If you’re hunting pure stablecoin yield, you may find yourself tempted by the Zunami UZD/FraxBP pairing, currently in fourth place by yield among pure dollarcoin pools.

Just a few hundred thousand in liquidity, about 2:1 imbalanced in terms of the $UZD token. Ripe for whales to play games. Should you ape?

We couldn’t possibly tell you! That would be a question for your registered financial advisor, not a handsome Substacker who persistently refuses to offer you the financial advice you so desperately crave. What follows is simply a summary of what we’ve found. You can utilize this work as a jumping off point for doing your own research.

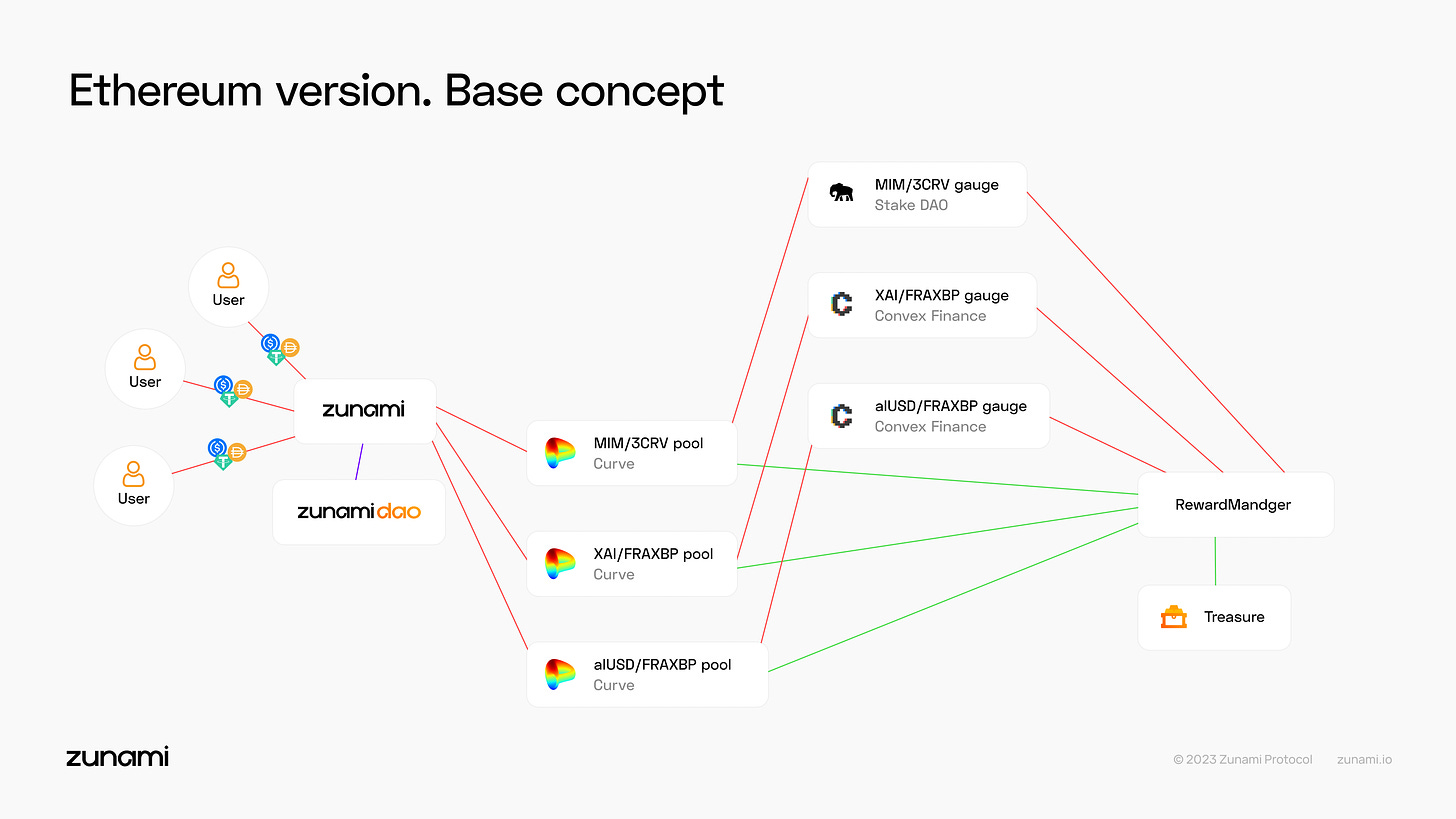

Zunami bills itself as a “decentralized yield aggregator for staking stablecoins,” aggregating yields from among Curve, Convex, and Stake DAO. In this manner, you might find it loosely analogous to Conic Finance.

The protocol at present offers two primary functions in their app: (1) depositing stablecoins to earn yield, and (2) minting the $UZD stablecoin against this staked position.

At present their app claims the recent APY from staking sits somewhere around 10%

The website indicates this yield is generated by diversifying deposits into a trio of pools:

This is the reason we consider Zunami appears similar to Conic Finance — the Zunami docs directly describe this concept as an Omni pool (which may ring some bells if you follow Conic.) Single-sided liquidity staking has historically been cursed, so we hope these two new attempts at solving this challenge prove successful.

At present Zunami accept deposits in $DAI, $USDC, $USDT, and $FRAX. Onboarding new assets appears to be governed by a Snapshot vote, with $FRAX the newest of these assets to be supported.

Once a user has deposited they receive a Zunami LP token, which can be used to mint the protocol’s native $UZD stablecoin. This $UZD coin can be deposited into the corresponding Curve pool, which once was the recipient of heavy $UZD rewards during the bootstrapping period, but has since turned to more conventional birbs.

The website boasts that $UZD “perfectly solves the stablecoin trilemma” — though we’re not sure whether proponents of said trilemma would necessarily agree with this assessment. $UZD is backed by $USDC, $USDT, $DAI, and $FRAX, all of which carry dependence on redeemable stablecoins. Redeemable stablecoins to date are a good choice because they have certainly proven to have a strong peg mechanism and large potential TVLs.

However, the $USDC depeg a few weeks ago briefly cratered the value of $USDC, $DAI, and $FRAX — we expect $UZD’s underlying collateral also carried exposure to this brief depeg, at least making at least the “depeg protection” plank of the trilemma subject to the same risks as these underlying assets.

Is it safu to invest your funds? Our default recommendation is to wait for the great Llama Risks team to evaluate a protocol, as they have a more thorough rubric than we can offer with a short and cursory overview. In this case, Zunami already sailed through governance without an accompanying risks report, so you’ll have to act however you feel appropriate.

Anybody considering using Zunami should be aware of a recent incident affecting the protocol. In late January, while transferring funds to the $XAI pool, the team suffered a sandwich attack, losing about $50K to MEV bots. This caused a brief imbalance in the price of the Zunami LP token, which attackers quickly exploited to drain additional funds. Losses totaled $260K, a substantial loss relative to the protocol’s size, but thankfully quite small for DeFi.

The Zunami team was transparent about the details of the attack and quickly released a compensation plan. Among the steps they took:

Item 2 (withdrawals suspended immediately) helped stem the bleeding in this case, but also points to a potential rug risk users should consider. A protocol that can suspend withdrawals has the potential to rug your funds.

Indeed, this issue was also acknowledged as a “high" security concern during the team’s recent audit by HashEx.

Proper decentralization of ownership rights is a tricky balance for small protocols. As demonstrated during the January incident, the ability for the team to quickly react and pause user deposits proved valuable in quickly reacting to the hack and preventing further losses.

However, as protocols grow in size, this capability represents a vector by which malicious regulators, who are explicitly antagonistic towards cryptocurrency, could compel the protocol to rug users.

The proper balance of decentralization is a difficult line to toe for new protocols. Often times it’s impossible to get a fledgling protocol off the ground without a degree of centralization that enables the early team to move swiftly and react to changing conditions. Yet many projects never decentralize, and keep these early controls. Eevn if the owners’ intentions are pure, they may nonetheless be compelled by regulators to shut down the project and undermine their users.

We don’t necessarily see excessive centralization at the early stages as a dealbreaker. It’s usually more of a rough necessity. After all, several larger protocols considered to be “blue chips” and/or “base layers of DeFi” also carry such risks. Yet they remain in common use, a refrain frequently hammered by leading decentralization advocate Chris Blec. On this level, we cannot rightly critique Zunami’s centralization without acknowledging the problem is endemic to most of DeFi.

For their part, the Zunami team has weighed in some on the subject. They posted about their plans for decentralization back in mid 2022, though the post had no mention of admin control over withdrawals. Additional clarity on their plans to decentralize could give potential LPs more confidence.

Two positive omens are that the team is responsive to feedback and take a keen interest in the topic of risks. The team based the most recent release of their $UZD stablecoin on feedback from the Curve community. The protocol’s founder, Kirill Kozlov, also posts useful material on risk factors on stablecoins:

The Zunami protocol is centered on Ethereum, but also exists cross-chain on Binance Smart Chain and Polygon. This provides additional utility for the stablecoin, but beware that bridges are also common targets of hacks. Take extra caution when bridging.

Finally, a note on fees. All protocols need a sustainable source of revenue or they will quickly dry up. Zunami takes the following fees to fund their treasury, which appear to be in line with market rates:

We hope the above article provides a good jumping off point for any parties interested in researching further. If you’d like to share additional information relevant to Zunami Protocol, please share it in the comments!

Disclaimers! Author has no position in the Zunami ecosystem.