Check out our daily DeFi roundtable, today featuring the Conflux Finance team:

Last week Redacted released details on their upcoming stablecoin, $DINERO. The new token immediately stands out as providing one the more novel utilities among stablecoin platforms.

For those unfamiliar, Redacted Cartel ($BTRFLY) is the rare OHM fork to have survived and even thrived over the past year of doldrums. From an early day the team focused on acquiring flywheel assets, which turned out to be pretty useful assets to survive a bear market.

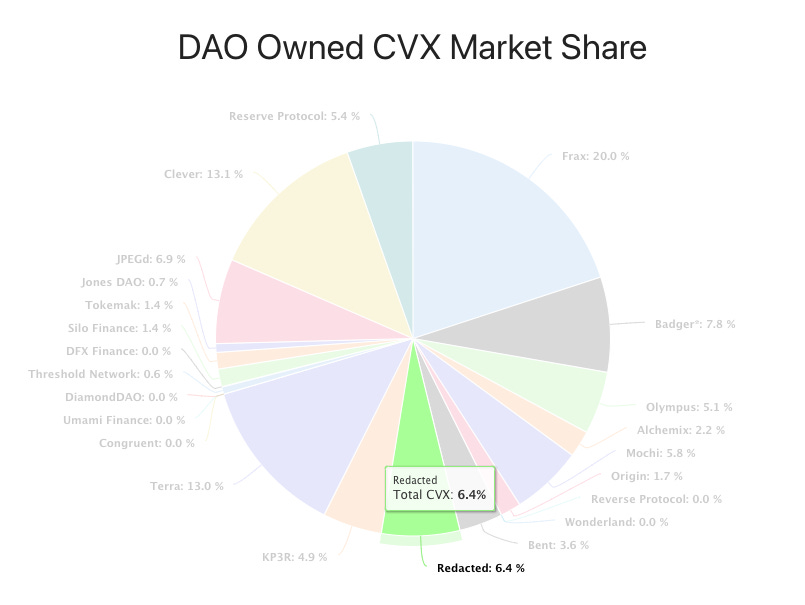

As a result, Redacted today enjoys an enviable ability to redirect liquidity wherever they may need. For instance, the team operates multiple different strategies for earning yield on CVX through Pirex, efforts which have earned Redacted a 6.4% slice of DAO-Owned $CVX, for instance.

Given their history releasing well-thought out products like Pirex and Hidden Hand, we were eager to see their twist on their much-rumored stablecoin $DINERO, which like $crvUSD has been teased since at least last year.

The release proves the over-collateralized offering indeed has a number of unique design points, most notably positioning it directly into the center of the hottest topics, including ETH staking and MEV.

User-Owned Blockspace

The key innovation underlying $DINERO is that it looks to compete within the increasingly competitive Ethereum blockspace wars.

Specifically, the protocol plans to operate a premium decentralized RPC, with access powered by their new stablecoin. This will take the form of a Redacted Relayer in which users can pay $DINERO to broadcast meta-transactions.

The predominance of MEV and Flashbots has popularized the concept of "premium" block space on Ethereum's ledger, which promises users privacy and protection from malicious actors exploiting economic activity.

Redacted is positioning themselves well to jump onto this trend. Whether users are interested in paying for block space using a stablecoin instead of ether is a new concept, we’ll be interested to see how it lands

ETH-Backing

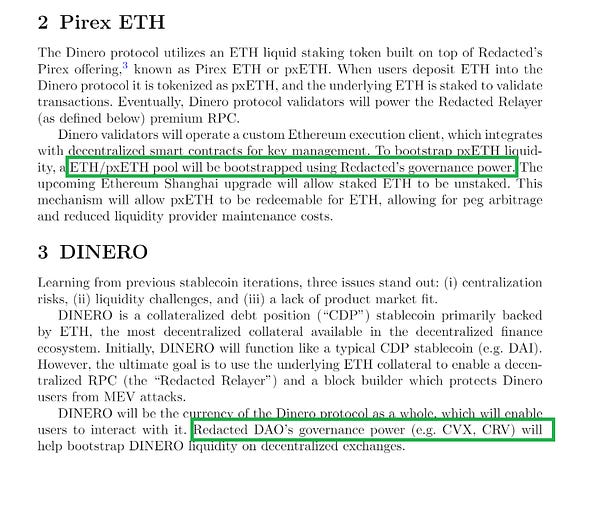

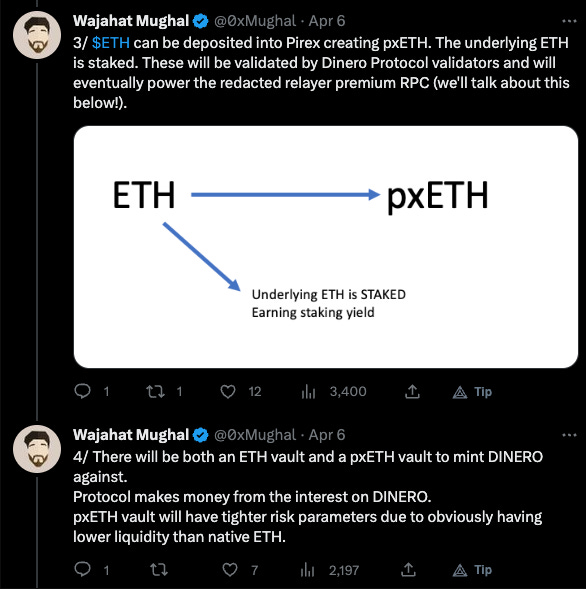

The peg mechanism for Dinero is designed to be built primarily on the back of Ethereum, specifically Redacted’s Pirex ETH ($pxETH).

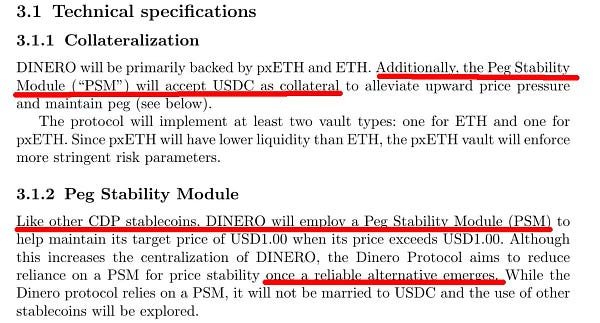

ETH-backed stablecoins are a tried-and-true formula at this point. The pushback against the tokenomics was primarily due to the integration of $USDC.

To keep $DINERO pegged to $1, the token utilizes a “Peg Stability Module,” much in the vein of MakerDAO’s DAI. For Redacted, the PSM will initially accept $USDC as collateral.

The recent brief depeg of $USDC, along with several stablecoins pegged by it, has awakened the community to the stablecoin’s risks. Thus the $DINERO token drew some flak from decentralized competitor $LUSD:

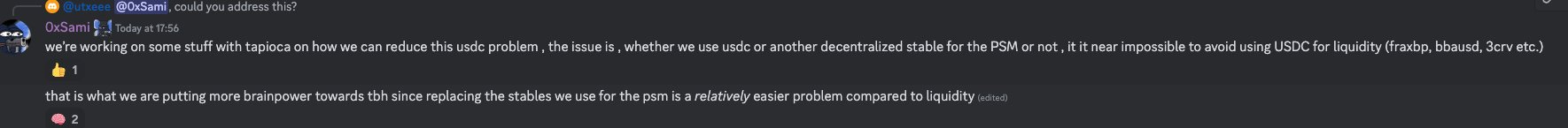

The protocol’s ambitious founder 0xSami is aware of the issue with $USDC, seeing it as the best interim solution for the time being with plans to solve this down the line.

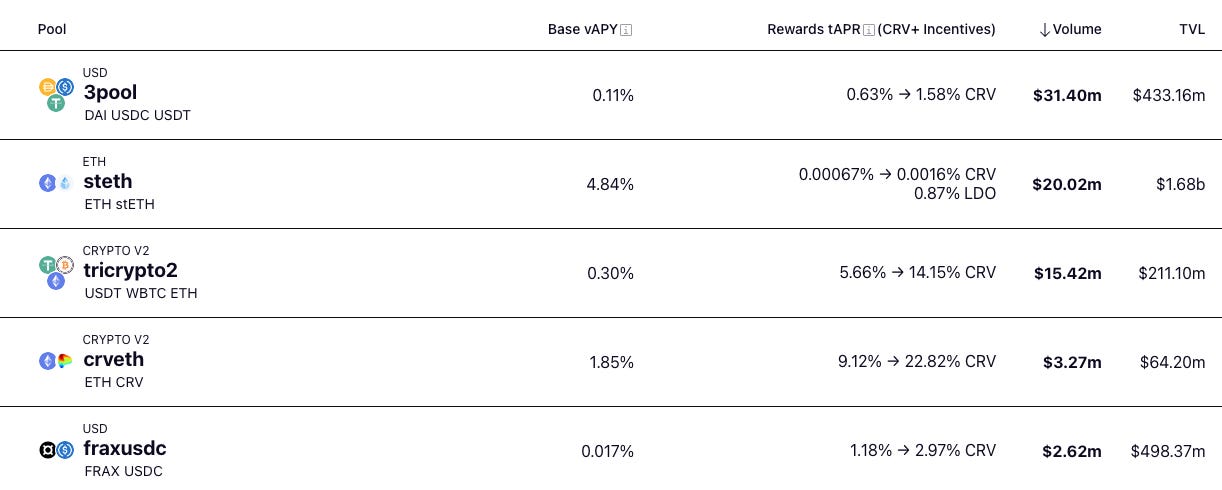

One thing is for certain: thanks to Redacted’s focus on acquiring flywheel assets, it will have little trouble attracting liquidity to its pool, as they are signaling their flex.

Fan reaction was mostly positive.

However, Rex, speaking on Friday morning’s Leviathan News roundtable, was less impressed:

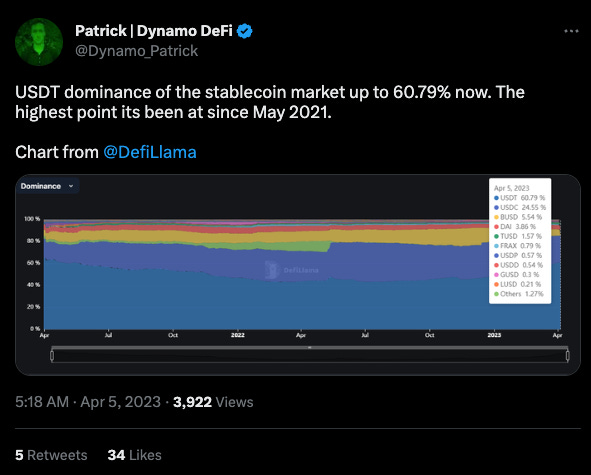

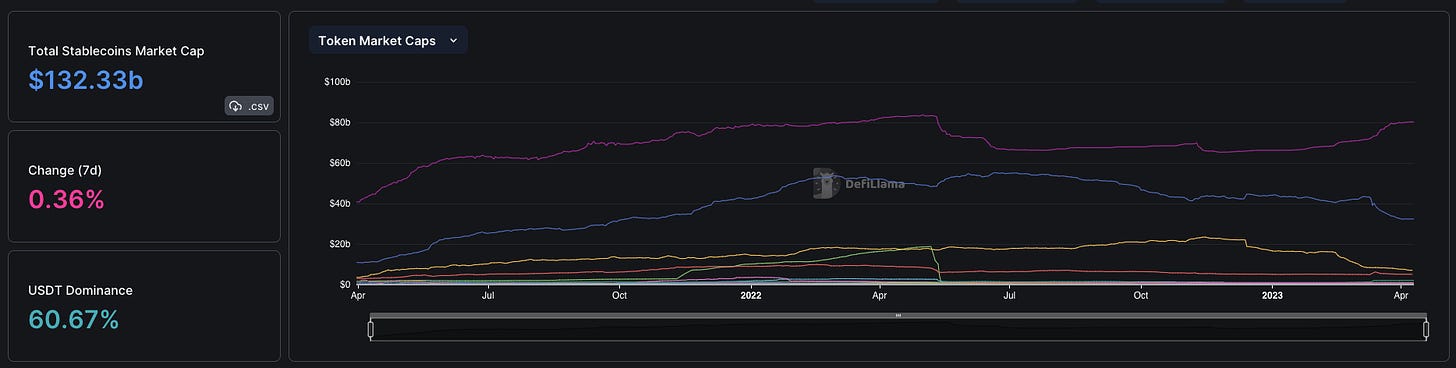

In the broader context, the stablecoin landscape is, of course, anything but stable. Following the aforementioned USDC weekend of terror, Tether has been consolidating its hold over the stablecoin market.

Among deposit-backed stablecoins, the biggest movers of late have been $TUSD and $PAXOS.

Although 1:1 redeemable stablecoins like USDC and Tether first established the stablecoin market, concerns over exposure to the hostile US landscape are driving narrative interest in more decentralized offerings like Curve’s $crvUSD and Aave’s $GHO. We hope $DINERO stands strong among this new batch of stablecoins.

For more on $DINERO, check these great threads:

Keep it up! I really like your posts like this!