While several protocols are sitting tight until after the merge, Frax is proceeding full speed ahead. The protocol is closing out the ETH 1.0 era with a bang!

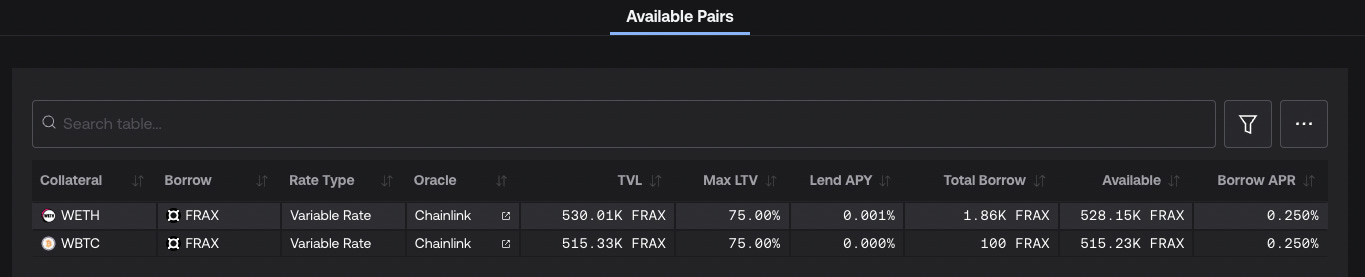

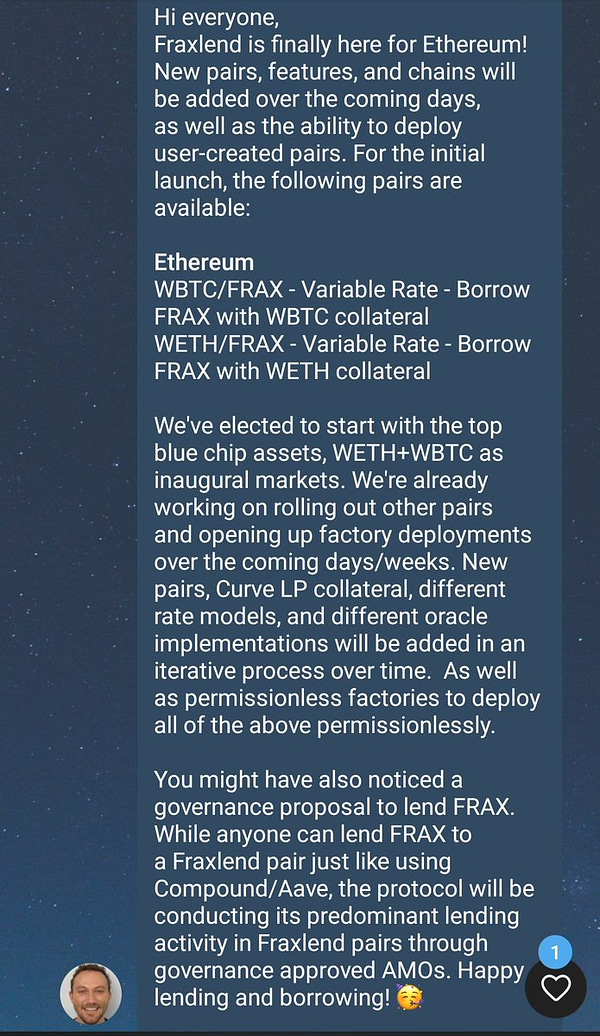

Yesterday saw the launch of the much anticipated lending platform Fraxlend. The lending platform debuted with trillion-dollar narrative tokens WBTC and WETH, along with big plans to onboard more tokens.

Fraxlend rounds out the Frax empire, bringing a stablecoin, lending platform, and trading platform under one roof.

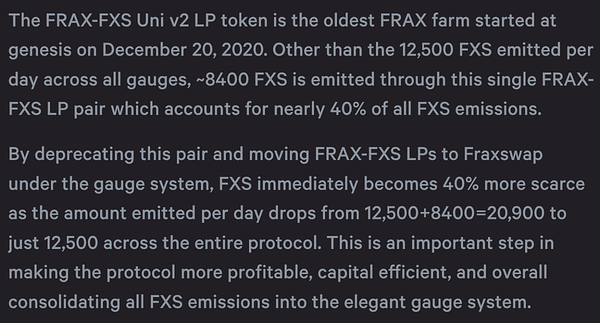

We’ve already seen a large rebalancing of liqudity in anticipation of Fraxlend:

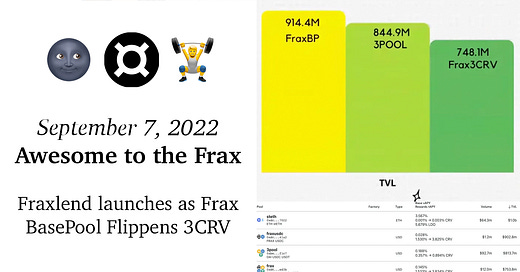

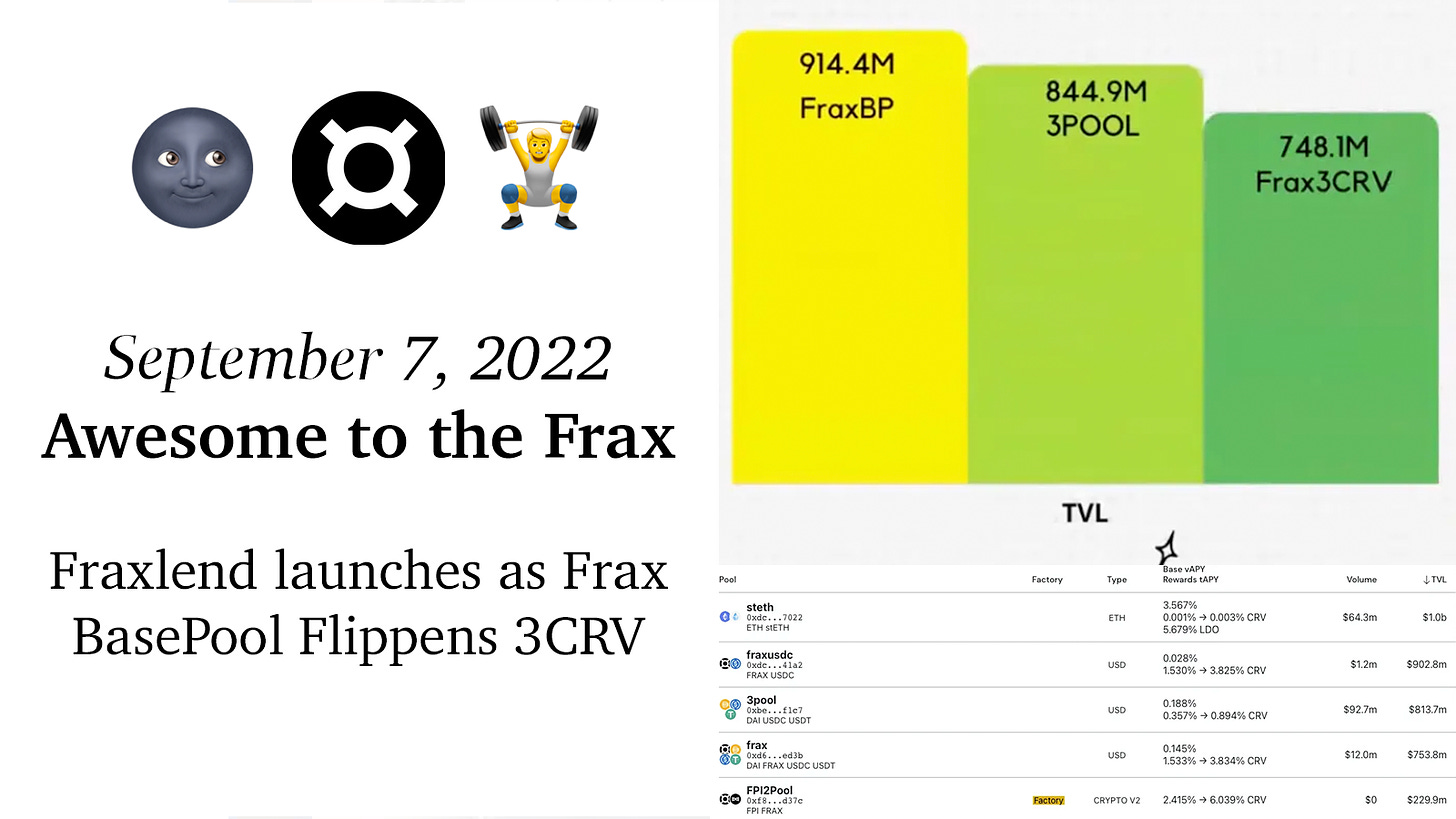

Amidst all the shipping activity, we also enjoyed a major flippening. The Frax Base[d]pool now boasts a higher TVL than Curve’s classic 3pool.

It’s a great reminder that stablecoins are highly volatile (see also, Binance dumping USDC for BUSD).

In fact, Frax now holds three of the top five pools by TVL on Curve.

The flippening is no surprise to anybody who’s been watching. Frax planted the seed by launching its base pool. Frax watered it by promising liquidity incentives. Today we enjoy harvest season.

Since the launch of the Frax-USDC base[d]pool, several Curve pools have quickly been launched against the pair. Promising heavy liquidity and heavier incentives, these pools are flourishing. Gradually…. then suddenly.

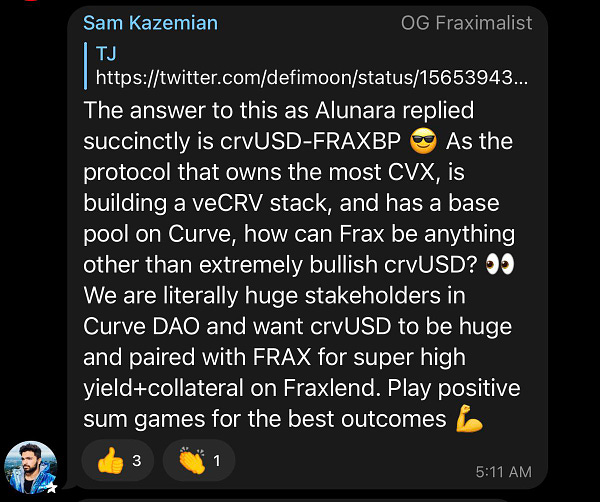

Is this the beginning of the much-anticipated Curve Death Spiral? According to the plans being laid out in public, it appears Frax’s intentions are far more collaborative in nature.

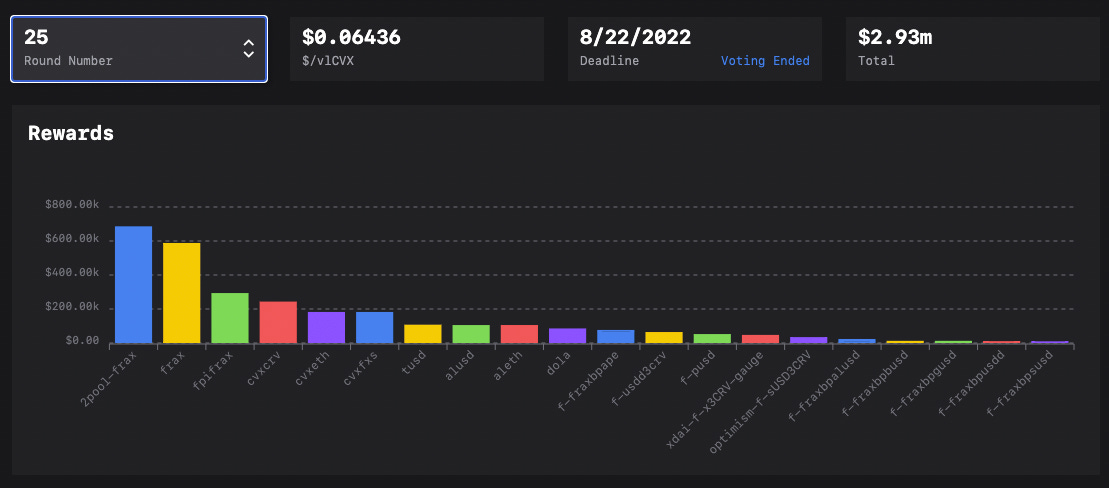

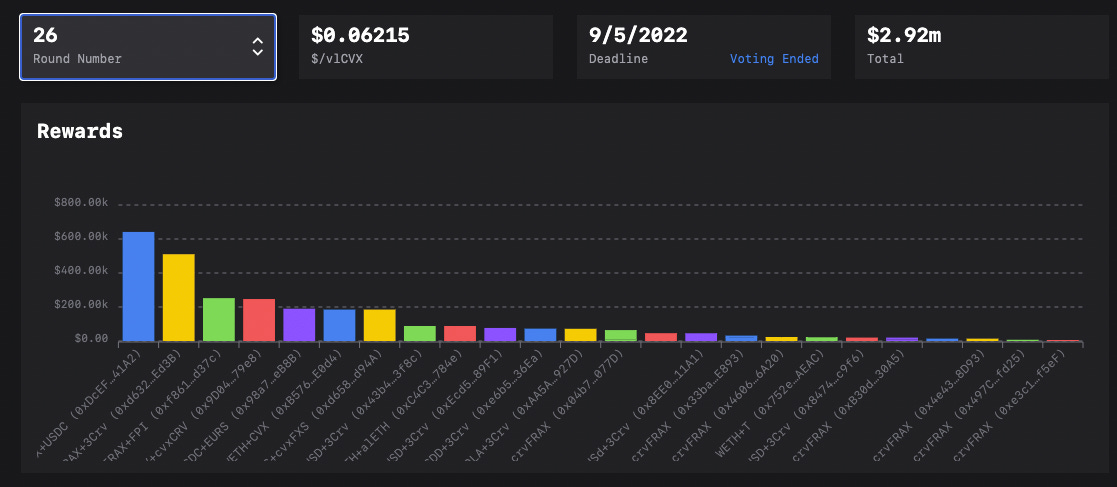

The Frax birb game is also evolving to fulfill their promises of incentives. Between Votium rounds 25 and 26, Frax changed up their strategies. Instead of a lump sum offered to 2pool, we instead note a shift towards the long tail of Frax-paired pools.

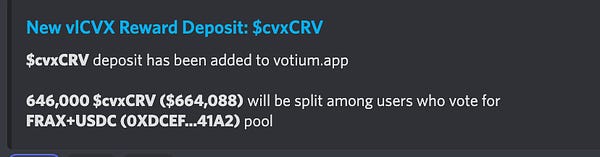

These bribes are also getting paid out in Frax’s ample stash of $cvxCRV.

Further downstream from the Frax pool creation, these new pools eventually find their way onto the Frax side of Convex. Convex brings the yield farmers to Curve pools containing Frax, as well as native Fraxswap pools.

Concentrator is also leaning into the ascendant Frax.

For anybody concerned about FraxBP exposure to the risky USDC, check the following thread by 🧠

What does it all mean for $FXS? You’re on the wrong Substack for that. If you’re seeking price talk, we don’t do financial advice, technical analysis, or other forms of speculation here. We can only comment credibly on cool tech being built.

Frax, as it happens, is building cool tech in spades. This tech is also gaining heavy adoption. This feels like the holy grail for crypto projects. In a rational market, one might expect strong fundamentals would be screamingly bullish. Crypto markets don’t really seem to care about “fundamentals” though, so we don’t get to enjoy such nice things.

Alunara’s Law™️ states degens have a 1 week max time horizon.

Despite all evidence to the contrary, we irrationally and stubbornly continue to believe fundamentals will win over a long enough time horizon. We hold out hope that over multiple “wash, rinse, repeat” boom-bust cycles, fundamentals will assert themselves in the form of fundamentally sound projects not collapsing, and tanking slightly less each bear cycle.

Therefore we keep $FXS on our “gud coin” list even as it looks comically undervalued to our perspective. YMMV, NFA, DYOR!

Disclaimers! Author has exposure to $FXS and other assets in the Frax ecosystem.