In this thunderbera market, sitting in on-chain DeFi has been relatively cozy. Yes… price action may be down only, but as far as the major infrastructure is holding up, we’ve seen relatively few casualties in DeFi. Particularly compared with the carnage rippling throughout the centralized services LARP-ing as DeFi.

Sadly though, this weekend we saw the first major DeFi infrastructure crumble due to exposure to the FTX criminal fraud. Ren Protocol, whose team was funded by Alameda, revealed funding will expire at the end of 2022 and announced new plans.

For a bit more background on the parasitic takeover…

Fortunately the wrapped Bitcoin does not appear to be at risk. Nonetheless, the team is distancing themselves from Alameda with their plan to sunset Ren 1.0. This has some fairly major effects on the Bitcoin-Ethereum renBTC bridge of which every ape should be aware. Minting of new renBTC is being swiftly disabled, and withdraws (burns) will be disabled after a month.

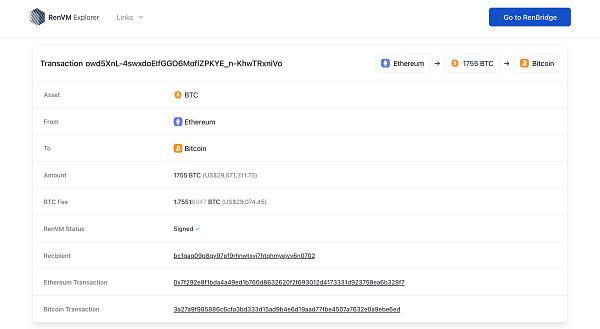

The burning of the Ren Bridge comes shortly after it was used as a getaway route for the FTX “hacker.” Whomever liquidated FTX funds to ETH spent the weekend converting this ETH to renBTC and burning it back to Bitcoin.

The destruction of the Ren Protocol v1.0 bridge had always been part of the long term roadmap, the recent events have simply hastened the timeline. The team has lofty ambitions for Ren v2.0. However, the new version is not yet ready, so users may face a delay before Ren Protocol ramps back up.

The entire situation presents an issue for every destination where renBTC is accepted on Ethereum, which is most heavily Curve. Every Curve Bitcoin v1 pool (with the exception of HBTC) has exposure to renBTC.

Although there is a slight ambiguity in the language through which some people believe the renBTC address will be reused on launch, most observers believe this is unlikely and probably impossible. Curve has confirmed to us the team is indeed working on replacement solutions.

Given there may be some period between when renBTC sunsets and the new bridge is launched, you may wish to exit to another form of wrapped Bitcoin if you don’t want to be stuck holding renBTC for this interval. Not financial advice, of course.

For at least the moment the imbalance has yet to occur. The Curve sBTC pool, which is the largest pool containing renBTC, is not showing any sudden movement in the direction of an imbalance towards renBTC.

Perhaps the effects of the FTX “hacker” draining renBTC is presently outweighing any other impact on renBTC? Or maybe users are just sticking around to enjoy the hefty trading fees?

As we mentioned at the outset, Curve really has proven quite cozy during recent market activity. Curve Bitcoin pools in particular have benefitted greatly during this period of turbulence. Nonetheless, be aware of the risks if you remain in these pools… these are dangerous waters!

When we say Curve pools have proven cozy, we’re specifically referring to the ability to store your existing tokens and earn additional tokens. Nearly all of these tokens have plummeted in price. However, if your money was sitting in TradFi, you might have lost the actual tokens themselves. One of these outcomes is clearly preferable.

If your belief is that tokens may go up in price over a long term time horizon, you may be more interested in avoiding losing your balance of tokens and accumulating more where possible, with less concern about short term price fluctuations.

Again, not financial advice. Just something to keep in mind as we prepare for another “big week ahead.”

Disclaimers! Author previously had exposure to $renBTC through the sBTC pool, but unwrapped the balance to $WBTC.