As always, the fundamentals underpinning DeFi remain exciting, even if the price action seems wholly disconnected from these developments.

For one such teaser… incentivized borrowing in the new crvUSD weETH market hints at how the LRT space remains…

Additionally, this morning Resupply got announced.

While handicapping the range of potential launch results with the great Cryptovestor, he feels we’ll know very quickly whether or not Resupply will fulfill its lofty potential. We’ll be watching over the next month to see how it plays out, with the timeline of launch events for the upcoming monthy outlined in the above thread.

For now, the most important takeaway for anybody still holding vePRISMA is the two week deadline to break your lock and be eligible for the airdrop. You’ve been warned…

It’s not the only important airdrop news to be aware of for followers of the Curve ecosystem… for today’s newsletter we focus on our frens at Yieldnest.

YieldNest

DeFi remains maddeningly complex. This complexity can be a systemic threat to the entire industry. The institutions that are showing up only touch the battle tested “blue chips” that can accommodate their entry in size. Retail, suffering information overload, keeps their distance.

For this reason we’ve been eagerly tracking the progress of YieldNest, whose mission statement is to “simplify DeFi for all users.” They’ve been attacking this mission from many different angles, including fun tie-ins like an AI agent that amassed thousands of followers in weeks.

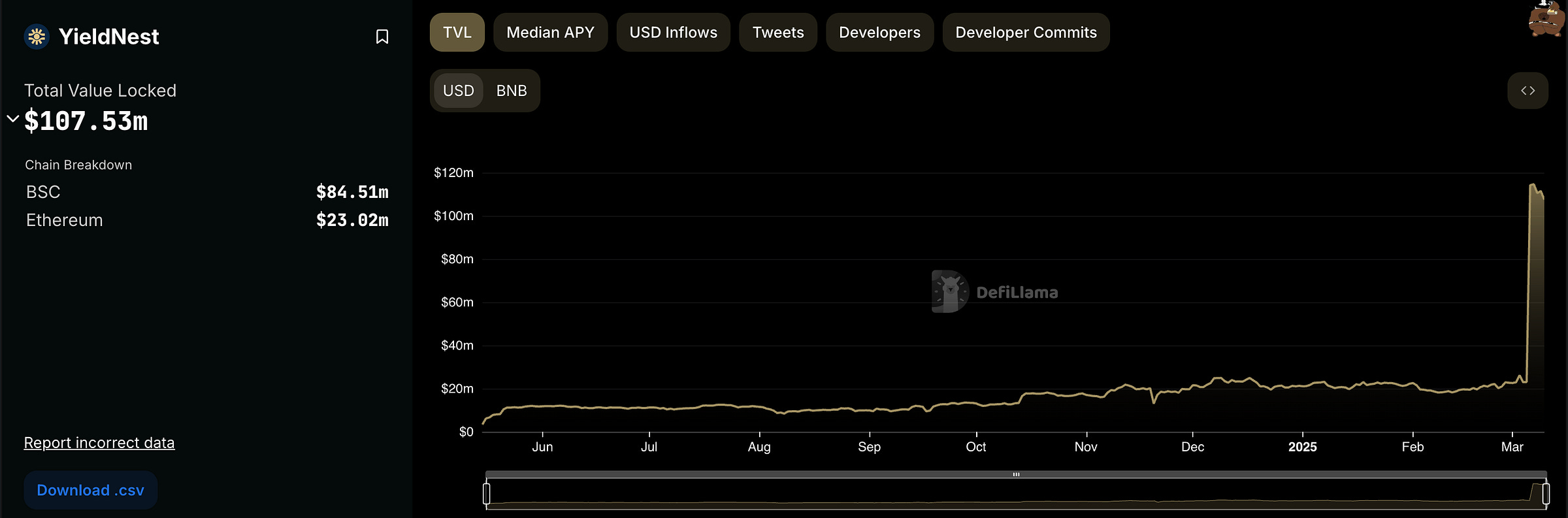

We’re pleased to see the market is finally appreciating their hard work… in a big way.

Observers tend to imagine growth as the cliched “hockey stick” a slow and gradual climb. More often success in most ventures looks more like this punctuated equilibrium. The most common outcome is years of grinding followed by a sudden breakthrough, should the founders last so long.

YieldNest earned their much-deserved breakthrough this past week, becoming well-deserved “overnight successes” after months of slogging.

It’s not only the YieldNest team who can celebrate this fortunate turn. Everybody who’s been following this blog is likely to share in the outcome. The team announced official airdrop details, very generous to fans of the flywheel.

For their entire journey, the team has been running a “Seeds” program points program. Odds are pretty good if you’re reading this newsletter, you may be eligible.

As good friends of the Curve ecosystem, they’ve announced the final round of their seeds program includes healthy distributions to a variety of holders around the flywheel, including Llama NFT holders, holders of veCRV, vlCVX, veSDT, and veYFI.

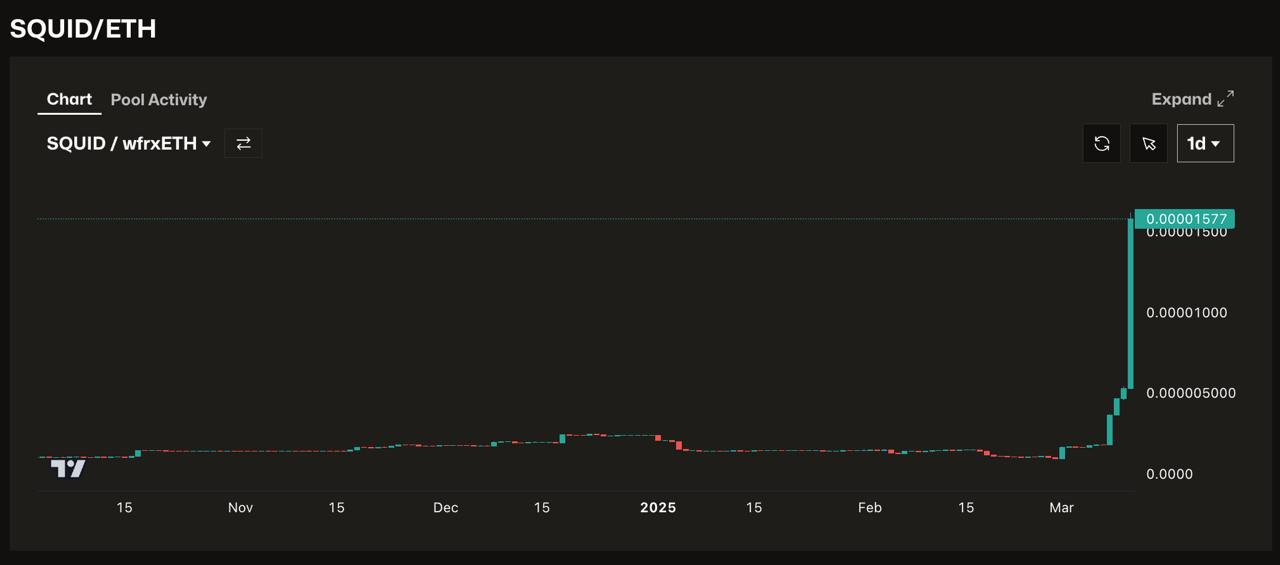

Notably, LPs in the Leviathan News SQUID pool are eligible, making for a situation where the rich get richer!

Their airdrop checking page is located at https://app.yieldnest.finance/seeds and constantly updated, recommend to confirm eligibility before it closes.

Airdrops are nice, but the most exciting potential from YieldNest is the slow and steady profits accruing to yield farmers who partake in their max LRTs. Liquid Restaking may have lost attention as a narrative, but with $8 billion in TVL the sector remains an influential 7.5% of all the entire DeFi market.

The team recently penned a lengthy and well-argued editorial on the state of LRTs, arguing that the reality of LRTs lag behind the vision, because the restaking ecosystem in 2025 remains fragmented with incomplete infrastructure, delayed rewards, and security gaps.

Within the sector, YieldNest’s MaxLRT products stand out as bridging this gap, due heavily to the fact that YieldNest’s products were built by yield farmers and for yield farmers. The team has deep origins in the Curve flywheel, and they architected their MaxLRTs with this knowledge in mind.

MaxLRTs are comfy for yield farmers in that the team absorbs the onus of dynamically reallocating funds across risk-adjusted strategies. The use of L1 settlement makes the accounting transparent, and they lean into trends like AI to balance risks and rewards.

They describe decisions they made to focus on safety and composability here:

As a result, their tokens are getting well integrated as building blocks of DeFi, leading to a lot of profitable strategies for yield farmers. A few we spotted, and how we are taking advantage of these products, below the fold. All others must wait to join this AMA with founder Amadeo Brands