Thursday, February 16: Archimedes Leverage 🔩🇬🇷

Archimedes Finance launches leveraged stablecoin yield on Curve

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world”

— Archimedes, but probably in Greek

Archimedes is a strong candidate for the Michael Egorov of antiquity. We could probably write a whole week of articles lauding Archimedes’ contributions to math, physics, astronomy… but we’ll leave it at this: if Archimedes Finance lives up to their namesake, they’ll be in rarefied air.

They no doubt picked Archimedes as a mascot to reinforce the “lever” concept. Their launch offering is a 10x stablecoin yield leverage product.

Their first liquidity event is playing out shortly, so if you’re interested you should read on to learn more. Remember, as always, nothing in this newsletter constitutes financial advice.

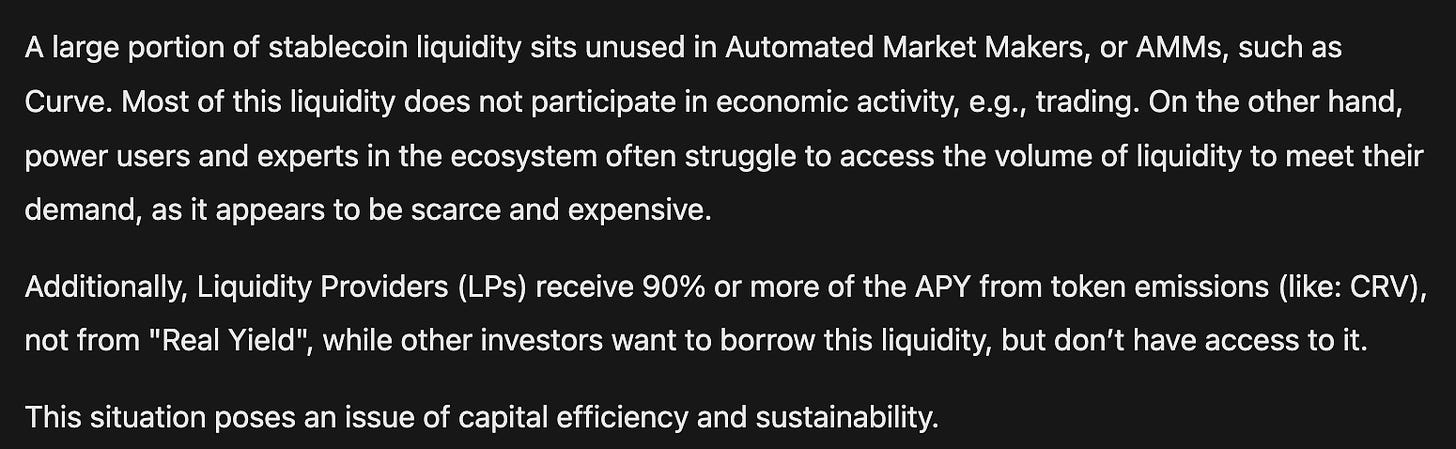

The team’s white paper articulates tackling the problem of idle liquidity:

Archimedes envisions solving this by auctioning this liquidity to the highest bidder among borrowers.

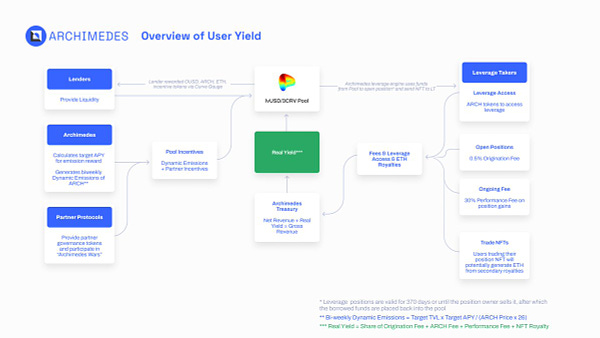

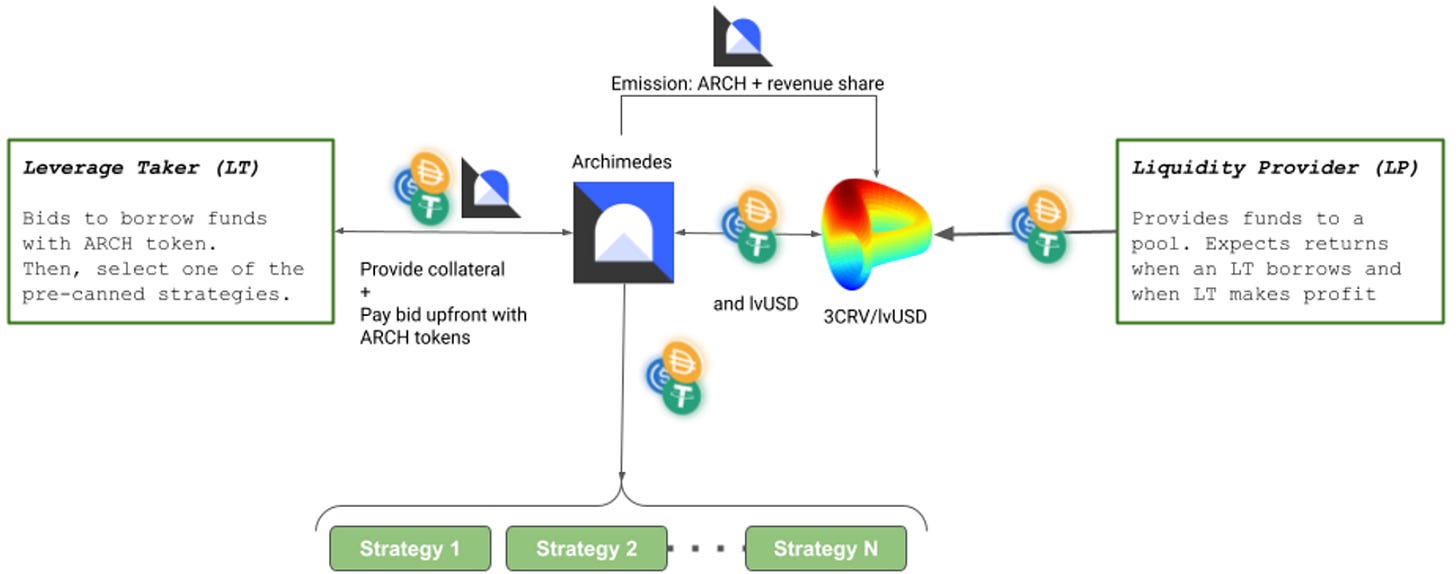

The general flow is:

LPs participate by putting money into the 3CRV/lvUSD pool on Curve.

Archimedes borrows from this pool to auction to leverage takers.

Leverage takers can select among a handful of pre-canned leveraged strategies

Any revenues are shared with the pool LPs to provide incentive to deposit. Leverage takers also pay a handful of other fees to support the protocol’s operation.

Going further down the rabbit hole, we see the entire mechanics hinge on their $ARCH token. The $ARCH token is used by leverage takers to bid on available liquidity in an auction. $ARCH emissions will also be streamed to LPs.

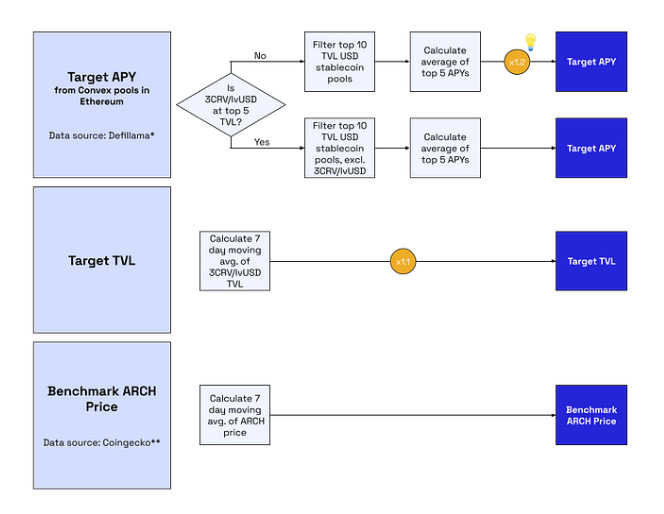

Striking the right balance here could make or break the protocol. The team adjusts the emissions rate a few times each month to aim at a target value — following this formula means in year 1 the protocol may emit anywhere between 322K to 6.5MM $ARCH tokens. The specific mechanics of their dynamic emissions schedule are outlined in this article.

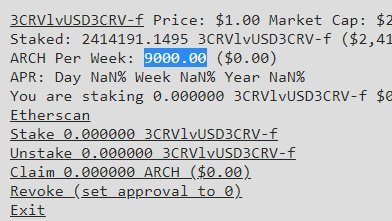

For the first event begins in just a few days, in which the team is distributing 9000 ARCH tokens with a target APY of 15%

Their initial strategy is exclusive to Origin Protocol’s $OUSD, a yield-bearing stablecoin. Origin Protocol has been in operation since before the bear market struck, and held its peg throughout, making it a good choice for a launch partner. As a yield-bearing stablecoin, Archimedes will provide access to leverage up to 10x this APY.

They also plan to expand to Liquity’s $LUSD and Synthetix’s $sUSD this quarter.

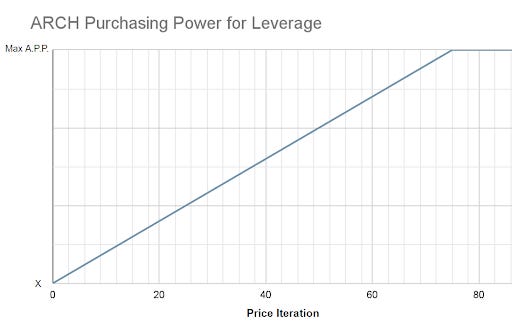

To access the liquidity, the team will be conducting a capped Dutch auction each period, whether the purchasing power rises steadily until the round is full or the maximum ARCH Purchasing Power rate is hit. All details are announced ahead of each auction.

The team has completed an audit through Halborn and their Github repository is open to the public and well organized. The founding team, heavily from MIT, is completely doxxed. They recently raised a $5MM seed round to launch their platform — we’ll see if this proves an asset or a liability in this hostile regulatory climate, but these signals may give some investors comfort.

Will it work? We have absolutely no idea. Should you ape? Again, we have no idea. They’re kicking up over the next few weeks, so we simply want to bring it to your attention. If you are interested so you can do further research for yourself.

For our sake, we are pleased to see Archimedes innovating in the realm of DeFi with a novel concept. With many moving pieces, there’s always the capacity for unknown unknowns to throw it out of balance.

The $lvUSD pool has been already seeded with $4MM of liquidity, so fortunately the supply side has been successfully bootstrapped. Their launch will provide a barometer for the appetite of the demand-side (ie Liquidity Takers). We can imagine, as with any project launching into a tough DeFi market, juicing demand may be the biggest challenge.

In addition to other disclosed risks, a lack of bidding demand might cause an Archimedes [death] spiral and cause investors to get Archimedes screw[ed]. Of course, this is a risk with everything in DeFi, we just wanted to squeeze in some puns related to notable Archimedes inventions.

From what we’ve seen, the outstanding team has done their homework and considered several edge cases. Their documentation and blog are thorough and well-reasoned, definitely a must read. We believe if the team hit any roadblocks with their initial offering, they’d be more than capable of pivoting their strategy as needed. We’re interested to see where the experiment goes!

For more, we recommend visiting their website, Github, Medium, Twitter, Discord and Telegram.

See also these threads, the first of which comes from DeFi Made Here. Ser Made Here appears to be content with ARCH’s tokenomics, which is high praise for the project given his thoughts when he joined us recently for a debate on the subject of protocol emissions.

Stay safe!

Disclaimers! Author has no position in $ARCH or Archimedes Finance, because Americans are forbidden (“protected”) from using the service thanks to our numbskull leaders.

"But probably in Greek"

.

.

Well, here you are (in ancient Greek):

"Δῶς μοι πᾶ στῶ καὶ τὰν γᾶν κινάσω"