The SEC yesterday revealed scathing findings against TrueCoin LLC / TrustToken Inc. The entities settled and paid a strangely low six figure fine.

Did… did Gary accidentally protect? The findings allege that 99% of the reserves backing $TUSD are “invested in a speculative and risky offshore investment fund” as of September 2024 (aka… the current month)

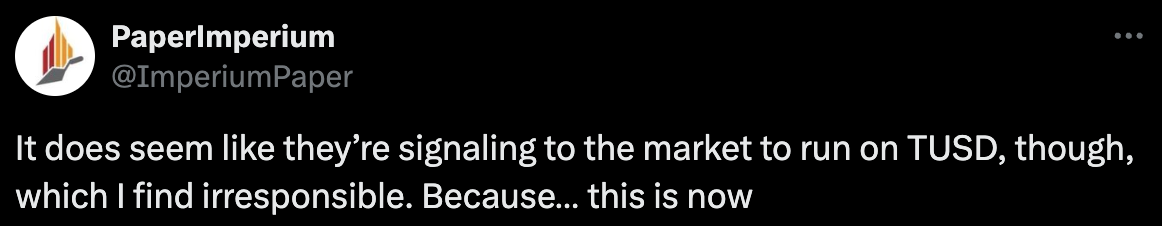

We’re not feeling terribly protected just yet, as we can’t help but notice that the extremely questionable $TUSD is still enshrined as a Peg Keeper for $crvUSD:

Should you panic about the fact that $crvUSD has such a reliance on $TUSD?

We wouldn’t ever recommend anybody to “panic,” but we should hasten a serious discussion about reducing or, most likely, removing $TUSD’s role as Peg Keeper.

If you don’t recall what a Peg Keeper is, check out this writeup from last year:

June 16, 2023: The Peg Keepers ⚖️💰

No Llama Party today! In case you are disappointed by these developments, we can offer you a special bonus if you read to the end!

The good news it that $TUSD’s role in the Peg Keeper ecosystem is already the most limited. Of the four Peg Keepers, $TUSD has a mere $10MM debt ceiling, whereas $USDC and $USDT boast a $25MM ceiling.

At the moment, there’s just $31K of debt in the $TUSD Peg Keeper, which represents the amount of unbacked $crvUSD that was traded into the pool the last time that $crvUSD traded at a premium. $USDC and $USDT have $3.97M and $1.26M, respectively.

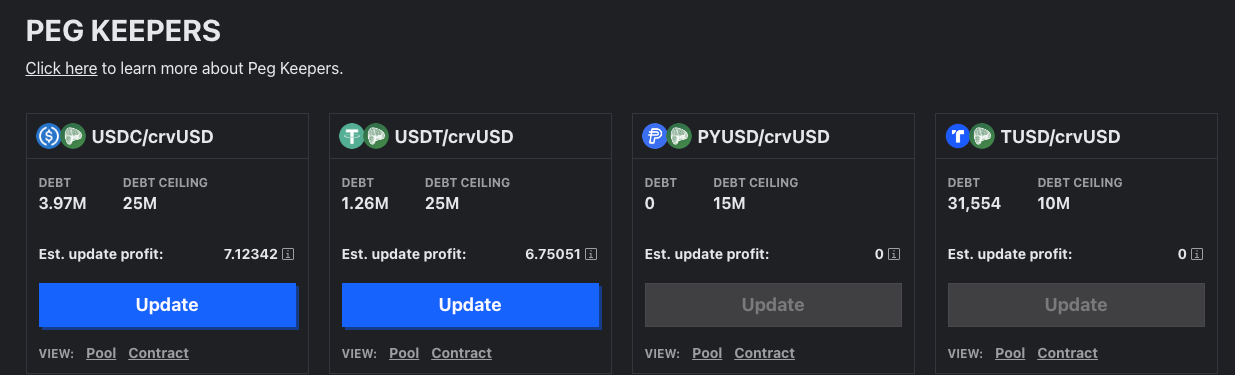

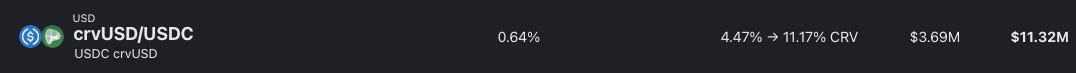

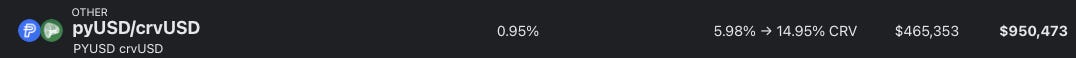

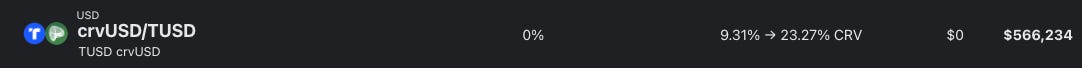

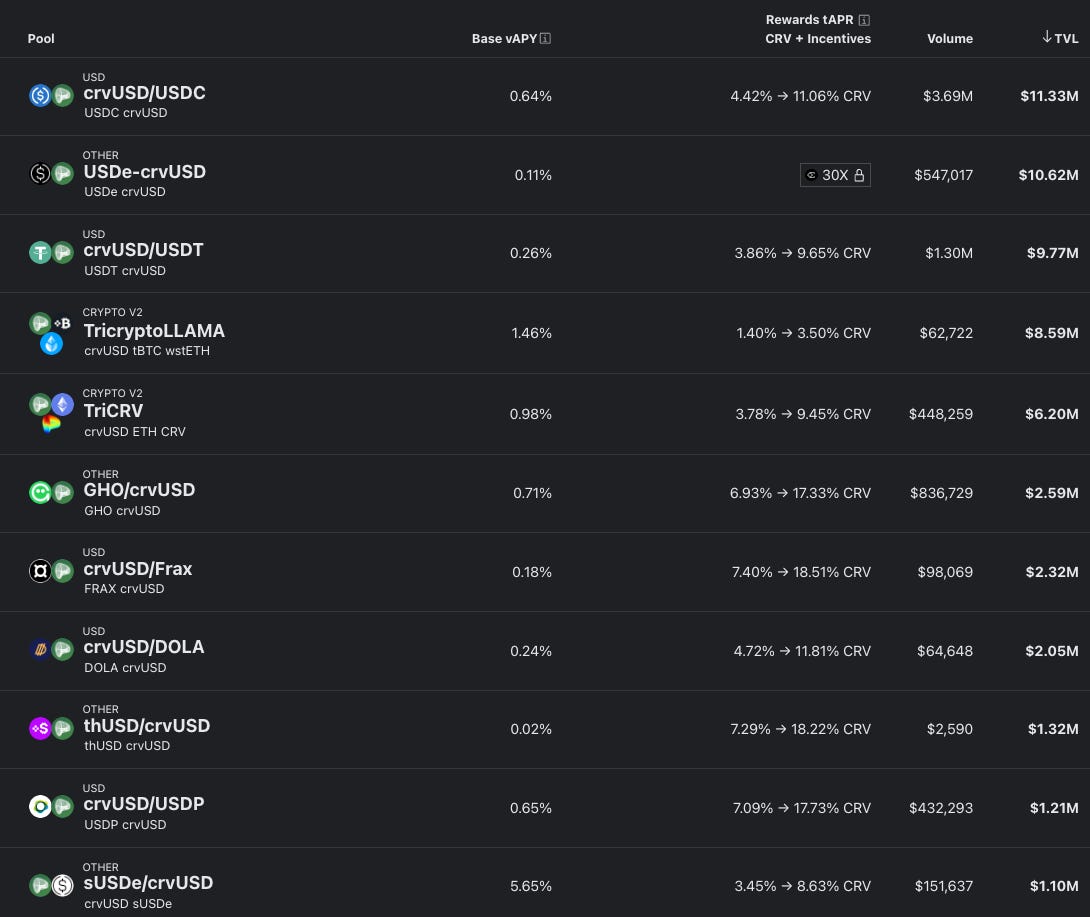

Of the four pools the Peg Keepers are authorized to trade into, $TUSD is already relatively shallow. The TVL of the $USDC and $USDT pools are a healthy $11.32M and $9.77M, while there’s only $566K in the $TUSD pool.

If $TUSD depegged immediately as a result of the vaunted CurveCap publicity, the risks to $crvUSD would hopefully be manageable. The Peg Keepers are designed by their nature to de-weight the coin that is trading furthest away from peg, so a sudden depeg would shift weight towards the other three Peg Keepers.

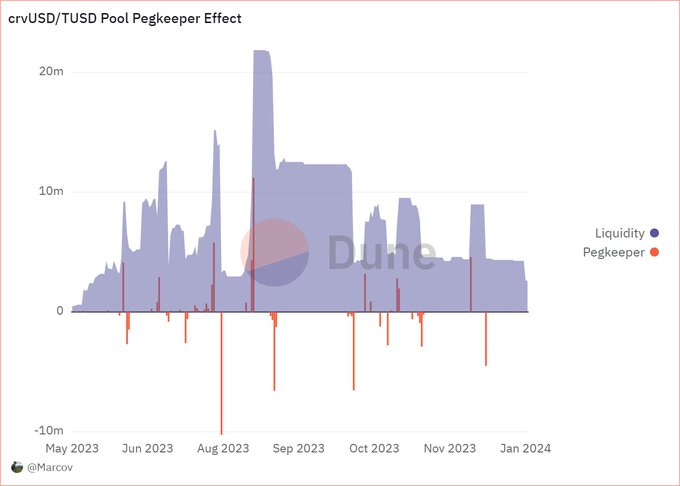

We saw $crvUSD hold a strong peg last year, even after $TUSD peg getting threatened shortly after the stablecoin’s launch.

June 28, 2023: $TUSDepeg? 🌇💥

Tomorrow we’ll likely zoom out to look at the late breaking news that BIS is looking to build a CBDC platform using Curve’s v2 pools, so drop your reply guy takes over the next 24 hours if you want to be included in the newsletter…

Despite the fact that $crvUSD has functioned and held a resilient peg over the past year of exposure to $TUSD, there’s not a particularly strong argument for keeping $TUSD as a Peg Keeper. The historical argument for $TUSD is to provide some more geographical diversity to the Peg Keepers. Surely any such advantage does not counterbalance the risks of keeping $TUSD in the ecosystem.

In last year’s risk report, Llama Risk had a lot to say on the subject.

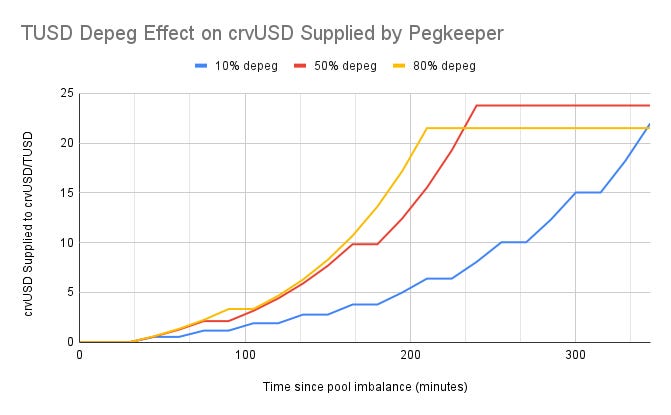

The report goes into good detail on the risks that $TUSD poses to $crvUSD, including criticism of $TUSD’s transparency with regard to reserves and attestations. The team model how a severe depeg $crvUSD may get minted up to its debt ceiling into the pool.

They recommend flat out: “$TUSD should not be included as a crvUSD Pegkeeper.”

WormholeOracle of Llama Risk has already created a proposal to reduce its debt to zero. The days of $TUSD as a Peg Keeper should be numbered.

In the event we do see $TUSD ousted as Peg Keeper, what might replace it?

You’d want to look for a stablecoin that was relatively trustworthy and had decent TVL. Of course, appropriate debt ceilings would be set if a new Peg Keeper was onboarded.

It’s worth noting that Peg Keepers trade into and out of the pool in size, so they can have noticeable effects on the pool’s TVL:

A snapshot of $crvUSD pools:

The Ethena USDe pool is large, but its mechanism may be too novel to engender trust that it would be an effective Peg Keeper. The next largest pools are $GHO, $FRAX, $DOLA and $thUSD, all of which are interesting as they would be more decentralized stablecoins than had been historically utilized as Peg Keepers.

A strong redemption mechanism is an important consideration. It’s nice when arbitrageurs can trade the pool back to peg in the event of imbalances. The strong backing of Reserve Protocol’s $eUSD might make it a good contender, though it would need to move liquidity to a $crvUSD pairing.

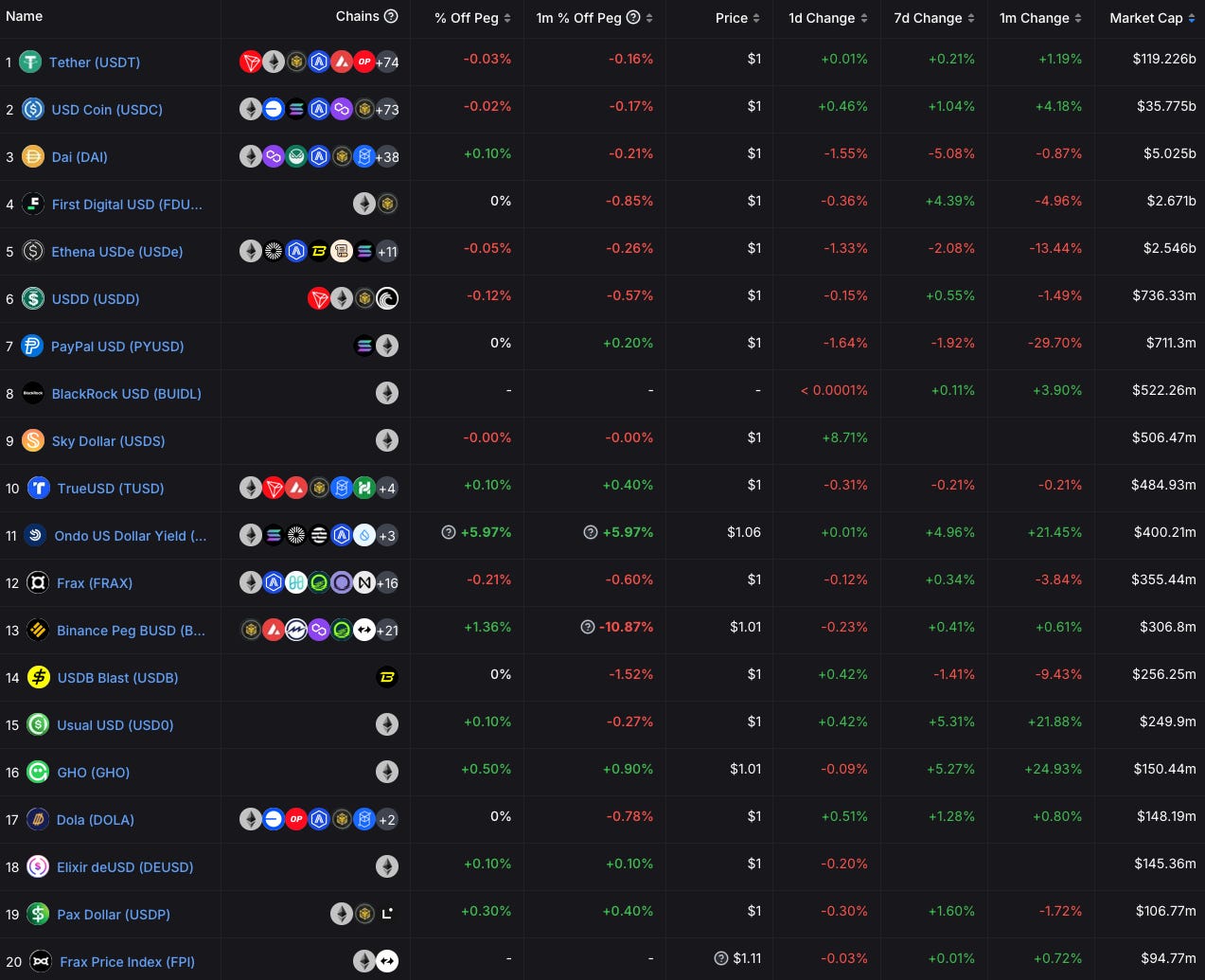

If new pools are being created, other options exist. From DefiLlama’s top stablecoins by market cap:

First Digital’s $fdUSD is the fourth largest stablecoin and could thus be an option, although it’s only presence on Curve is as a points farm. Usual Money’s $USD0 also exists as a points farm, but could be converted. Mountain’s $USDM just got a gauge approval, although its extremely new.

Really, it’s hard to imagine any stablecoin that wouldn’t be a step up from $TUSD. It’s time for a serious discussion about whether $TUSD is the right choice for a Peg Keeper, and which token/s should replace it.