Dec. 5, 2023: The Institutions are Coming! 🐴📣

Trident Digital proposes to incentivize liquidity for PayPal's $pyUSD

Yesterday we covered the broader crypto market turning euphoric as we watched the dam separating institutional money and Bitcoin starts to buckle.

December 4, 2023: Bitcoin @ $40K 🍀🎰

Sort of hard to believe $BTC is back above $40K. In its wake, $ETH is holding above $2200, alts are up anywhere from a bit to a buttload. Welcome back, bulls! Let’s face reality as it is. What does our $BTC dominant world look like? It means Michael Saylor ascends to main character status?

Today, we see signs the dam may have already started to burst, as a remarkable governance proposal hit Curve to incentivize PayPal’s stablecoin $pyUSD.

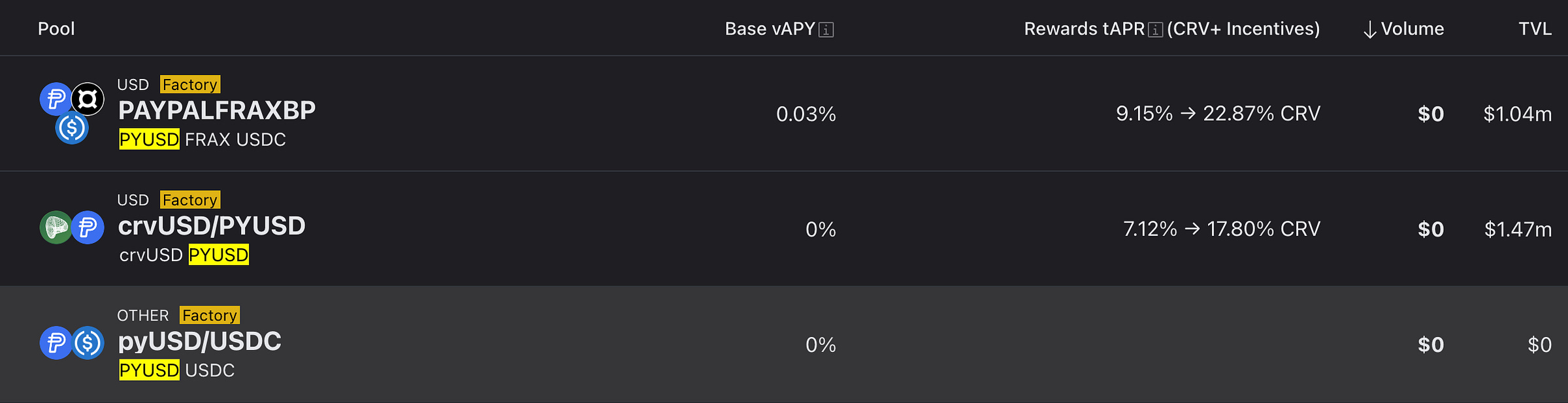

A pair of $pyUSD stablecoin pools had previously been created by the community to provide onchain liquidity with $crvUSD and the Frax-USDC base pool. Both of these pools scraped together $1MM worth of liquidity, becoming major onchain liquidity sources for the $125MM stablecoin. Yet it’s the currently empty $pyUSD - $USDC pool which may become the most notable yet…

It’s notable in that the pyUSD/USDC pool is explicitly likely to receive liquidity incentives (colloquially known as “birbs”) originating from the real world.

Birbs had previously been a game mostly played by onchain actors, given how easy it is for tokens to slosh throughout DeFi. Yet it had been far more difficult for TradFi to join the fun, given the heavyhanded regulatory environment in America.

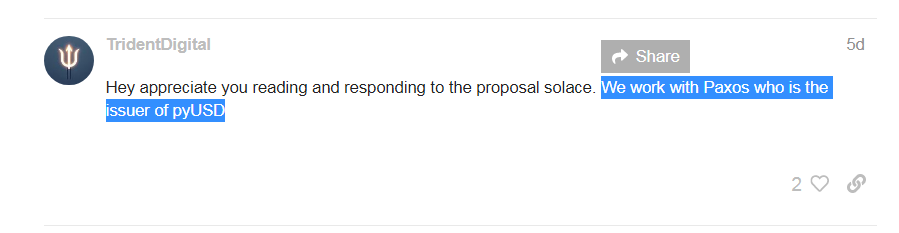

In this case, the intervening steps between offchain PayPal and the onchain incentivizations is facilitated by Trident Digital Technologies, which is working with Paxos and plans to incentivize via Votium.

Unsurprising that observers are euphoric, while death spiral00rs are struggling to find ways to scoff at the news.

Most of us believed that TradFi liquidity would find its way into DeFi amidst the inevitable rise of crypto, but few of us believed this might happen so soon.

The synthesis of TradFi and DeFi stands to be a gamechanger. TradFi is staid and ossified, but holds prioritized access to the relatively infinite supply of the money printer. DeFi is dynamic and innovative, but has been largely cut off from this massive liquidity.

The overall money supply is around 20 trillion USD, while the entirety of crypto has struggled to hold a 1 trillion market cap. Of this, the stablecoin market is a measly hundred something billion.

On the chart of top stablecoins, you’ll note that decentralized stablecoins, those primarily backed by crypto (ie $LUSD, $mkUSD, $crvUSD), all sit outside the top ten at around the $100MM range. Meanwhile, stablecoins which can be minted by centralized players using actual dollars are able to grow quite swiftly into the range of billions.

PayPal’s USD, which has done little thus far except 1) exist and 2) get brutalized by the draconian regulatory regime, has nonetheless managed to stay competitive with the decentralized stablecoins of the world, a testament to the sheer amount of liquidity potentially at play here. In other words, a successful decentralized stablecoin is still basically a rounding error in the real world.

In the prior bull frenzy, we observed so much demand to incentivize pools as to drive up the value of tokens like $CRV and $CVX. Might the same dynamic play out in this bull cycle?

Impossible to predict the future, but at least at the moment the flywheel tokens are lagging the crypto bull run, implying that investors are dismissing or ignoring this news.

For our sake, we’re quite bullish on the news. It appears as if not only is PayPal moving to shore up liquidity, they are also beefing up other vital pieces of stablecoin infrastructure.

We were quite curious to see specifically how PayPal intended to accomplish this perilous chain of liquidity from meat space to the degen casino.

Specifically, it’s structured as follows:

PayPal works with Paxos to issue their stablecoin

Paxos works with Trident Digital for incentivization

Trident Digital launched about six months ago, when they apparently began blogging. They’ve parlayed these blog posts and their senior Coinbase pedigree into an $8MM raise and a sharp landing page that prominently touting their work on $pyUSD.

Trident also touts having have helped facilitate incentives for USDP-PSM on Maker. With these two achievements, Trident is arguably already among the more active and successful TradFi companies bridging the offchain and onchain worlds. Keep tabs on this team, showing off far more bite than bark.

The United States, where crypto is de facto illegal, presents some of the biggest risks for operators and therefore also the highest rewards. We hope this generation of companies that help bridge TradFi and DeFi wind up more successful than the prior batch that got decimated by the FTX/3AC/LUNA fallout.

Among this class of promising companies, see also, Reserve Protocol, which also happens to be excelling in the world of US-based companies operating within the onchain world.

Finally, if you’re enthused by this news, a quick note to follow the great Cryptovestor77, where you could have been tipped off about this two months ago.

Our previous coverage on $pyUSD

August 8, 2023: $pyUSD Mafia 🏦💵

The stablecoin wars remain anything but stable… just like the community’s mental health. PayPal rocked the news cycle with their announcement of $pyUSD, a new stablecoin. It’s rightly considered a watershed moment for crypto, as aptly explained by Austin Campbell on

September 11, 2023: $pyUSD in the Sky 🥧☁️

WARNING: Cryptocurrency usage is becoming de facto illegal in the United States, and we never recommend USians use cryptocurrency without first consulting with a lawyer, a priest, and a registered financial advisor. For everybody else, this article provides a

See also, the full governance proposal.