Watching Curve’s flywheel spinning into full effect is a gorgeous sight. If you staked any time in the past, you might be sitting back and watching the show.

Consider, Curve just launched a pool factory for v1 pools, up to 34 user generated pools. Each pool generates trading fees, good for veCRV holders 📈📈📈

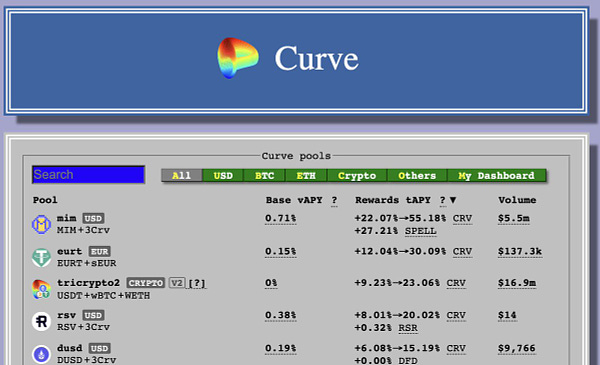

People are mostly using these for stablecoins, but you could build anything, even as outlandish as wrapped NFT pools. More practically, we see things like Fixed Forex. It’s not only gaining traction, it will also soon be getting rewards:

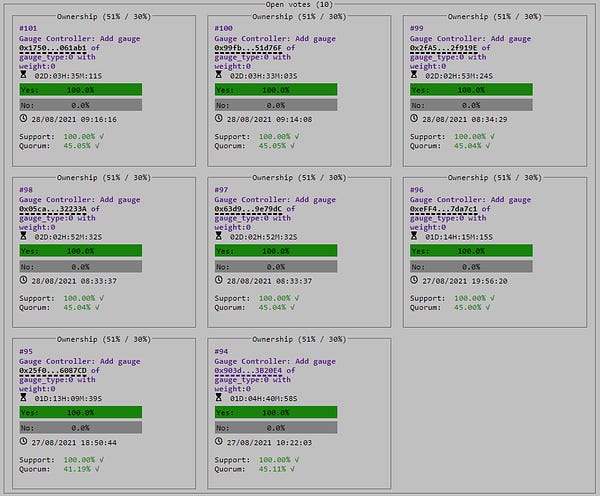

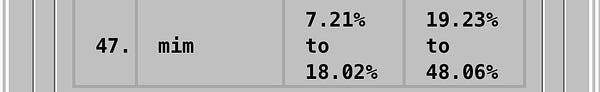

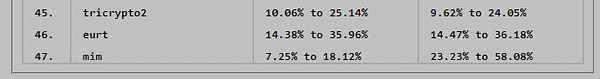

What happens when there’s ever-more pools and ever-fewer rewards? Competition escalates. Good thing we have an efficient bribe system, especially one that accrues more value to veCRV holders 📈📈📈

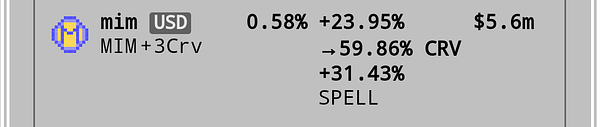

Currently brandishing the largest wand, the $SPELL bribes are working like magic:

Ergo, whoever controls the bribes is clearly in the catbird seat.

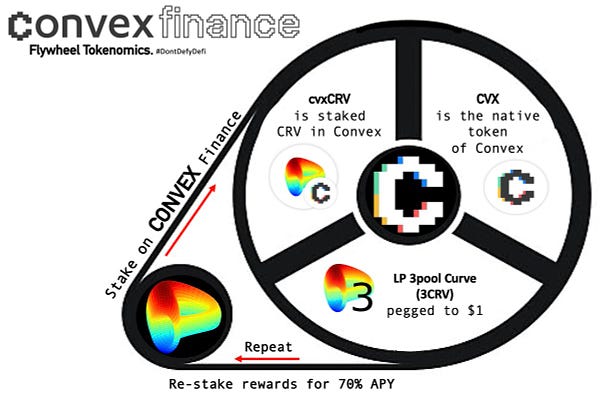

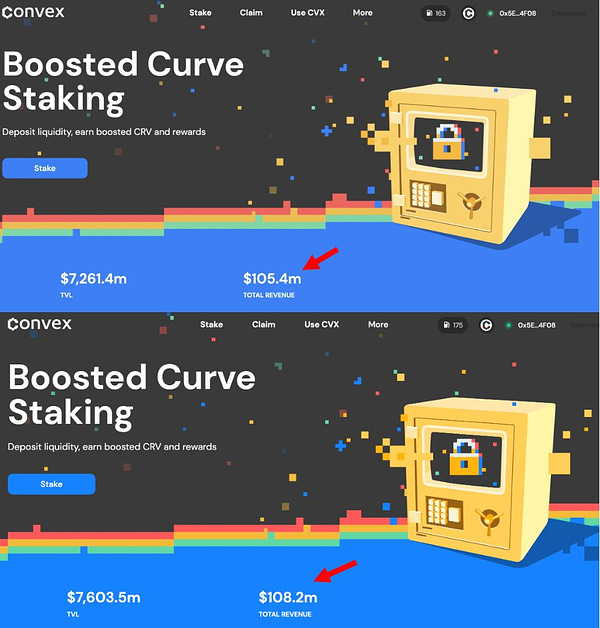

Convex Finance is subsuming Curve. The protocol controls nearly 100MM veCRV at their disposal on over $7B worth of volume locked, all the while throwing off value to everybody in the ecosystem📈📈📈

Convex will basically control all voting rights on Curve via Votium release. At this point, the intense bribe wars will undoubtedly extend to Convex.

If you happen to believe Convex is stupidly underpriced in the market, your optimum strategy is probably to just shut up and grab it while it’s cheap.

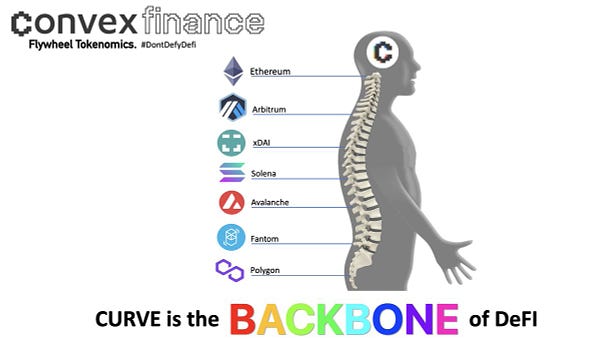

The effects so far are primarily just value captured on Ethereum at the moment. Yet we know DeFi is moving to other chains as the mainnet becomes absurdly overpriced.

Fortunately, Curve is hard at work expanding across multiple chains at the moment, frequently with chains directly incentivizing this expansion 📈📈📈

Ranging from the bootylicious Polygon, (already half a billion in Curve volume locked), to integrations announced but unlaunched (Arbitrum, Solana, Avalanche), Curve helps these chains grow their DeFi ecosystem and return value back to the flywheel 📈📈📈

As these chains reach maturity, imagine the additional opportunities which could be unlocked in the future 📈📈📈

You don’t even need to understand precisely how all the gears of this machine fit together. Even if you’re small brain…. you see a money flywheel accelerating, WYD?

For more info, check our leaderboard at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV/$CVX maxi.