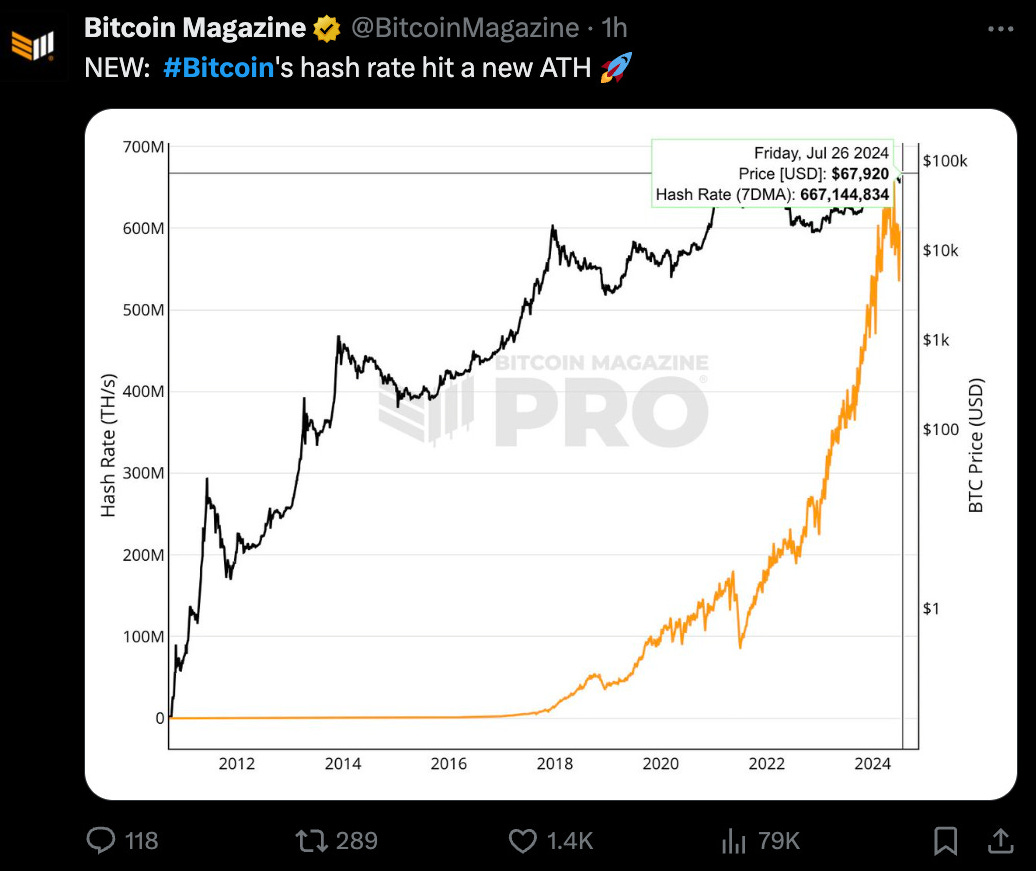

Bitcoin hash rate is again at all time high…

Bitcoin price responds by…

ETH has an ETF, and inflows are now above water!

ETH price…?

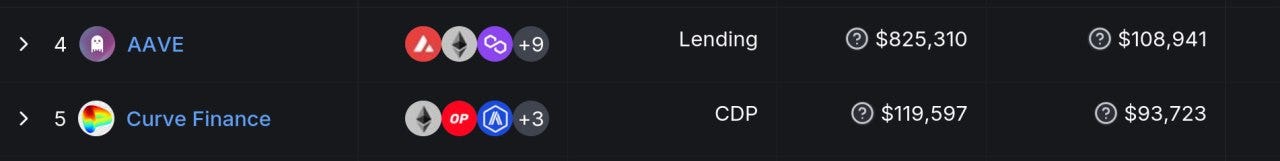

What about our precious Curve?

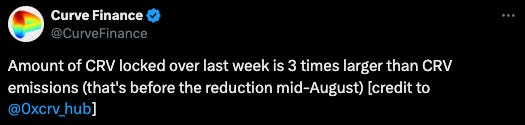

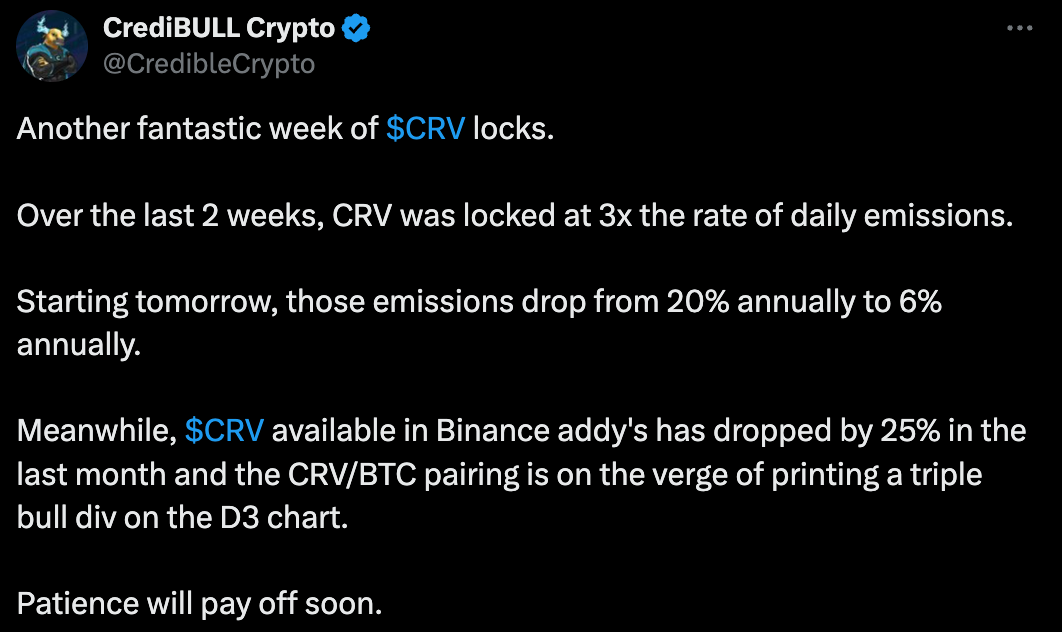

Locks are up…

That is… locks are way up…

Like… locking up the entire 2024 emissions in a month type up…

✅ Dwindling supply

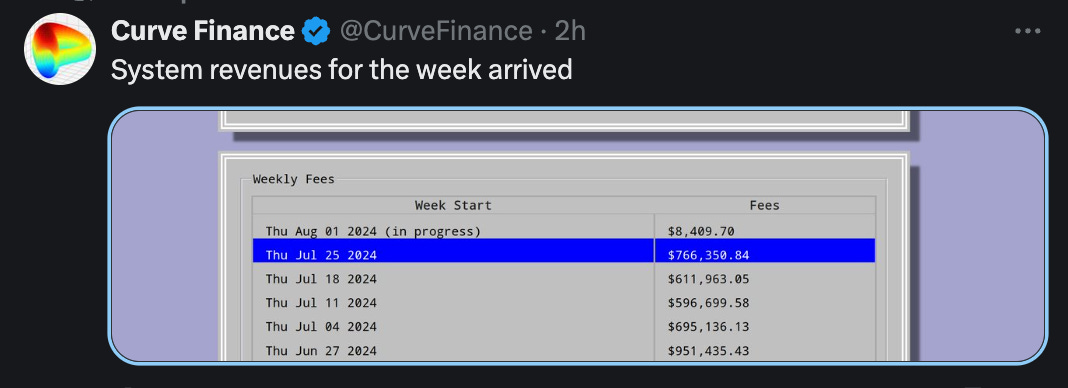

What about veCRV revenues, paid out in $crvUSD?

Up, up, up…

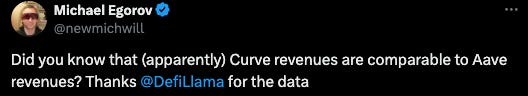

On the same scale as even Aave…

Best of all… dev activity is at all time highs

The upshot? Down only…

As the bard said… ‘wasshu gana do…’

Stick around, let’s see whether it’s us or the market that’s gone crazy. Here’s what we’re looking at while we wait…

Sadly, the era of Mich sprinkling excess $CRV around the ecosystem to juice growth is drawing to a close, the victim of hacks, liquidations, and inflation cuts.

But he can still drop knowledge bombs! Subscribe…

Many such pearls of wisdom from this recent space…

Flashloans!

Our Network wrote up both Convex and Stake DAO in the same issue…

In unstable times, we should all do a bit of stablecoin maxxing…

See also, our piece on stablecoin farming…

July 29, 2024: Leveraged Stablecoin Farming 🚜🌾

We’ve written before on how DeFi mostly continues to work just fine, even despite today’s cartoon valuations 🤡. We see the issue of blue chip markets occasionally trading like memecoins, pumped and dumped by whales without regard to fundamentals, but that’s usually separate from protocol operation.

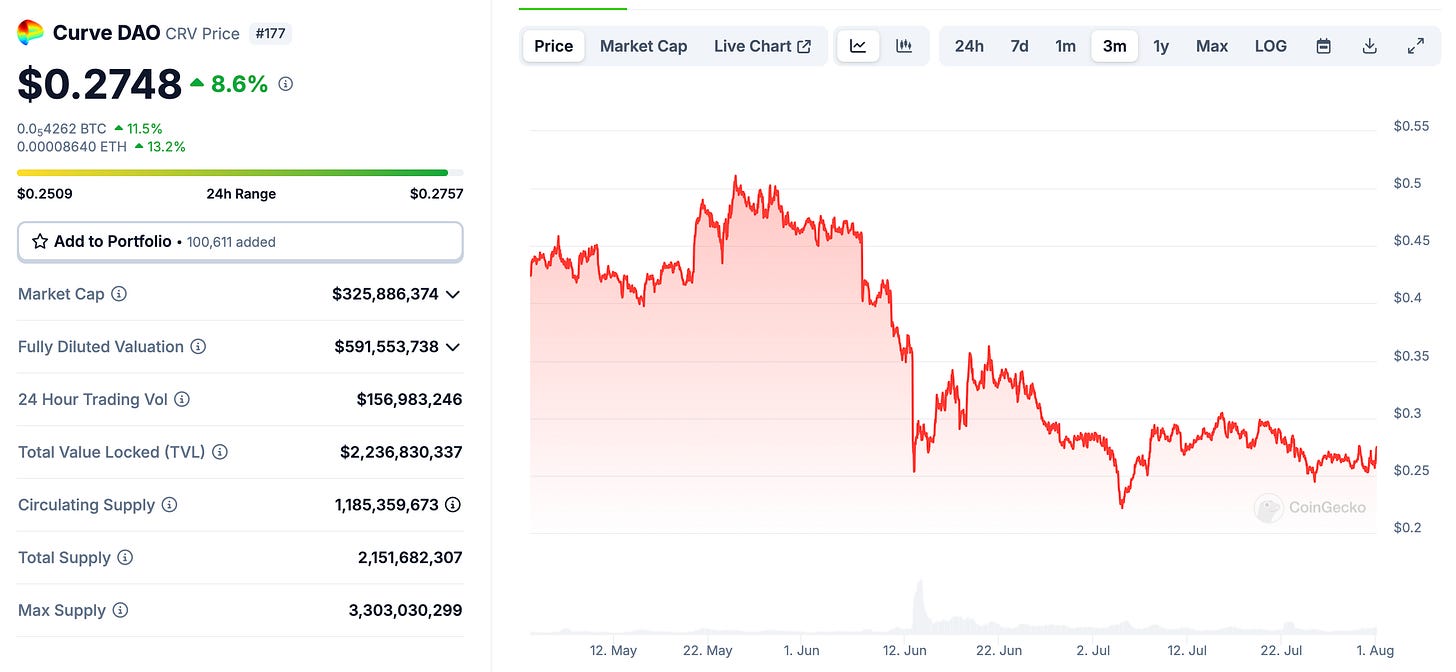

Just imagine… some Curve leveraged stablecoin pools earning good native yield, then borrowing against them using Llama Lend…

If you haven’t already, study Inverse Finance…