Feb. 17, 2022: Curve Governance Endorsements 🗳️✅

Vote Early, Vote Often

A ton of interesting governance proposals hitting Curve as the v2 ecosystem expands. Here’s some conversation starters and ill-informed endorsements to help you fill out your ballots (not election advice).

A Parameter

3 of the 9 open votes are parameter votes to change the A parameter.

Adjusting the 3pool is the most notable change, as this is one of Curve’s most epic achievements. The 3pool currently has over 4 billion worth of dollarcoins, and can handle extreme transaction size without much depeg risk. The proposal is to push the value of A even higher.

For those who are unfamiliar with the A parameter, a higher value of A turns the pool from the Uniswap style invariant (where a large order is likely to cause slippage) to more of a straight line (where price stays more constant. The 3pool assets are all considered relatively stable so it can handle a line that is basically straight (no price movement) except under extreme circumstances.

For reference, here are the current A values of the main v1 pools, along with the few lines of Brownie you need to replicate this for yourself:

On the proposals to adjust the A parameter, I’m an idiot so I don’t know any better, but my gut says go with it. The downside appears to be mostly around regaining a peg if the pool becomes depegged. This is a hypothetical, which I would expect could also be addressed by lowering the A value in such trying times.

As my fictitious fourth grade teacher said, “Take chances, make mistakes, get messy!” I’m therefore in favor of fiddling with all the pegs just so we can get more data points. But again, I’m an idiot, so you should cast a more informed vote, and weigh in on the governance forum or in the comments below if you have other thoughts.

Gauge Votes

The other 6 governance proposals are all for new gauges and all of them are worthy of consideration.

FRAX-2POOL (FTM)

A couple days ago we noted the FRAX-2POOL received the honor of being the first boosted pool on Fantom. This pool has already passed quorum, but it’s a good time to open debate on larger considerations around FRAX.

$FRAX has excelled at navigating the Curve Wars to the point it has farmed millions of $CRV the past few months alone. However, $FRAX has never been whitelisted, so it has nothing to do with the $CRV it accumulates but to dump $CRV and accumulate $CVX.

The prior discussion being referenced was over one year ago on the forums. The primary argument against the idea came from Convex:

Should the matter come back up, the debate would surely look different from a year ago. Much has changed from this time, to the point $FRAX has grown into a major empire, even partnering directly with Convex.

For more detail on the $FRAX empire, you should reference this great series by the DeFi Education Substack (not affiliated with DeFi Education Fund to my knowledge).

It would be really interesting to hear if $FRAX has indeed still has interest in a white-listed $CRV and what these ambitions are. Presumably it would be an improvement on the status quo, and quite likely it could be structured as a major win for all flywheelers. I vote yes on this hypothetical vote

RAI-FRAX

A second $FRAX vote is also up in the form of a RAI-FRAX gauge vote. The great @_bout3fiddy_ has recommended against this pool due to its lack of liquidity!

I also could not find a discussion in the governance forum on this topic. It would therefore seem prudent to get more clarity on this particular empty pool and resubmit for a gauge vote after a bit more insight.

DYDX

The DYDXETH pool vote is a moot point, as the gauge vote already passed quorum unanimously.

In terms of liquidity, the DYDX looks awfully dicey by liquidity, considering there is just $122 deposited. However, the discussion played out without any opposition, even from the aforementioned @_bout3fiddy_. The team layed out plans for decentralization over the course of 2022 and it’s exciting that Curve features into their plans.

Boomers may recall DYDX is famous for enriching everybody on the planet except Americans with their airdrop, because Gensler was doing his mafia protection thing.

Since the vote already passed, we’ll endorse saving your money on gas and not participating in governance just this once.

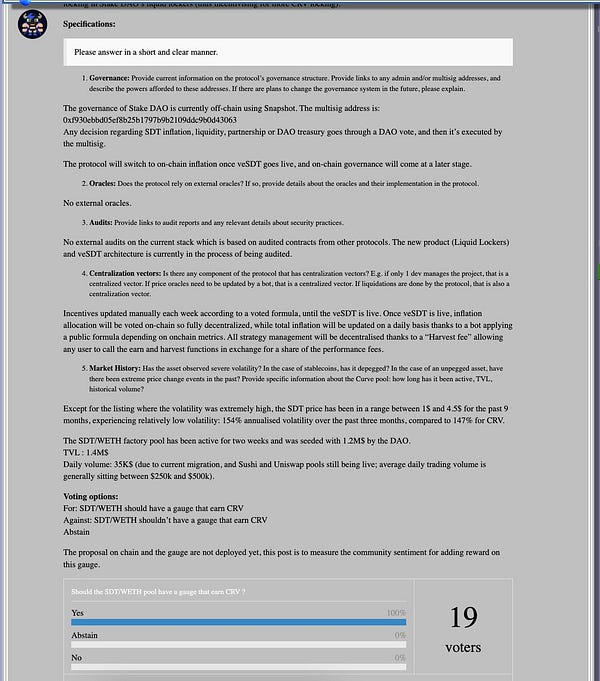

SDT

StakeDAO has already attracted over $1.6MM to the pool, and provides a convincing yes case. Monseiur Bouteloup has already provided more for us than Gensler in the form of pictures of dogs in trench coats.

Review the discussion and rubber stamp this vote.

CADC

In a particularly interesting geopolitical time for this discussion, the CADC in this pool represents a collateralized and redeemable Canadian dollar. The pool has about $500K in liquidity.

In the forum discussion @_bout3fiddy_ fished out some additional details about the pool.

We’d imagine the 2/3 multisig could be better decentralized, but the transparency has been excellent so far, and we presume our frozen friends to the north need all the help they can get.

Mostly out of spite for willfully obtuse Senators trying to foment stablecoin FUD on the outcome we’re actually observing with banks, we’d vote yes. Let’s show off just how much better Curve works than the existing institutions, and maybe help our Canadian neighbors in the process.

PWRD-3CRV

This one is easy because Crypto Risk assessments have already weighed in here with a detailed report:

They also recommend against this pool at the moment.

“Considering there is currently little benefit to veCRV holders, we propose that the DAO wait till the PWRD-3CRV gauge does sufficient volume and the pool matures into a more active pool.”

Of course others disagree.

Check the Curve forum and make your own decisions, but we’d trust fiddy’s guidance here and recommend waiting on this one.

All around, voting is a really important part of the governance process, so we urge everybody to cast their votes.

While you’re being safe, careful for scammers on Arbitrum. Being permissionless can come with problems sometime.

"Move fast and break things" silicon valley mentality doesn't mesh very well with crypto. Software engineering in this space should work differently. “Take chances, make mistakes, get messy!” is a bad mindset to have when we are trying to avoid major black swan events. You wouldn't have this mindset (I hope) if you were engineering a 737 aircraft for example. We're not building Twitter where a 500 page error now and then is okay. We're building mission critical infrastructure for the entire world to run on.