Sept. 30, 2024: $AERO-drama 🛬🍿

A tale of LVR, Toxic Flow, and next generation AMM architecture

DISCLAIMER: author has exposure to mentioned tokens CRV, VELO + AERO (but not UNI)

Although nobody really wins in 𝕏 beefs, this weekend’s flare-up was worth highlighting for the reason that it led to a good discussion about the theoretical intricacies of the bleeding edge of AMM architecture.

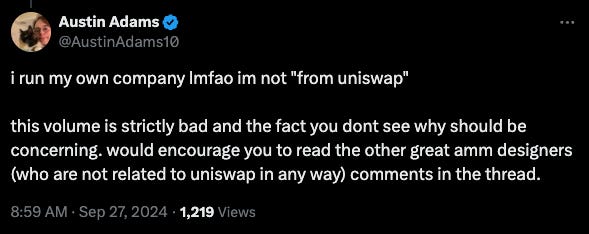

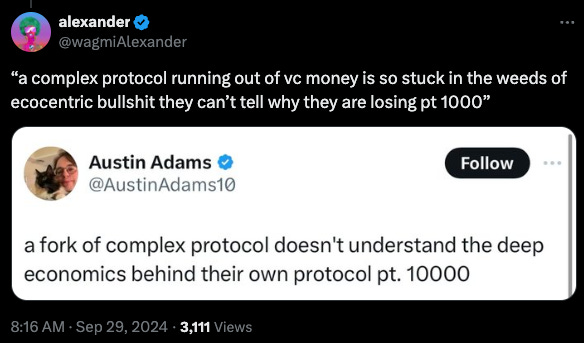

The opening salvo was fired by former Uniswap researcher Austin Adams, who has since left to catpost and build independent AMM design company Whetstone. Read the thread in its entirety to understand the context, which we’ll break down in greater depth toward the end of the article after we review the flame wars.

The *drome community is naturally protective of their protocol’s reputation, just as one would hope and expect to see (would anybody trust their funds to a protocol that simply folded on confrontation?)

No surprise the hostilities flared up as if somebody had tossed a can of gasoline into a BBQ pit. Below we’ve done our best to snapshot all the key skirmishes, without adding too much of our leftwit commentary. Begin warming your popcorn oil…

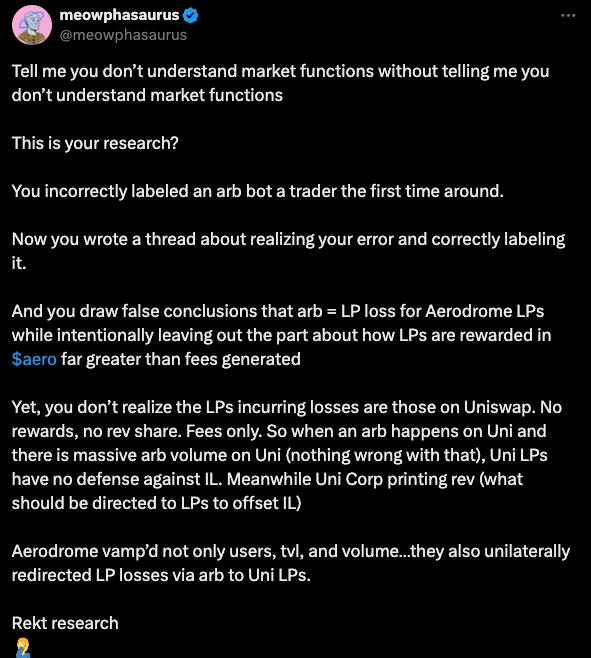

The Aero community was quick to weigh in…

Counter-threads…

Comment threads…

Dashboards…

Feeposting:

And we’re close to the end of the hostilities…

Not yet, just a bit further…

OK, let’s stop here. The “Dynamic Fee Model” has been invoked…

Dynamic Fee Model

So what is wrong with Dynamic Fees? We’ve seen dynamic fees leading to great APYs on Curve lately, is this a bad thing?

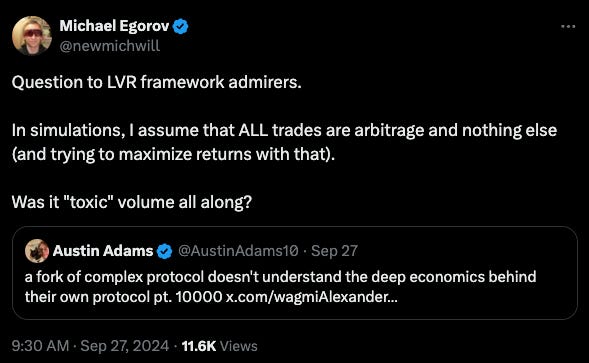

Curve Founder Michael Egorov enters the chat…

The answer is that dynamic fees are in fact good, but in terms of the frontiers of DEX design it’s already yesterday’s news…

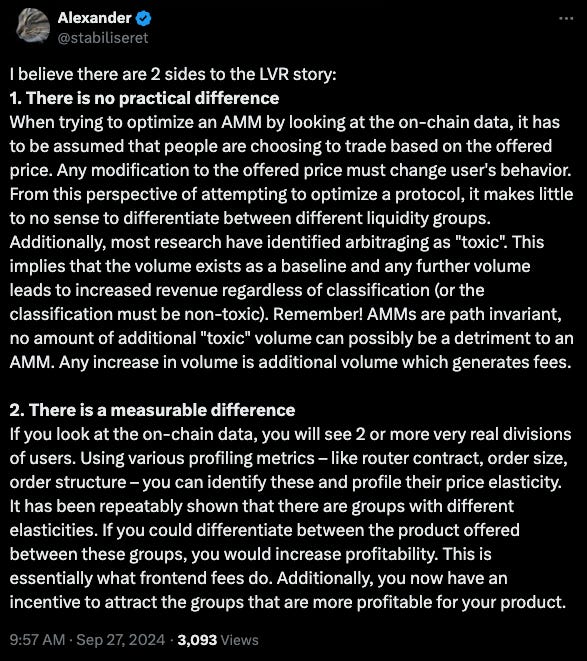

You can see how, the conversation starts to turn productive around the time it turns to DEX architecture.

In truth, it’s an important subject as few understand the nuances.

Admittedly, we’re not among this elite cadre of under a dozen right-curvers. We promise that as soon as we fully understand this crypto ish, we’ll shut down our newsletter as we retire to get rich running anonymous MEV bots in the background. But we’re not there yet, and as long as we have more to learn, we’ll keep churning out paragraphs for your benefit.

Now what about this LVR term that got thrown about.

LVR

Maybe you typed “LVR” into Google and checked out of the conversation when you learned it referred to an American footie club.

In DeFi, LVR stands for “loss-versus-rebalancing.” Last year it was memorably derided as an impossibly theoretical construct:

Despite being imperfect, it persists because it works pretty well when AMM engineers optimize towards this concept. It’s roughly analogous to how the discipline of economics draws its best results when it operates on the premise that microeconomic actors are mostly rational, even though this premise is clearly countermanded by reality.

Once again Curve inserted itself into this debate, noting that its optimizations have historically been to maximize returns given only the presence arbitrage trading.

Which prompted some comments.

And user lmy1352 added productively to the conversation… 🙄

For the extreme left-curve LPs (like the author, who makes like one transaction each month if gas fees dip,) it would be effectively impossible to approach this theoretical optimum. The passive LP generally does not care about “toxic flow.”

In the universe where multiple types of AMMs coexist, LPs can theoretically bounce among different types of pools depending on expected volatility:

Which brings it all back to the question underlying the original premise… is it possible for “volume” to be bad?

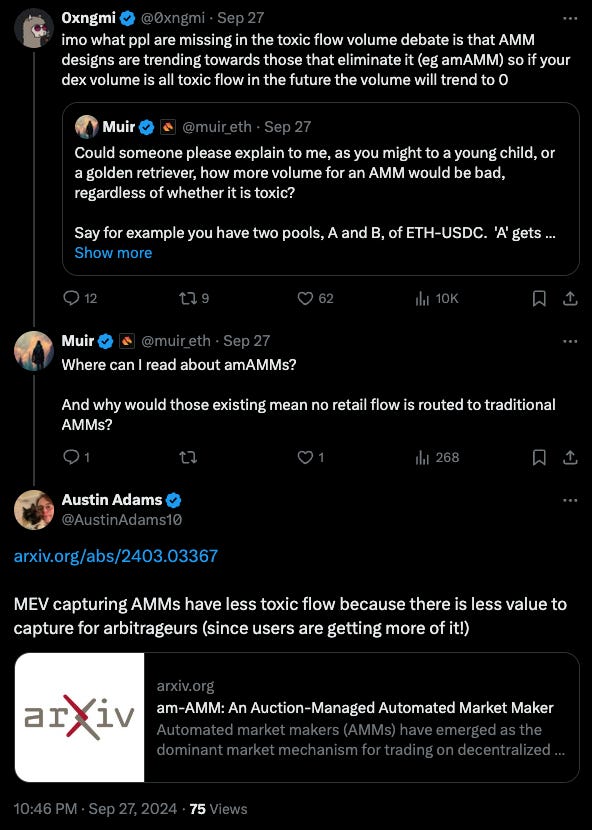

Finally, what is being done at the AMM architecture level to solve the problem? Ser Adams takes the opportunity to point to the amAMM, an MEV capturing AMM:

The result will be an emergence of newer DEX structures, for which the metric for success is less likely to be raw volume.

Disclaimers! We did our best to capture everything here, but please drop clarifying comments below!