September 29, 2023: Steakhouse 🥩🍽️

Proposals for wstETH rewards, OP and ARB grants, $crvUSD updates, and more

Based on the following level of ecosystem activity, ask yourself, which token deserves the higher market cap. $BTC or $CRV?

Here’s all the news that’s fit to print…

Steakhouse

If you’re active in Curve governance, we urge you to check out the Steakhouse proposal. The proposal would revamp some of the infrastructure to bring $wstETH rewards to the assorted stETH pools on Curve, presumably a reaction to the intensifying LSD wars. The stETH pool has been a mainstay of liquidity on Curve, even during the bear, and therefore it’s critical to our protocol’s overall direction.

Based on the the poster’s reputation alone, we would support it. The user who posted, Martin Krung, exemplifies the type of big brained degen who makes us perma-bullish on crypto and remain excited throughout an otherwise hopeless bear cycle. As a member of the crypto class of 2011, he’s utterly brilliant and could presumably retire off his wealth if he wanted, but instead he sticks around and continues lending his talents to building amazing crypto startups and otherwise improving this space.

Fun story… he previously claimed to have invented the e-girl filter, by which a man uses a female avatar to juice their Twitter following. While we question whether he was the first to explicitly try this tactic, it was nonetheless amazing to see how effective it proved… even when he made his subterfuge explicit, embedded his male photo within the pic when zoomed in, and carried a gendered first name, he still got people to follow nonetheless.

He now claims to be the inventor of the vampire attack, and hope to hear the story someday.

In other governance news, we also see a proposal by another brilliant OG who keeps us bullish on the space, Wormhole Oracle has a proposal for receiving an Optimism grant.

The backstory behind this fraught grant, now years in the making, is something else. We’ve been working on Ser Oracle to try to get him to tell the full story, because it would provide about a week’s worth of content. Suffice to say, it’s not been easy and we encourage you to support the proposal to bring this saga to its close.

Thankfully, Ser Oracle’s work on Arbitrum grants has usually been more straightforward.

The jockeying for Arbitrum grants in this case is a bit intense, and worth reading through their forums to see how competitive it may become. We hope it goes through, as it would juice $crvUSD adoption on the chain.

$crvUSD

Speaking of $crvUSD, a big 9MM mint has casually pushed debt to an all time high.

As $crvUSD continues to quickly impress itself upon the DeFi ecosystem, we’re seeing it become core to some highly competitive farming strategies.

The user friendliness of the liquidation really needs to be experienced to be believed. Of course, many users go max degen, but for those who prefer to stick to “play it safe” mode, it’s quite remarkable you can achieve 71% with a rate of 10% annual losses if things go wrong… all to buy entry to the juicy yield farming strats from above.

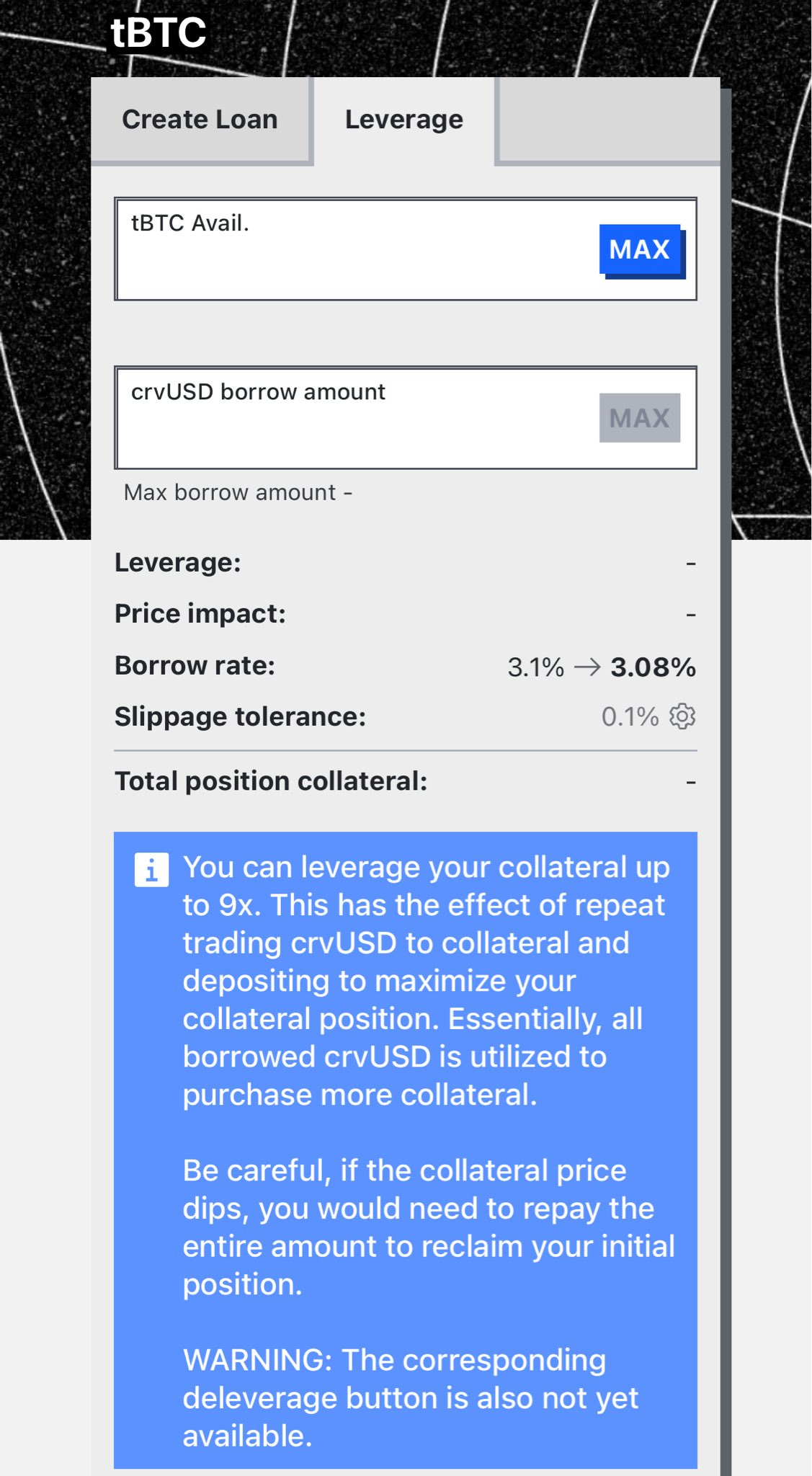

Or if you prefer to simply max lever up, we won’t judge…

The core of $crvUSD’s success, though, has to be the extreme stability, a function of relentless arb traders. Here’s some tips for those resolute players…

For more updates on $crvUSD, follow user @pasharus_ who has provided great updates on underlying metrics lately.

See also, this great deep dive on Silo Llama’s $crvUSD markets by the great Nutoro.

Lockening

Just as Bitcoin could once be mined from a laptop before it moved up to an industrial scale mining game, $CRV lockening used to be for smol fish before major protocols got into the fight.

$CRV lockening lately has continued exceeding emissions, with Yearn and Stake DAO seeing disproportionate locks.

Vyper

There’s been an interesting new repo to interact with Vyper using Rust…

Meanwhile, help secure Vyper while also accessing Certora!

More

The next big “WEN” delaying some devs is surely the launch of the next Stableswap-NG… Curve here provides an update.

The v2 pool lending strategies at Gearbox have continued to explode. They are currently voting on adding TriCRV to their high APY strats following early successes. Go vote, gearheads!

Archimedes has been picking up the omnipool game to fill the void left by Conic Finance.

Protocol f(x) continues to celebrate their successful launch. The esteemed doctor has a good thread on it.

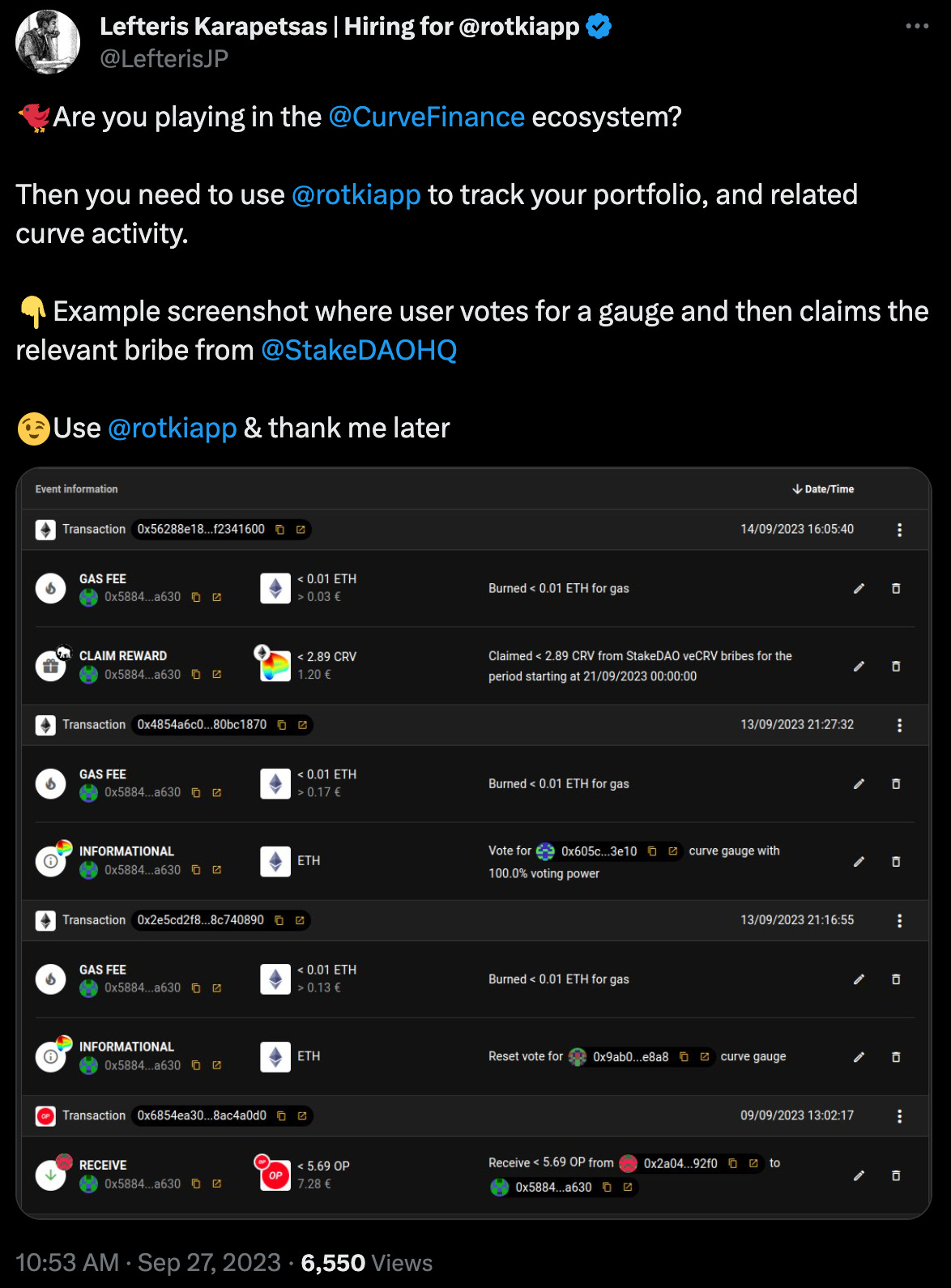

Finally, if you’ve been using Curve and want to track your gains, take a look at Rotki!

Weekend Reading

Recommended reading for the weekend while we generally don’t post: