April 1, 2022: An iConic Moment🍦🎉

Conic Finance announces Omnipools and Airdrops for flywheelers

“How can you worry about airdrops when Europeans are suffering!?!?” Gotchu covered in a rare double header over here…

Airdrop season continues!

Yesterday Conic Finance announced their upcoming launch, complete with an airdrop for $vlCVX holders.

What is Conic Finance? Just yesterday we reviewed the benefits of DAO Jones, which offers staking to a single token instead of pools.

Similarly, Conic Finance’s concept of “omnipools” appears to allow users to stake a single token, and allow Conic Finance to automatically reallocate this token as rewards reallocate. Quite useful!

Omnipools would in fact be quite useful. To take one example, yield on Bitcoin has been atrocious lately. A cncBTC would be useful in pushing towards chasing whichever pool happens to be getting a marginally better 1%.

Conic also announced an airdrop. Following the Lendflare IDO announcement, our prediction that flywheel airdrop season was back looks to have been prescient.

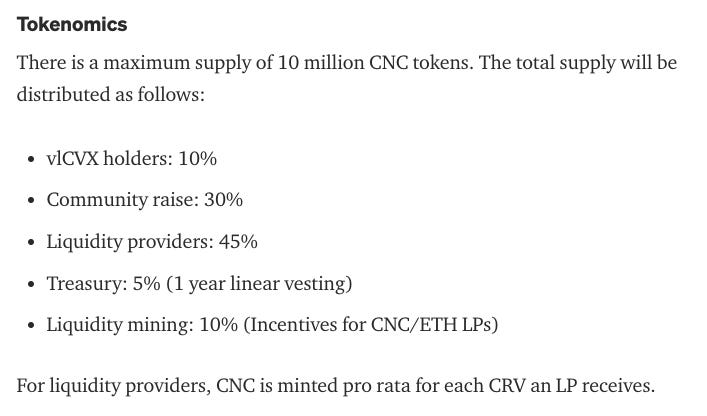

In this case they have a 10MM supply, of which 10% are being distributed to vlCVX holders. Details to come soon.

The last major airdrop, $EPS, would go on to tank. Yet $CVX did great.

So should you farm or dump? Who knows? The tokenomics might suggest there’s slim revenues in store for Conic holders. In this case, Conic is collecting… zilch. No performance fees, no exit taxes.

So, how then would their token have value? They cite:

“If decided by vlCNC holders, platform fees could potentially be introduced and paid out to vlCNC holders.”

We would presume such a vote would be very likely to pass should it hit the ballot. That said, perhaps a truly charitable project may also be a good candidate for veFunder gauges as well.

There’s a lot to dig into. As always, you’ll find your best form of protection comes in this long thread by @crypto_condom, flagging the lack of an audit and insurance:

The announcement was also covered ably by @LowCapCo

Caution is indeed always advised for new projects. Plenty of open questions. How would they utilize v2 pools, which often have higher yields but suffer impermanent loss? What if your coins are in a risky pool that depegs? None of this is to cast aspersion on the concept, we’re just interested to see how the promising concept gets fleshed out.

Positioning itself relative to Curve, the site upgrades the early Windows UI with a fancy and partially functional Mac GUI.

Another key cultural overlap between Curve and Conic is the reluctance to accept VC funding. In my experience, VC funding is the number one predictor of startup death. Sure enough, today Curve is dancing on the grave of so many VC-backed knockoffs.

It’s promising positioning to call themselves “Conic,” from which some of the best pure mathematical curves can be derived.

I always was bugged by Ellipsis Finance, which seemed a veiled reference to an ellipse, the warhorse of conic sections. However an ellipsis is only archaically connected with an ellipse. An ellipsis more commonly refers to the rhetorical device or punctuation mark. And we all saw how Ellipsis turned out dot dot dot…

So be it the free tokens or the mathematical purity, the flywheel community is rejoicing at the announcement.

Good coverage! and ty for the s/o.