December 5, 2022: Splitting the Atom ⚛️⚡

Synthetix proposes Curve parameter changes for Atomic Swaps v2

Major proposals are facing Curve governance votes at the moment. Some are even proving surprisingly contentious.

Synthetix

We’ve already seen the potential of Synthetix atomic swaps. Their v1 version flexed their power this past summer as they dropped nine figure volumes on the reg.

Now they’re shipping the newest version.

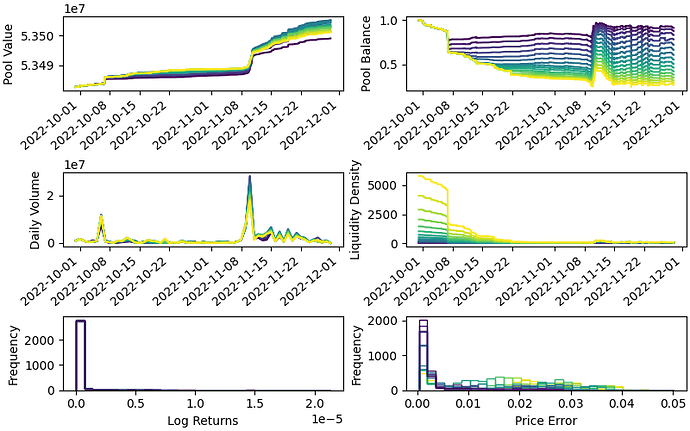

The rollout of Atomic Swaps v2 explains the recent uptick in Synthetix volume you may have noticed recently.

As they complete their rollout, they require some tweaks to their affiliated Curve pools, which serve as the cornerstone of Atomic Swaps infrastructure.

Specifically, they require lowering fees for their major routing between sUSD and sETH — fees which will make for a very competitive pool all around.

In reviewing this,

already ran the numbers and found these numbers are solid, provided the primary use case of the pool is for liquidity for Atomic Swaps.More detail is contained in the affiliated governance forum post. The proposal looks well on its way to passing.

This marks an exciting close to 2022 for the Synthetix team. The team is launching much more than just Atomic Swaps, they’re also releasing Perps v2 and Synthetix v3.

You might have missed all the action going on under the hood, but devs surely haven’t. The community has been building steadily throughout the bear.

Also, blink and you may have missed it… Synthetix is getting picked up by some CME price feeds, along with some other notable tokens.

This era in crypto feels like a great time. Only good things can come when VCs are dropping like flies, yet developer activity is maintaining apace. Not financial advice of course, but keep your eyes fixed firmly on Synthetix…

renBTC

The other big vote on Curve surprised everybody by being more contentious than expected

Curve has been working to sunset nearly every Bitcoin pool due to exposure to the expiring renBTC. In doing so, the team is releasing a new base pool consisting of just WBTC and sBTC (Synthetix BTC).

Despite the seemingly straightforward nature of the proposal, a major whale looked as though they might block the whole process from the get-go.

This whale owns more vlCVX than Curve itself, and initially tipped this to a no vote.

Since then, the community has rallied more attention to the cause.

At present the vote looks likely to pass.

Reminder that if you are in any of the Curve Bitcoin pools, you may want to take action to protect yourself during this transition period. Specifically:

Withdraw to renBTC and exit from Ethereum to Bitcoin.

Withdraw to WBTC or sBTC and redeposit into the new base pool.

Trade to other forms of BTC

Yield farming has been rather good lately for those who have the risk tolerance. The sunsetting of renBTC demonstrates why it cannot be considered a passive strategy. Conditions fluctuate all the time, and you should only be aping if you plan to follow the changing landscape frequently (#NFA).

Remember, you never want to be the last one in the pool…

Yes, the requirement to reduce commissions is relevant now not only for Synthetix.