September 11, 2023: $pyUSD in the Sky 🥧☁️

Beginner’s guide for accessing sky-high yields using $pyUSD

WARNING: Cryptocurrency usage is becoming de facto illegal in the United States, and we never recommend USians use cryptocurrency without first consulting with a lawyer, a priest, and a registered financial advisor.

For everybody else, this article provides a brief background of $pyUSD and some basic tutorials on how to use it! Tutorials include lessons on how to :

Earn Rewards on $pyUSD

Use $pyUSD to access DeFi

Obtain $pyUSD

Background

PayPal’s stablecoin $pyUSD has officially turned a month old!

August 8, 2023: $pyUSD Mafia 🏦💵

The stablecoin wars remain anything but stable… just like the community’s mental health. PayPal rocked the news cycle with their announcement of $pyUSD, a new stablecoin. It’s rightly considered a watershed moment for crypto, as aptly explained by Austin Campbell on

The world of traditional finance may think in time horizons of quarterly growth (or longer), but in cryptocurrency a month in the space nearly qualifies you for OG status. Particularly in this awful market. So it’s a good time to check in on $pyUSD’s traction to date.

As we mentioned during its launch announcement last month, we count ourselves as fans of the new stablecoin and hope for its success. So none of our usual light snarking here should be construed as a critique of their efforts, as we know how tough launching anything into a down-only market can be.

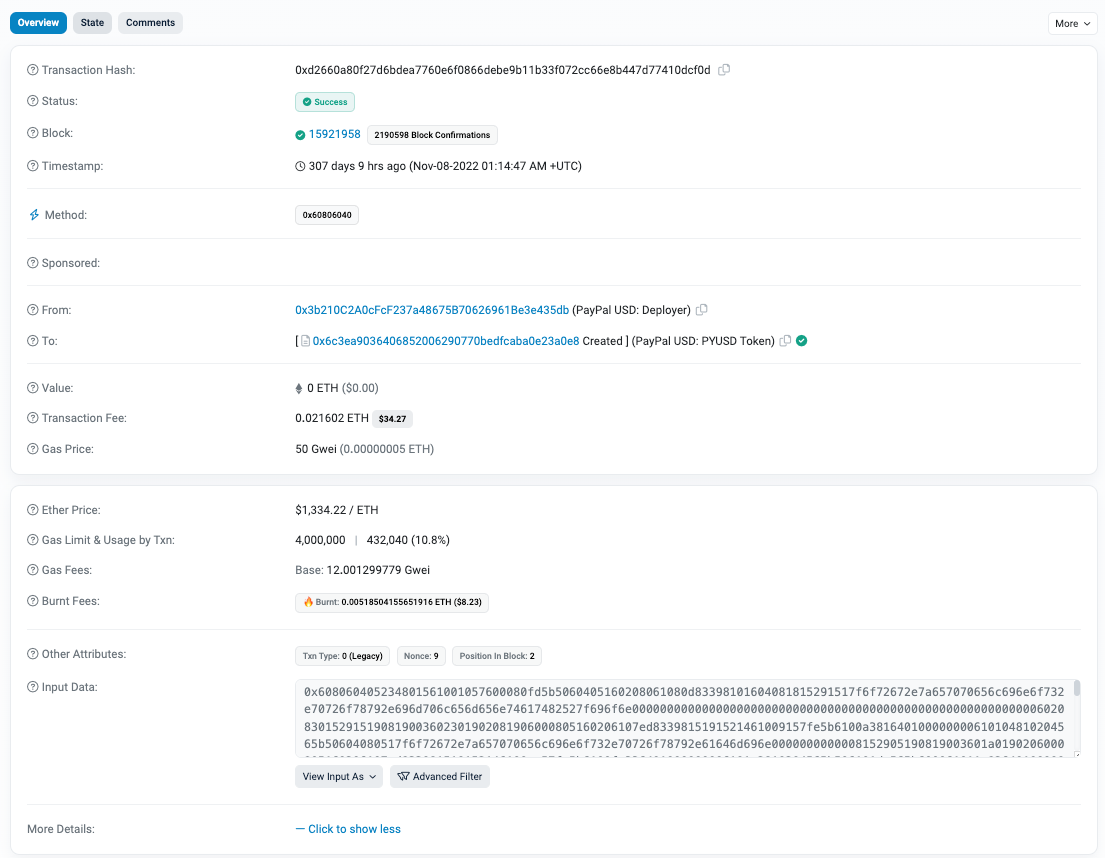

Now that we’ve finally deduced the stablecoin’s address, which was noticeably absent in our prior launch article, we can actually check the chain and unpack the truth. One particularly notable factoid about $pyUSD is that it launched onchain almost a year ago.

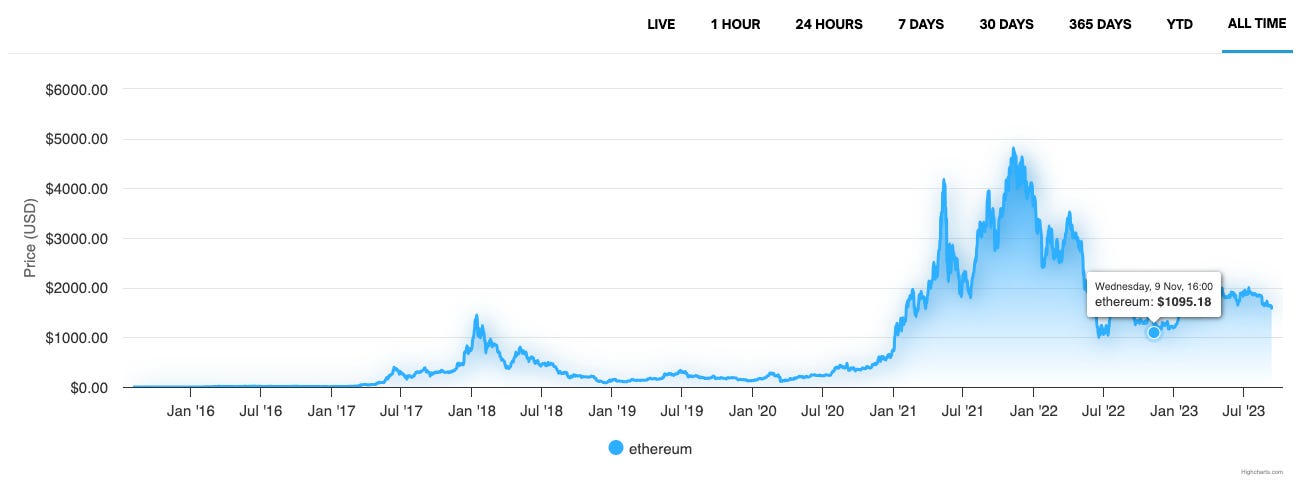

It’s sort of tough to remember through the blur of the bera, but this was back when Ethereum price was in the absolute gutter following its ATH, touching briefly below $1K. Sentiment was in the gutter, as crypto degens hit the first trough of despair.

Brilliant timing by the PayPal team to build the dip, and commendable convictions to stick around through the slump.

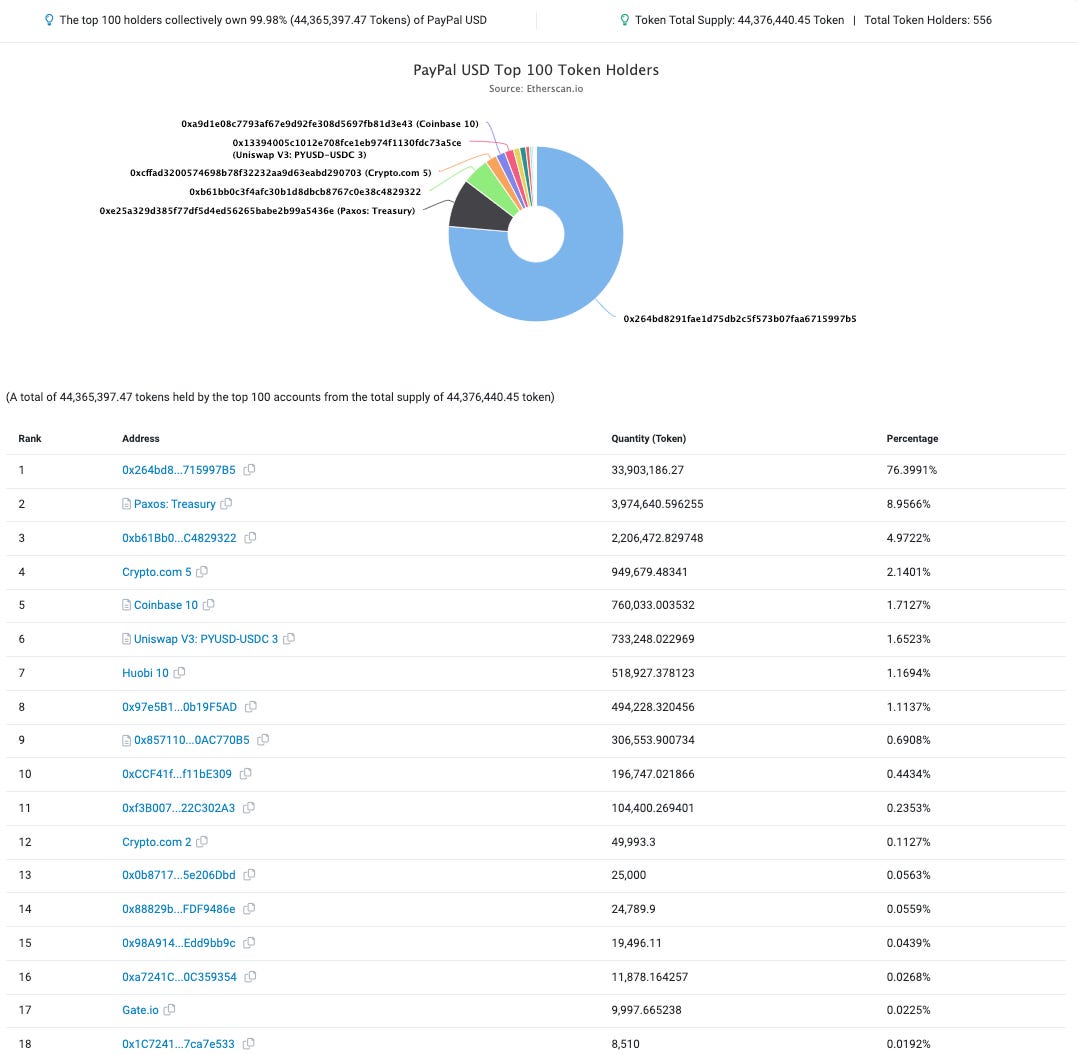

Per Etherscan, there’s currently a healthy circulating supply of $44MM. However, the strong majority of this is a single address that we presume is an internal address and doesn’t appear to be counted in total supply by other trackers.

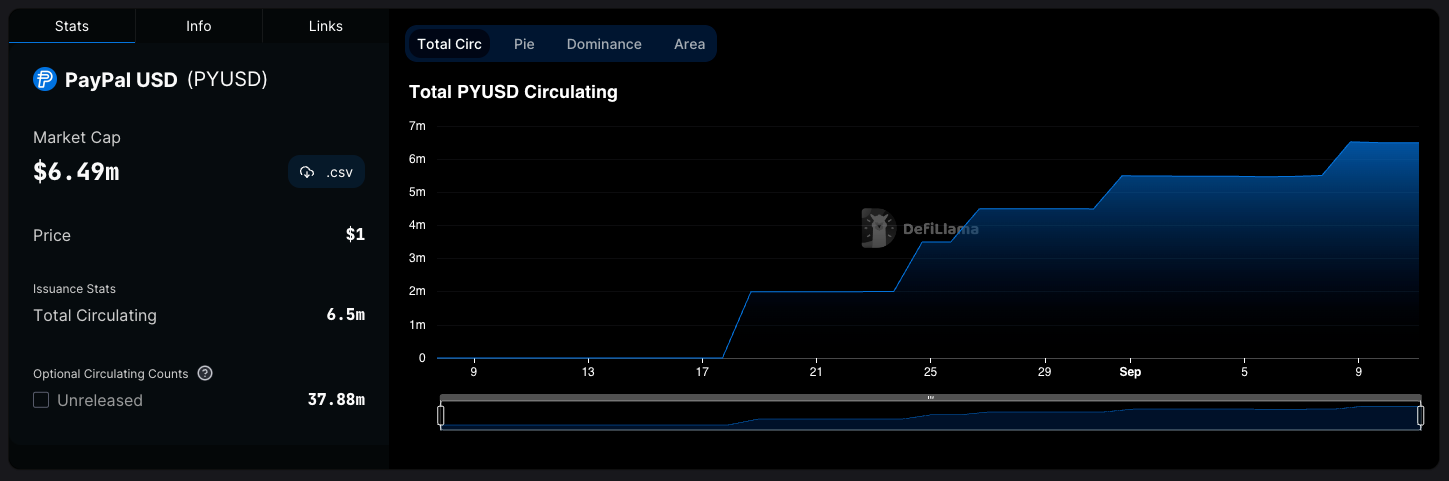

Per DeFiLlama, they only credit $pyUSD a market cap of $6.49MM, with the first activity occurring from August 17th.

At this market cap, $pyUSD is scarcely outcompeting $XTN, the rebrand of $USDN after it depegged from $1 to just over a nickel. The PayPal coin is lagging behind Aave’s $GHO, which launched this past quarter and sits 3 cents below peg pending the launch of its stability module. Prisma’s launch of $mkUSD last week has already 3x-ed $pyUSD’s market cap.

So you might say it’s a torpid start for the consumer-facing giant? Perhaps, but it’s tough to ignore the putrid state of the market for anybody who placed a big bet on US innovation. The clowns in DC have been aggressively working to cede America’s potential to lead the new digital economy. Based on the $USDC supply chart they’ve been sadly successful in their quixotic and ill-considered mission:

So we enter this more than willing to accept that launching a new stablecoin into such macro conditions will be, at best, choppy.

While there’s been some efforts to set up the onramps into PayPal USD through existing financial services, there hadn’t been a ton of work to give users any particular reason to move their wealth onchain. At the moment, the onchain world is a horror show of hacks and scams. Why move funds away the FDIC-insured shelter of TardFi, with easy access to risk-free T-Bill rates subsidized by soaking taxpayers?

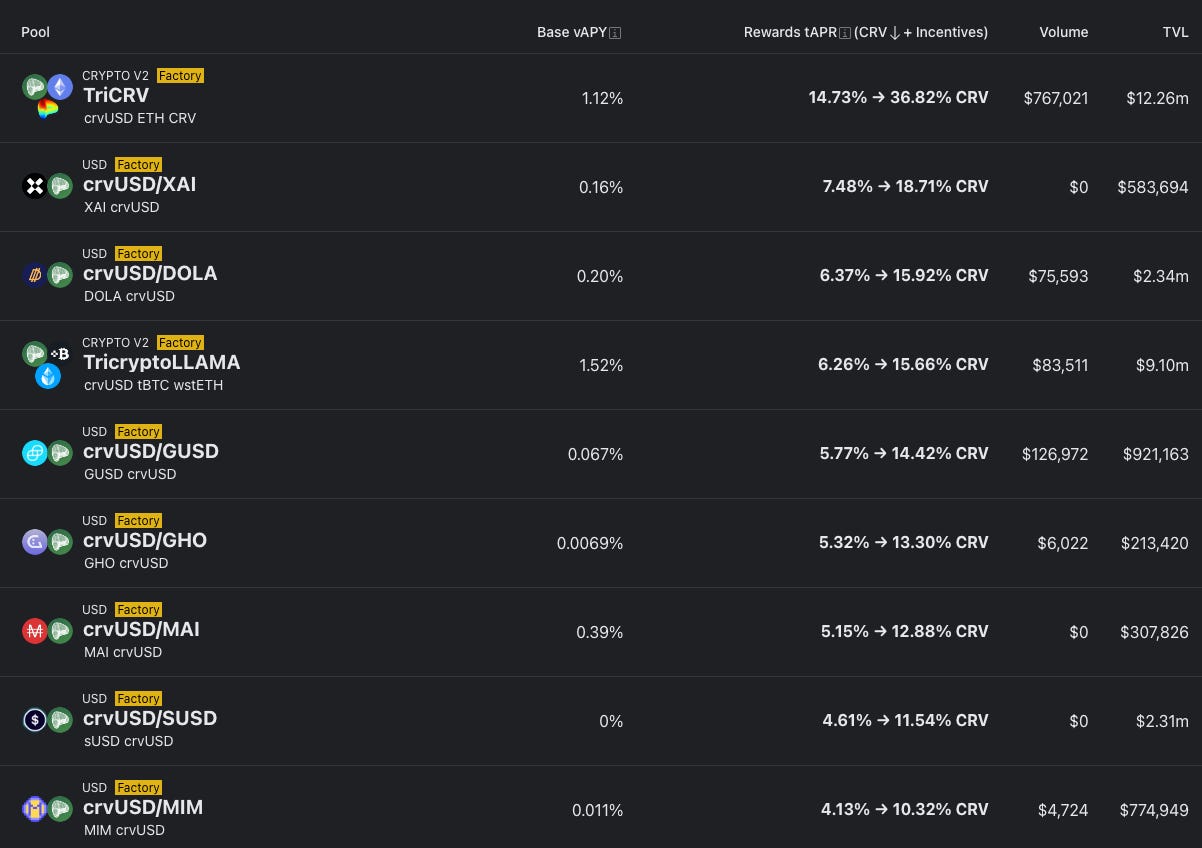

The easiest answer is incentives. Yield is the killer app in DeFi. A few basis points is often sufficient to entice users to wade into the risky waters of cryptocurrency. We saw a textbook example last week, when Curve was able to land into second place on Base by TVL.

August 31, 2023: Finally... Based 🧪🧑🔬

Curve is live on Base Chain! Other than launching some basic infrastructure, Curve has historically had a very sedate presence on other chains. It makes some sense when you look at flows of liquidity. Its largest chain outside mainnet is Arbitrum, which accounts for just ~1% of its TVL.

On Base, Curve landed over $30MM TVL within a week. All it cost was a fraction of this amount in rewards. The chef’s kiss is that the feat was achieved with incentives dished out in $CRV, a token being heavily cursed out for scraping all-time lows. If a token allegedly in the throes of a “death spiral” can nonetheless fuel several extremely successful product launches, it goes to show the power of offering yield.

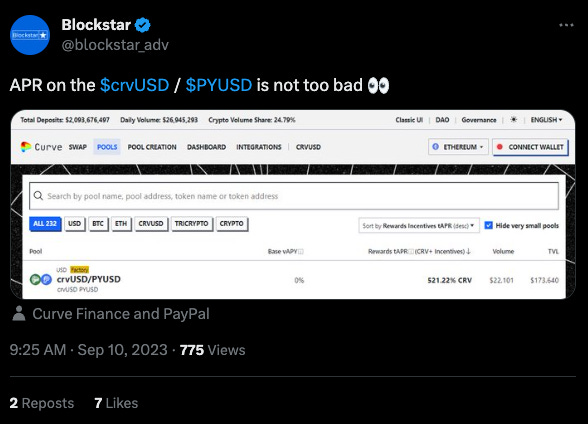

In the past 24 hours we may therefore have seen the first catalyst for demand for PayPal’s stablecoin. An enterprising degen launched a crvUSD / pyUSD pool through the factory. Mich seeded it with juicy incentives. A gauge vote has been created to sustain said incentives.

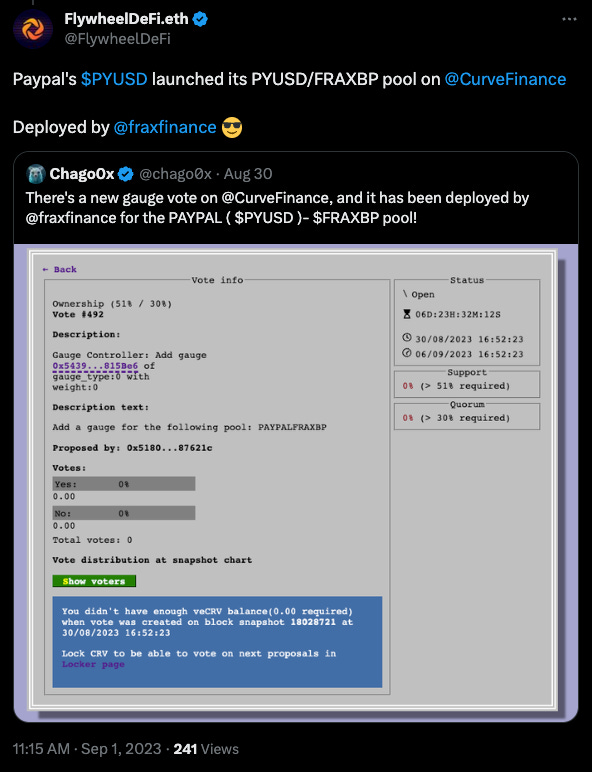

Meanwhile, Frax deployed a pool for a pyUSD / FraxBP pool:

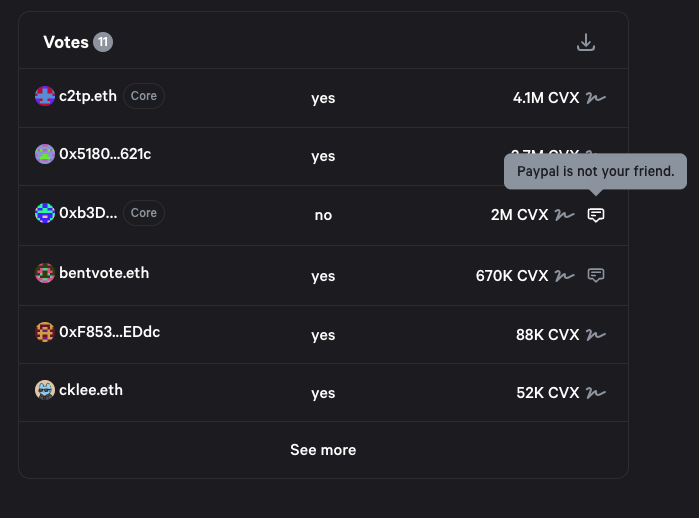

The vote passed, albeit with more pushback than usual.

A sudden influx of rewards would not only attract nearly a million dollars in liquidity to the pool, but it would also provide an easy set of rails for users to mint $pyUSD to quickly access the wider world of DeFi. The existence of these pools allows for trading pairs with $crvUSD and FraxBP, and thus the entirety of DeFi.

Most amazingly, PayPal needed to spend zero money or effort on this process. The entire onchain architecture was built out swiftly from interested users without PayPal needing to lift a finger. With the community so bullish on $pyUSD, we also remain bullish on its prospects!

What follows are a few simple guides for some basic $pyUSD activities for complete n00bs. Read on for simple beginner instructions for how to…

Earn Rewards on $pyUSD

Use $pyUSD to access DeFi

Obtain $pyUSD

Earn Rewards on $pyUSD

Are you enticed by the high yields you see on Curve for $pyUSD? OVER 100%?!?!?

Before adding liquidity, keep in mind that these yields can and will fluctuate (generally downwards). You will also need to use maybe ~$100 ETH to pay gas fees to enter/exit these pools, which will erode any possible yield. It’s particularly tough to overcome for smaller sized deposits <$10K. Finally, we offer no advice on regulatory or tax implications for yield farming.

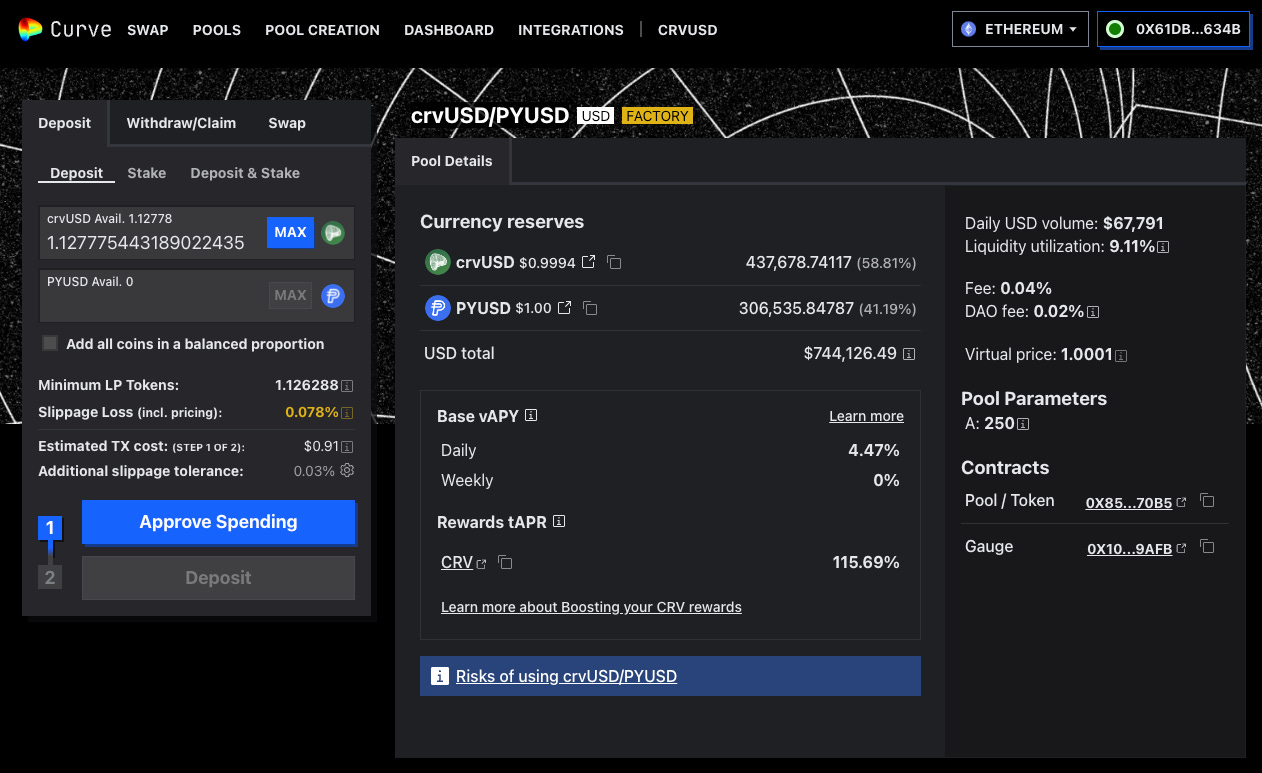

Start by visiting the target pool page and ensure your wallet is connected. If you have a balance of any of the pool’s constituent tokens, it will show in the “deposit” tab.

When you add liquidity to the pool, you are buying a token, referred to as an “LP token,” that represents your position as a liquidity provider. This token will accrue value as trading fees accumulate to the pool, so the exchange rates will vary over time (presumably only upwards if the pool is a functional pool with pegged stablecoins).

As you enter your target values for $crvUSD / $pyUSD here, you can see the expected bonus or loss you in purchasing the LP token. In the above screenshot, the user would lose .078% on their $1.13 deposit, as warned in the yellow text. You should be aware of this value, even if you do not mind a small loss.

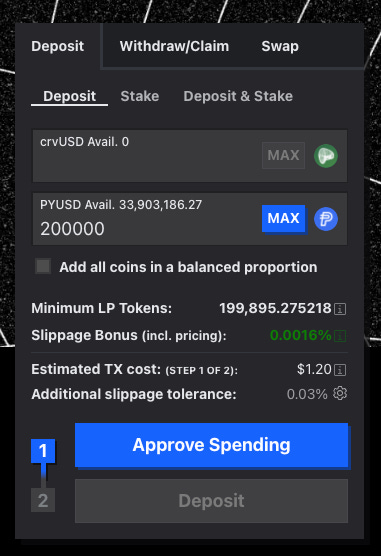

Since the pool is short on $pyUSD in the above screenshot of currency reserves, a user could simply add $pyUSD to receive a bonus.

Or if the user wishes to deposit both coins, they could check the “Add all coins in a balanced proportion” box to have no slippage at all.

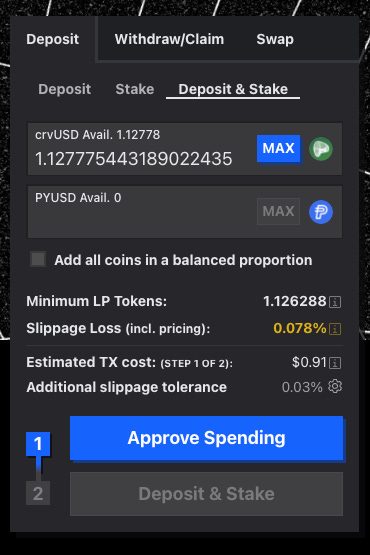

Finally, before you press any buttons, check whether you are are on the “Deposit” tab or the “Deposit & Stake” tab.

If you are planning to earn rewards on the Curve site itself, we recommend you first browse to the “Deposit & Stake” tab, where you can complete the entire process with just two transactions, one for approval and a second for depositing.

You may want to take these steps if you have previously locked veCRV. Many pools offer a “boost” to the rewards earned, only accessible to users who have locked veCRV. This is indicated by an arrow on the rewards display in the UI.

As of publication on the $pyUSD pool, the arrow is absent, and all users can achieve the max boost by staking directly into Curve. However, it is expected that $pyUSD will be utilizing the usual boost mechanic as early as this Thursday, at which point you would need veCRV to maximize your rewards.

However, locking $CRV as veCRV has its own complex mechanics. Instead of dealing with this hassle, many users prefer to rely on other protocols, like Convex or Stake DAO. Such protocols manage the complexities of this process on their behalf of users for a small fee.

If you are planning to use external sites make sure of the following:

Check if the target pool has already been added in the external protocol’s UI

Make sure to use the “Deposit” tab and not the “Deposit and Stake” tab on Curve.

Whichever option you choose, once you are ready, follow the two steps displayed in the UI by signing the transaction in your wallet. More details can be found in the Curve documentation, or the support channels in Telegram or Discord.

Use $pyUSD to Access DeFi

If you have $pyUSD and wish to use it to access other coins onchain, then you may be interested in selling your token for other tokens that offer yield farming or leverage opportunities. Again, this can be risky so make sure to understand the risks involved before doing this! It may also have tax considerations, so make sure to consult with your registered financial advisor!

For this example, we’ll presume you are interested in yield farming opportunities involving $crvUSD, a popular stablecoin with a bespoke peg history and many farming opportunities

Several different sites exist to sell tokens into other tokens. We cannot possibly write a tutorial for all of them, but the process is basically the same.

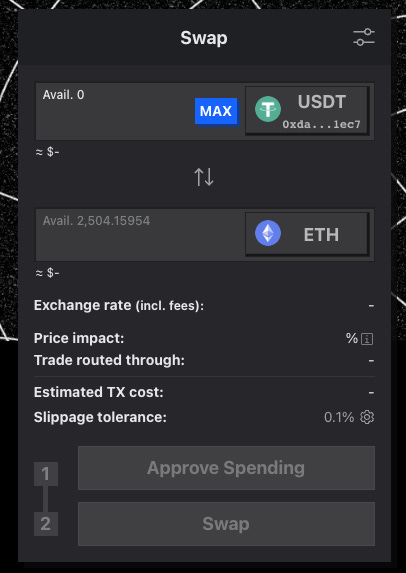

On Curve, a leading DEX, when you visit the homepage you’ll see a box allowing such transactions.

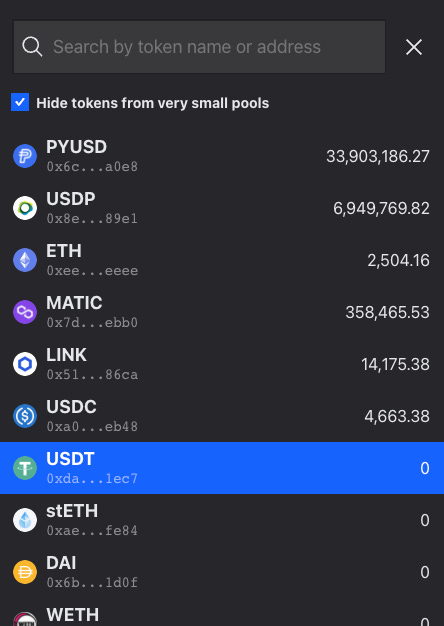

After connecting your wallet, you can click the first box (in the above screenshot, the box that says USDT), you can see a list of tokens you have in your wallet. Select $pyUSD.

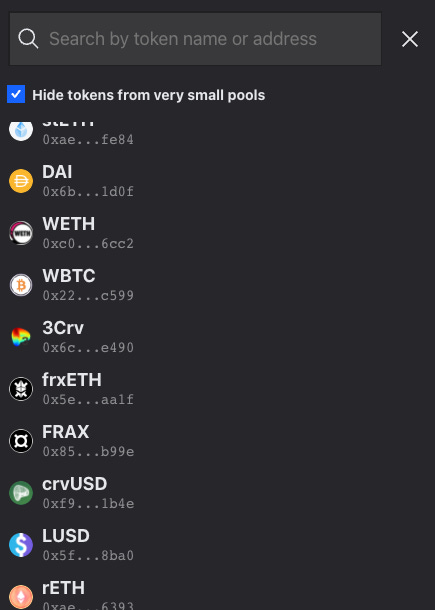

Select the amount you want to exchange, then use the second box to select among popular tokens. You can search by the token name, in this case “crvUSD”

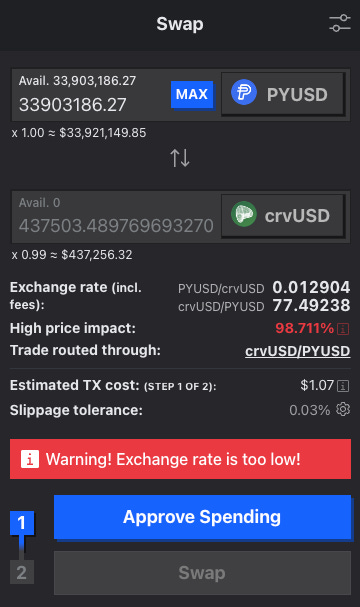

Before you confirm, check the rate. In this case, the routing cannot support $33MM worth of $pyUSD tokens, so the transaction would have a heavy loss of almost 99%

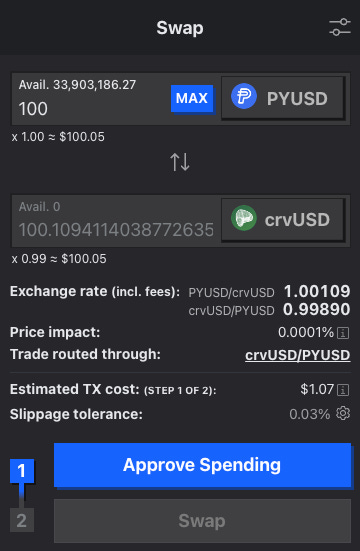

Selecting a more modest amount and price impact is lessened.

Once your order looks good, you can click the two buttons to approve and confirm your transaction. From there, you can access wherever you like in DeFi. For the $crvUSD example, you’d use the same guidelines for staking from above.

Although this example focused on using the native Curve router, we always suggest that users shop around for prices when trading tokens. We particularly recommend LlamaSwap, which functions as an aggregator of aggregators that is weighs prices among several aggregator, inclusive of gas fees.

Good luck!

Obtain $pyUSD

We suggest “obtaining” $pyUSD rather than simply “minting” it, because we have not been able to successfully mint $pyUSD ourselves. In conversations with other users, they also had difficulty minting and sending it onchain.

However, PayPal has seemingly been working with other centralized exchanges. One user who researched options for bridging $pyUSD onchain described Coinbase as “seamless.” So we’d suggest simply purchasing $pyUSD on the friendly CEX (or “Centralized EXchange”).

We’ve also observed some other integrations, so you may have luck with other CEXes. We imagine PayPal has business relationships with several major players in the US who are dipping their toes into crypto, so actors like Coinbase and others integrating $pyUSD may prove easier ramps. Though one person we asked said they tried and failed to mint $pyUSD on Paxos, which is the issuer of $pyUSD.

Users have similarly reported difficulty doing this directly from PayPal, though we imagine this is just some combo of growing pains and difficulties in navigating the obtuse US regulatory minefield.

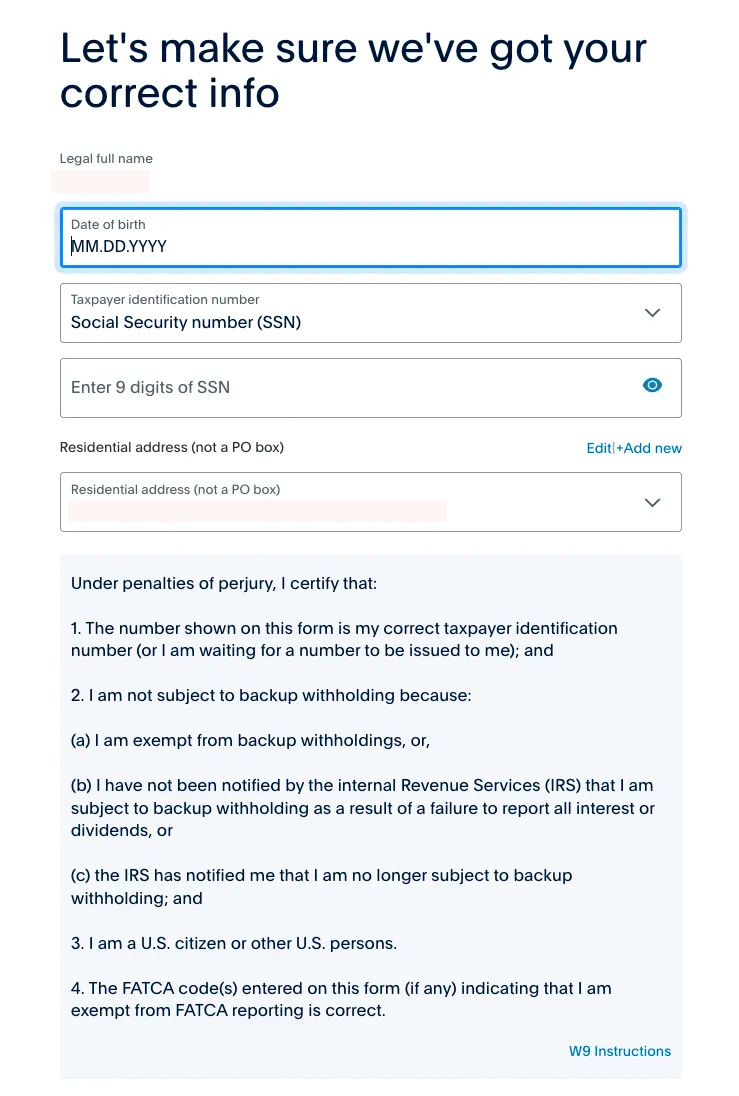

We attempted to walk through the process and put together some screenshots that are relevant, but since we didn’t previously have a PayPal account we expected that the setup process might take a few days.

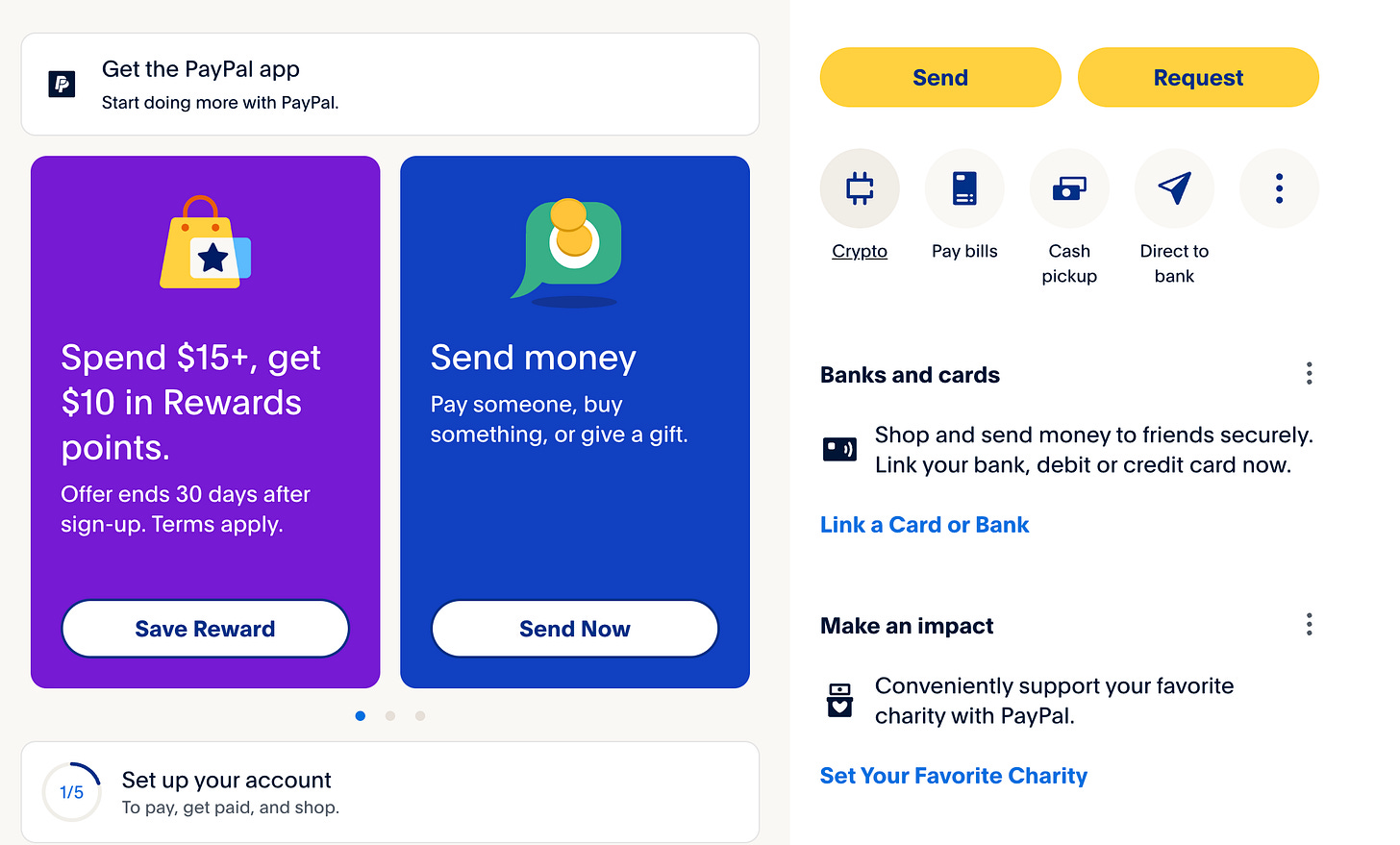

Still, whensoever their app supports it fully, it’s displayed fairly prominently in their UI and could be a friendly onramp.

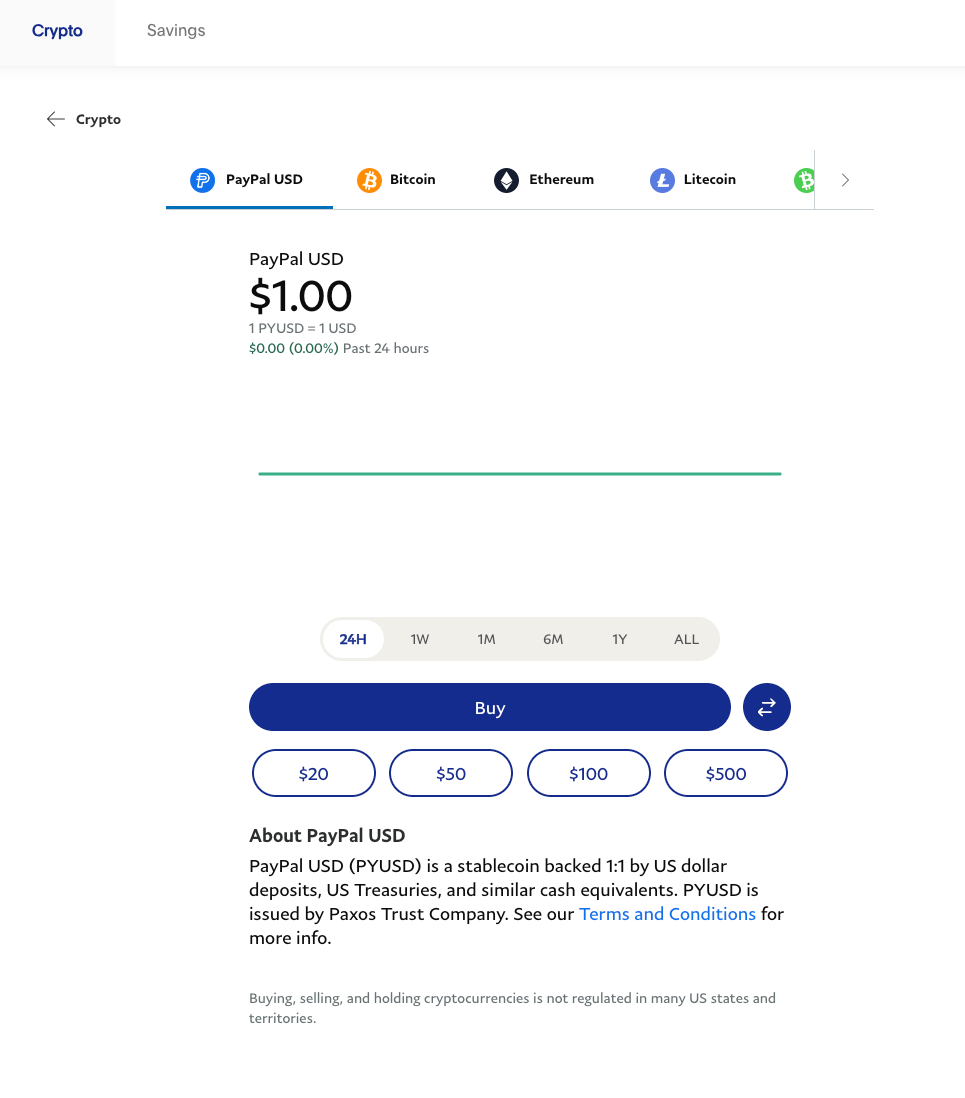

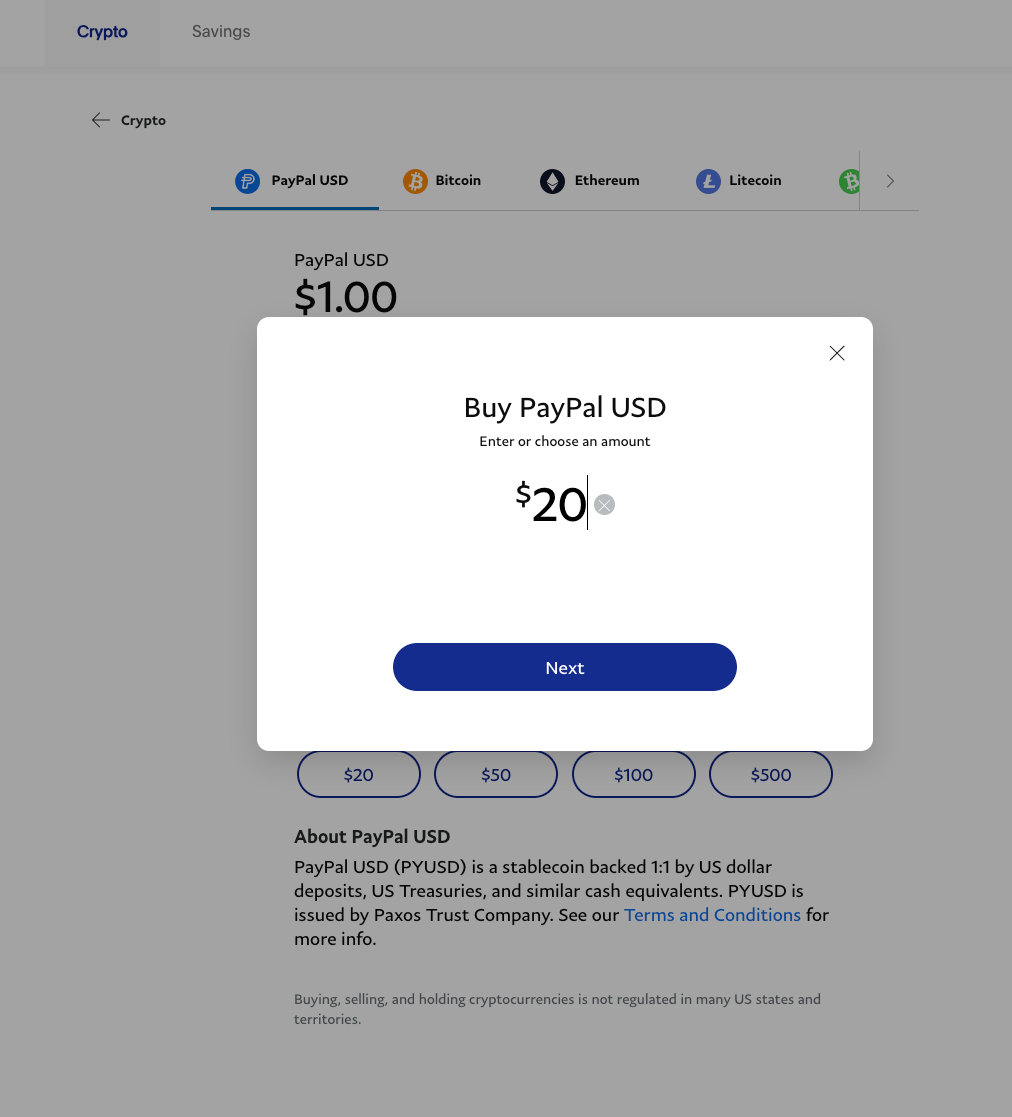

We started at their homepage:

Then we clicked the “Crypto” button right near the top.

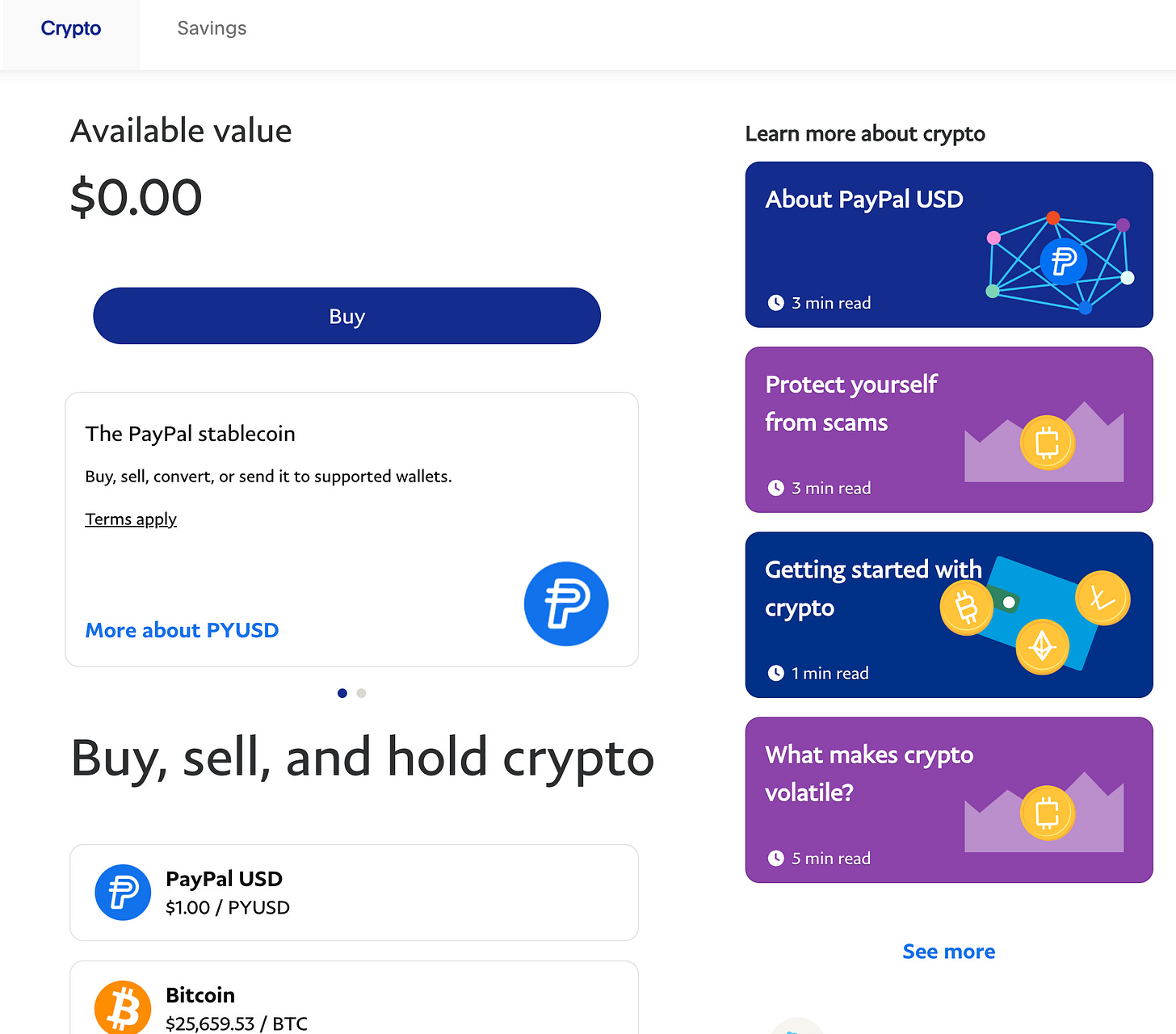

The first displayed token was PayPal USD:

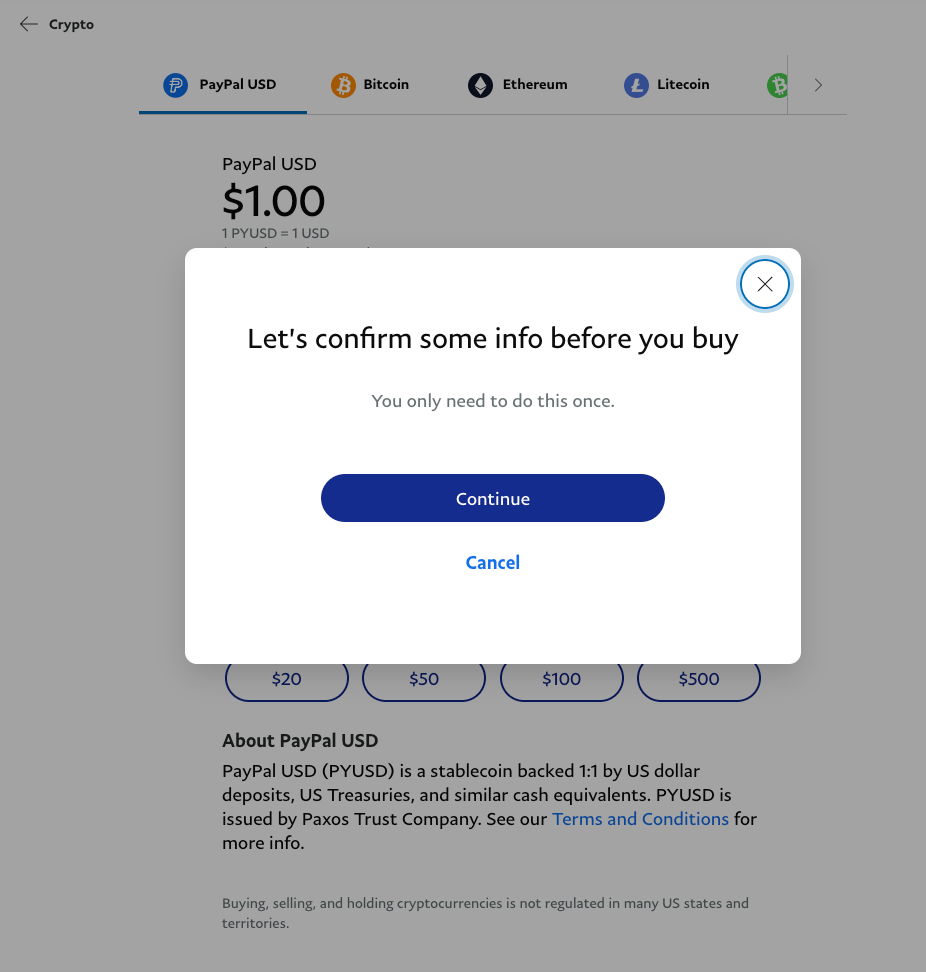

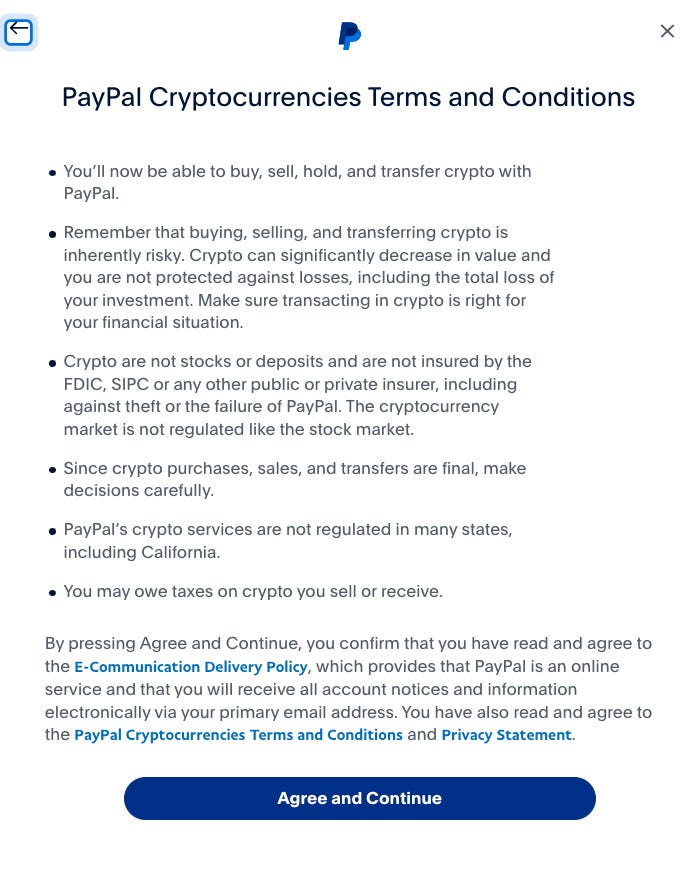

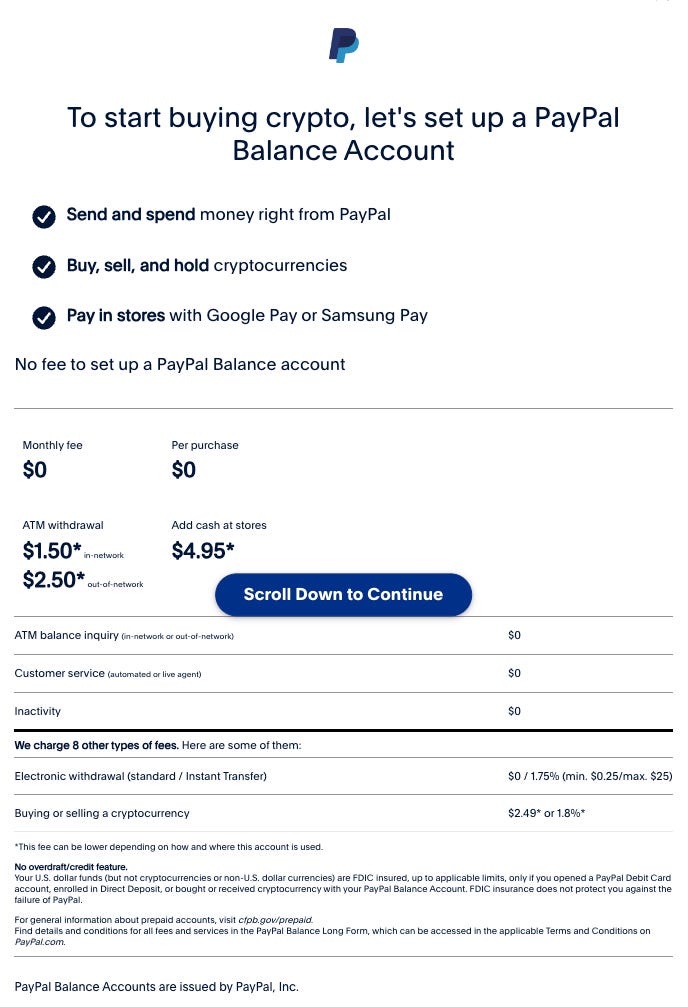

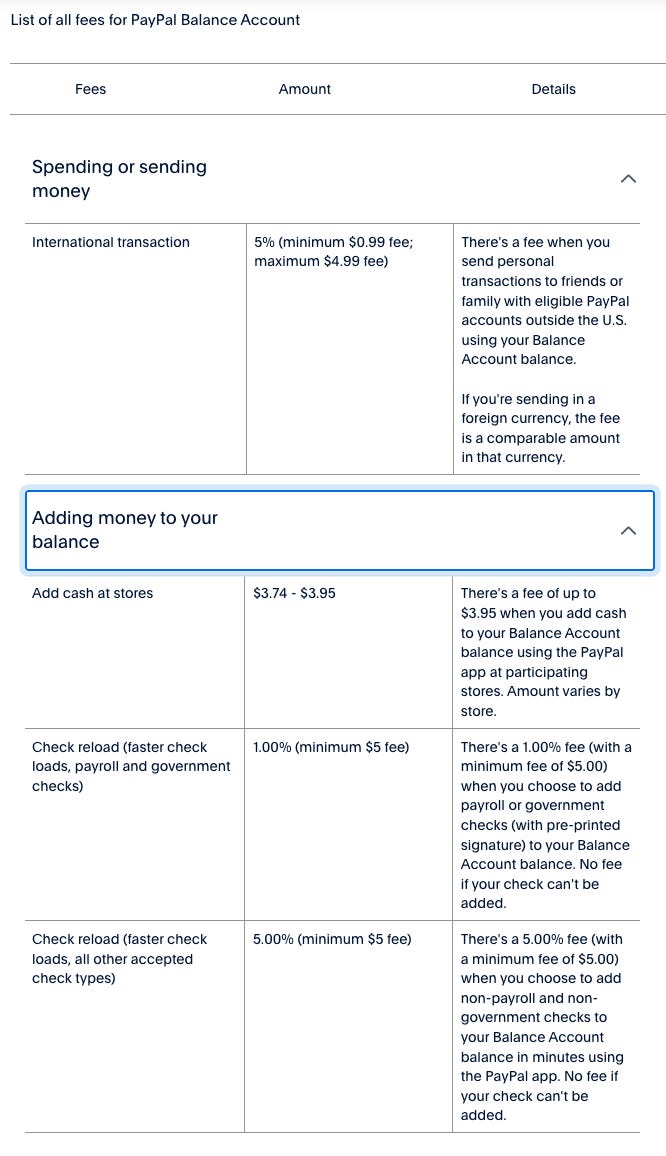

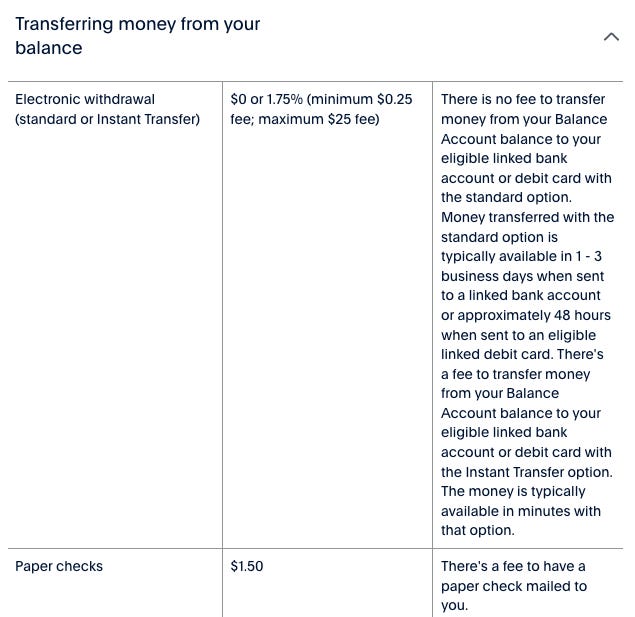

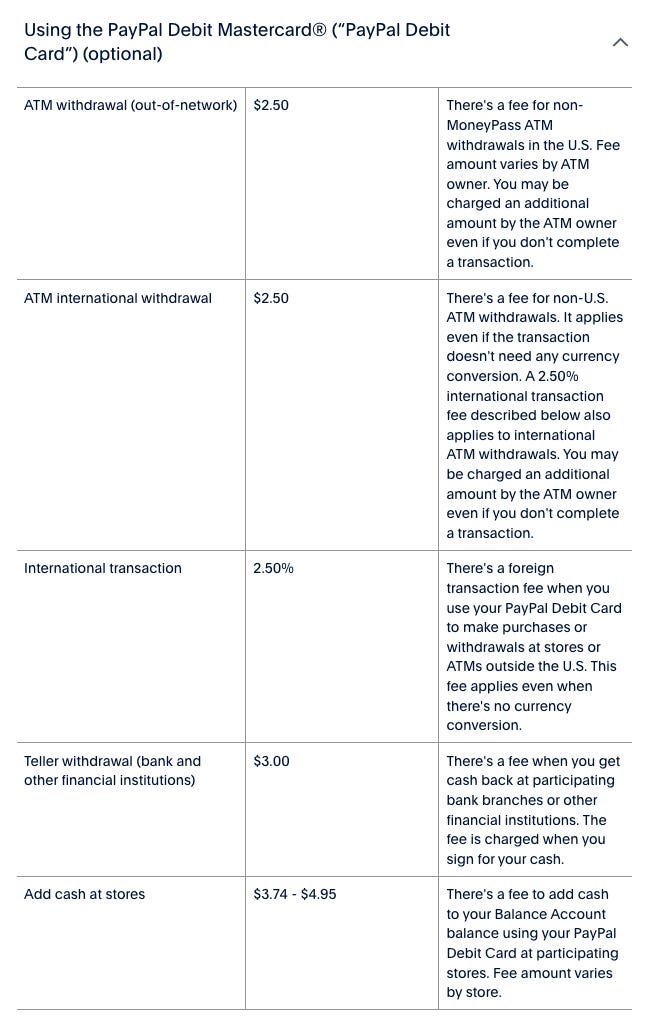

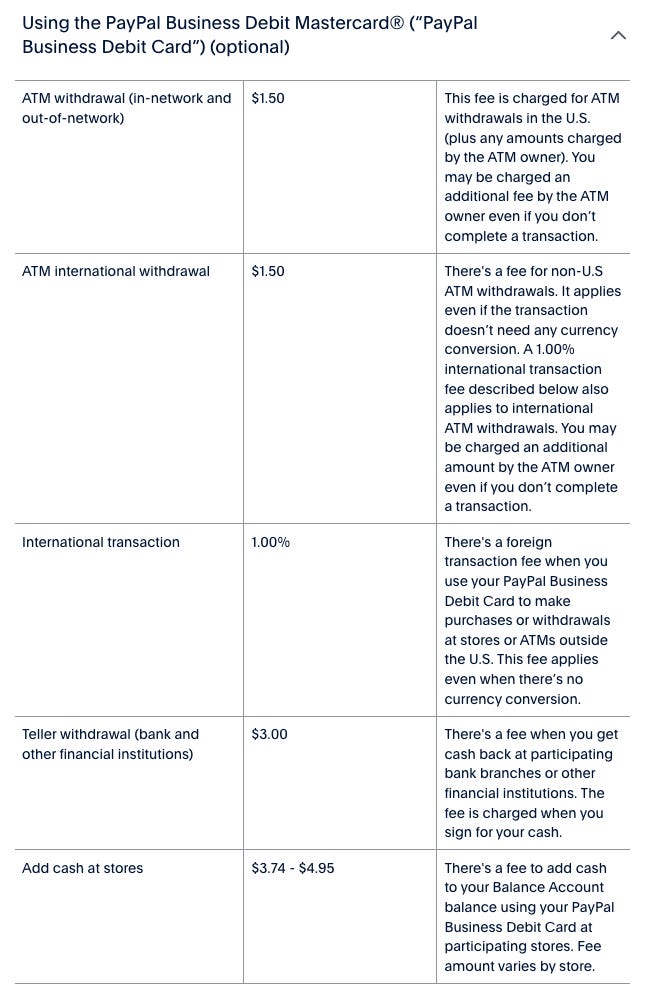

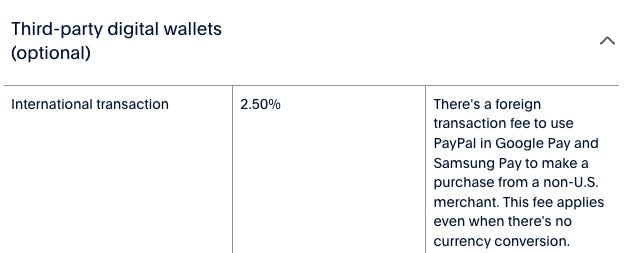

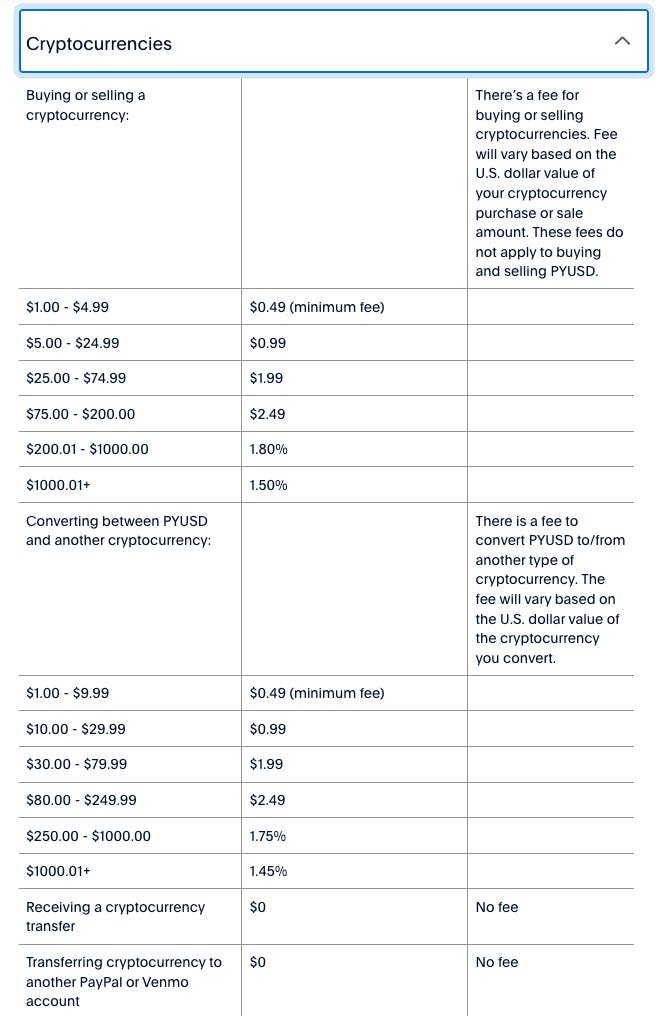

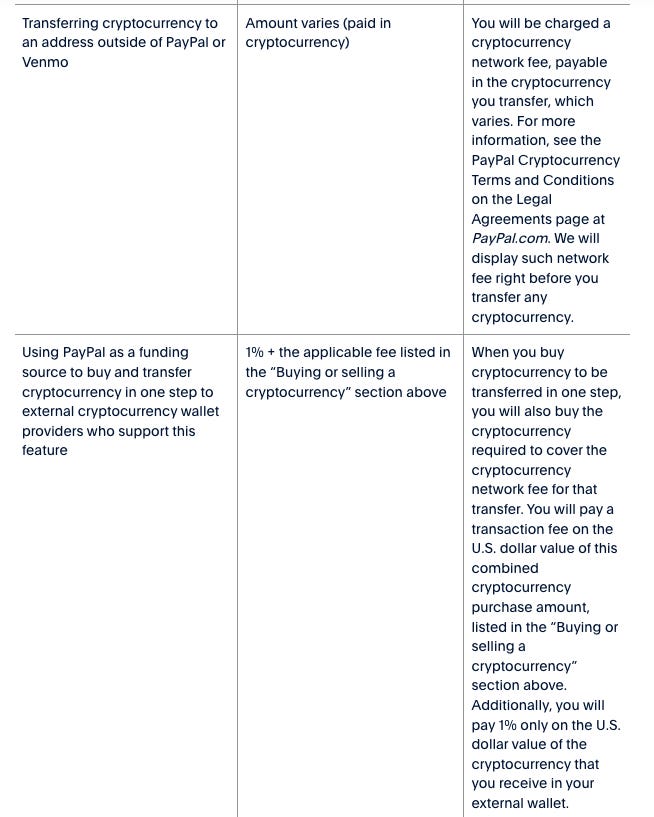

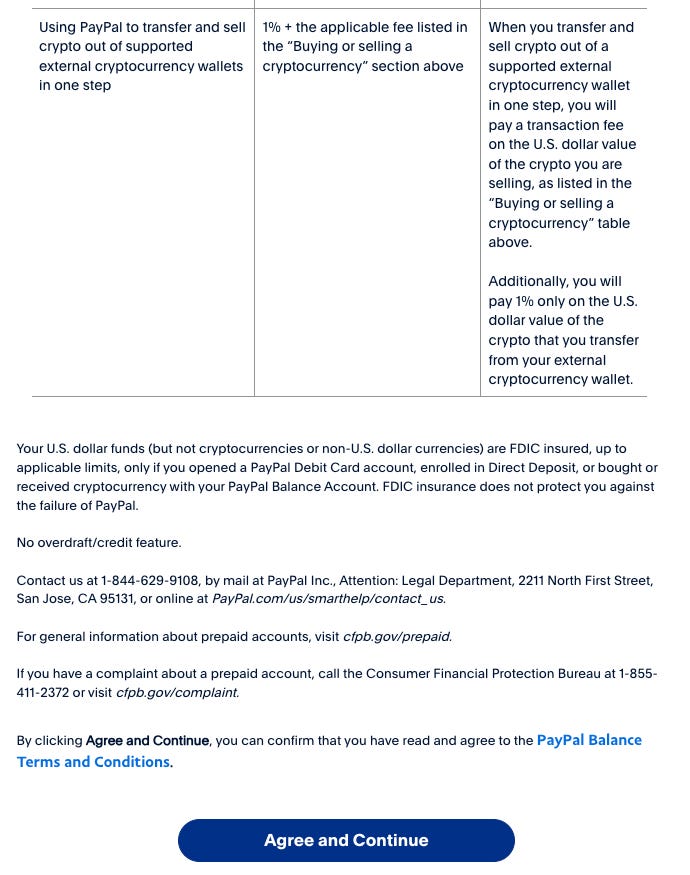

The terms and conditions for those interested:

As a fully doxxed person, I don’t even freak out when I hit the KYC page — it’s just part of daily life under the regime.

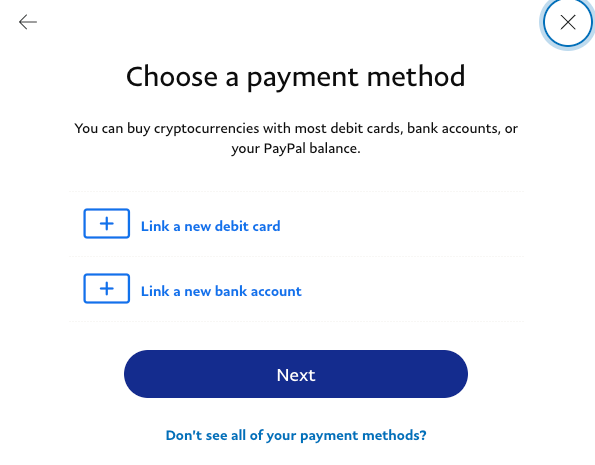

Wow, smooth sailing, is this actually going to work?

Holy smokes, it’s so easy?

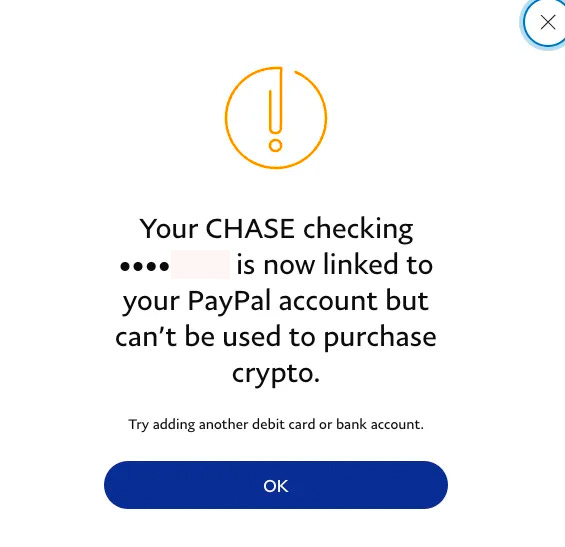

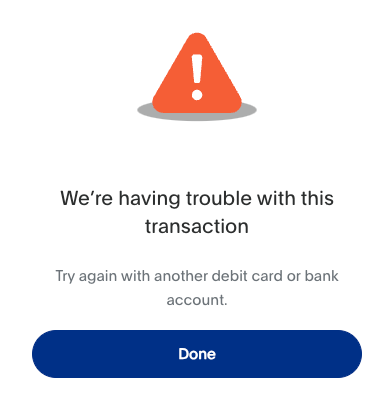

Ah, nuts… of course my one remaining CHASE account won’t work… (I’d closed all personal accounts previously due to horrendous savings rates and hostility toward crypto).

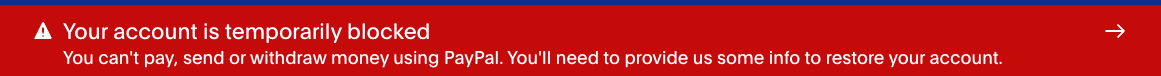

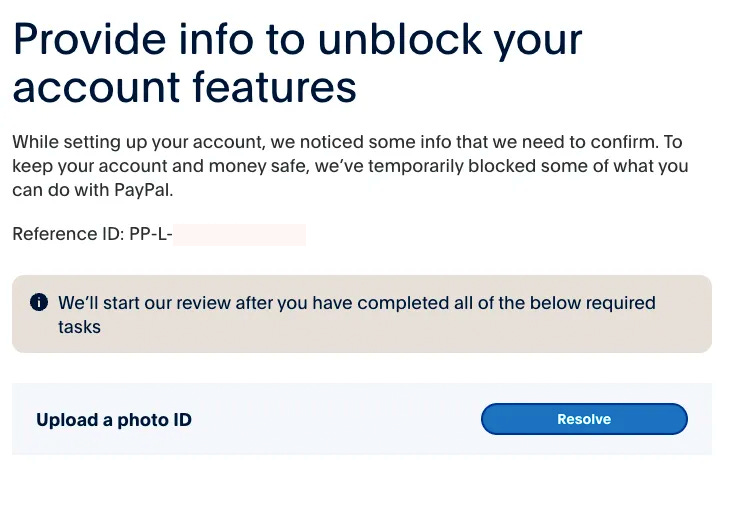

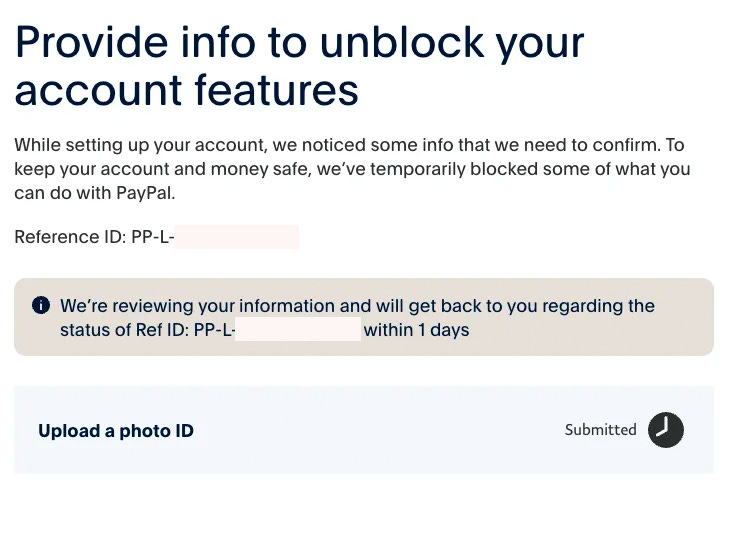

Looks like this action triggered their alarms. I tried simply using the bank to fund my PayPal account balance, but no dice…

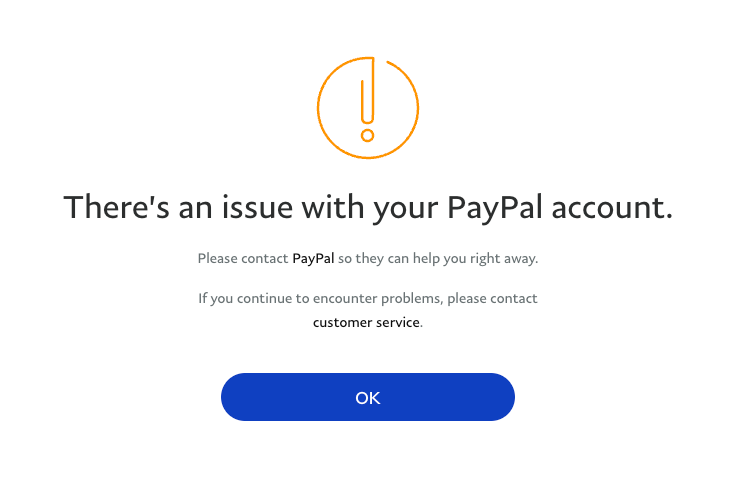

Oh well, looks like I’m headed to solitary.

Whensoever I get out on good behavior and figure out how to bridge our $pyUSD offchain, we’ll update this article with info on how to use PayPal to bridge onchain! For all else, try Coinbase.

Aside from the hurdles required by a bloated, inert and counterproductive KYC regime, it’s so easy to get started using $pyUSD!

Disclaimers! Despite TradFi hurdles, author is nonetheless exposed to $pyUSD through the ease and magic of DeFi composability