August 31, 2023: Finally... Based 🧪🧑🔬

Curve launch on Base chain accidentally triggers gold rush

Curve is live on Base Chain!

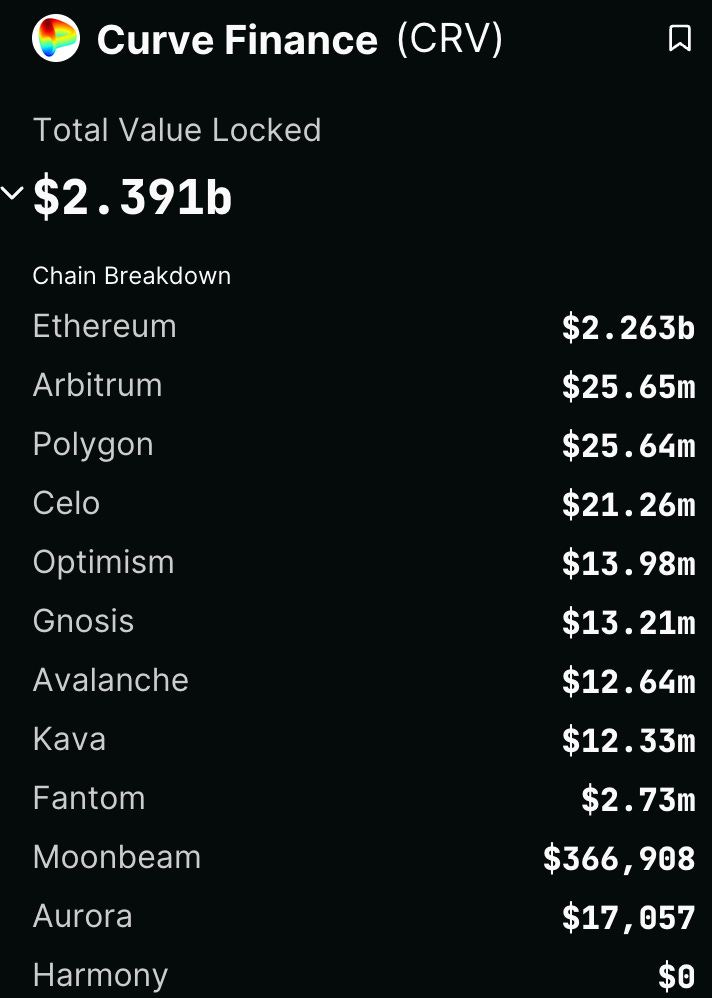

Other than launching some basic infrastructure, Curve has historically had a very sedate presence on other chains. It makes some sense when you look at flows of liquidity. Its largest chain outside mainnet is Arbitrum, which accounts for just ~1% of its TVL.

So it’s easy to see why Curve places little emphasis outside mainnet. Several chains don’t even have a fully featured factory. The multichain incident tossed a monkey wrench in pushing boosts cross-chain.

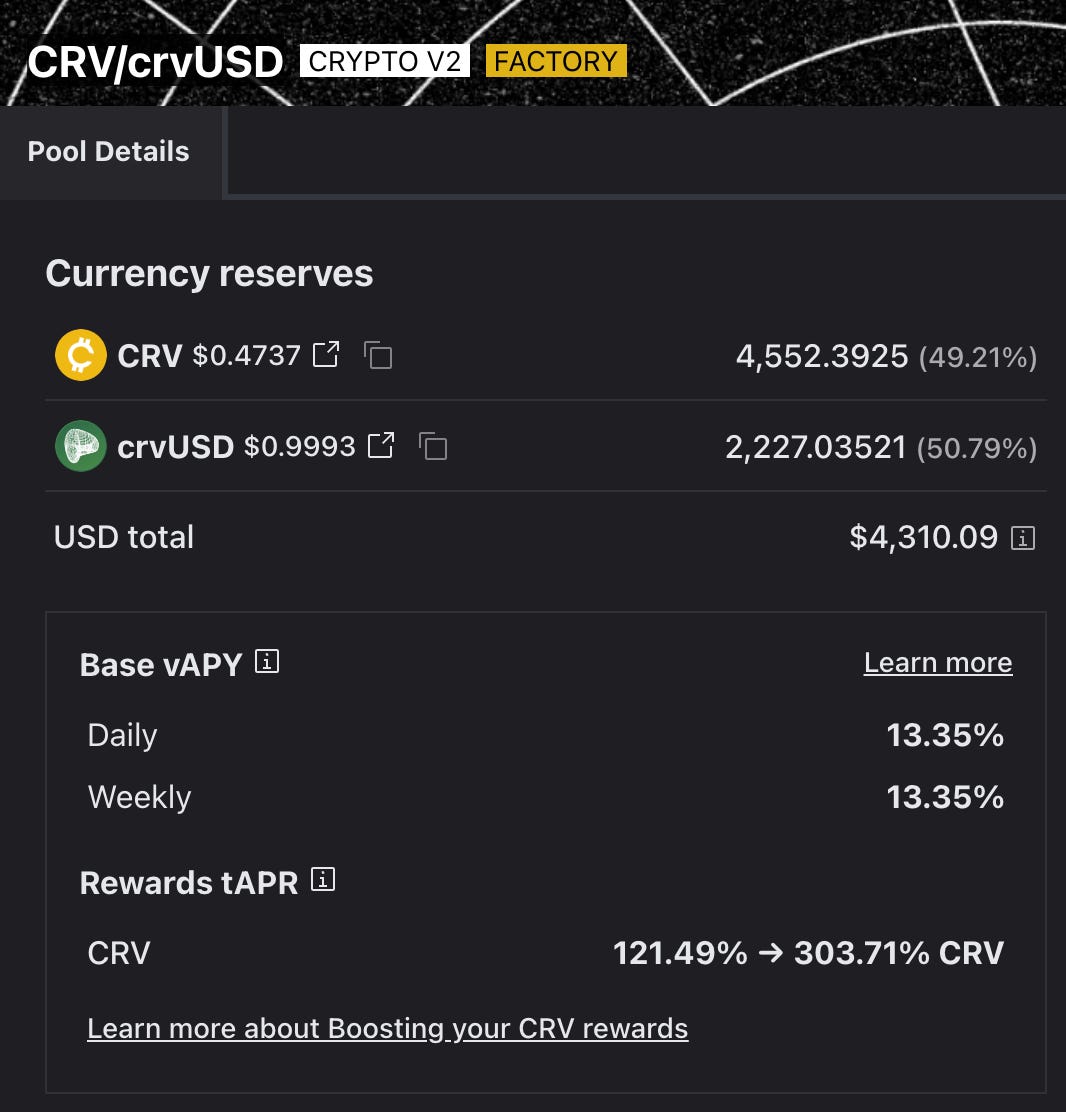

Yet the Base chain launch ended up being a surprise bonanza. Just look at the fine architecture on this pool!

OK, maybe most people were less wowed by this than by these rewards…

Million% APYs? With just a few days left in the season, we finally got ourselves a DeFi Summer! Too good to be true?

In fact, the math works out. Curve was attempting to seed 150K to the three pools for a week’s worth of rewards. But sidechains work a bit different from mainnet. When $CRV rewards are deposited manually, the gauges treat it as if it was a DAO streamed emission, like on mainnet where it requires boosting and resets every Thursday at midnight UTC.

The deposit happening just before the Thursday deadline meant that the entirety of the rewards streamed for just three hours.

A two comma APY? Well, yes, if a madman kept depositing 50K $CRV every few hours for a year, then this lofty value may be sustainable.

So an otherwise straightforward launch turned into an utter gold rush. Or if you like, a bit of an experiment in degen psychology.

Within three hours, the Base deployment attracted over $6MM in TVL. The pools became absurdly imbalanced in the moment, as users didn’t particularly care about insane slippage, anything to insert their face right in path of the rewards firehose.

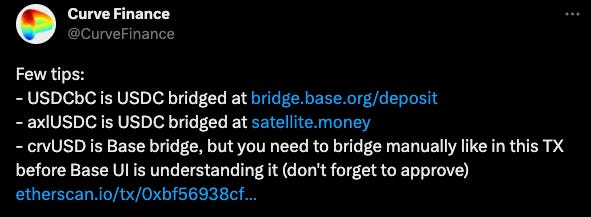

No time to figure out how to bridge tokens in a balanced fashion! It could get confusing after all, some of the tokens like $crvUSD have to be bridged manually. $USDC gets confusing as Base supports two (soon to be three) versions.

Here are the instructions if you are still jeeting into Base…

After three hours the madness would subside and more typical rewards would be streamed.

Following last month’s Vyper hack, it’s nice that we’re back to the traditional paradigm, in which Curve errors ran in favor of LPs…

July 6, 2023: The Cash Couch 🛋️💸

Thank you to all who turned out to ETH Barcelona and attended the panel on Risk Factors in Stablecoin/DeFi Design. Really enjoyed this conversation, make sure to follow giga-brain fellow panelists @TheBlockAdopter and @Tiza4ThePeople as well as the outstanding moderator

All the same, the short term frenzy did nothing to blunt the accidental effectiveness of Curve’s launch. The TVL kept climbing, jumping from $6MM to over $11MM overnight.

Protocols interested in bootstrapping liquidity should take note of the incident. The affair cost 150K in $CRV (worth ~$75K USD at today’s cartoonish discount), a relative bargain to bootstrap $6MM in three hours…

Although it was a slip-up and not a devious marketing strategy as some people surmised, the genius went a level deeper. Base chain has no way to bridge $CRV back from the chain as of publication.

Great way to drop a token without sell pressure!

Although, Curve actually wants bridging as much as dumpers do. Finally, some unity in this PvP space.

Fortunately, the enterprising $CRV haters would find a way to dump without a bridge. One of the most exciting elements of the Base deployment is that it came with a fully featured factory, supporting the launch of both crypto and stable pools.

These factories aren’t yet supported on every chain, although we’re seeing it get rolled out swifter lately. The ability for anybody to create and launch their own pool is where the real magic tends to happen in DeFi.

Somebody (not Mich’s address) quickly resurrected the CRV/ETH pool which could allow them a repository to dump $CRV for ether.

Another somebody (also not Mich) retaliated with a $CRV / $crvUSD pool and incentivized it with rewards, perhaps to encourage dumping into the protocol’s scrip.

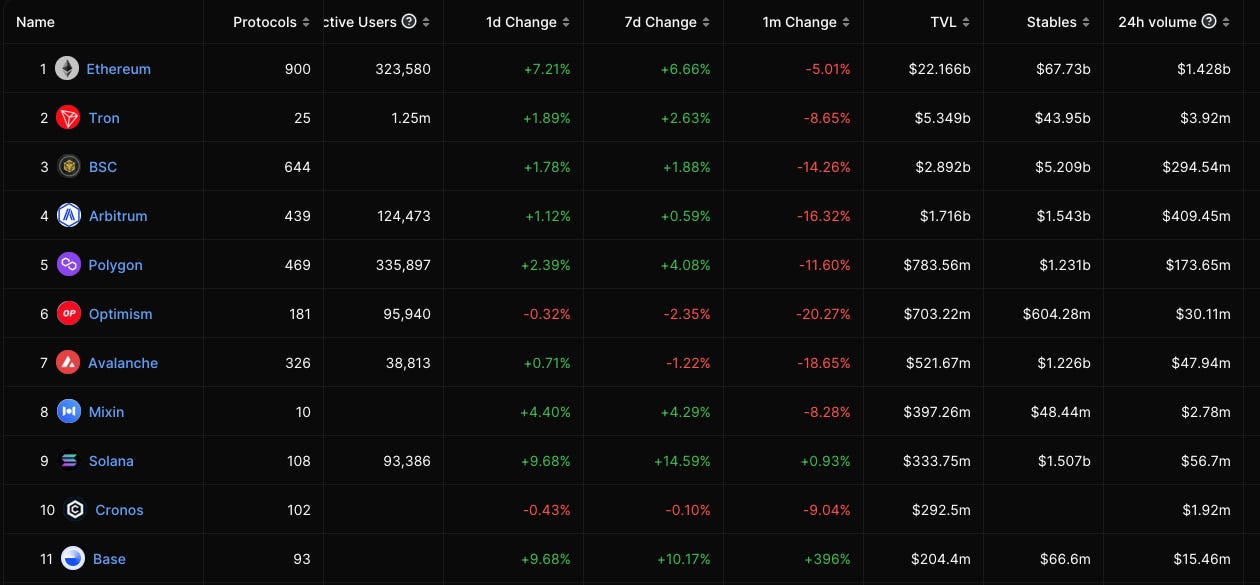

Among chains, we’d bet that Base has more staying power than most. They’ve enjoyed a very successful launch in a bear market. Base is quickly rocketing up the DefiLlama leaderboards, sitting within spitting distance of the top ten.

They attracted a lot of attention-grabbing apps.