Curve, amidst a flurry of democracy, also introduced a governance forum vote to reweight the $MIM pool from 0.5 to 1.0

Boomers may recall the intense debate on the subject of double-dipping:

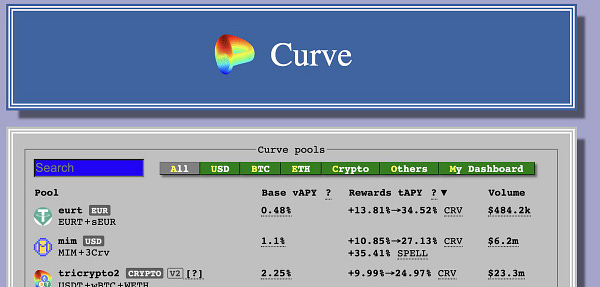

The Curve community sought to reduce incentives for pools which may cause leveraged Curve farming. However, users brought data suggesting the policy didn’t really work as intended. In particular, the pool that suffered most was the $MIM pool, which could not be used for double dipping yet carried a burdensome type_weight of 0.5. This halved any rewards it would ordinarily earn.

Had this been a western-style democracy, the data would surely have been ignored, as the powers-that-be doubled down on the original flawed policy. However Curve is operated by a far more responsive governance, in the form of a functional and well-architected DAO. We quickly see this vote appear to restore MIM’s type_weight to 1.0, restoring it to parity with other pools.

It amounts to a victory for @BlockEnthusiast, who brought the data in the first place.

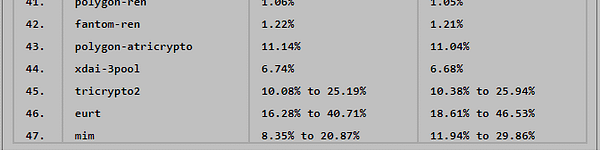

In fact, a successful vote could magically transform the Magical Internet Money poll into one of the most, if not the most, lucrative pool.

Adding to the rewards, $MIM has also been making heavy use of the bribe-a-hub.

The data clearly show the bribes are effective at influencing gauge votes.

The $SPELL rewards, the fee-accruing governance token for Abracadabra, has been gaining popularity as DeFi degens put on their robes and wizard hats.

The Abracadabra protocol just celebrated passing $100MM in their lending markets.

If you’re searching for yet more magic in this world, we also see hints the $SPELL will be cast across multiple popular blockchains.

If you’re not familiar with the Abracadabra ecosystem, this thread provides some background.

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV maximalist and has no stake in the $MIM pool.