Bitcoin is in a sleepy phase, primarily stuck between $50-$60K the past month. As we saw yesterday, money is flowing out of Bitcoin to USD and ETH at the moment. Is it too early to say Bitcoin is hibernating?

Bitcoin has gone full midwit — the biggest BTC haters are no longer just those who know too little about crypto, but also those who know too much.

A persistent issue with Bitcoin is relatively poor return rate relative to other denominations in DeFi.

We’re pondering a larger article on this subject — it’s mostly just be the natural repercussions of an asset class with Bitcoin’s properties: high demand, extreme scarcity, and expectations of high growth.

A few good threads are also discussing this subject:

The recent BlockFi rate adjustment definitely put a bit of a damper on bitcoin lending.

The issue at present is where does the HODL-er go? Essentially, BTC farming strategies are:

Lowest Risk: Keep in cold storage, don’t stack sats, only get price movement

Medium Risk: Small DeFi gains on tokenized BTC, biggest risk is depeg

Highest Risk: Trade into other assets (ie ETH/USD), get eye-popping DeFi rates, but risk losing on BTC price movements

Another trend of note — within BTC lending pools, you often don’t tend to get Bitcoin back directly. It’s most common to get a miniscule BTC return plus generous helpings of some new protocol’s governance token, which always has the risk of shooting to zero.

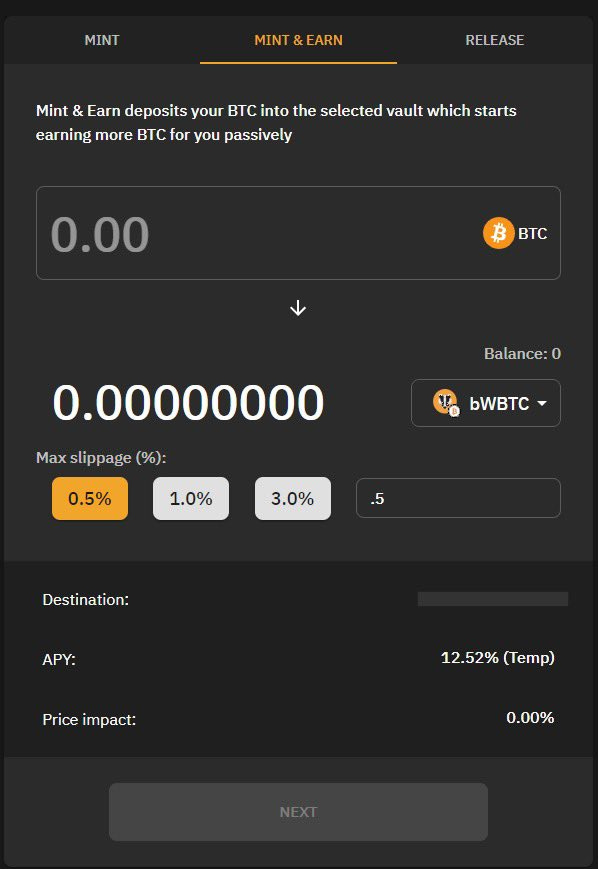

With BTC lending seeing rather poor rates, we’re observing money scattering across the ecosystem looking for returns. One popular destination is BadgerDAO, which has reached over $1B in volume locked. They focus on making it easy to get Bitcoin onto their platform.

Their execution has won some praise, in a manner of speaking

Bitcoin on Curve

In a “blink and you might miss it” sort of moment, Bitcoin volumes are creeping up across most of Curve’s Bitcoin pools. The top ten pools by volume now consist of half Bitcoin-denominated pools:

Curve’s BTC returns are decidedly less impressive at first blush than other assets on the platform. Pools generally don’t do much better than 0.5% base APY, and the effective rate including max rewards mostly falls below 25%. This means the bottom ten pools by max effective return are also all bitcoin pools:

So, heavy volume is flowing into the worst returning pools? Such is the state of Bitcoin on defi. Where else would you go? Curve’s return is becoming the risk-free rate of Bitcoin lending in the market.

pBTC

We couldn’t complete our discussion without noting pBTC, the tokenized bitcoin that is bucking the trend. The Curve pBTC pool has a base APY of 3% with max effective rate above 40%. pBTC is actually amidst the middle of the pack among Curve’s non-Bitcoin pools.

The pBTC pool also looks to be the pool of choice for Curve whales. When we sampled Curve user portfolios, we found the most common BTC exposure among whales was pBTC followed by sBTC (among an insanely small sample size - DYOR)

Another point in its favor, the pBTC pools is providing 1% PNT rewards, the governance token for pNetwork. This token has been increasing steadily throughout 2021.

The pNetwork overall has been doing quite well lately. pNetwork, (the p seemingly standing for “provable”, but the white paper suggests it could also stand for “portable” or “pegged”) has crossed $30MM in assets locked.

The token is up to 38 bridges across various currencies, and they recently launched bridges to Binance Smart Chain and their first NFT portal. Also within the pNetwork ecosystem is the Steroids app that provides a simple frontend for farming.

A bear case could be that $30MM in assets locked is still relatively small in the world of DeFi (about 500 BTC). Maybe hackers haven’t considered it worthwhile to really stress tested the platform and/or a big money attack could somehow stress the peg. Small market cap often equates to greater risk. Perhaps the higher return on pBTC is effectively pricing in this risk already.

As always, we never give you financial advice here, we can just point you in the direction of interesting technology and protocols we find. Still, tell us what you think. What are your bitcoin strategies for 2021?

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a Curve maximalist, has no stake in Badger or any pNetwork token.