Feb. 14, 2022: Cross-Chain Boosties 🌹💝

In lovely llama Valentine's gift, the flywheel expands everywhere

What’s everybody lookin’ at?

Even if you’re not a coder, it’s always worth trying to read through the published source code of any contract, just to better inform yourself. In this case, the green comment text gives you all the context you need.

This contract, proudly rocking Vyper 3.1, contains a function that can “push veCRV data to a child chain.” In other words, the coveted “Cross Chain Boosties” are imminent.

I have a bad habit of thinking of L2 sidechains as slums. Lots of poor people, fewer services, trouble with crime. It’s no wonder rich people are initially reluctant to visit. All these sidechains are great in terms of speed and low fees, but entrepreneurs and builders have typically been drawn to where there’s the most money, and that’s been traditionally been Ethereum L1.

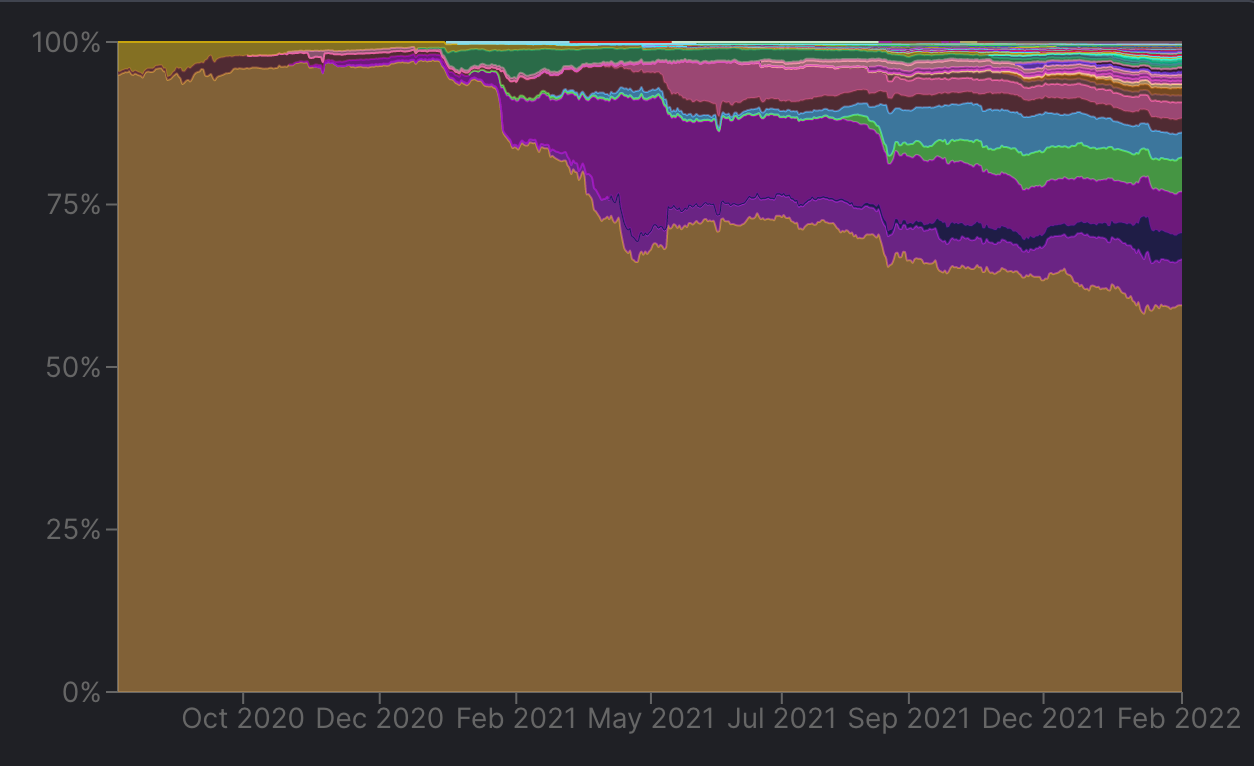

Yet the landscape is changing fast. Cross-chain DeFi has been expanding to the point where Ethereum dominance could drop below 50% this year. If you want reasons to be bool-ish, imagine life where each of these smaller colors bands scales to the size of where ETH is today… and imagine how big ETH becomes in the rollups.

How much of this is the effect of Curve classing up the sidechain ghettoes? Wherever Curve plants its flag, it provides DeFi a strong backbone and a meaningful ecosystem evolves. Does Curve’s presence actually cause DeFi to start taking off on all these sidechains? Or is Curve just really good at guessing where the puck is going?

Whether correlative or causal, the presence of Curve’s high efficiency algorithms is a great for L2s. Curve notably launched a v2 pool in the vein of TriCrypto almost everywhere. TriCrypto provides for reliable, decentralized access for individual traders to convert among the most important crypto assets even in the most vicious market dumps.

Meanwhile competitive products tend to become useless during high volatility periods, or for that matter, even when running expensive advertising campaigns.

As Curve starts deploying v2 factories cross-chain, Curve is poised to become the de facto hub of DeFi activity everywhere. Gentrifiers soon need mostly fear crossing the hazardous bridges between chains, unless Curve figures out a way to solve this problem too.

Even despite Curve services being offered everywhere, the incentives to cultivate liquidity were missing one key piece of the Curve drama: all these chains were far removed from the front line of the vaunted Curve Wars.

For those not familiar with Curve ponzinomics, a key utility of $CRV is the capability of locking for veCRV, which allows you to boost your rewards on various pools. On sidechains you could earn rewards, but not boost them. All the veCRV was siloed onto Ethereum.

Thanks to this groundbreaking announcement, the boosts are flowing everywhere!

The Curve-Convex-Votium flywheel already had the power to dictate success or failure on L1. Now they’ll expand their power onto every chain. The honor of the first cross-chain boosted pool will go to $FRAX / $2CRV on Fantom if the vote passes.

The announcement notably affects Convex, which holds about half the veCRV supply. Convex should see its power extend far further in a multichain boostie world. As the battlefield grows, the brinksmanship and strategy surrounding the Curve Wars becomes much more complex.

Already we’ve seen Geist Finance make a large Convex purchase directly due to this announcement.

“Curve is beginning to support veCRV boosts on Fantom meaning Convex will likely launch there in the coming weeks. As a result, we are happy to announce we have purchased $1.5m in CVX for the Geist treasury.”

It’s likely to be an interesting few weeks for the Curve Wars! (not entertainment advice)

For the speculatoooors, my experience is that flywheel tokens tend to drop in price whenever they generate historic achievements. This stupidity of crypto markets is one of many reasons I’m not a trader and therefore a bad source of financial advice. Others have a more bullish target than me:

I’m plenty content just situating myself near the front lines and hoping to take incoming shrapnel, seeing as the Curve Wars are mostly fought using money cannons.

Disclaimers! Not financial advice!