We know it’s been a rough year for a lot of people. Yet we’re sort of congenitally unable to be anything but perma-bullish.

Our least popular opinion: 2022 was pretty great year!

Here’s our receipts for this controversial claim, presented in helpful Top Ten Year-End Buzzfeed Listicle format.

10. Chicken Bonds

In the bull market, you could just clone another project, announce 1000x the yields, and watch the apes line up. The bear market forced DeFi builders to get more creative if they wanted to capture users’ imaginations and wallets.

What better example of nailing your launch than the success of Chicken Bonds.

Chicken Bonds required an extra ounce of creativity to get off the ground. The team put their heads together and brainstormed bespoke tokenomics. The builders communicated the seemingly complex concept clearly, getting readers intrigued. Their ecosystem required an NFT for its mechanics, so they added just enough artistic flair to bring the concept to life without looking a gimmick. A great concept, perfectly executed.

Watching participants maneuver through the first round of bonds has been a fun distraction in a year marked by fraud and pain. The launch of Chicken Bonds symbolizes the best of what this space has to offer.

9. Don’t Step on Snek

One could imagine web3 development slowing down in a bear, but devs kept building out the future of Ethereum as if nothing changed.

It was an all-around breakout year for python web3 tooling. Hot Vyper summer smashed. NPC-ers became the highest grossing Vyper NFT in history. Ape Framework became the industry standard.

Titanoboa stands out as a notably Big Deal™️ — the sort of 0-to-1 innovation that makes Python not so much a follower in the world of web3 development, but a leader.

Catch up on the year latest developments via the online PyChain conference.

8. Tornado Chasers

Granted, you may find it hard to see a silver lining in the unconscionable arrest of Alex Pertsev and the sanctioning of Tornado Cash. The crackdown easily ranks among the most heinous acts committed by a western democracy in recent memory, which happens to be crowded competition.

However, we do take comfort in how the community rallied in the aftermath. Many believers in cryptocurrency filed suit to contest the shenanigans. Even feuding Ethereans and Bitcoiners united briefly to decry the overreach. Our outrage proved it lasted beyond a news cycle. The community continues to organize for Alex’s release.

Encouragingly, our pushback has even had some success — OFAC bowed at least partially to the pressure. It’s a good sign that single-issue cryptocurrency voters are maturing into a political coalition that can move the needle when we speak up.

Sadly, Alex remains imprisoned on no charges. Keep the pressure on, we will win!

7. Big Vitalik Energy

Ethereum is culture. It’s important to keep morale high. A good general knows how to rally their troops. Vitalik found a way to raise the community’s spirits.

When our community is buzzing, there’s nothing more entertaining than crypto Twitter. That energy unfortunately receded this year, as users trickled back to their McDonalds shifts. The remnants needed something to break up the gallows humor.

When the above photograph dropped, it jolted the community like a clash of lightning. For a solid 24 hours, every post on the timeline was a joke on the subject, and they managed to always be funny. Frens we’d thought had disappeared forever came back from retirement to weigh in. What a day to be alive.

6. Do Over

There’s never a good time for a systemically important cryptocurrency protocol to collapse. Yet Terra was likely destined for failure at some point. We consider it an unqualified good that we ripped the bandage off before it got any worse.

Yes, you might complain that this incident eradicated all our bags.

We recognize how many people around the world were hurt directly by the incident, and know everybody’s bags are still feeling the pain today.

Yet we try to imagine the world where Terra didn’t collapse. We’d still be suffering the toxic influence of 20% yields perched on the edge of collapse. Kwon’s ego swelling to catastrophic size. Far better to have the field cleared for the rest of the crypto space.

We excised a lot of the worst actors from crypto this year, and we should feel richer for having lost them.

5. $crvUSD White Paper

Yes, we confess, we’re biased — this is a Curve-focused fanzine after all. We slotted this halfway onto this list, but whether you rank it higher or lower, the $crvUSD White Paper was a remarkable release for many reasons.

The paper itself represents a big leap forward for DeFi innovation. The internal mechanics of $crvUSD easily outlap any innovations we’ve seen out of TradFi in decades. We believe the concept of lending-based stablecoins leveled up on the release, and we look forward to seeing how $crvUSD reshapes the entire stablecoin industry. We also have reason to believe it could reshape Curve, but that’s a story for 2023.

Even before the paper launched, $crvUSD hype managed to remain a major story throughout the entire year. Considering the amount of hype, it was truly impressive the paper’s release managed to meet the moment. Timing the repository’s release for the climax of the Avi/AAVE incident was a particularly inspired bit of showmanship and cemented $crvUSD as a seminal moment for our year in review.

Of course, $crvUSD is not actually launching in 2022 as it undergoes extra testing to make sure the cutting edge mechanics uphold Curve’s reputation for safety. We’ll see how the release goes, but early signs are that $crvUSD will play a major role in 2023 and beyond.

4. FraxBP

Frax had a phenomenal year. It’s difficult to pick out a single “best” from the team’s many product launches. FrxETH, Fraxlend, FPI… the list goes on. Yet the impact of FraxBP in reshaping Curve liquidity deserves special mention

It’s hard to believe that earlier this year, Frax was seemingly going to pair up with Terra and create the 4pool. Instead, of getting rekt by the fallout, instead we got treated to a leaner, meaner FraxBP.

Crypto’s supposed to be dead right now, we’re told. Nobody building or shipping, and launches are presumed DOA. Yet dozens of protocols emerged to launch a trading pair against FraxBP, enticed by juicy incentives. Looks like some of us are still around.

The entire Curve ecosystem has been completed upended in the past twelve months, with liquidity migrating from 3pool to pools built against FraxBP.

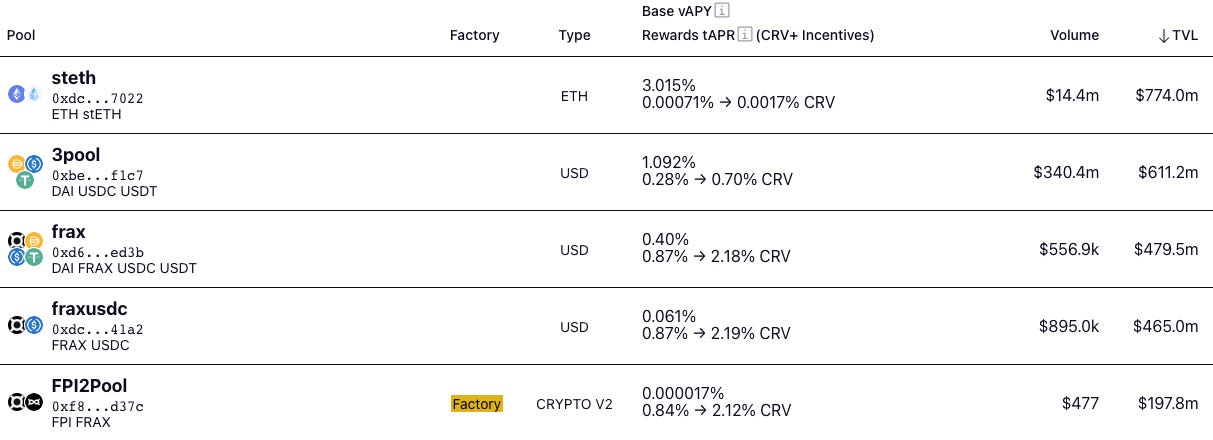

Frax now has 3 of the top 5 pools by TVL, along with 20-some pools against the base pair and counting.

The bear market remains the best time to ship things. No protocol is better positioning itself to lead the recovery than the big brain energy from Frax. Bullish!

3. Arbitrum Season

One of the biggest stories of the year was the amazing innovation emerging from all corners of the Arbitrum ecosystem. The innovation was so impressive that $GMX even posted a positive return on the year, an ultrarare feat amidst the 2022 bloodbath.

With our laser-focus on Curve we didn’t get to cover as many of the Arbitrum protocols as closely we wanted, but they’re top of our radar. We couldn’t possibly list everything happening, but we expect to several unicorns to emerge next cycle from the likes of GMX, Dopex, Umami, Radiant, Vesta, Camelot, Shell, Rage Trade, Plutus, Mycelium, Hegic, Y2K, Cap, Sperax, Jones DAO, Vendor Finance… the list goes on.

The exciting developments prove not only that innovation is alive and well during this bear market. It further proves that Ethereum’s dreams of scaling on L2 are likely to become a reality. It has also cemented Arbitrum as the epicenter of innovation.

2. SBF Arrested

The tail end of the year was a surreal experience. Faced with outright, blatant fraud on a level that would make Bernie Madoff blush, the collapse of FTX was difficult in itself, and likely to bring more pain for months to come.

But the absolute worst part was the immediate aftermath, as we were forced to endure an onslaught of puff pieces from legacy journalists on why SBF was akshually good. More than any “number goes down” action on the year, the positive articles about SBF and company were an unspeakable torture upon anybody still clinging to a few shreds of sanity. At the time, it seemed the con artist’s monumental grift would succeed.

Thankfully, a sense of justice was restored when SBF was arrested. By no means is the saga finished — the plight of SBF so far has been disappointingly lightweight. We don’t know his ultimate fate.

Yet persons possessed of common sense can at least see the wheels are in motion. A horrendous cancer is being excised from our body politic. Journalists forced to comically backpedal is a welcome sight.

We expect the FTX will unfortunately bring more contagion in the first part of 2023. Centralized firms LARPing as DeFi collapse in slow motion. Fortunately, with so much of the crypto charlatans’ clutter getting culled, it finally feels as if the foundation is set for better protocols to emerge.

1. The Merge

We take particular delight in seeing major technological progress continuing to take place steadily in the unholiest of market conditions. Grifters might have postponed the merge to try and time a more favorable market. Ethereum devs are built different.

As we enjoyed the smooth transition to Proof of Stake, we also enjoyed so many of the other benefits of the merge play out. The regular second block times. The smooth operation of the validator community. The smell of burning ETH. The absence of the smell of burning rain forests from the meritworthy environmental impact.

Great stuff all around. The entire community stopped playing misery poker on Merge day, instead uniting in appreciation of the historic occasion. Even Bitcoin maxis seemed to stop squabbling temporarily to acknowledge the significance of the event.

Of course, more work remains to be done — we need Shanghai update so paper hands can withdraw. The behavior of some block builders in ignoring certain transactions can cause troubling delays — encrypting the mempool would be a big step forward. There’s always something more, but let’s appreciate what we did.

The enormity of the technological challenge was so complex it took several years to plan out. Naysayers thought it would never happen. It could have failed in a thousand unforeseen ways. Yet Ethereum merged in realtime without so much as a dropped block. And you’re bearish?