Just a Cross-Chain Boosties appears, Curve also drops onto its latest chain, Moonbeam.

We asked yesterday if Curve was creating DeFi on these various sidechains, or just very lucky at deploying onto chains that happen to become winners. We’ll have to keep an eye on Moonbeam for more evidence. Moonbeam was not previously on my radar, or seemingly other people’s radar as well. In fact, on DefiLlama’s list of 81 chains, Moonbeam ranks unranked.

Yet the chain has over 250K followers on Twitter. So my first question is whether they were actually quite popular, or just very adept at buying Twitter followers. Digging into it, the former appears to be true. Moonbeam looks to be the real deal, but I’d simply ignored it in my infinite ignorance. In fact, it’s notably the first EVM-compatible smart contract parachain built on Polkadot.

For the better part of a year, Polkadot ($DOT) has been hovering around the top ten market cap amidst Bitcoin, Ethereum, popular stablecoins, sidechains with usage, doggie coins, and $XRP + $ADA sticking around for the lulz. Polkadot’s position made some sense given the project’s pedigree and their ambitious vision of building the cross-chain dream through their ambitious parachain architecture.

Yet this infrastructure was technically very complex, so very little meaningful adoption had occurred. Users demonstrated they’d prefer to lose all their funds on makeshift bridges than learn Polkadot and build on it. The entire Polkadot project was at risk of being pure Hopium.

Moonbeam represents the most significant step I’ve yet seen in realizing Polkadot’s vision. Moonbeam is the first fully operational parachain on Polkadot with a complete Ethereum-compatible smart contract platform. Whenever developers can just re-use their existing smart contracts, cross-chain deployment becomes a snap. The Ethereum EVM has become the standard, gaining network effects as more new chains include EVM compatibility to bootstrap their app ecosystem.

In fact, it’s a noteworthy achievement when chains like Solana gain meaningful adoption at all despite programmers needing learn a new language like Rust. Polkadot’s substrate had somewhat struggled with this problem for much of the last year. The launch of Moonbeam may solve this problem completely.

Possibly looking to woo Curve developers, Moonbeam's homepage specifically called out the ease of using Vyper. With Curve’s smooth deployment, it appears this compatibility worked like a charm.

Curve appears to be the first major DeFi project to launch on Moonbeam, but we doubt it’s the last.

Moonbeam launched on Polkadot just over a month ago, putting it firmly in generation alpha. At the time of launch, Moonbeam received a crowdloan of roughly $1 billion worth of $DOT from over 200,000 supporters. 30% of this was distributed to the community in the form of Moonbeam’s native $GLMR token. Outside of attracting developers, common problems when bootstrapping a new chain include attracting a meaningful number of end users and sufficient liquidity. It appears as if Moonbeam has already solved for both.

Moonbeam also has all the other tools familiar to developers, including support for Metamask, the Graph, Etherscan, Debank, Chainlink, and a fork of Gnosis Safe. Reading through the developer documentation, they put strong emphasis on making life easy for Ethereum developers. For example, instead of using Polkadot’s substrate based addresses, they did the legwork to create a unified account structure compatible with Ethereum’s familiar 0x style addresses

Due to the cross-chain nature of the Substrate, these unified accounts have more nuance and properties than basic Ethereum accounts. Moonbeam accounts have to deal with concepts like “locked” and “reserved” balances that represent balances owned by an account but not yet spendable if users want to code using the Moonbeam base asset of $GLMR. It’s the sort of interesting technical details that serve to smoothly familiarize developers with the possibilities of Substrate programming.

In the past Curve had tiptoed into the Polkadot ecosystem, most notably with the rETH pool and some noise about launching on Kusama. The launch of an official Curve site on Moonbeam is the most serious foray yet into the Polkadot ecosystem. At the moment Curve has launched a version of 3pool with about a million in volume. If we see Cross-Chain Boosties and a v2 Factory get launched we may well see DeFi get kickstarted across Moonbeam.

v2 Factory Update

Speaking of the v2 Factory, it’s a good time to check in on some of the progress. We’d predicted the v2 Factory would lead to the launch of a ton of new pools, and it hasn’t disappointed on this front. New pools are being added on a near daily basis, to the point where the factory pools have already overwhelmed official Curve launches.

As great as these pools may become, new users should be aware of the process for how a pool navigates its way from the launch of a factory pool to becoming a powerhouse. Specifically, you should not just ape blindly into every new pool just because you see ridiculous numbers published for reward yields. All these new pools have a few stages to go through before they get up and running.

Yet a pool just blindly launched through the factory is essentially useless. Anybody can use the factory to trivially launch a wrapped DOGE-SHIBA pool within a few minutes, that’s easy. First question though, were the parameters set in a meaningful way? If not, the pool may fail before it gets far. Second, does it have liquidity? If there’s no money in there, you wouldn’t want to dive headfirst into an empty pool.

Once a pool has a few million worth of liquidity, it starts to come alive, allowing for basic functionality for trading between assets, or for smaller LPs to make deposits without wildly rebalancing the pool. Only after a pool has sufficient liquidity to be useful, then it becomes a good time to look at gauges.

A pool with sufficient liquidity needs to go in front of the DAO and receive a vote for a rewards gauge. The process lasts about a week, so there’s a bit of a lag between when a pool launches and when it starts to have impact. As you can see on the governance forums, several pools are aggressively pushing their way through the process at the moment.

Previously this had been a rubber stamp, but thanks to the Crypto Risk Assessments team, there’s more scrutiny being applied before pools just become eligible for free $CRV handouts. Voters should be judicious before approving these pools.

Once they’ve received their gauge, initially you’ll see sky-high numbers displayed on the Curve site, but beware that this is mostly just fun with basic math. When pools are small and a lot of liquidity gets added suddenly, the tiny denominator makes it look like amazing returns. Going from $0 to $1 is an infinite return in terms of percentages, but the practical upside is still well under a dollar. In practice, enormous yields dilute quickly and return to earth as the pool fills up.

Once the pool has earned its gauge, the final question you should consider is if the protocol is actually going to be a meaningful participant in the Curve Wars. If protocols need to compete for liquidity, they’ll be playing the Convex/Votium games in order to push incentives up and attract liquidity to their pool. We see this playing out with several new v2 pools, where rewards tAPR is holding in the double digits.

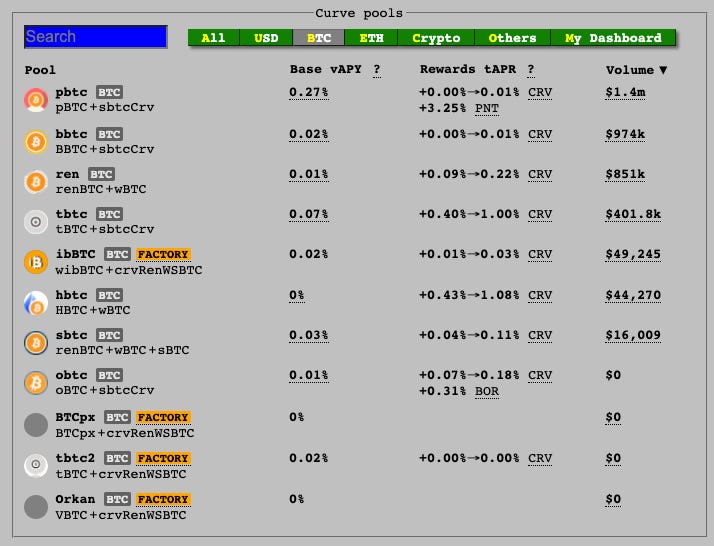

Meanwhile, nobody is competing for wrapped Bitcoin on Ethereum. Thus we see the state of Bitcoin DeFi on Ethereum is almost as sorry as the state of Bitcoin DeFi anywhere else.

It’s also worth reiterating that v2 pools are subject to impermanent loss, unlike v1 pools in most cases. Therefore you might also consider if you’re ok with a surplus of the asset that loses ground in price. I like the v2 flywheel pools for this reason… if, say, $CVX loses ground relative to $ETH, I wouldn’t terribly mind having a larger amount of the scarce income producing asset (possibly with sufficient rewards emissions to paper over the difference).

Nobody can predict the future, but a better understanding of how a v2 pool goes from concept to reality may help you make better informed decisions.