The BTC ETF Rally

Yesterday we got our first hit of “Up”-tober… for just a few minutes.

We may never know what caused the green candle, but we know the source of the errant CoinTelegraph story that dropped around the same time.

But seriously, maybe we’re at a point where deleveraging should pump the price of orange coin? In our opinion, crvUSD is the killer use case for Bitcoin.

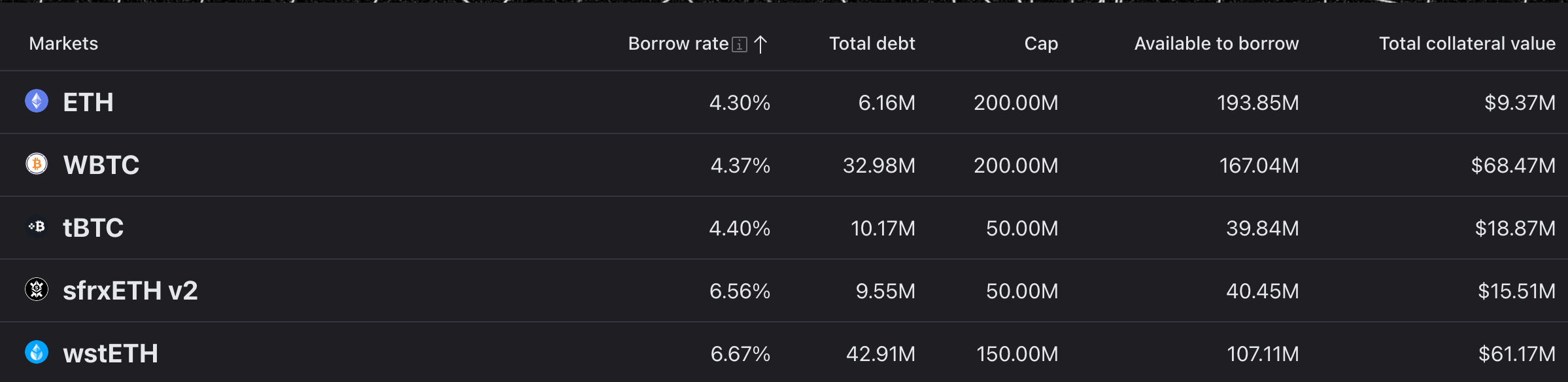

Among the $crvUSD markets:

Between $WBTC and $tBTC, bout $87.3MM worth of BTC has been wrapped and deposited to $crvUSD, just over the $86.1MM of Ether and LSDs backing the new stablecoin. The most stable decentralized stablecoin is now chiefly backed by the largest cryptocurrency.

We prophesied this flippening back in July, when we first described how $crvUSD was so useful for Bitcoin HODL-ers.

July 3, 2023: WBTC Summer 🎆🗽

The first DeFi Summer is now but a distant memory. Nowadays the popular narrative is all about LSDs and LSD-Fi, thanks to staked Ethereum earning a raw rate of… :checks notes: … 4% Yesser, a whopping and wild 4%… a number that falls short of treasury bills… has got degens buzzing. LSD-Fi has seized the narrative and spawned a cottage industry of protocols built atop staked Ethereum.

TL/DR: Posting staked ether as collateral is useful, but the marketplace is more competitive at providing destinations for staked ether. Whereas there’s no place to otherwise earn good yield on Bitcoin in a decentralized fashion.

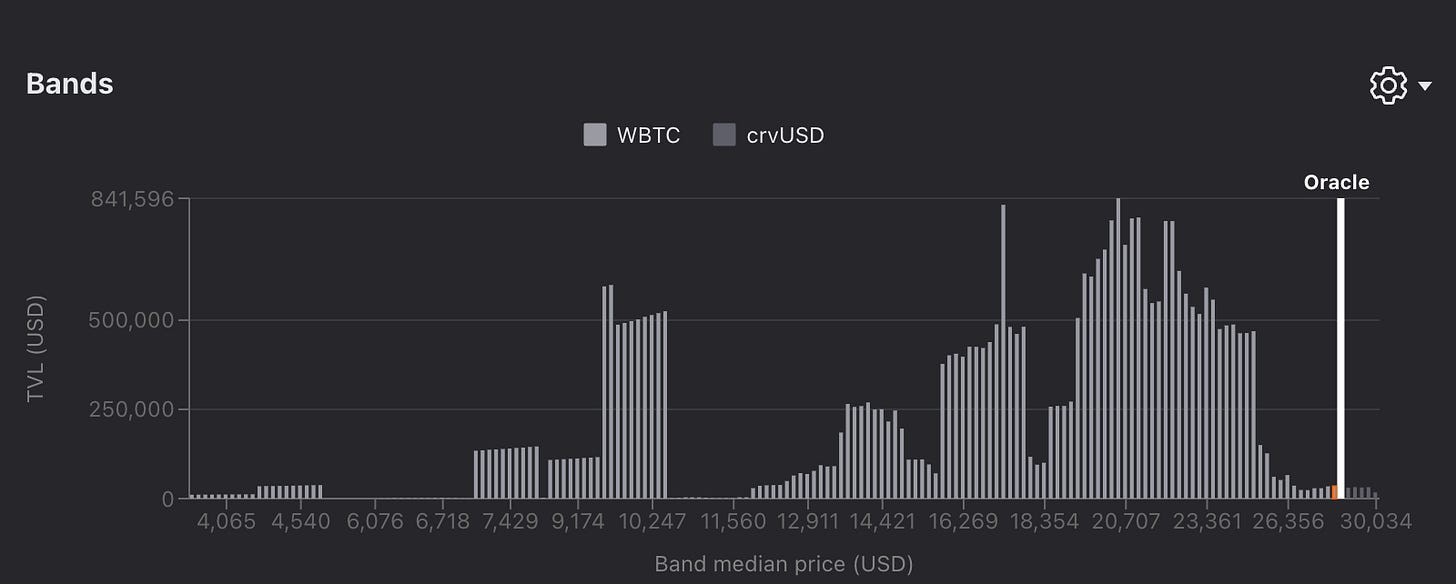

Moreover, the friendlier liquidation protections for $crvUSD is very well suited to the “don’t sell a single sat” crowd. This bears out in the risk profile of current $crvUSD users. Calculating their LTV:

Notice the users all embrace higher LTV for the ETH markets? You can observe how relatively conservative BTC users are, with most users keeping their collateral in bands below last cycle’s ATH of $19K, and few willing to go any higher than $25K.

The WBTC and tBTC markets also have the advantage of carrying lower interest rates than the LSD markets, which makes them suffer a bit less under cyclical periods of high borrow rates.

That said, the Bitcoin markets appear to be the most dramatically affected by high borrow rates. From the most recent rate peaks to now:

WBTC: 48.7MM —> 32.7MM == 32.9% drawdown

wstETH: 51.7MM —> 42.9MM == 17.0% drawdown

The WBTC users reacted much faster to the short period of high borrow rates than wstETH users, even though the latter suffered higher interest rates.

Now, we’ll grant that Curve only has about .01% of the total BTC supply. So if changes to $crvUSD are actually affecting prices of the largest cryptocurrency, it’s surely negligible. Yet high yields have a way of cutting through the noise and attracting liquidity. As the resilience of $crvUSD markets and the trustless bridging of $tBTC increasingly gain trust through successful operation, we imagine more BTC may find its way onto Ethereum for the next DeFi summer.

Therefore, the addition of a successful deleverage button may move markets, with the ability to make decentralized leveraged bets on BTC…

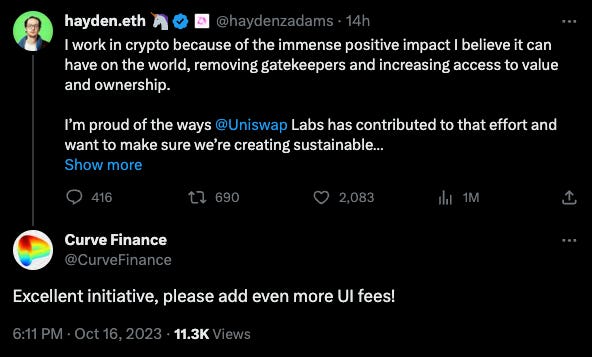

Frontend Tax

OK, what’s the deal with taxing use of a frontend?

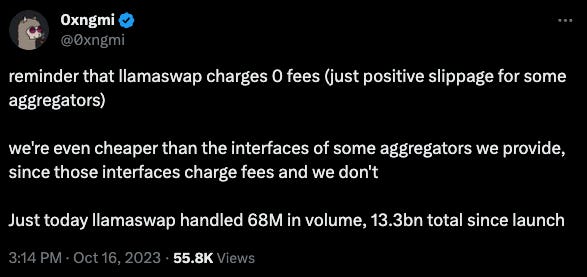

Jokes aside, it’s not a crazy concept. Using the UI of Uniswap instead of using the DeFi Llama swap aggregator is literally leaving money on the table. Checking among aggregators may yield the exact same price as the Uniswap backend, or it may yield better prices, but in no cases should it yield worse prices.

The proper financial term for low-information economic actors is “dumb money.” If you want to be charitable, you might lament that they simply are victims of information asymmetry — perhaps you might cast them instead as victims who never learned about the importance of aggregators amidst the fog of the US’s draconian crackdown on cryptocurrency?

Whatever the reason, dumb money abounds in crypto. Metamask has almost a 1% swap fee, and it prints big money. Nobody in business feels too bad about parting a fool and their dollar. We may think it’s smart to be in crypto, but not everybody in crypto is smart.

Uniswap has built a good business off of attracting and then fleecing dumb money. yet we suspect there’s other implications afoot.