After the hack, we predicted everybody should buckle up and prepare for a week of wading through high waters. Good advice it turns out.

Finally, after three hellish weekdays, is Curve rising again? A proverbial phoenix from the ashes? Here are some of the bright points.

TVL is Back

Frax Finance, which had pulled out all their liquidity while they assessed the situation, has judged it safe to redeposit.

Nice to see, though we enjoyed some of the elevated yields from the exodus. Social media is becoming more palatable as shorters have given up and there’s no reason to coordinate a firehose of FUD. So we appreciate whenever the occasional signal emerges from the noise, such as this great recap of the entire ordeal:

TriCRV

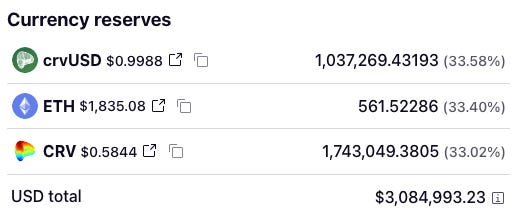

Perhaps more systemically important is the fate of TriCRV.

After CRV/ETH, the main source of $CRV liquidity onchain was erased, the approval of TriCRV rewards is delivering hefty rewards and spurring an inflow of liquidity.

Now up to 2MM in $CRV tokens and $3MM dollar value worth of liquidity.

Just before the hack, CRV/ETH had 29,570,169 $CRV in the pool — we’re still quite a bit away from this mark. Yet at the current rate of growth we should expect it’s not long before this pool again becomes the primary liquidity source onchain — this time with $crvUSD!

The Marketplace of Ideas

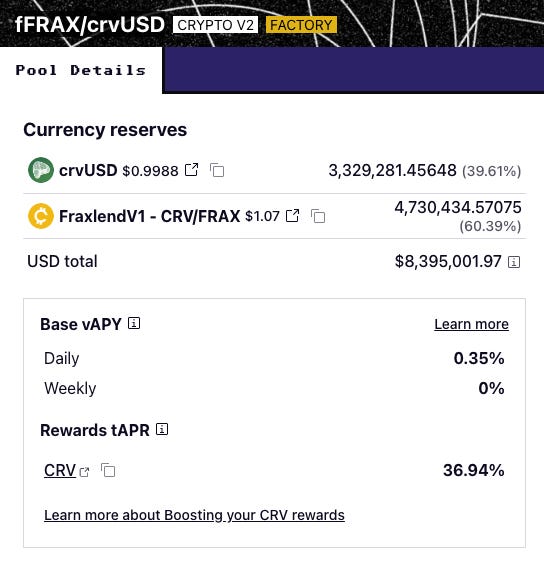

Perhaps the best upshot is the jolt to the marketplace of ideas. We felt the inspired creation of the fFrax/crvUSD pool was most exciting not so much due to the game of cat and mouse, but in how Mich captured the attention of the crypto community and used it to stupefy his critics by delivering an innovative move their feeble minds could never have imagined.

Reaching the haters doesn’t particularly matter all that much… once this is said and done they’ll just retreat back to whatever dark corner they crawled out of.

All you need from the little stunt is to inspire a genius builder like Sam… and suddenly we’ll see DeFi get reshaped when all is said and done.

We don’t care that our niche newsletter has a low ceiling… we’d rather write for a single builder than a million reply guys.

$crvUSD

The other genius idea we would hope might emerge from all this is the superiority of $crvUSD’s architecture as a lending platform.

The way most CDPs work, a user can abandon their collateral for dead. If it does death spiral towards zero, the protocol absorbs the risk and has to figure out what to do with the bad debt.

In $crvUSD, as the collateral asset spirals, arbitrageurs are buying up the collateral for a stablecoin. Setting aside the concept of buy pressure, the design of this system offers innovative protection against tail risk.

In other words, if $crvUSD accepted $CRV as collateral (which it seems it wouldn’t do due to endogenous collareralization risk), the protocol could easily absorb Mich’s size without risk to the protocol.

Incidentally, since $crvUSD isn’t particularly willing to touch endogenous collateral anytime soon, maybe you should be the one build it, anon. It’s not like you need more evidence that the concept can be stable…