Was this… alfalfa?

All you had to do was wait a week and keep close watch over the Curve GitHub

So, what exactly is st-crvUSD? Looks like you’ll need to dig into the code…

Or at least peruse idle speculation on Telegram social channels…

Staked crvUSD is a good guess, but without a README it could be anything…

Some more authoritative takes hit the official Curve social channels:

From socials

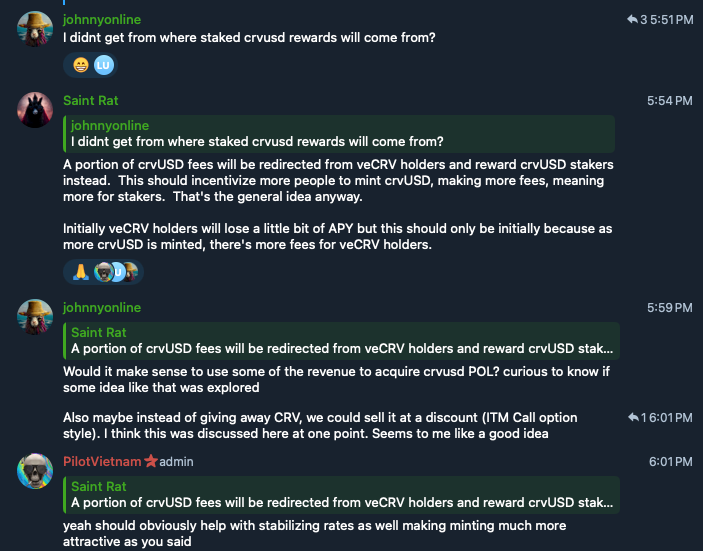

TL/DR from this:

st-crvUSD is staked crvUSD that natively earns an APY

With no free lunches in DeFi, this yield will be redirected from veCRV.

The intent of st-crvUSD is to encourage more minting and stabilize borrow rates

It’s a sink! Another supply sink for crvUSD…

Let’s see what wonders the codebase reveals…

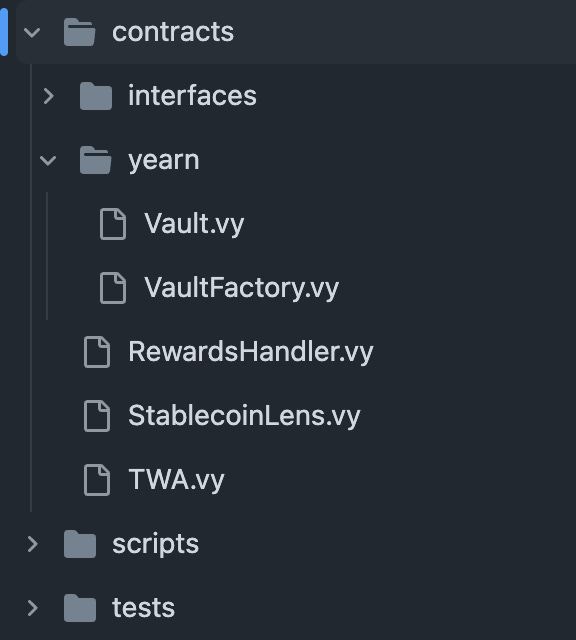

Certainly the easiest way to ship a few thousand lines of code… reuse what’s already battle-tested in prod. The bulk of st-crvUSD relies directly on the Yearn v3 Vault, even faithfully preserving the documentation.

If you’re familiar with yCRV, the code is almost exactly the same other than some cosmetic changes that appear to be the result of linting.

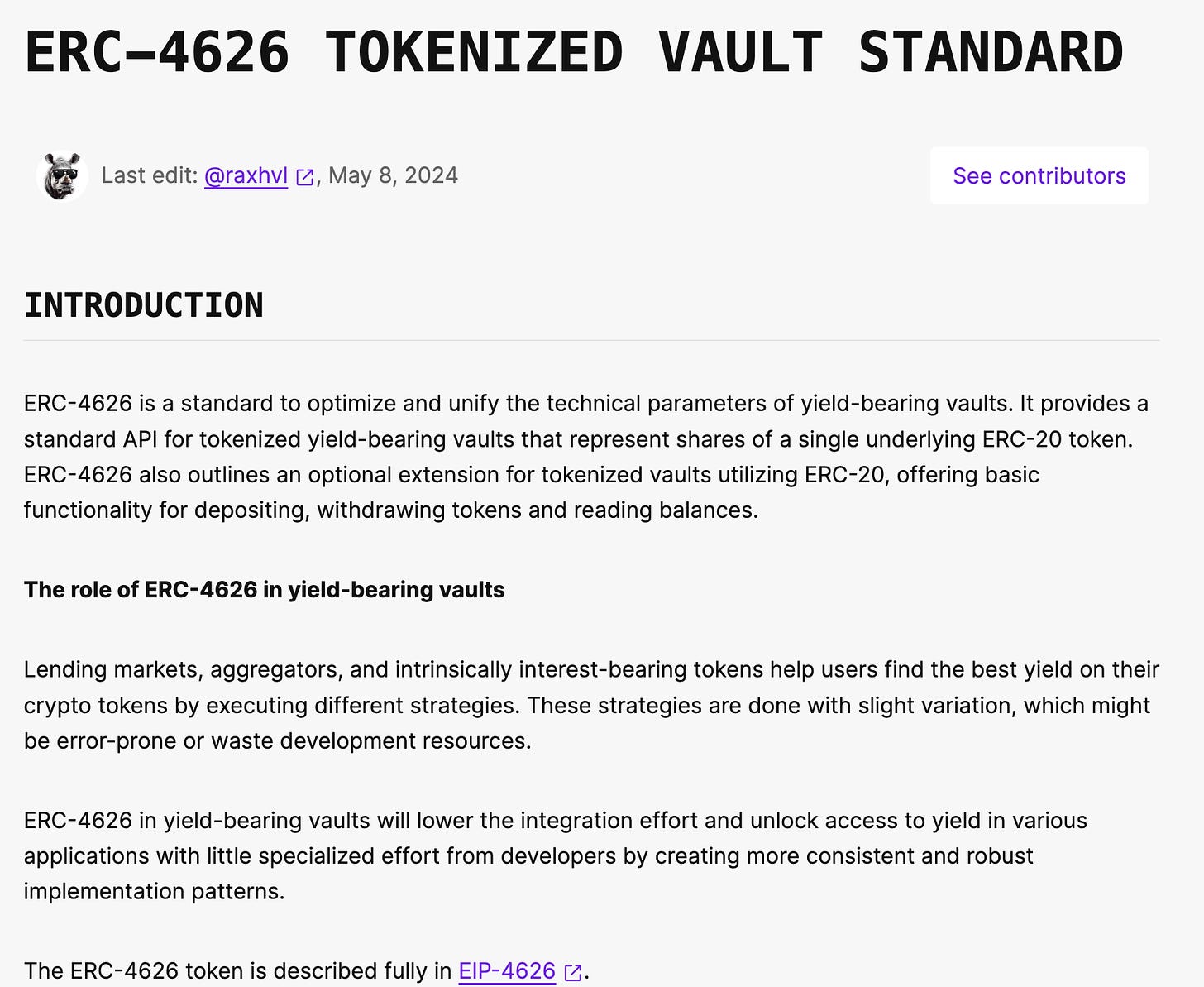

Yearn vaults work with the ERC-4626 tokenized vault standard, so you see the usual concepts like converting into shares (similar to Llama Lend vaults).

The new code is in the Rewards Handler, which is responsible for distributing the rewards to the st-crvUSD vault.

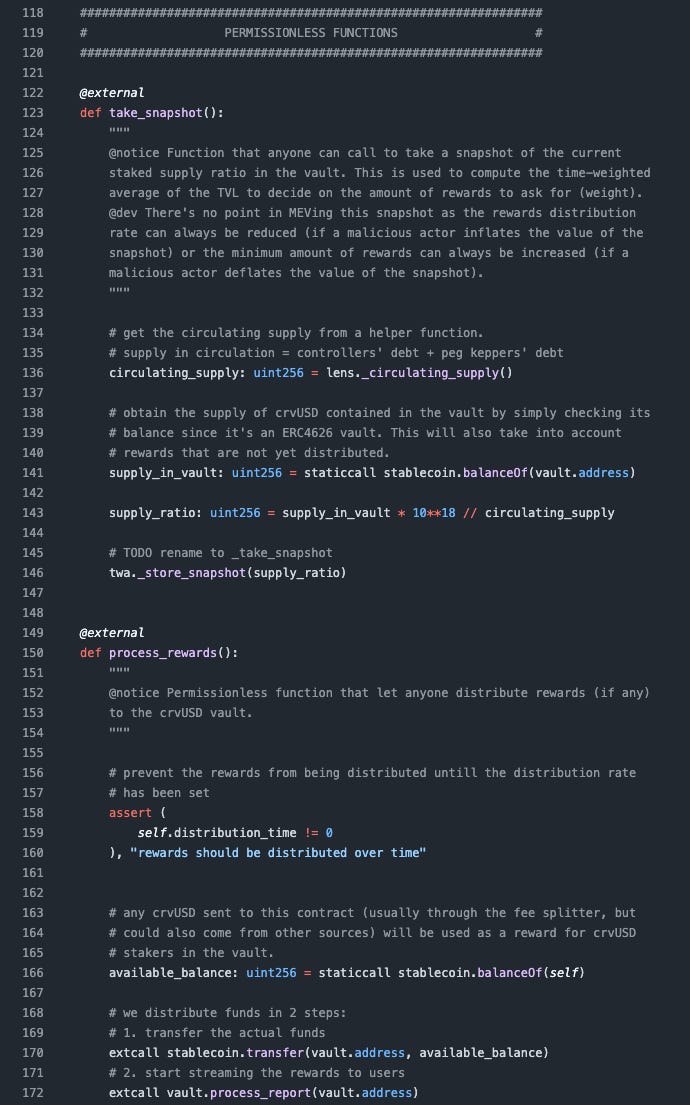

This contract mostly deals with calculations to handle the flow of rewards. A pair of permissionless functions exist, in which anybody can spend the gas to grab a snapshot of the current amount of rewards or distribute them to the vault:

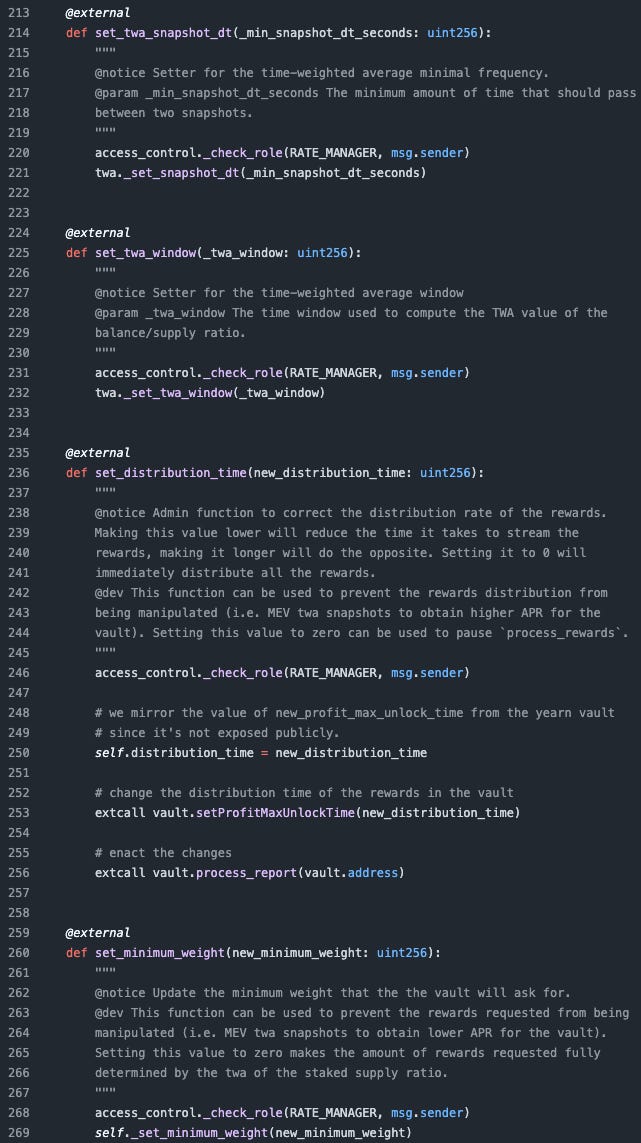

The admin (DAO) reserves the ability to control specific parameters pertaining to the reward collection rate:

A pair of companion contracts serve as helpers to perform a few computations.

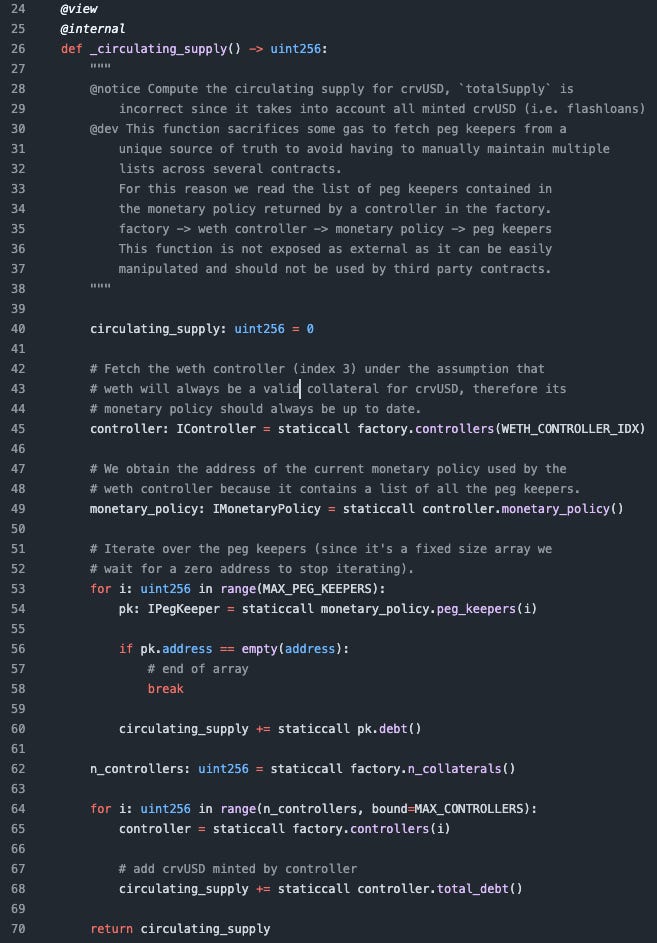

StablecoinLens.vy calculates the current circulating supply of crvUSD

Notably, you can’t just call the totalSupply function on crvUSD because it includes all minted crvUSD even if it may be out of circulation, such as the effect of flashloans. Instead, it iterates over all the debt stored in the Peg Keepers and Controllers to get the circulating supply.

The contract presumes WETH is enshrined as collateral and would need to be replaced if for some reason WETH was discontinued and its monetary policy was out of date (the WETH monetary policy used to fetch the current list of peg keepers).

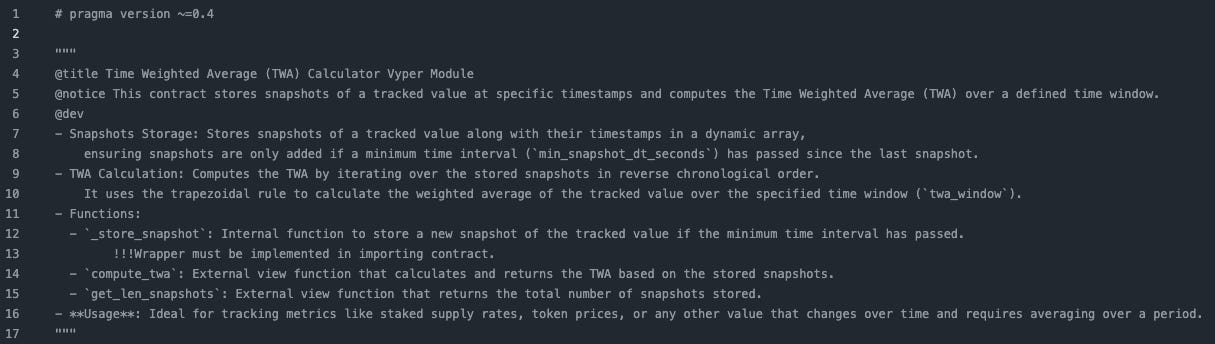

Finally, there’s a TWA.vy (Time Weighted Average) calculator used to compute smooth averages so that the spice / rewards flow according to the limits set by the rate managers.

This provides a brief walkthrough over the highlights of the repository. For further details, the GitHub includes a full test suite that show off the usage of many of these contracts. The Curve team is also standing by in dev and support channels to answer further questions.

The real open questions are less related to the functioning of the contracts and more to the business cases. That is, the contracts will presumably be safe. In the unlikely event something got overlooked, the consequences would not be catastrophic — no user funds are managed here, but a week worth of rewards may get flushed down the drain in a severe downside scenario.

The business question is what might happen with the existence of a st-crvUSD token? Would the team want to pair this with other yield-bearing stablecoins? It’s non-obvious that the DAO would want to spend its scarce emissions on incentivizing such pools, as it would already paying some of its emissions to subsidize the st-crvUSD yield.

However yield-bearing stablecoins are popular… sDAI, sUSDe, sFRAX… and they make for a fairly natural pairing in pools. The dev work being quickly completed (kudos to Alberto and another of Curve’s many Michaels on the fine work) we’ll be looking forward to seeing how the community pushes this going forward.