Join the live Llama Party at 9 AM PT — no guest of honor so expect a free-for-all.

Disclosure: Author has exposure to Curve pools containing assets referenced herein, including 3pool, MIM and bLUSD/LUSD3CRV. None of this is financial advice.

Tether GUD?

In one of the more unexpected narratives we’ve been tracking lately, it turns out the unexpected winner of SBF’s criminal fraud was… Curve trading volume?

The effect appears to be genuine — the great Blockworks research dashboard confirms this effect is due to an unexpected uptick in stablecoin trading volume:

For most of the past year v2 crypto pools (grey) had flippened stablecoin (blue) trading volume. Over the past month, the trend has steadily reversed course.

Moreover, it’s not just any stablecoin trading, but the effect is due to the trusty 3pool reasserting itself. Rumors of its obsolescence appear to be greatly exaggerated.

Just as this past May, the pool became massively imbalanced towards Tether when SBF’s criminal fraud came to light and FUD dropped. Whereas the pool rebalanced more gradually last time, the effect has been more sudden this time.

The namesake of the “Fiddy Indicator” also has been observing the situation. Unusually, a lot of this action is coming from a single address.

As of December, balance not only returned…

…but now Tether is in fact underrepresented.

Browsing through many of the transactions over the past few days, it appears a lot of the volume is going through 1inch, though we haven’t conducted a rigorous breakdown.

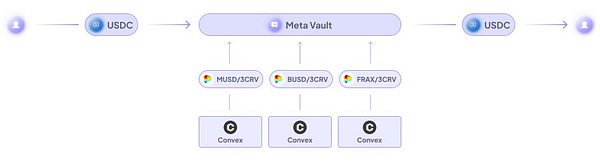

The 3pool continues to find ways to cling to relevance. Simply sticking around for a long time, a lot of interesting other services get built atop it. Most recently, check the new mStable Meta Vaults built off 3pool:

Pool Creator Fees

This is an interesting one… in the NFT space, there’s an incentive for people to create NFT liquidity pools because they can take trading fees for themselves. What about allowing Curve v2 pool creators to earn their own trading fees too?

Haowi kicked off the conversation.

It may require a few tweaks, otherwise users would toss up dummy pools for popular tokens. Fiddy suggested a pool manager responsible for ongoing maintenance of its parameters to optimize for profit.

Certainly an interesting idea, and a good incentive to get a longer tail of tokens onto the platform. Follow and join the discussion if you haven’t already.

Cockfighting

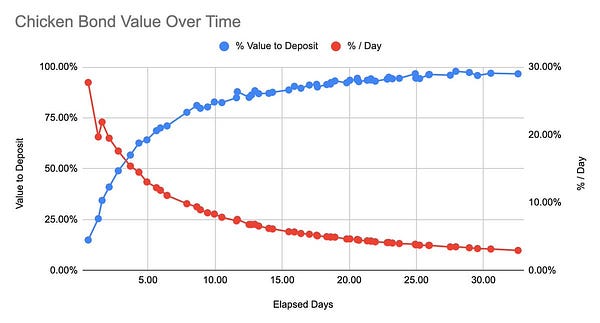

As we hunt for recessionary diversions, much of the crypto community has revived the ancient tradition of cockfighting. It’s been an absolute thrill to watch as Liquity’s Chicken Bonds turns into a gripping bloodsport.

Liquity is now seeking a governance vote for their Curve pool.

The pool was already streaming decent rewards in their native $LUSD, so passing the proposal could make the pool even more interesting.

Diligent Deer penned a thorough writeup of the mechanics for the great Crypto Risks Substack.

Though the report did not issue a recommendation on the particular gauge vote, it’s nonetheless critical reading before voters cast an informed ballot.

Lenders and Borrowers

Following the Avi/AAVE fight, we’re seeing things work themselves out over at AAVE.

Meanwhile, Abracadabra is weighing a proposal to launch a $CRV cauldron.

Omnipools

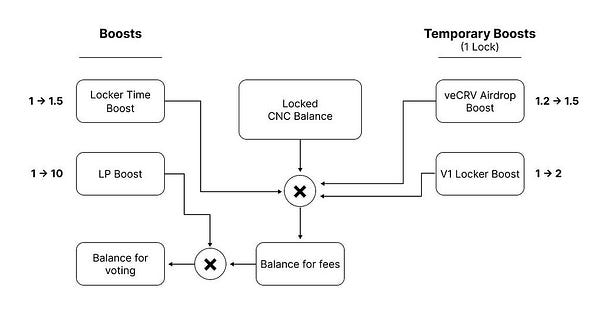

Conic Finance are preparing to launch their “omnipools.”

The team have an advent calendar’s worth of events planned for December.

Definitely pay attention if you want to help shape the protocol’s early omnipool strategy.

Silo

Silo Finance recently got a gauge for its XAI-FraxBP pool, and it’s starting off quite juicy.

This marks the fruition of Silo’s big plans from March of this year:

Yet there’s a more advanced way to play this one than aping right in (not financial advice)...