Now that we’ve completed our flywheel ponzinomics prerequisites, we can move on to more advanced coursework. In this applied lesson, we observe the real world cases for how protocols are actually leveraging the various pressure points across the flywheel to influence liquidity.

TERRA

We know Terra has massive ambitions to win the Curve Wars via their 4pool.

Lucky for Terra, they have the dry powder available to insert themselves into the lead. In recent weeks they’ve been deploying their massive treasury to accumulate not just Bitcoin, but also $CVX. They’ve pulled ahead of FRAX for the lead here, according to https://daocvx.com/ and Delphi Digital:

They appear to be sourcing this $CVX from Binance.

Note the amount of CVX available on the open market is very small. If new combatants wanted to buy their way ahead of Terra, there would only enough CVX on exchanges for about two more participants to buy their way to the top before liquidity dried up. In other words, the rough contours of DAO owned CVX landscape are more or less established.

In addition to hoovering up $CVX, Terra appears to have been splashing millions of dollars worth of value onto Votium for several weeks to incentivize their pools, first the MIM-UST pool then the UST-wormhole pool. We imagine their next targets will be 4pools.

FRAX

For weeks, FRAX had reaped the benefits of Votium’s efficiency. For nine straight rounds, FRAX has dumped over $5MM worth of tokens apiece. They’ve been the largest briber in all but two rounds in Votium’s entire history. Bribes were so efficient, this allegedly yielded $25MM in free money for FRAX.

Over the next few rounds, keep an eye on if this strategy evolves, especially following the launch of pitch.money

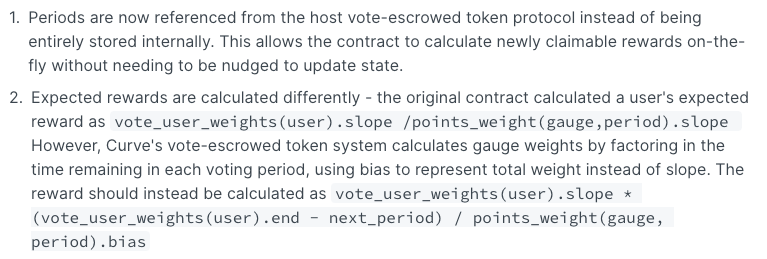

As the bribe ecosystem has grown, there’s more pockets of cash being tucked into different sites. Pitch.money allows protocols to incentivize liquidity to both the CRV and FRAX ecosystem through code that largely borrows from bribe.crv.finance. For curious devs, here are a few of the notable tweaks that they made:

FRAX dropped $250K into Pitch’s first voting round to incentivize the launch of the Fantom 4pool.

Clearly the service is meant to become a hub for activity within the FRAX ecosystem. Given that FRAX reduced their overall Votium bribe slightly last week, it may be noise or it may signal they intend to shift activity to the new service. Keep an eye on how FRAX utilizes this system over the upcoming weeks.

Also keep an eye on which pools FRAX chooses to incentivize. They recently launched a v2 pool for $FRAX-$FPI, their inflation adjusted stablecoin, which has already gathered $12MM without any incentives to date. Both FRAX and TERRA also have an interest in supporting pools built against 4pools.

FRAX and TERRA are naturally playing these games at the varsity level given their status. Not every protocol is already a behemoth, though. More interesting is considering how newer protocols are finding strategies to bootstrap liquidity on Curve.

RETH

Rocket ETH has a tried and true plan. Find the biggest whale you can, then keep going till you find one even bigger. In this case they put themselves on the map directly through the largesse of a single benefactor.

Rocket ETH has the ambitious goal of disrupting the Lido monopoly on ETH staking. Lido’s stETH pool has $5 billion in volume, earning 0.62% boosted CRV rewards along with 1.35% LDO incentives. Rocket ETH’s pool for comparison has just about $100MM TVL, earning 1.39% boosted at the moment.

SILO

Another great place for up-and-coming protocols to seek out well-heeled benefactors is to lean on larger protocols. SILO for one recently worked with FRAX to pump their $SILO-$FRAX pool.

They’re currently enjoying that early honeymoon stage for small pools that get hooked up to the Curve firehose.

One strategy to get protocol-owned CVX lobbying for your pool would be to simply launch a pool containing 4pool. The protocols have directly announced they’ll support such pools. This is possibly the biggest opportunity available for young protocols.

INVERSE

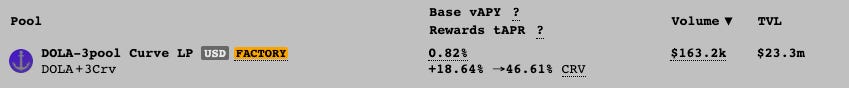

Along these lines, Inverse is partnering with Yearn to incentivize their DOLA pool. However, they’re doing so not with bribes, but with unique means of leveraging Yearn’s CVX votes.

The way to play this strategy as an ape is to track small pools about to get gauges and sit in them at the beginning. Here’s how it’s working out in this case:

KP3R

If your protocol was wise enough to accumulate $CVX, you can ride this existing stash quite a ways. $KP3R has a healthy 5.9% piece of the pie, and is using it to built out an entire Forex system.

Anybody who acquired large stakes of either $CRV or $CVX are discovering it has great utility to build with down the line. Which brings us to…

STAKEDAO

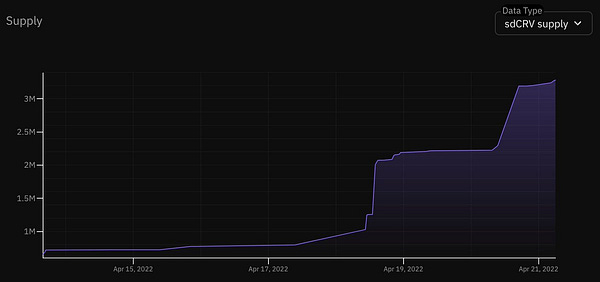

Along the lines of FRAX finance building their own bribe.crv.finance, StakeDAO also just launched a clever new service to rent out governance power.

The Curve whitelist is one of the scarcest and most tightly-guarded commodities in DeFi. Only Convex, Yearn, and StakeDAO have successfully navigated this thorny governance process to be whitelisted to lock CRV at the smart contract level. Even the behemoth that is FRAX has not managed this feat.

StakeDAO found a clever way to leverage their whitelist powers in the form of the CRV Liquid Locker. This service is described in full detail in their announcement thread:

Among other highlights, this includes a boostable “whitelist-as-a-service”

It’s not quite the monstrosity one might expect.

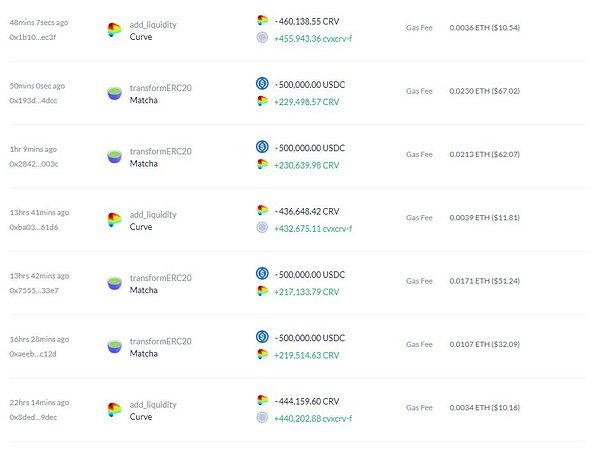

The sleek interface already works across $CRV, $FXS, and $ANGLE. Since launch, it’s already attracted about $10MM worth of $CRV, including a few whale moves.

It’s going to be fascinating to see how non-whitelisted protocols will be leveraging this rental whitelist in upcoming rounds.

JPEG

JPEG’d is aiming to be a direct combatant in the Curve Wars. The protocol has a $100MM market cap and is presently aiming to get a gauge onto their JPEG-ETH v2 pool.

Promising bribes is a fairly easy way to excite the community around the flywheel. The JPEG vote appears to have passed quorum since the above post.

This particular strategy is almost too effective — we saw in the wake of the Mochi fiasco that users dance to money almost too readily. Voters should always exercise scrutiny before giving away free money in the form of Curve emissions:

*C

We don’t know much about the meatspace world, except that there’s a fair amount of US tokens hot off the presses and eager to escape TradFi for crypto.

Don’t be surprised if you see VCs using any number of recent crypto funds they’ve raised to try and manipulate the Curve Wars.

Behind the smoke and mirrors, many VC firms have revealed themselves to be second-stringers in the new economy. Their strategies are often less sophisticated than the smiling stock images on their websites suggest.

See also, YC

SIFU

Last but not least, we’re’ not sure how to categorize this particular Kung Fu style…

One final caution for the casual ape

With so many new opportunities launching to bribe veCRV or vlCVX holders, always be careful. We’ve not had time to audit all the sites, so you should use them only at your own risk. Even ignoring rug risk, veterans can make mistakes. DeFi is very much a “learn by doing” type system.

When in doubt, ask around Discord and Telegram channels before you write anything on-chain. Odds are good somebody else has already made mistakes and are keen to help you avoid their errors.

Disclaimers! In addition to flywheel tokens, author has exposure to $FXS and $JPEG