We know “hopium” is a tough sell these days when the timeline is peppered with “despairium”

BUT…

If you’re able to remind yourself that the token price ain’t nothing but a number… a number subject to the influence of notably absurd 🤡 markets with little relation to fundamentals… then maybe you can better tune out the noise.

During periods of peak panic, the fact that short-term focused degenerate gamblers are uninterested in a token that’s great for delivering long-term incremental cash flows is hardly noteworthy.

Forgive us if we give token price scant attention in this blog. The fact of the matter is token price doesn’t interest us. We remain captivated by the big success story that is the rollout of $crvUSD. As markets broadly melt down, $crvUSD is shrugging this off, hitting all time highs while maintaining a bespoke peg.

Is it possible that blood-sopped markets are good for new users, to enlighten them on the advantages of $crvUSD’s friendlier liquidation mechanism?

TBH, we’re not particularly sure anything can cut through the noise on social media. We wouldn’t be surprised if we learned the median $CRV shorter had never even heard of $crvUSD. Our enemies may be savage, but they’re not terribly intelligent.

ASIDE: Optimizing For The Algorithm

Lately we’ve learned something about the social media algorithm of X, neé Twitter.

Every time we work hard to generate thoughtful educational material about Curve… we’re lucky to get a few thousand eyeballs upon it. Sometimes significantly less. And it’s primarily siloed to only be viewed within our fine Curve community.

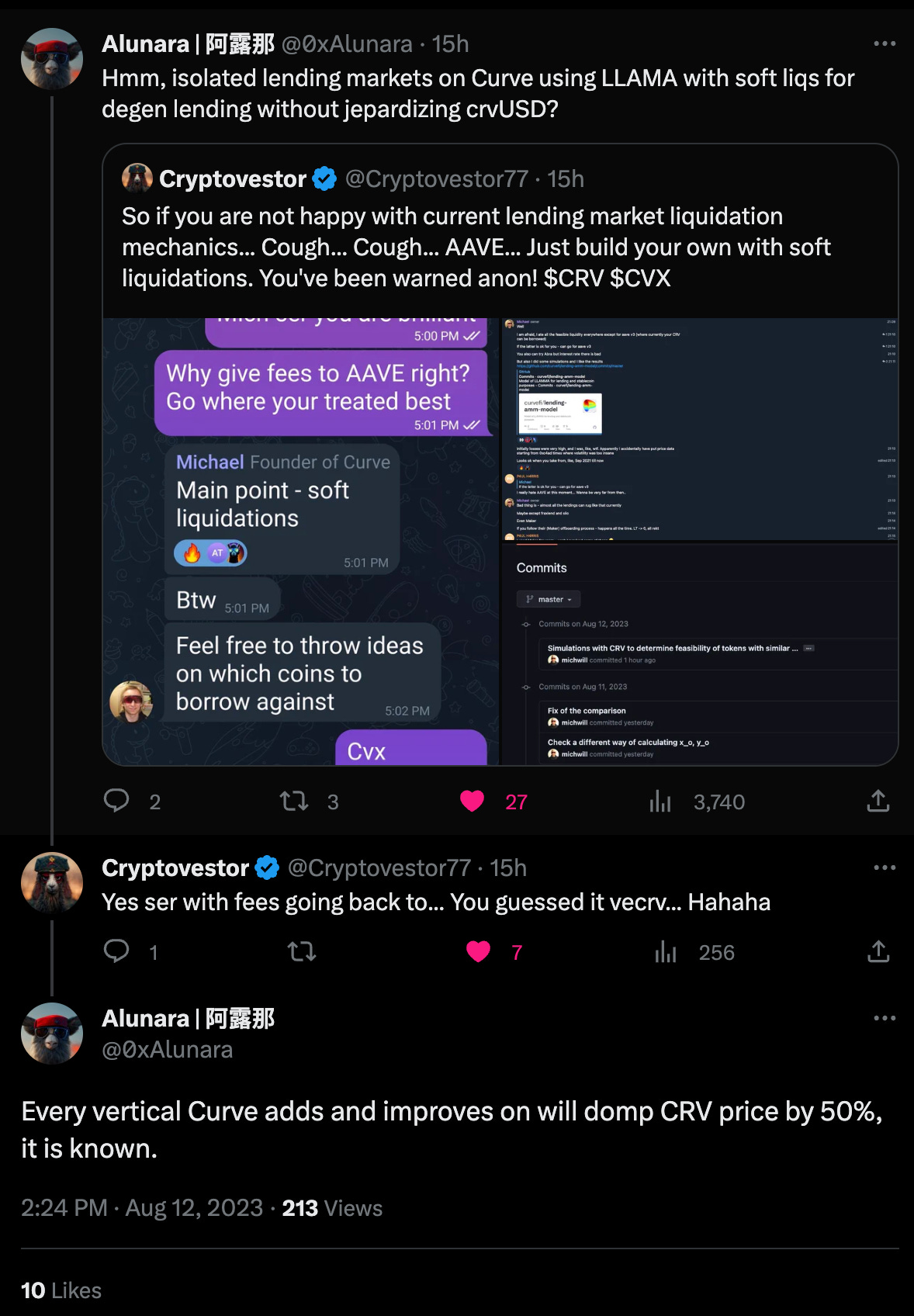

At the same time, whenever we post what smells like FUD about Mich loans or house or whatever, we draw significantly wider reach. These two posts, at roughly the same time, saw about a 4x difference in eyeballs, despite the latter getting less engagement otherwise...

We picked just one example, but the trend is consistent. It’s a real thing.

We don’t at all mean to imply that the former bird app is deliberately juking the algorithm in any way, shape or form against Curve. Quite the opposite in fact, given the number of scams, they clearly don’t pay any attention to our corner of social media.

Instead, we suggest that the algorithm appears to be an accurate reflection of the actual social structure of the asylum we still call “crypto Twitter.” For whatever reason, the broader community is more interested in seeing Mich get a bloody nose than they are in learning about anything we’re building. There’s perhaps some timeless wisdom one could draw from that.

At any rate, if you can’t beat the mob mentality, may as well milk it. We’re doing our Sunday finest to try and exploit this phenomenon in a vainglorious attempt to inject our account into the conversation and using the attention to shine the spotlight onto the novel $crvUSD liquidation mechanism.

While we doubt the message will penetrate through to the masses, we nonetheless do find it interesting that this maximally degenerate, highly leveraged test position, set up by Mich in pukey markets, is so difficult to liquidate. Perhaps, given enough eyeballs, a few people will get the message?

We doubt many people pick up on the nuances of this strategy, but we may as well try to meet the crowds where they are standing and seize the conversation for ourselves. Maybe it’s a good time for some anon to create a Captain Ahab meme account, that does nothing but quote Moby Dick and valiantly fail in its efforts to harpoon Mich?

At any rate, even if Curve’s message never spreads to the masses, then take some comfort in knowing that our little community holds something like information asymmetry (aka alfa). In this case in particular, it may even lead to the next big thing…

THE NEW WEN? “ISOLATED LENDING MARKETS”

An unrealized hope for $crvUSD is that it would inspire the market to compete. One might expect competing lending protocols would be forced to implement friendlier liquidation mechanisms to battle back against $crvUSD’s gains.

Instead, with the market remaining broadly underinformed about $crvUSD, Curve is simply building these opportunities for themselves. You had your chance, anon devs! Now Curve will reap the spoils instead...

Earlier this week a new repo, and therefore a new “WEN,” just dropped…

It’s not at all difficult to explain the game of checkers being played here. Mich is always interested in playing with new lending protocols with his sizable $CRV stack. The trouble he faces is that these protocols struggle to handle his girth. This leads to a predictable outbreak of mob violence every time token prices drop.

If the market won’t build it for him, his solution is to simply build his own ideal lending protocol.

He has already built out the basic mechanics: LLAMMA as it stands would be eminently capable of handling $CRV as collateral in size. However, “endogenous collateral” is a bit of a dirty word. Backing $crvUSD in any amount with the protocol’s native $CRV could lead to plenty of trouble and is almost certainly a nonstarter.

However, by retrofitting the LLAMMA liquidation mechanism into isolated lending markets, then there is no endogenous collateral death spiral risk of contagion infecting $crvUSD…

So while improved innovation and cash flows will presumably be bad for the always beleaguered $CRV price, it’s an absolute win for the protocol.

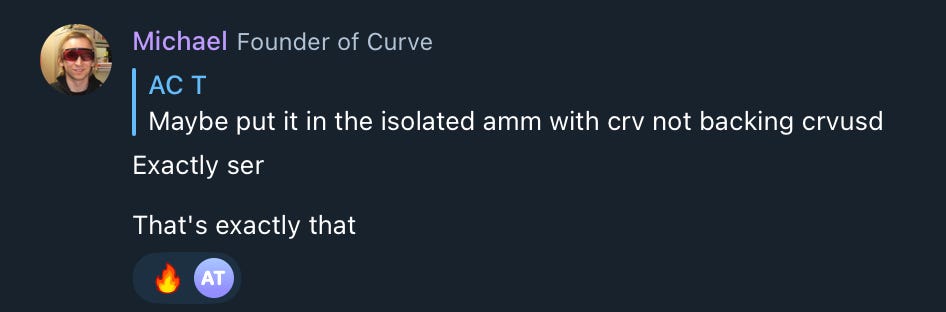

Some of the smartest builders appear to get it…

There was quite the epic brainstorm thread on Telegram about the possibilities for how to build out these isolated lending markets…

It’s certainly quite genius. Whenever there’s turbulence, it seems there’s always a new WEN on the horizon…

The only downside is that, if it takes as long as $crvUSD to get everything through development and audits, then we may be in for several more years of “WEN ISOLATED LENDING MARKETS” or “WEN LLAMMA SHORTS” before anything finally drops.

Brace yourselves for several more bull-bear cycles before anything drops. We know the algo is stacked against us. It all means more mobs marauding against Mich’s mansion in the meantime.