August 21, 2023: Silo Llama 🧑🌾🦙

Silo Labs launches fork with $crvUSD as bridge asset supporting multiple tokens

Friends! We joined Friend.tech despite our asocial tendency to ignore most new social media. So far we’re impressed by several facets of the UX, such as the mobile-only interface that bypasses the app store and the backgrounding of the cryptocurrency and bridging elements.

Of course, every social networking site is a fad with a variable half life, generally erring towards the shorter lifespan. We’ll plan to enjoy this one while it lasts.

We’ll be discussing our intended use of our Friend.tech more within our private room, so snag access if you want to discuss more there. We’ll reinvest any profits we earn from trading activity into buying the llama community. Please alert us if you’ve joined so we can buy up your profile access on the cheap.

Silo Finance

Last week Silo launched a “Llama” fork, in which the native $XAI dollarcoin was replaced with $crvUSD.

Since the announcement, the new protocol popped off, quickly shooting past $20MM TVL, which grew Silo’s overall TVL 40% over the course of a week.

For those unfamiliar with Silo, they emerged from winning the ETH Global hackathon with lending markets that are isolated (“siloed”) from each other to prevent contagion risk.

They’ve held up successfully since their launch exactly one year ago. We don’t always celebrate protocol birthdays, because we couldn’t possibly remember them without the help of LinkedIn, but this one happens to line up nicely so Happy Birthday!

Survival over the past year is no easy feat. Vultures have been actively scavenging over our industry’s corpses for loose change. Surviving a year in the bear market is indicative of some degree of success.

If you’re unfamiliar with Silo, we’d recommend you get a bit more background before reading this article. Within our blog, we can point you to previous articles or our long interview with founder Aiham.

The Silo Llama version amounts to a direct fork of their codebase, but utilizing $crvUSD as the collateral asset for all markets. For their prior version, they chose collateral tokens that were meant to be a reasonably stable pairing with the borrowing token — for instance raw ether was paired with the $CRV token, and dollars with dollars.

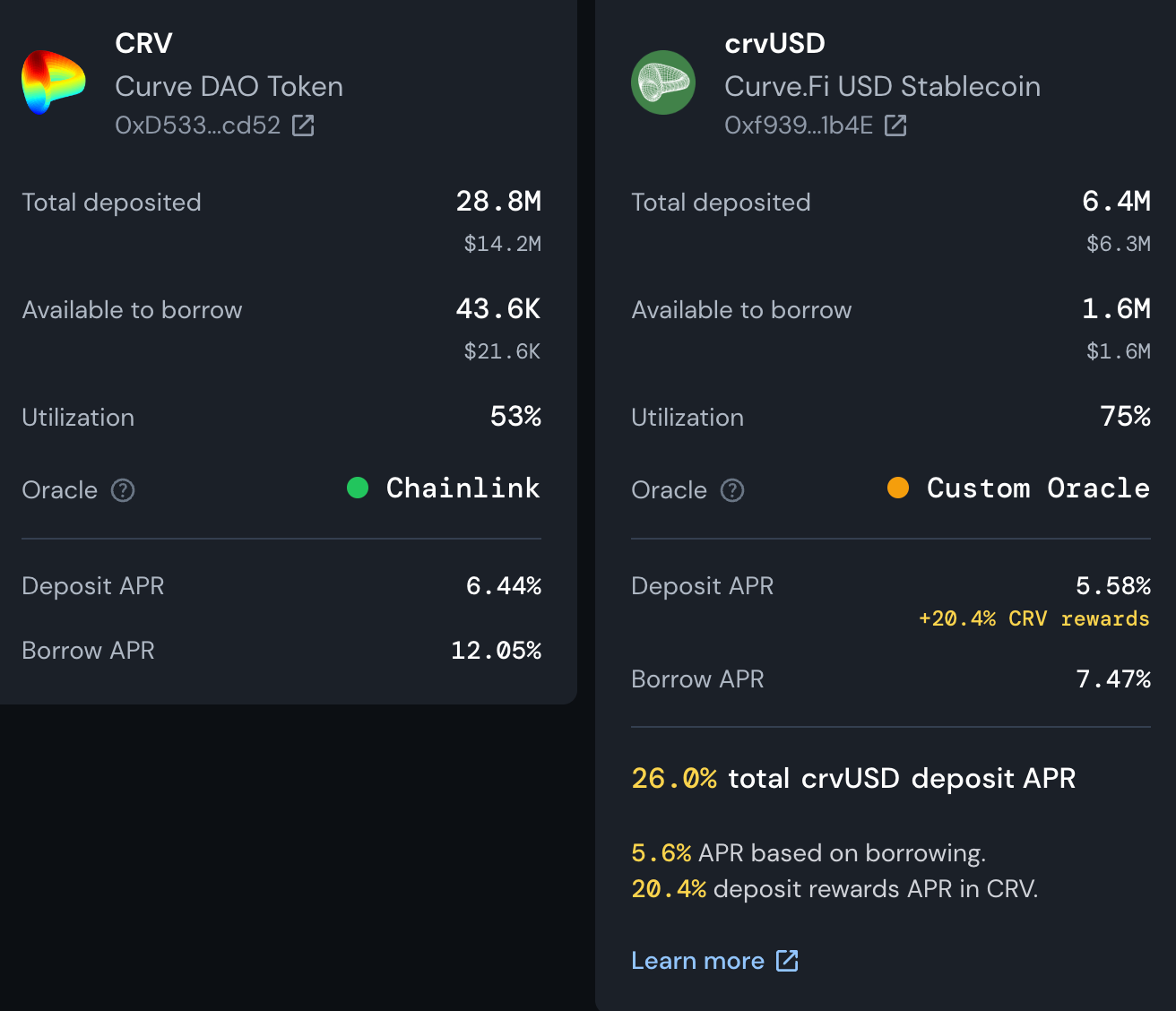

Silo launched the lending markets with several collateral assets familiar to users of the prior Silo version. Of the markets though, the $CRV market is the most bustling.

It’s a perfectly logical fit. $CRV to $crvUSD has a native trading route through the new TriCRV pool. Meanwhile, Curve has signaled extreme reluctance to open a $CRV market directly for $crvUSD, given concerns about endogenous collateralization. So opening a secondary market makes a lot of sense in the hunt for product market fit.

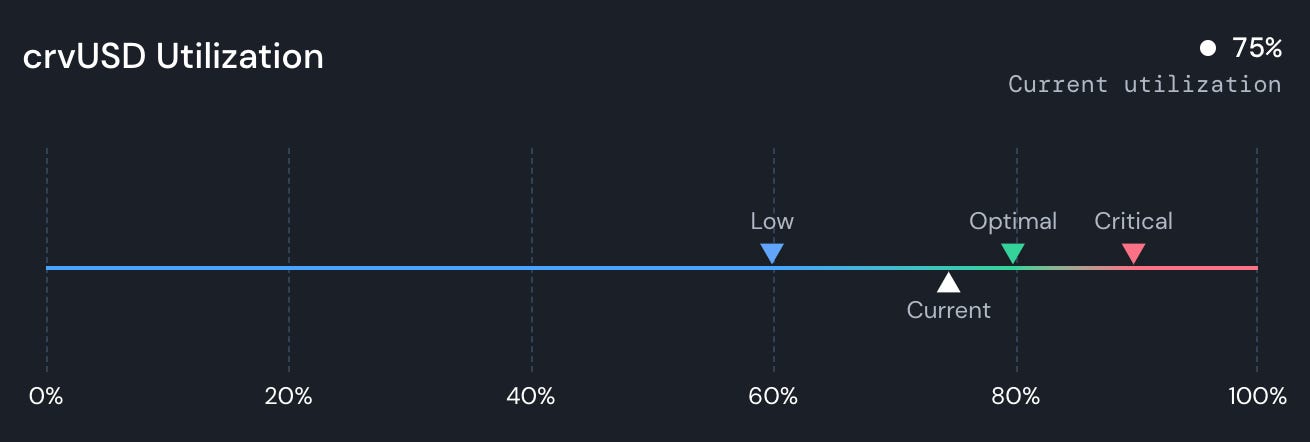

Such traction can be tough to build for marketplaces, where supply and demand must exist on both sides in perfect balance. At the moment they’re striking the exact balance they’re hoping for between these pairs.

Of course, Curve Founder Mich is famous for using his massive $CRV holding to play around with lending protocols. He’s always been an outstanding user, actively managing his health with a perfect record of zero liquidations. The downside is that his presence inevitably attracts a relentless army of tiresome nags who will concern troll the protocol to death over trumped up moral implications of any $CRV exposure.

But hey, any publicity is good publicity, right? The team is ready to have this conversation, as they demonstrated on Leviathan News this morning when they discussed this and much more. Worth a watch!

Another topic we touched on during the livestream was the fate of $XAI, which previously served as the in-house stablecoin for Silo. As founder Aiham explains, bootstrapping a stablecoin like $XAI is cost-prohibitive for a small protocol, hence the move to supplement $crvUSD.

Looking over the numbers, $crvUSD has already soared past a $100MM market cap, while $XAI is about a tenth of this. For the smaller protocol, there’s a certain logic to focusing on building out the lending infrastructure while simultaneously patching weak spots for $crvUSD.

It’s worth noting that the $XAI : $crvUSD pool is the highest yielding Curve pool, perhaps an indication that degens fear $XAI could ultimately be phased out by the protocol in favor of $crvUSD. While this may be a possibility, we don’t believe this is likely for reasons explained in the above livestream. The bigger risk is that liquidity may be frustratingly low, and slippage may be an issue for deposits in size.

That said, at the moment you can get very good returns supplying $crvUSD to Silo — which has the side benefit of giving Mich more opportunity to diversify his lending markets.

As for Silo’s bet to build synergistically against $crvUSD, it strikes us as a well-timed bet. $crvUSD TVL has been rocketing upwards on low borrow rates. The amount of borrowed $crvUSD supply hit a record this weekend, catching up with the ambitious Peg Keepers that preceded the pump.

Is this the effect of leverage entering the system? We saw $crvUSD notch its first 9 digits quickly without leverage, we’ll find out soon enough if 10x leverage earns the coveted tenth digit.