Special guest post by Curve Cap Intern!

In yesterday’s article, the author lightly FUD-ded $CRV, giving a take on why the token price was bad at a time veCRV revenues were at a high.

April 16, 2024: Underwater 🌊🚽

Since the newer subscribers don’t have the benefit of having followed this blog for four years, let’s reiterate our mission statement here. This is not a blog focused on cryptocurrency prices or trading. If you’re looking for tips or hints on how to get rich, please look elsewhere. We never have, and never will, offer financial advice.

One of the several reasons reason the author cited was memecoins. However, the author does not endorse memecoins, so he farmed this post to an intern, refused to read it, and violently hurled the mug of coffee he’d just requested in our direction.

It’s not a surprise. Curve’s overall attitude towards memecoins has traditionally been characterized as anywhere from indifferent to hostile. This was always a deliberate strategic choice on behalf of the community of Curve contributors.

Of course, now the market is experiencing peak memecoin mania, so it makes perfect sense that the $CRV token price number is being punished for failure to hop onto this bandwagon narrative. Causes are rumored to occasionally lead to effects…

A slight social distancing between the Curve DAO and memecoins historically provided at least some contrast between Curve and Uniswap. The latter was the primary listing hub for nearly any random token that got launched. This blog often contrasted what was dubbed “Uni’s focus on dog tokens” against Curve’s focus on bootstrapping healthy pools for key trading pairs to get sufficient liquidity as to compete on slippage.

Early on, the Curve community took a lot of steps to prevent nearly every pool from getting a gauge. The Curve community stepped up its quality control, adding things like the Llama Risk team to better vet gauges.

This grew so scrupulous that previous lines of FUD suggested Curve’s obsession with gatekeeping quality tokens via DAO votes may have been hampering its growth:

Sept. 29, 2022: Race to the Bottom

We know the Crypto Risks team is good. Very good. Arguably the most influential and highest quality Substack in all of DeFi. Their work protects billions of dollars from falling victim to the worst ponzis and scams. On top of this, they author exhaustive research reports on cutting-edge DeFi protocols. These reports would be a bargain at a price ta…

However, Curve’s insistence on delivering emissions only to quality pools makes strategic sense. The long tail of s—-coins is not a major revenue driver for Uniswap, which gets most of its fees from a few competitive trading pairs.

Similarly, Curve fee burners often neglect random pools or small sidechains until the fees accumulate to a point where it’s worth spending time claiming — hence the “couch cushions” phenomenon in which Curve is more prone to discovering large pockets of excess money lying than they are to death spiral toward poverty.

For the most part, we feel it was the right decision to gatekeep memecoins somewhat, and most of the Curve contributors would tend to agree. Curve is very adept about getting its piece of major trading pairs and optimizing this to excruciating detail.

You’ll note that the factory presets for Curve v2 pools are optimized for larger cap tokens, while relatively little work had been done on trading small cap memecoins.

Memecoins trade quite differently from large cap tokens, generally taking a quick road to zero, but sometimes rising to the top of Coingecko rankings. The Curve v2 pools should theoretically be able to handle this sort of volatility, but it’s never been properly tested in prod.

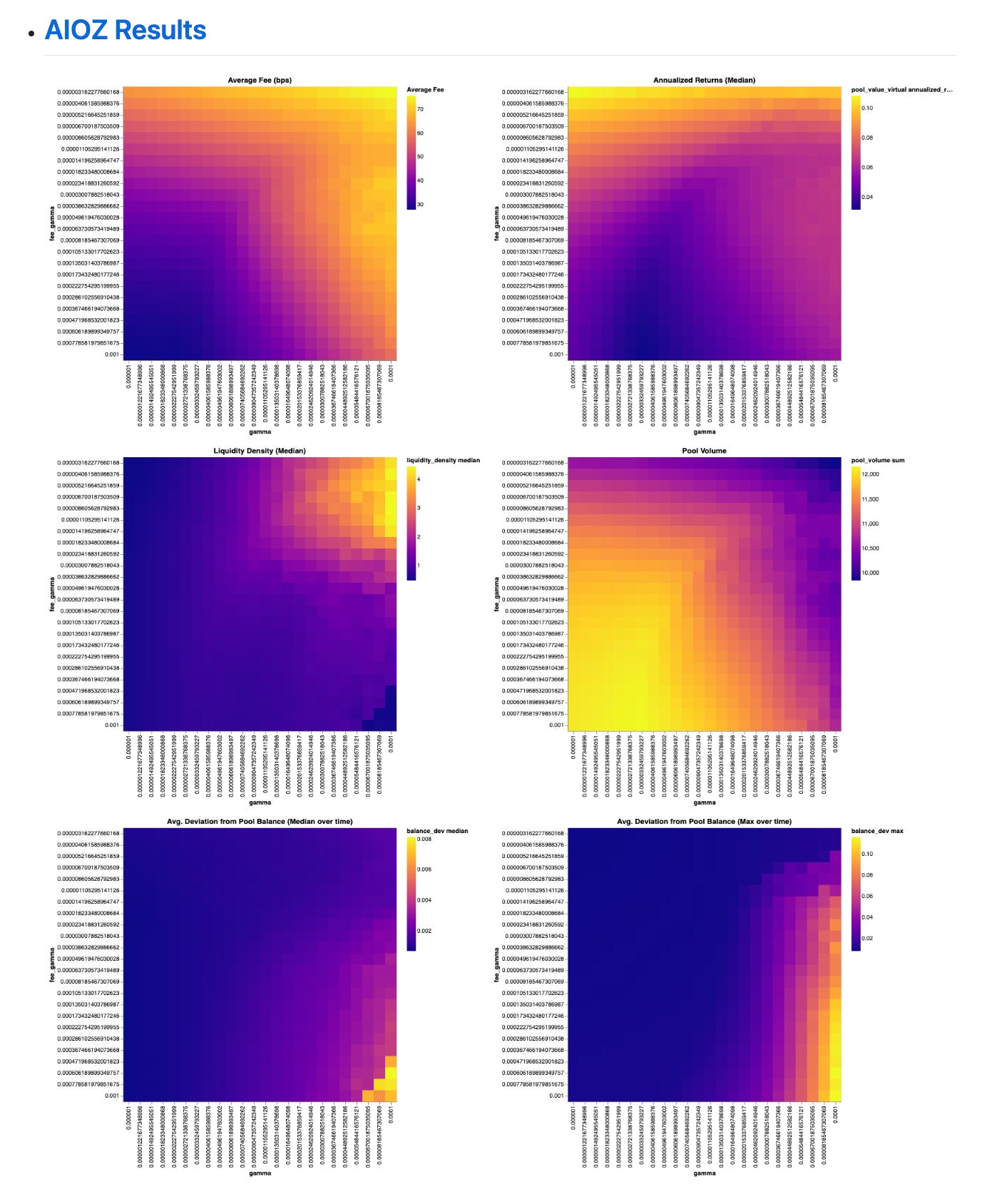

In fact, Curve Research recently did a detailed analysis of three memecoins to determine the optimum parameters for a memecoin v2 pool by studying three such tokens using Curvesim: AIOZ, FET, and PEPE.

The results:

Despite this intense research, there’s not been a major test of such parameters on a successful pool yet. If you want to contribute to science, you try launching your v2 pool using these parameters and report back!

However, you may have some issues? Memecoins in 2024 still have trouble launching on Curve. What follows are three case studies on recently launched memecoins that tried to launch on Curve, but ended up facing friction.