September 12, 2023: SubDAOs 🌊🔱

The debate on using the Curve community fund to deputize nimbler SubDAOs

Forgive the late post! This post was getting too opinionated, so we got delayed in redrafting some of our arguments to deploy them onto the even playing field of the forum.

Let’s take a look inside the sausage factory that is the Curve grants team.

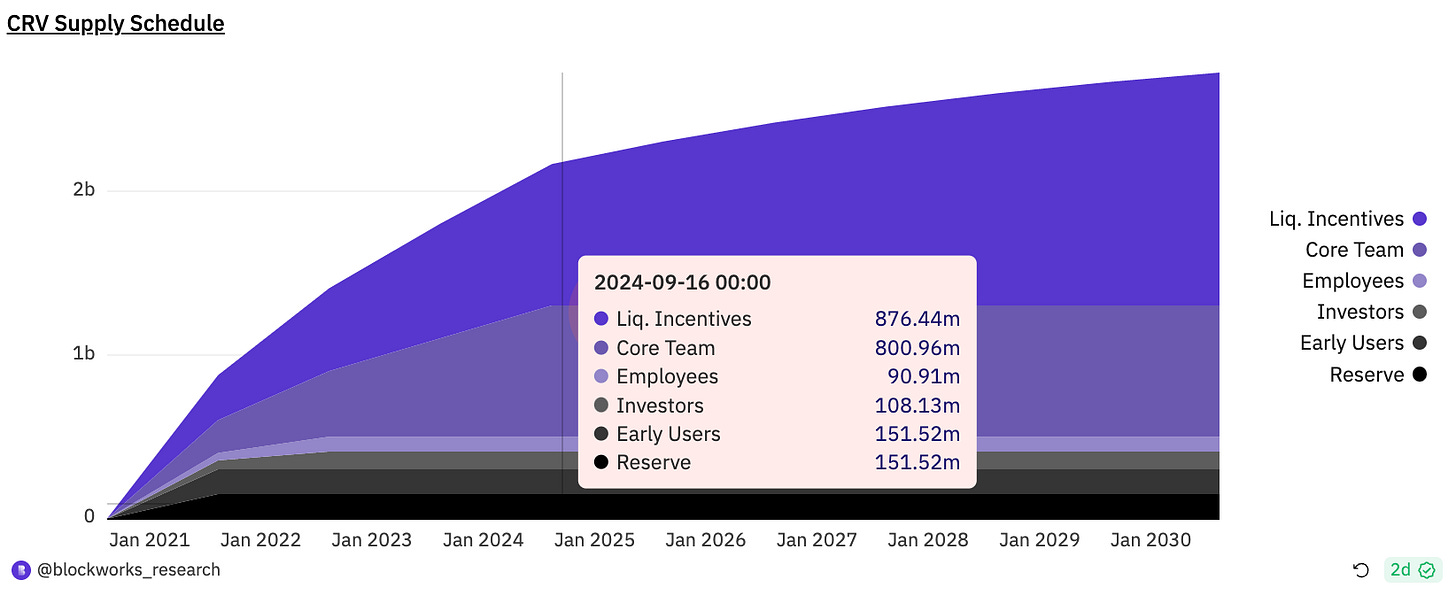

The existence of the Curve Grants team is as preeminent in Curve’s early growth as the Bill of Rights is to the US Constitution. From the very outset, Curve had an aggressive inflation schedule, complete with 151MM $CRV sent to a wallet to do… something.

The usage of the 151MM $CRV granted to the community was initially a hot topic, back when a $CRV was worth something. The early phase of Curve’s existence hotly debated and implemented proposals to define what was supposed to be done with this money.

The very second sCIP was authored by the OG, WormholeOracle, to address how to put this money to use.

Then the third sCIP, by Curve Founder Charlie, would formally establish the Grants programs.

Flash forward to today, where there is a Community Grants program which exists but is, in our humble opinion, a laborious bureaucracy.

Problems with DAO governance are familiar to anybody who follows crypto. We may all be bullish on cryptocurrency in the long run, but the broader crypto community is somewhat less enthused about DAOs more generally. In practice, DAO governance has suffered many problems, including voter apathy, poor representation, arbitrary decision making, and outright fraud. Watching democracy in action work itself out onchain, we’re still in the early experimentation phase at best.

The Curve Grants committee, to its credit, has been far more successful than several attempts at governance by multisig. From WormholeOracle’s 2022 review, the committee has been quite active and iterating towards practicality.

The linked spreadsheet tallies its activity.

Then you note the last line in December, where the team claims 24MM $CRV and you get a sense of the differences in scale we’re talking about. The grants councils was not formed to be miserly, but rather to invest actively in promising project which may benefit the community.

The parsimony is downstream from the difficulties in the process itself. Wrangling signers on a 6/12 multisig across multiple timezones, some of which are effectively on hiatus, is more of a chore than anything. It’s Wormhole Oracle himself who does this job, quite commendably.

In 2022 the committee authorized outgoing transactions about once per month, averaging 65K. It’s a reasonable rate for a clunky 6/12 multisig, for which it can be time consuming to wrangle signatures. Towards the end of the year, you can see attempts to streamline the process by attempting to pay groups in installments and testing services like LlamaPay.

At a rate of about 65K per month, it will take decades to get through its most recent vest. It could even extend this runway infinitely if it could wrap this $CRV for yield, but we understand that this may be outside the committee’s scope.

Relative to other DAOs with grants programs, the Curve grants program appears as relatively torpid and unserious.

A properly functioning grants council should properly shine like a beacon, attracting great ideas and builders from the community. As it stands, the Curve grants committee gets a lot of spam.

When I met with teams interested in grants at EthCC, I had to caution them to prepare for a challenging fight. Multiple times in the past few years we’ve seen projects which should be right in the wheelhouse of grants funding instead just get Mich to pay directly out of pocket, knowing that a successful reimbursement would be an uphill battle and months delayed.

The bright side of the deliberative process of the grants committee is that the caliber of recipients of funding from the Grants Council is top-notch. A sampling of the gigabrains who receive such funding include the Llama Risk team, Curve Analytics team, and Vyper language. Without singling out the specific right-curve individuals with these groups, I’ll suffice it to say that many of these people are absolutely the best in the business.

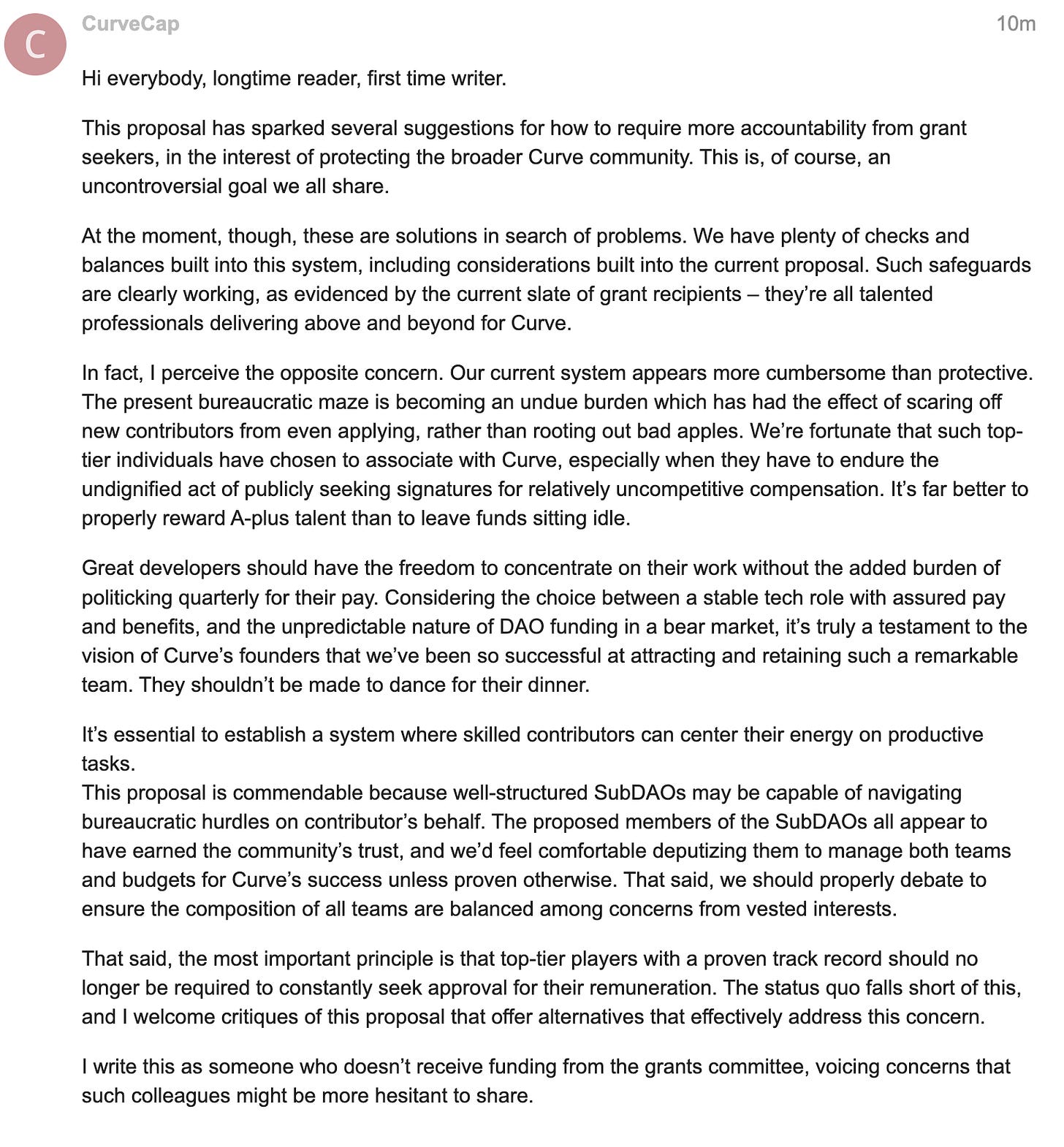

The biggest problem is that the process reduces such A-listers to menially begging for scraps. At this point I fear I’m veering too heavily into opinion. I put a lot of my thoughts into my first governance forum post, cautious of using this newsletter to force public opinion.

As always, Benny says it better.

Which segues perfectly into this latest SubDAO proposal. All parties to the Grants Committee are aware there’s a problem. There may not yet be full agreement on the specific mechanics to fix it, but this proposal is a very good way to force such a conversation.

Among members of the grants committee I’ve spoken with, there’s been a very positive response to the concept of SubDAOs if structured correctly. The rough idea of such a structure is that the Grants committee, which is slower and more deliberative, primarily assumes the role of controlling the flow of funds to and oversight of SubDAOs. The SubDAOs are then intended as smaller and more nimble organizations, managed by a leaner group of active multisigners, and more discretion over allocating their budget as they see fit.

Wormhole Oracle, who published the proposal, understands the internal issues better than most. Therefore he might carry extra credibility on the subject, and we applaud him for forcing a tough conversation.

Without any specific comment on the exact composition of multisigners within the SubDAO proposal, the proposal’s abstract is rock solid in our opinion.

We don’t particularly know if such a system would work out in reality — it’s entirely possible that each SubDAO could evolve to be as bloated and bureaucratic as the main committee, but it’s our opinion that doing something is certainly better than doing nothing. Yet if the SubDAO concept fails, the grants committee maintains its full authority to cancel their vest, scrap the SubDAO, and start over from scratch.

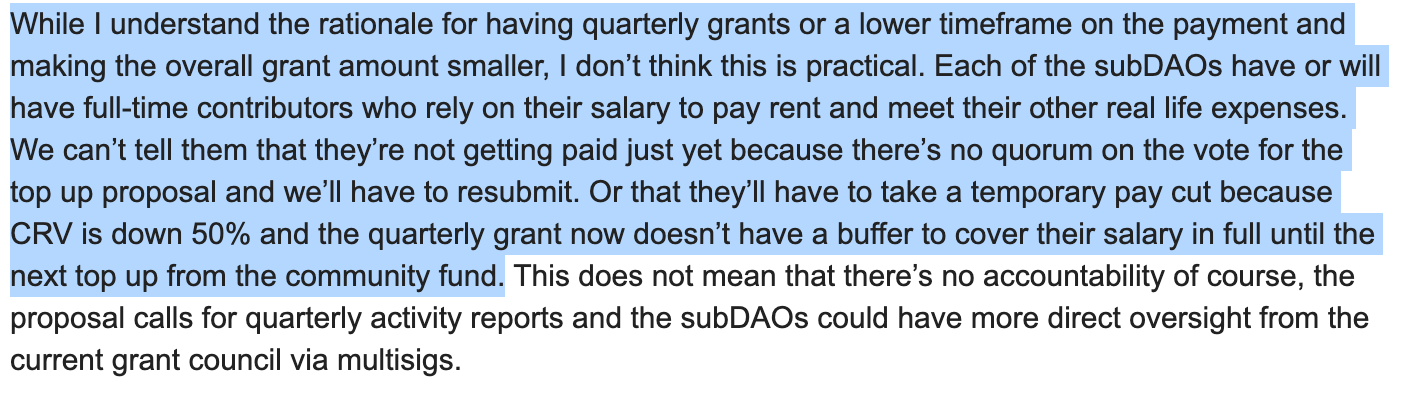

The broadest category of pushback we’. e seen centers of misunderstandings of the proposal. There’s a fear that the funds would simply be allocated to the multisigners within the SubDAO, as opposed to reinvested around the ecosystem. If this was a problem, it could be corrected with tweaks like requiring SubDAO multisigners to be compensated directly by the Grants committee.

Yet we think it’s a silly concern, as realistically there’s little chance the SubDAOs would vote to enrich themselves. The meat of this endeavor is to give them more ability to efficiently invest the capital into projects they believe will benefit the Curve ecosystem in the long run. Write checks first, then justify it after the fact to the broader DAO, as the SubDAOs absorb the process of politicking and shield contributors from the red tape.

Another strain of pushback centers on short-term concerns about sell pressure on $CRV. Even though the quantity of $CRV is released linearly over time, it’s still more tokens that may enter the market and cause prices to go down.

However, we don’t particularly have much appetite for short-term attempts to manipulate the price at the expense of the long-term health of the ecosystem. These $CRV tokens were earmarked specifically to be spent years ago. Failing to fulfill the DAO’s explicit instructions here is borderline fraudulent, and we’d expect the committee to carry out these obligations.

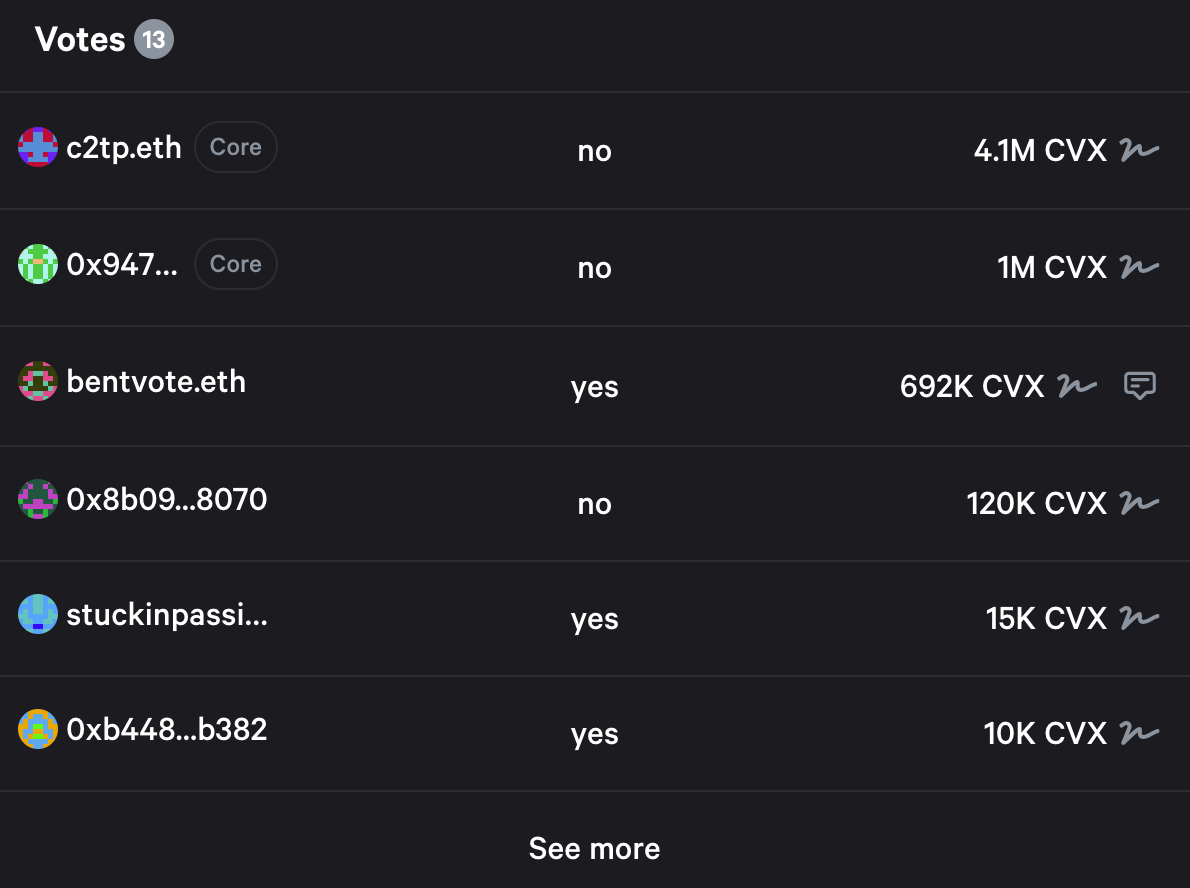

Anyhow, this particular version of the proposal is unlikely to pass, given the early opposition from voters on Convex

We know this means it’s just the start of a longer conversation. We do believe it’s a few tweaks away from a good final draft. Perhaps apply some scrutiny to the SubDAO teams, members and amounts. Shake it up as needed, but on balance it’s a good proposal.

Whatever happens, we believe the status quo is not a viable solution. If this SubDAO proposal is not the right specific proposal to fix some of its issues, we hope critics advance proposals that solve these issues.

Disclaimers! Note that author is not a member of the grants committee, nor an ongoing recipient of funds. The only interaction were a few early newsletters that received a few thousand $CRV from a few years back.