September 15, 2023: Locks, Stakes and Two Smoking Proposals 🔒🗳️

Analyses of new Convex proposals to readjust its fee structure

Disclaimers! Everything that follows is educational in nature and not financial advice! Author has exposure to basically every alphabet soup permutation of CRV/CVX/FXS he can find

Recovery

An update on yesterday’s article on the recovery snapshot…

September 14, 2023: Recovery Snapshot 🚑📸

Since the Vyper exploit, many protocols are returning to normal operations. Notably, JPEG’d is basically back up and running, with just a few lingering amounts to be addressed.crv.mktcap.eth is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Turns out things are spiralling under control even more rapidly than expected.

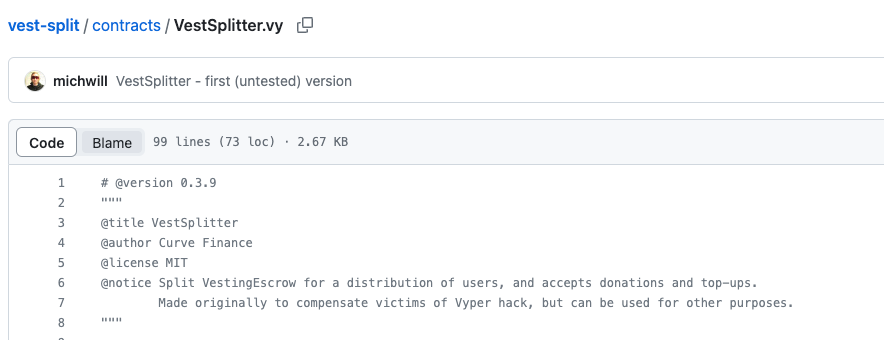

After publication, Chan-“Chad”-Ho pointed out another new repo called VestSplitter. Wonder what this might be used for…

I get that many of you in Web3 inexplicably refuse to read code, but for heaven’s sake, the screenshotted lines are plain English. If you won’t read this before bugging support with requests for updates on the CRV/ETH hack, then you deserve whatever mutes the mods dish out…

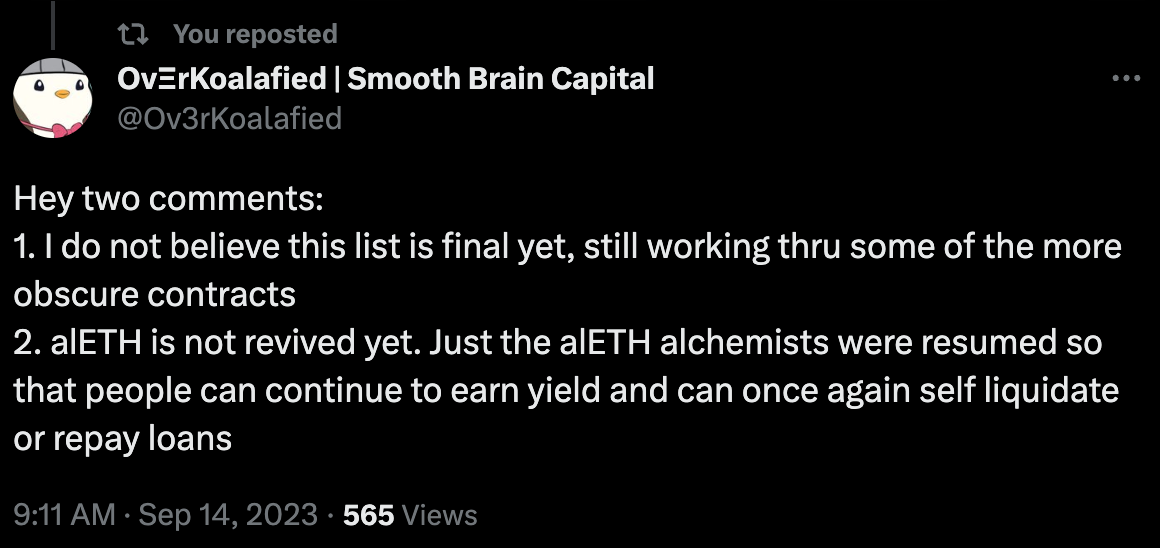

Also, while I’m issuing corrections and clarifications, note that if you aren’t on the recovery list you need not panic just yet:

Convex

A pair of major new Convex proposals dropped, and both appear to be well on their way to passing.

Generally the pattern with Convex is that tokenomics gigabrains get very excited in the immediate aftermath, and then a few weeks later left curvers hindsight catches on to why it was big. So you might want to invest some time today to learn what’s going on (not educational advice!)

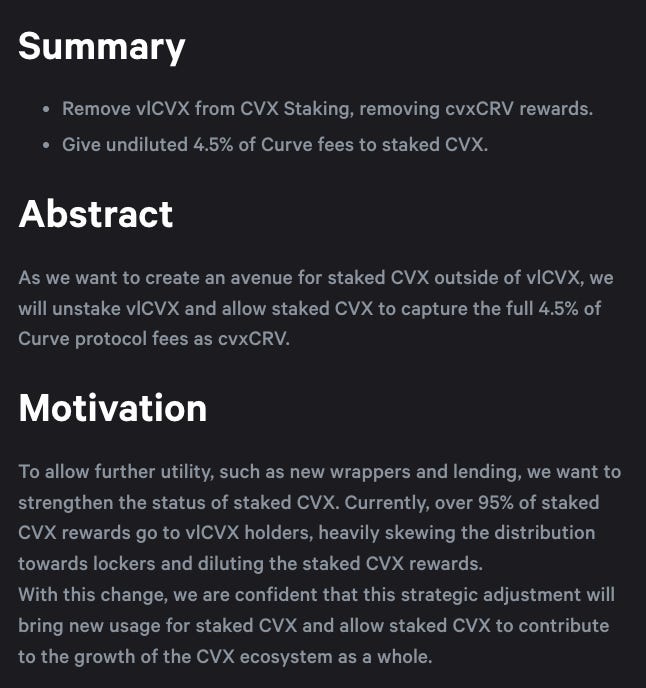

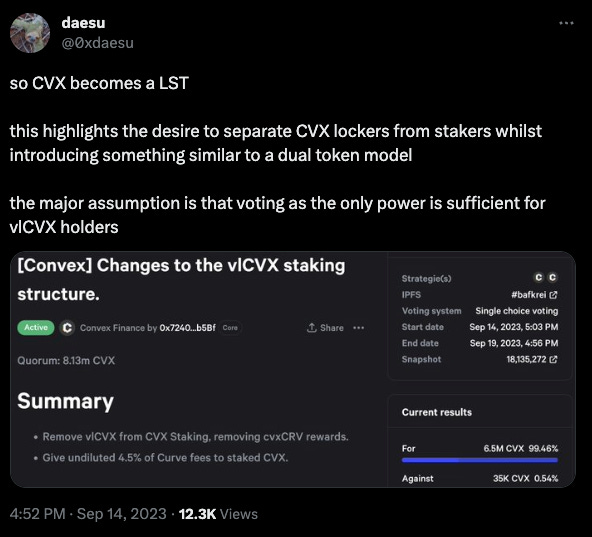

The first vote shakes up vlCVX staking

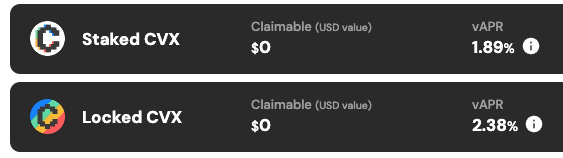

This tweaks the following two items on the Convex site:

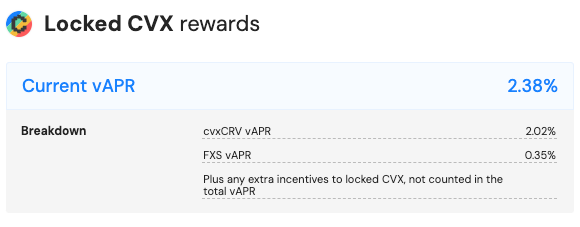

This change would reduce some rewards from vote-locked CVX, which is used primarily for governance (or often simply rented to Votium for birbs). Specifically, it affects the 2.02% cvxCRV vAPR chunk of rewards on the screenshot below.

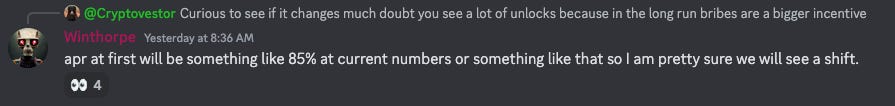

These incentives get shifted to staked CVX. The team has run back of the envelope numbers on what these changes might mean for staking APR.

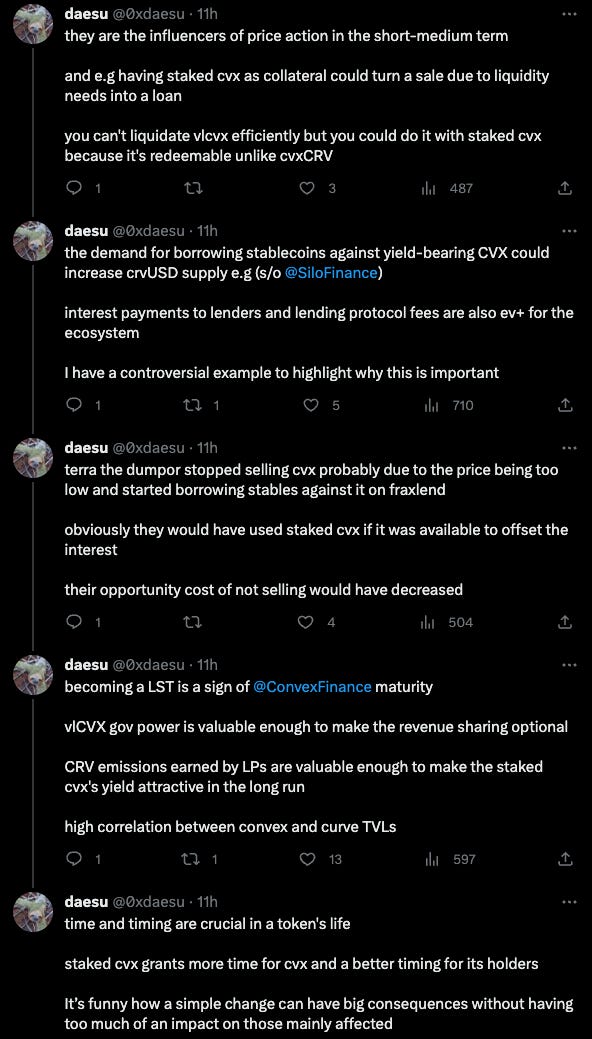

In the DeFi world, incentives work to stimulate flows of liquidity. So it’s likely that money is going to chase this APR. Once capital chases this yield, the numbers will surely cool down. So if you plan to compete for this yield, you may want to have dry powder ready ahead of time.

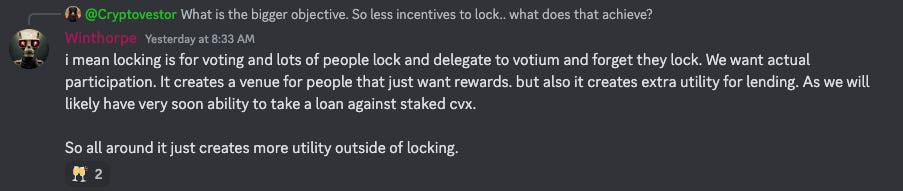

But, why would Convex want more users staking than locking?

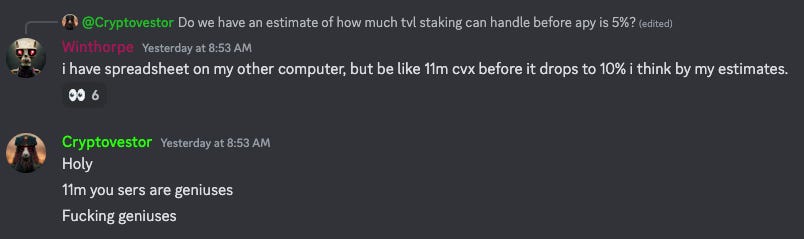

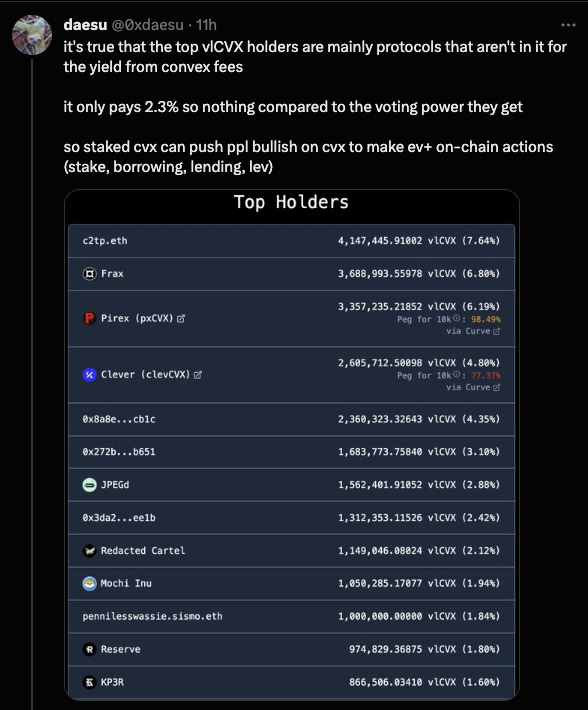

This proposal is not “strictly” a win-win proposition, since lockers take a small hit. However, advocates of the proposal are placing a bet that several vlCVX lockers are protocols chasing the voting power, and won’t care be scared off by the drop in incentives.

On the margins, a few lockers who see their locks expire over the next few weeks might migrate to staked CVX. Yet the locks inhibit this behavior slightly, so yield chasers may need to buy up scarce CVX to get access.

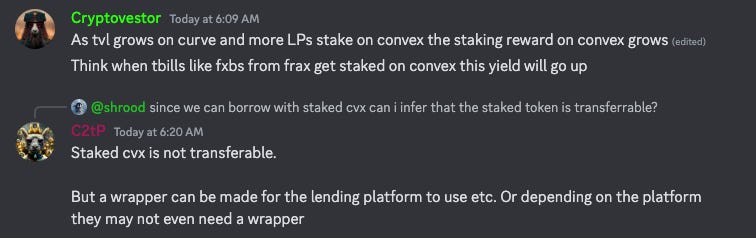

Of course, don’t overlook the thrill of taking a loan against staked CVX earning yield.

On top of all this, this new vote has already spawned a new copypasta.

The proposal is some real big brain stuff from the team, congrats!

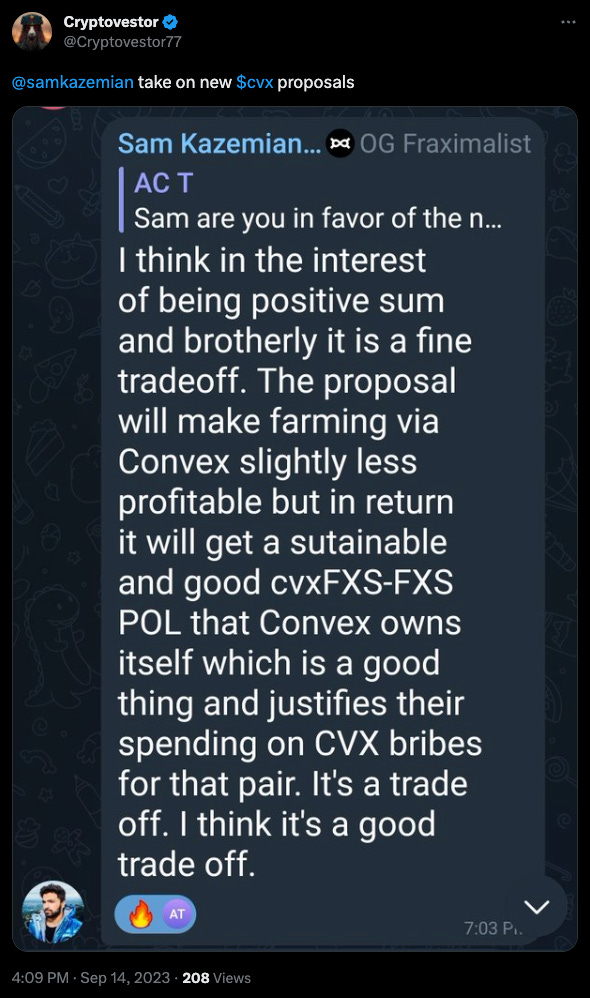

The second proposal adjusts FXS treasury fees.

It’s getting a bit less buzz, but also appears to be a well thought out attempt at rebalancing that is mostly uncontroversial.

Both proposals are sailing towards approval. So what does this all mean for your aching bags of flywheel tokens?