September 22, 2023: TriCrypto Parameter Split Test 🔍📈

Optimal Pathways in Curve's Liquidity Ecosystem, Part 1

A power user suggested an idea for an occasional segment exploring some of the interesting stories told by trading activity in notable Curve pools. It’s a good idea, so today we’re going to walk through some recent interesting activity and narratives emerging from various Curve pools:

TriCrypto Parameter Split Test

crvUSD Fee Split Test

LUSD Panic

cvxCRV Repeg

TriCRV Volume

TriSilo Utilization

yETH Sandwich

TriCrypto Parameter Split Test

Like Visa vs. Mastercard, or Coke and Pepsi, the two new TriCrypto pools on Ethereum are sufficiently similar to each other that they can effectively offer a split test.

You may recall recently when some interesting behavior was identified in the Base TriCrypto pools.

September 5, 2023: Labor of Love 🛠️❤️

You may have been enjoying your Labor Day weekend, but Michi was clearly busy.

Based on this research, the USDT pool received an upgrade while the USDC pool has been held constant.

With a little data since it went into effect, we can observe the results:

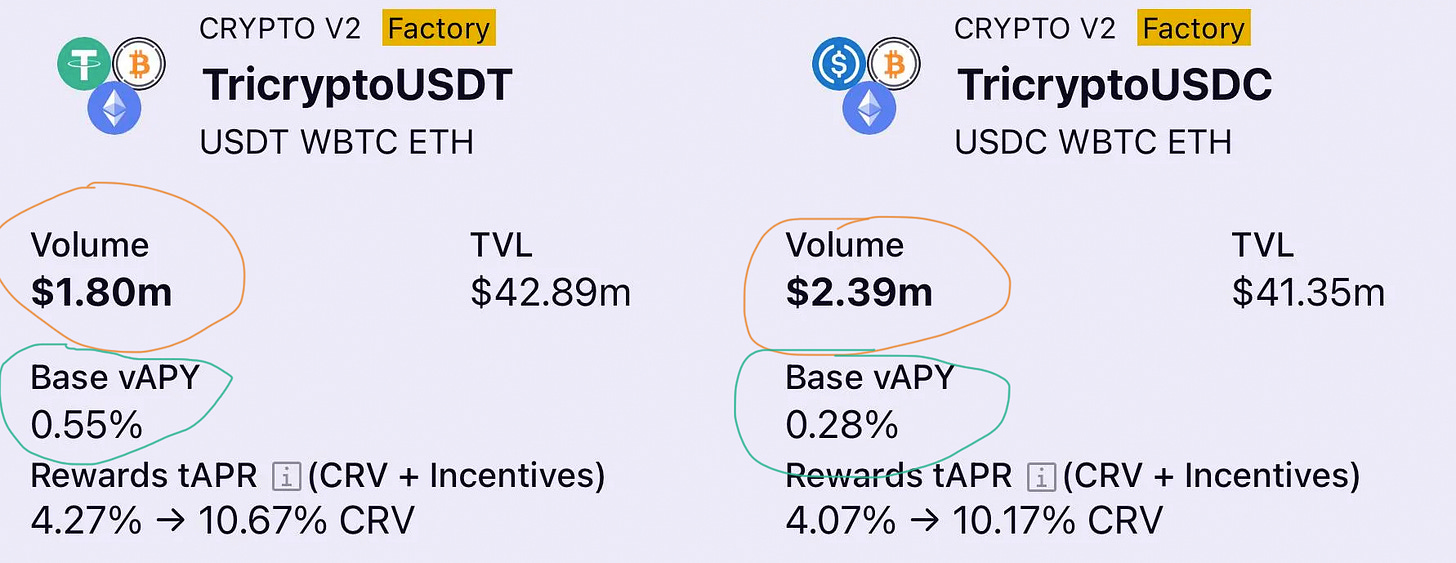

The volume, circled in orange, is on a similar scale in the two pools, both roughly $2MM. In fact, the adjusted USDT pool shows a little less overall trading activity. Still, the base vAPY, in green, represents a good measure of the trading fees, and it’s nearly double the USDC pool.

To offer a simple explainer of what’s going on here… TriCrypto pools have a variable fee structure. The smaller mid fee is charged when the pool is balanced, and a larger out fee is charged when the pool is out of balance. This effectively is a tax on arbitrageurs, who tend to pocket the profits when the pool is out of sync.

The idea with these new parameters is to allow for slightly more depegs, which will trigger more opportunity for out fees to be collected.

Visualizing this can be a bit tricky. What follows is the only remotely conceptual math. If you’re scared, just keep reading past this section, where it gets easier.

Within TriCrypto, there is a price scale (where the liquidity actually sits) and a price oracle (the actual price of the assets). Price scale will generally lag price oracle.

Since these have three assets in TriCrypto (dollars, BTC, ETH), we can look at how far off price scale is from price oracle — with BTC depegs on the x-axis and ETH depegs on the y-axis. Here is the full scatterplot of divergences on Base Chain TriCrypto’s lifecycle.

Since the assets are mostly correlated, these divergences overall mostly show a diagonal, usually when ETH or BTC move suddenly. When clustered at the center (1,1), it means everything is perfectly balanced.

Now, let’s cherry pick a short window just before and just after the change to the A parameter. Here we use a lighter shade of blue for older blocks, and a darker shade of blue for newer blocks, so you can visualize the time progression as the pool drifts.

You can see, just before the parameter trade, these tended to depeg in a very narrow window. After the parameter changes, they deviated a lot more. Greater deviation allows for more arb trade possibilities at the higher out fee.

Dropping this down to one dimension, you can see the volatility before, during, and after the ramp (green), with an EMA (red) to smooth it out. The major takeaway is that red line is higher on average after the ramp, indicating more divergence and more time spent in out fee territory.

The ramp on the changes to the mainnet TriCrypto pool lacks enough data to draw firm conclusions yet, so we’ll revisit with some more data and a look at fee data for the duration as well.

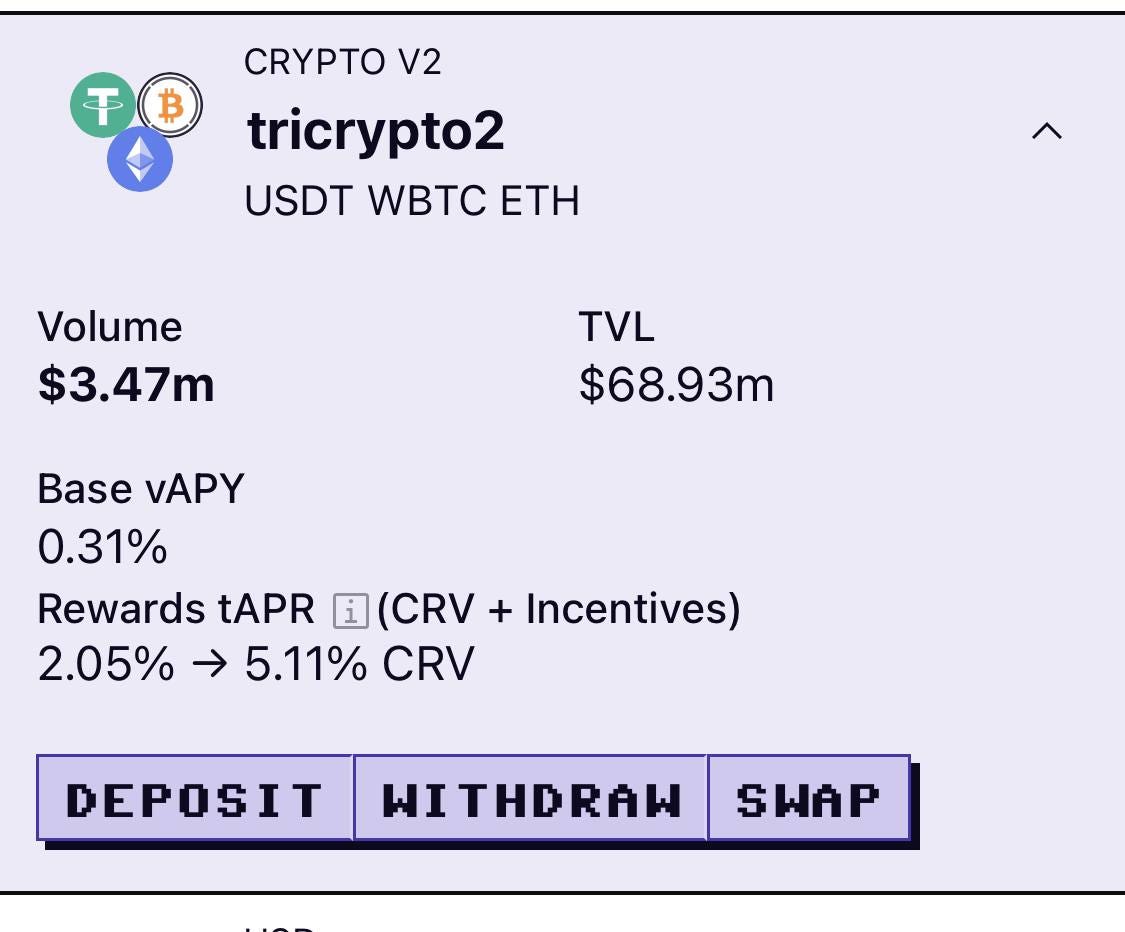

Incidentally, these newer pools are still smoked by the volume in the older TriCrypto v2, which is less efficient. What..?

There’s a variety of reasons, including a bit more TVL, but most notably the older pool is better integrated. Particularly by MEV bots that run attacks using the pool’s liquidity.

crvUSD Fee Split Test

In another USDC vs USDT split test, the crvUSD trading pools for both these major coins essentially have monopoly power at the moment. Since Curve is the primary source of liquidity for $crvUSD trades, why not charge monopoly pricing and see what we can get away with, right?

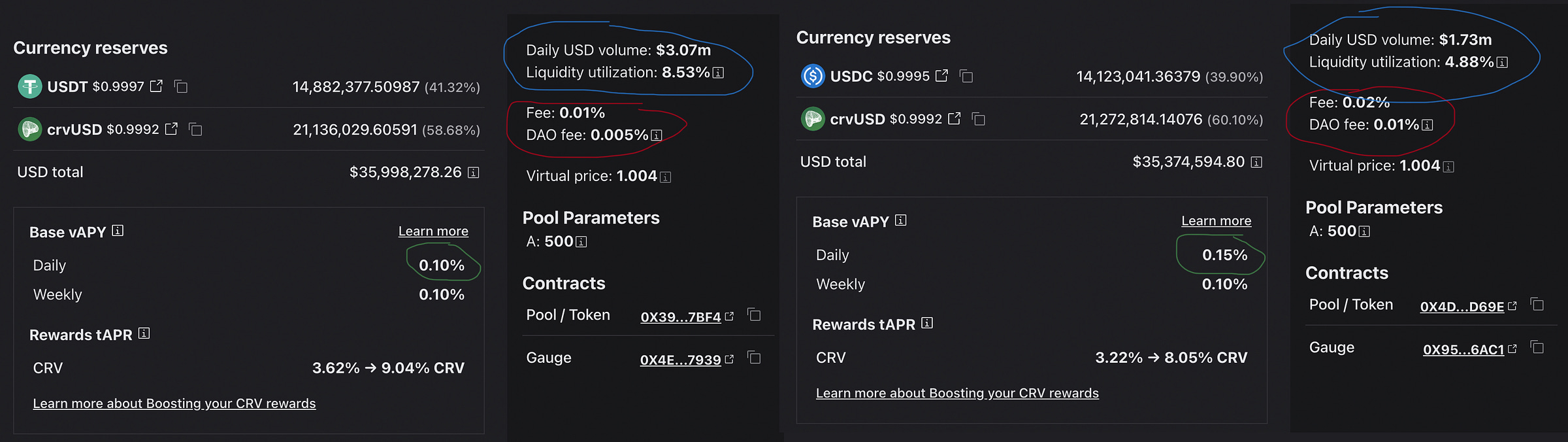

To test out what would happen in prod, USDC got its fees doubled while USDT saw its fees stay constant (circled in red).

Circled in blue, we can see that the overall volume of the latter is about half that of Tether. Yet the base vAPY (green) hasn’t necessarily been hurt, and in fact sits about 50% higher. More observation is warranted, but preliminary results look good.

LUSD Panic

Liquity’s $LUSD hit second on the top five in terms of trading volume for Curve over the past day.

This comes on heavy utilization and a slight drop of LUSD pricing in the pool.

What’s going on?

It seems, there is some panic about a different LUSD, Linear USD, on Binance Smart Chain. The coin was exploited and rapidly dropped to zero. In the confusion, it seems some traders panic sold Liquity’s $LUSD.

The depeg represents less than a penny for LUSD, so it’s not a major opportunity. Still, it presents a very slight opportunity for anybody who wants to bet on the repeg. The $crvUSD pool with $LUSD provides above market rate in terms of incentives:

cvxCRV Repeg

Speaking of repegs… at this point, cvxCRV is experiencing monthly shocks, as well as equally swift moves to rebalance the token.

Zooming in to the hour mark, you can see the sale was instant, the re-arb activity took place over the span of hours, and leveled off around $0.97

TriCRV Volume

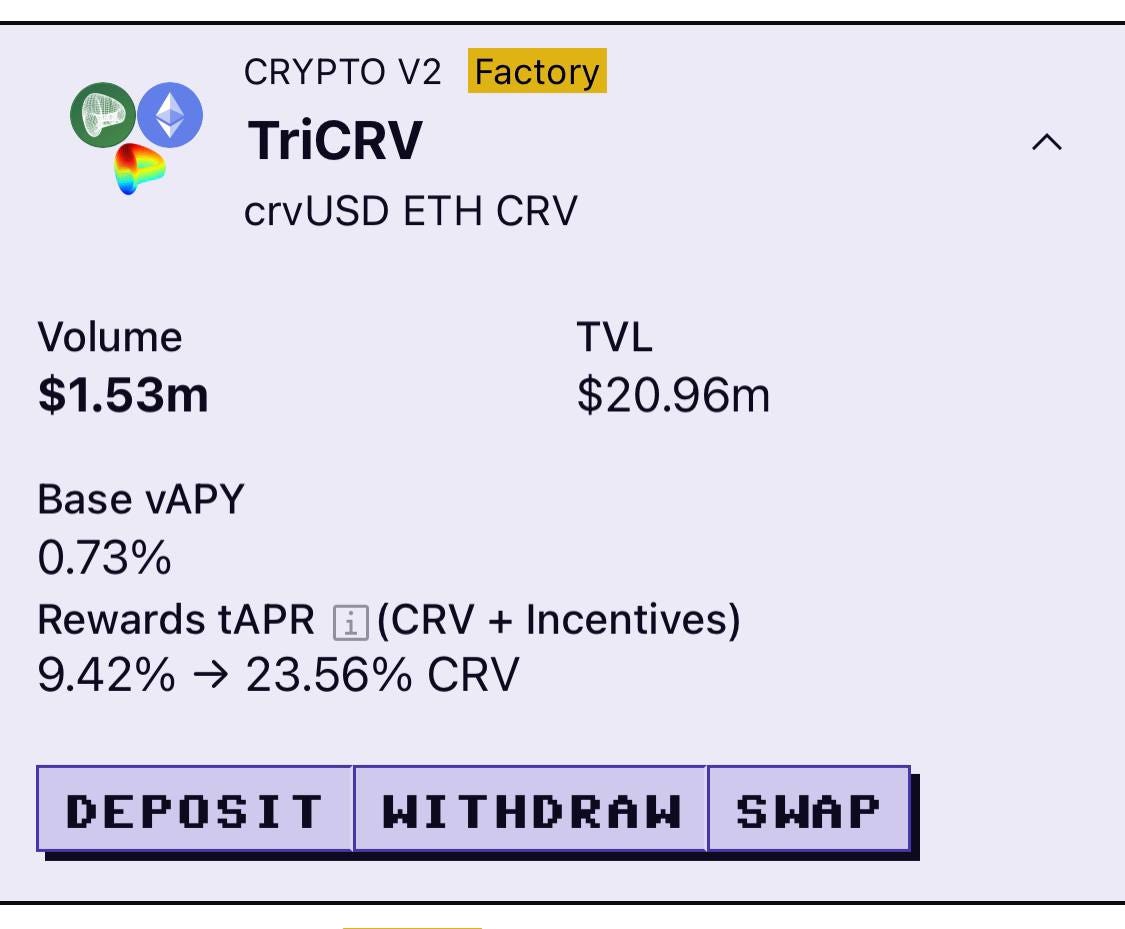

With CRV/ETH collapsing into a singularity, TriCRV has emerged as a superior liquidity pool thanks to the TriCrypto:NG optimizations and the addition of $crvUSD to the pool.

Here we see a healthy $1.5MM trading volume on the $21MM in TVL over a period where the token mostly traded within a narrow range.

TriSilo Utilization

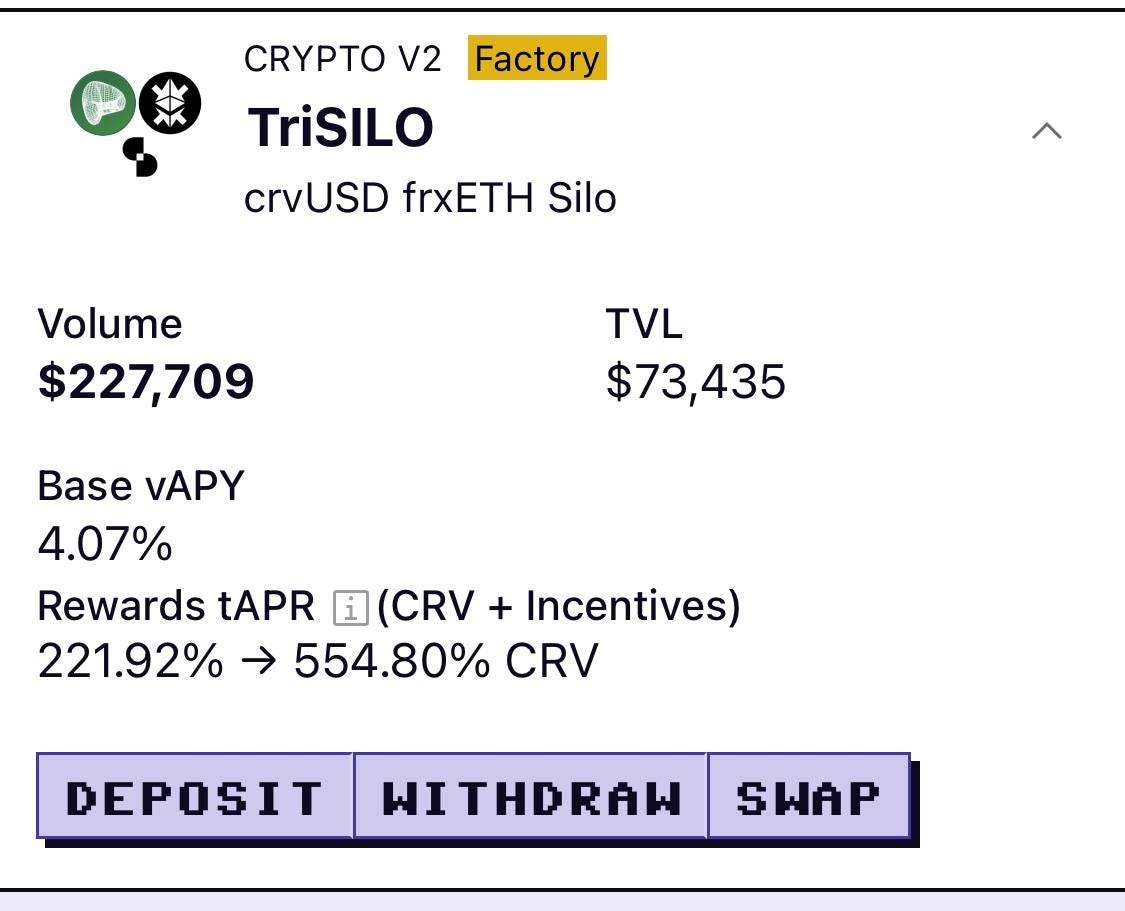

A very cool new pool launched in TriSILO, which combines crvUSD, frxETH, and the SILO governance token. The rewards are of course nice, but what’s going on with that volume? $227K on $73K TVL? 4.07% Base vAPY? We don’t have a good explanation.

yETH Sandwich

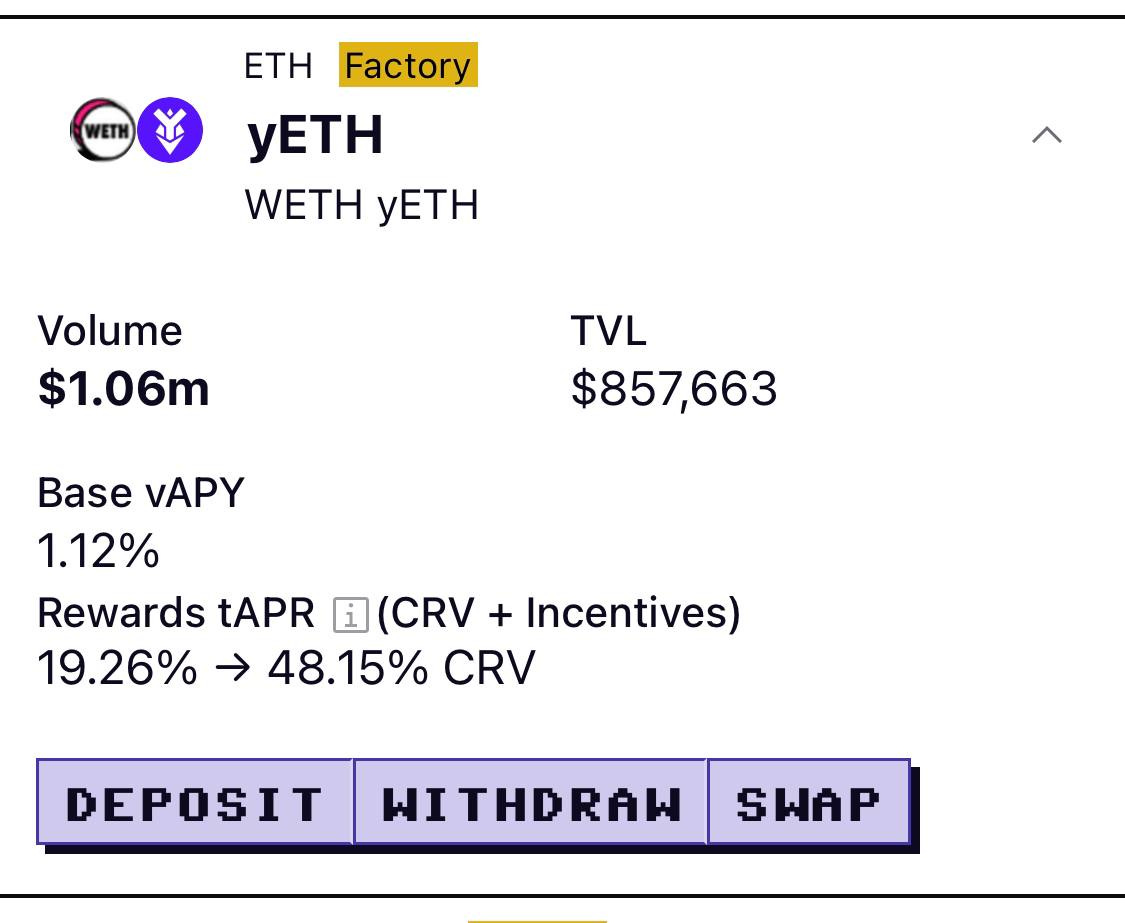

Another huge utilization alert… $1MM volume on the new yETH’s $858K in TVL, which works out to >100% utilization.

Looks to be some hefty volume due to a major sandwich attack, depositing a few hundred ETH to siphon out 1.74 ETH from a 2 ETH tx.

It’s getting hard to find a cheap lunch in the bear market!

Thanks to Mich + Naga King for so much help and inspiration here…

Weekend Reading

We don’t usually publish over the weekend, but you may want some longform content to whet your crypto appetite. Here are some good pieces published lately, some of which you may have missed since X censors content linking to Substack:

Benjamin from Mai on Stablecoin Bridging

Reserve Protocol 3.0: Streamlining Trades with Atomic Dutch Auctions