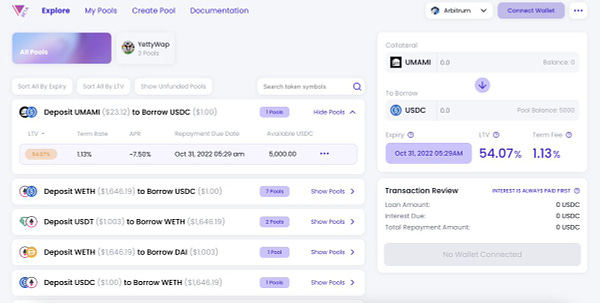

Vendor Finance launched its open beta earlier this month onto Arbitrum, the DeFi playground. The protocol heavily touts its “non-liquidatable, fixed-rate, perpetual loans.”

Distinct from the previously highlighted protocols, Vendor accomplishes their “no liquidation loans” by requiring the lender set fixed lending terms up front.

All loans on Vendor are created with a fixed end date and a fixed (or decaying) interest rate. Lenders set the terms, and borrowers borrow directly from lenders.

Naturally, Vendor Finance still has a concept of defaults in their system. Whereas a liquidation can wreck you due to random price movements, in Vendor you can only get rekt by not fulfilling the terms you agree to up front. If the borrower doesn’t repay by the due date, they forfeit the collateral. Price fluctuations don’t enter into this equation.

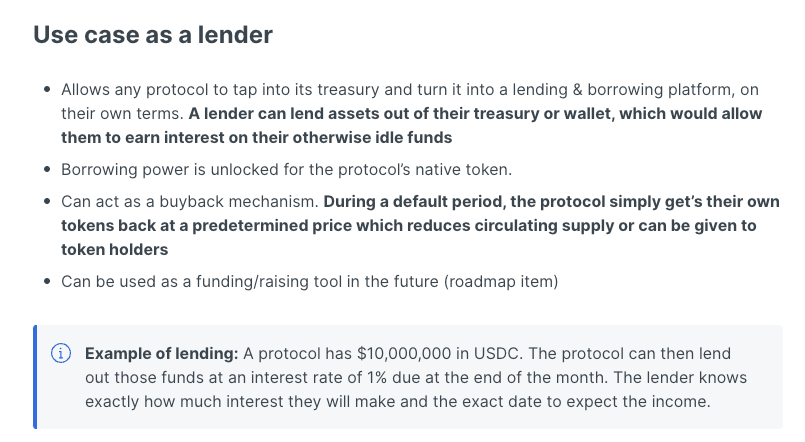

Per Vendor’s highly readable documentation…

Borrowers also have the option to rollover their loan as they approach the due date.

If this slightly shifts the risk profile to the lender, this can be mitigated by the flexibility the lender has in setting the terms.

Anybody can permisionlessly launch pools for any whitelisted asset, which includes the usual assets ($WETH, $WBTC, major stables) along with others like $CRV, $FRAX, $UMAMI.

The protocol therefore opens up new potential use cases for lenders, such as DAOs to create strategies to monetize their treasuries:

Further ideas from the community…

Fees are Vendor gets 3% of defaulted collateral and 10% of interest. No token yet…

For a deeper dive into lending, we recommend the book Debt: The First 5000 Years. It paints a picture of our entire social and economic structure in terms of debtor relationships between borrowers and lenders. It’s a lengthy but captivating read that may well last you through the bear.