The wildest day in DeFi since last May sees 6.4% of TVL evaporate in the span of 24 hours. Even now, the $MIM and $UST remain plugged in to life support, and may still collapse at any minute.

The upshot for flywheelers is that the stablecoin FUD added up to a record shattering day for Curve.

Curve witnessed about $4.20B in daily volume amidst the chaos. This obliterates the previous record, which sat somewhere around a third of the way to $6.9B (all numbers converted to meme values for degen convenience).

The difference between Curve’s stableswap invariant and other elementary formulae was on full display, as the various Curve pools were about the only place the pegs mostly held.

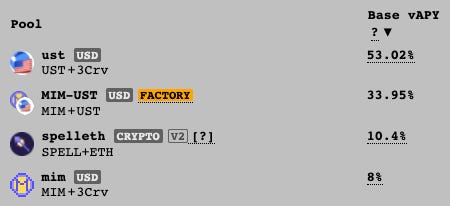

A snapshot of Curve’s base vAPYs taken at the peak of the FUD captures the wildness of the 24 hours. For reference, Curve base vAPYs seldom tick above 1%.

Nobody ever said the Curve Wars wouldn’t be bloody!

Abracadabra

For those of you who don’t understand the magical Abracadabra ecosystem… I can’t help you. The fast moving ecosystem always moved faster than I could keep up with. Curve keeps my brain full.

What I’ve pieced together is that Wonderland ($TIME), the piece of the ecosystem most exposed to Sifu, is essentially rekt, currently debating whether to pull the plug.

The other pieces of the ecosystem, $MIM and $SPELL, got hammered due to their proximity to Daniele, whose reputation has also taken a severe beating. Evanesco!

My understanding is that the architecture of these two projects are arguably more resilient than a mere personality cult and may survive, though they remain under fierce assault.

Then again, this was the last Tetra sighting in about a day, and whales are only known to be able to hold their breath for an hour.

Panicked traders sold off $MIM wherever they could find liquidity. The Curve pool, which started with billions worth of liquidity, is the only place $MIM remains mostly on-peg. Incredibly, despite a stunning 94%-6% imbalance, the stableswap invariant is holding at about 1 to 1.015.

Alameda Capital for their part withdrew nearly half a billion in the pool, and reportedly lost $90MM in the chaos.

Interestingly, it seems Alameda fled $MIM for $UST, which also came under the gun.

Alameda has always been accused of parasitism around the flywheel ecosystem. During $CVX’s brief early inflation window, Alameda farmed and dumped at industrial scale. This netted them quick cash, and provided early Convex bulls opportunity to buy in as low as a couple of bucks. Once they moved on, protocols with more interest in the governance aspects of the token started acquiring. Notably we see Alameda’s footprint around Curve is also much reduced after these shenanigans.

Speaking of Convex, our favorite flywheel token also got caught in the crossfire. This dip appears to be explained by one address who’d been dumping for weeks, along with some FUD around Wonderland’s CVX position.

Or possibly the Bankless effect.

Still, demand for $CVX persists.

The crazy $MIM run only served to strengthen Curve’s magical day.

The techies in the audience may be interested in examining the effects in realtime via Fiddy’s Jupyter Notebook to simulate the effects of a depeg.

At the moment the $MIM peg remains under threat but hasn’t yet collapsed. $SPELL is also bleeding out, having lost about half its already depressed value overnight.

Where does this all leave Abracadabra? Having gotten hit with the blunt end of the tsunami, some users are starting to point out the logical inconsistencies that were there all along.

Fortunately for Dani, friendly internet trolls are praying not for his death, but actually for his resurrection.

The whole thing is worthy of a web3 Shakespearean tragedy: a tale illustrating the perils of allowing a fleeting bromance to overcome your better judgement.

TERRA/LUNA

Once $MIM took a pounding, the Luna ecosystem is next in line.

The aforementioned Alameda liferaft out of $MIM would wash up on Korea’s majestic 해변.

For those interested in learning more about why $MIM’s struggles would hit the Luna ecosystem, take a read through these threads.

The Terra $UST coin has always been among the quickest to threaten to lose its peg. Although they earlier pitched their stablecoin as being held up through some incomprehensible Rube Goldberg-like smart contracts, in practice it appears to be closer to dark magic.

I personally steer clear of the dodgy ecosystem, but it’s worth noting they’ve had multiple depeg risks in the past and always found some way to avoid doom.

Other than Curve, one beneficiary of the $MIM $UST issues looks to be $FRAX, which saw its $FXS jump up in the fracas.

Regulatooors

A crazy conspiracy theory suggests this was all an elaborate fed plot. 🤔

Now, it did happen to castrate some of the more decentralized stablecoins, while at the same time making DeFi look horrible, at coincidentally the exact same time multiple parties in Washington DC stepped up their assault on cryptocurrency. Yet I have a tough time making the leap that Sesta’s horrible judgement was somehow part of an elaborate covert op.

At any rate, yesterday’s hurricane did happen to roar amidst yet more shenanigans from DC. While DeFi was busy nuking itself into oblivion, regulators prepared to salt the earth across the blast radius.

A bill in Congress was introduced by Jim “NGMI” Hines which, if passed, would effectively destroy any hope for the United States to enjoy a prosperous future.

Within minutes his score at PAC DAO plummeted to land him in the bottom 3, presently ahead of only Brad Sherman (being challenged by rock star Aarika Rhodes) and Sherrod Brown (not up for election). Wouldn’t it be a shame if a primary challenger in Connecticut’s 4th district (Greenwich/Bridgeport/Danbury) emerged and raised earth-shattering numbers from the crypto community!

At the same time, wee lil’ Gary Gensler decided his ego superseded the first amendment, and leaked plans to declare his authority over previously legal speech pending a 30 day comment window.

We’re in discussions to organize a write-in campaign, get ready to fight!