Big Crypto Poll Part 4: Usage 🗳️✅

What, Where, When, Why and How We Use Crypto

Fourth in our series dissecting the results of our Big Crypto Poll

The prior articles answered “who” is using crypto in fine detail. This article begins answering the remaining journalistic questions:

When

Why

How

Where

WHEN

We can safely say that our survey respondents have been around the block, so to speak. Respondents spent a median of 7 years using cryptocurrency. Don’t worry though, we’re still “early!”

Returning to the “dropoff” charts we introduced in prior articles, you can see (based on where the chart slopes heaviest) a few punctuations representing clear waves of heavy crypto adoption in 2017 and 2020, with users trickling in more gradually during intervening years.

You can note that there is a visibly sharper adoption rate for the high net worth users (defined as a reported onchain worth of $1MM or above). These users all joined crypto before 2015. Correlation or causation is not clear (they may be rich because of their crypto investments, or they may have been freer to HODL because they were wealthy).

Among our four values-based clusters the timeline remained mostly consistent, although you can see that the Global Access Advocates are the newest set, with <20% joining the space until adoption really started in mid-2017.

WHY

We imagine most users are buy a token because, no doubt, they hope number goes up. However, human motivation is complex and often layers reasons upon reasons. Our prior article on the core values that attracted users to crypto scratches the surface of why users remain in the space, even while the number is going the wrong way:

Big Crypto Poll Part 3: Values 🗳️✅

Part 3 of our series dissecting the results of our Big Crypto Poll

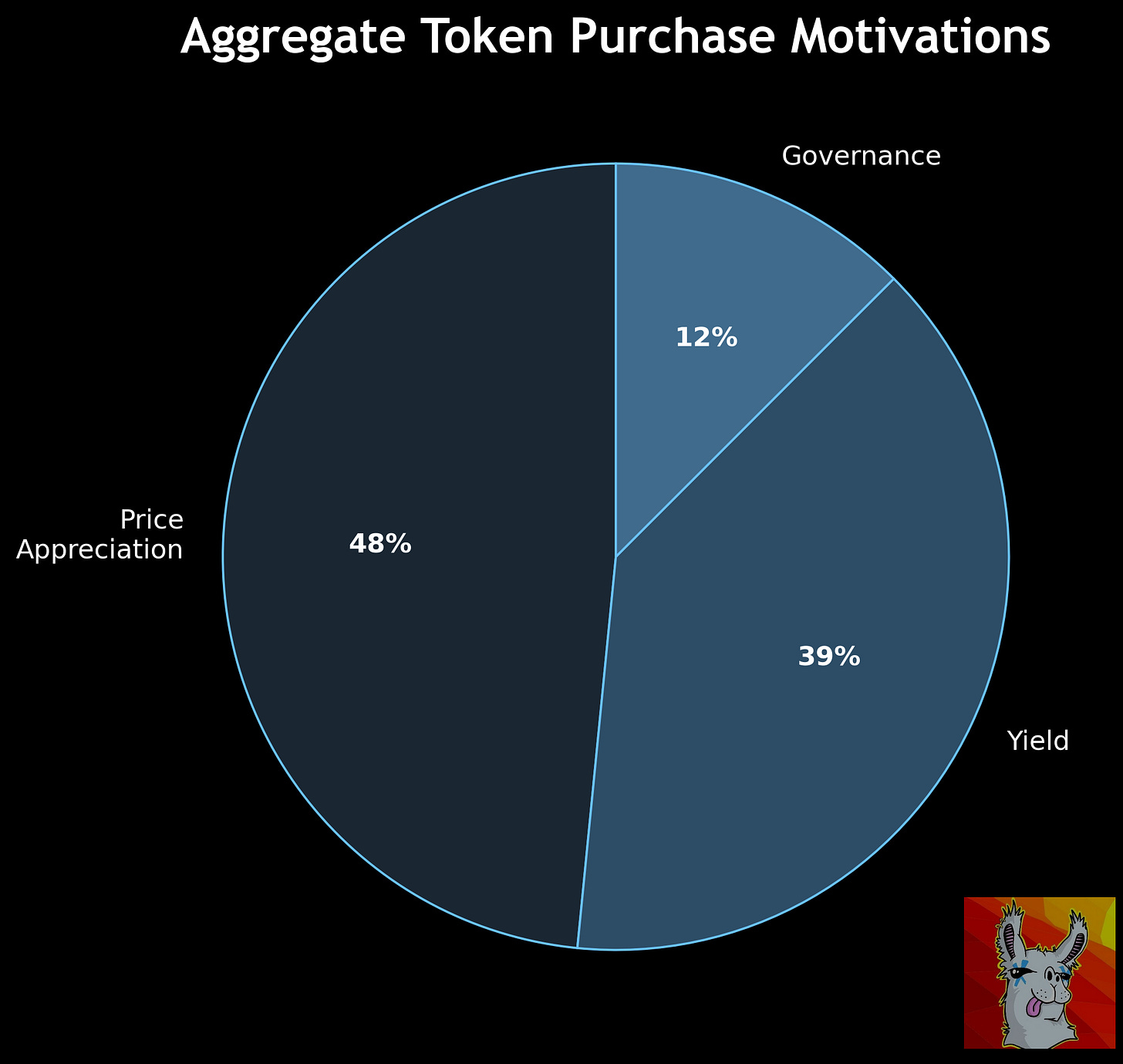

We asked another question that helped reveal the motivations underlying user interest in crypto: what was their primary motivation for purchasing tokens. We were a bit surprised to see the obvious answer, “price appreciation,” was the plurality response, but fell short of the majority. Motivations are indeed complex.

Perhaps most respondents are retroactively applying other reasons to self-justify why they are holding bad investments? At any rate, our four values-based clusters showed considerable variation in their answer to this question about underlying motivations.

No surprise, the cluster we dubbed Economic Opportunists were most heavily motivated by price. Meanwhile, the majority of True Believers and Global Access Advocates reported they purchase tokens for “Yield.” The actionable takeaway for marketers would be that protocols looking to compete on yield might emphasize values like global access and creative disruption in their messaging.

Why did you get into crypto?

“Make money/invest. But now it’s more of a hobby/pastime”

— Class of 2019, under $1MM net worth, 10-20 daily transactions

Our initial hypothesis was that the variation in motivations among these four clusters might be explained away by differences in net worth. In other words, once you’ve “made it,” you might care less about price appreciation, and might stick around in the space for other reasons.

In fact, the data showed the opposite. The wealthier the user, the more likely they were buying tokens for price appreciation.

Maybe the rich get richer simply because they care the most about getting rich.

HOW

Information overload is real. Crypto sheds more data than any one person can process.

How do users sift through this ocean of data to find signal about crypto? The conventional wisdom has it that crypto takes place on 𝕏, Discord and Telegram. The conventional wisdom is correct.

It appears we remain mere sims in Elon Musk’s world. Substack tied with Telegram here, but we suspect the numbers might be a touch elevated because the survey was so heavily disseminated through this wonderful blog!

The big losers here are traditional news sites and Farcaster. We gave respondents a text box to write what channels they found most useful. Of course, several listed our blog and our work with Leviathan (thank you!)