With attacks on stablecoins the latest craze among some particularly inept governments, the DeFi world is recognizing it might be wise to find other tokens in which to denominate.

Dare I suggest: the TriCrypto LP token

BENEFITS

TriCrypto is a perfect DeFi reserve asset. It embodies all the community’s ideals:

Decentralized

Ownerless

Permissionless

Immutable

Fungible

Composable

Automated

Fee-Bearing

Atop this, holding a TriCrypto LP token diversifies your exposure to the most important assets in crypto: Ethereum, Bitcoin, and stablecoins.

TriCrypto’s bespoke operation over the course of the year+ since it launched has got some degens noting its utility for passive farming — just as 3CRV became a better version of a dollarcoin, TriCrypto is a perfect passive LP asset which could serve as an excellent standard by which to denominate all of DeFi.

A TriCrypto token grants a bearer exposure to stablecoins — but it could not be easiliy classified as a stablecoin itself. At 33%, the stablecoin influence constitutes the minority of its value.

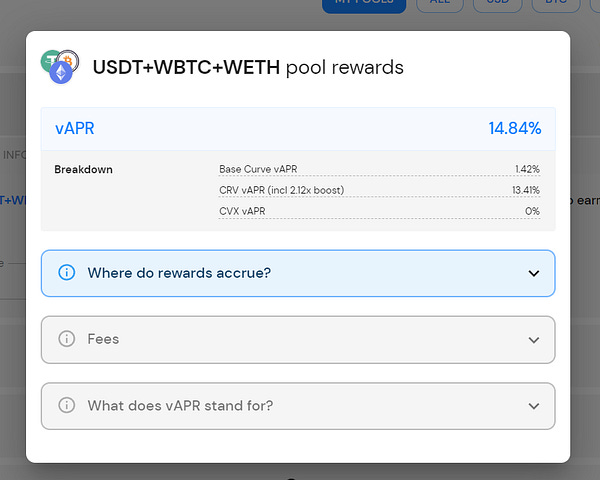

Helpfully, TriCrypto is also available on most chains, where it gets healthy rewards from $CRV emissions:

Fantom: 17.13% → 42.82%

Avalanche: 8.48% → 21.20%

Arbitrum: 7.99% → 19.99%

Ethereum: 7.86% → 19.65%

Polygon: 4.52% → 11.30%

You also need a reserve asset that is significantly more likely to survive regulatory crackdown than most centralized stablecoins. For this you need some sort of token that exists natively on-chain and cannot be destroyed via the real world.

TriCrypto has everything we need. Some protocols are already leaning into the benefits of its composability.

APPLICATIONS

As more applications get built atop TriCrypto, pricing in TriCrypto will inevitably become more natural anyway.

On Polygon, where gas prices are cheaper, Curve has launched a whopper of a TriCrypto pool containing 5 tokens.

You can also build TriCrypto into a factory pool on Polygon — meaning your token is easily tradable into the most important assets in DeFi.

Two pools have already launched this to stunning success. The CRV/TriCrypto pool has gathered $10MM in TVL, with up to 81% boost with rewards. Similarly, the legendary $MATIC team have launched a pool with half a million TVL, with max rewards flirting with triple digits.

Then again, it may stay underutilized as users flow into ETH/MATIC on mainnet.

Outside Curve, Yearn has built a 3Crypto Vault.

We also see Abracadabra has launched TriCrypto tokens for a vault for borrowers. See here how the protocol offers the ability to earn north of 100% APY because TriCrypto is composable!

DRAWBACKS

Using TriCrypto as a base layer would be subject to impermanent losses and gains as crypto fluctuated in price. The good news is that, thanks to the dollar backing, TriCrypto suffers about 1/3 less volatility than using Bitcoin or Ethereum directly, natively providing some diversification.

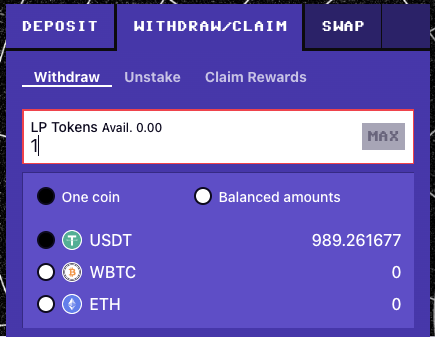

A major downside is that the “value” of a TriCrypto token fluctuates with the prices of the three underlying assets. Dollarcoins became the reserve asset of DeFi because people are roughly used to what a “dollar” can buy you. It’s far tougher to do the mental arithmetic of calculating the price of a TriCrypto token, which combines the prices of Bitcoin, Ethereum, and a dollar. An LP token is currently worth around $1K.

That said, we’d argue that a token that’s truly representative of DeFi would be better off if it did in fact fluctuate in value based on the price of BTC/ETH. All of crypto moves along with these assets, so it would remove some of the volatility of dollar denominated prices.

For instance, we know the price of $CRV in dollar terms has been wild over the past year, fluctuating between $0.50 and $3 — a 6x swing!

However, pair it with ETH, and much of this pricing volatility gets removed. Here the price has swung between ~.001 ETH and ~.0005 ETH, closer to a 2x swing than a 6x swing.

Another drawback would be the plausible depeg risk of WBTC or a paired dollarcoin (currently Tether). Both have proven very resilient through recent crashes, but given harsh regulatory action, both could be at risk of losing their value.

This is granted, but also an inherent risk of using DeFi broadly. An instant collapse in either Tether or WBTC would doom many services whether they were denominated in TriCrypto or anything else. The more likely scenario for either of these assets to be sunset would look more like the wind-down of $BUSD, which is allowing a one-year window to off-ramp 1:1, giving ample time to adjust.

A similar scenario for a sunsetting of WBTC or Tether would allow sufficient time to migrate liquidity to a new TriCrypto pool. We saw Curve go through such an event this past year, as the renBTC base pool was sunset on an accelerated schedule, yet Curve succeeded in quickly moving liquidity to a new basepool.

Granted, such scenarios preclude the sort of “set it and forget it” type passive investing, but we’d argue that anybody participating in DeFi should be checking on their investments at least monthly.

The other drawback, which may not be an issue for long, is gas considerations.

GAS CONSIDERATIONS

The biggest obstacle to actually moving to TriCrypto as a reserve asset for DeFi would be that degens would need TriCrypto to get significantly more gas efficient on mainnet.

On mainnet Curve does not support TriCrypto as a base pair due to gas costs. Instead this capability only exists on the gas-friendlier Polygon.

For example, a basic transaction using just TriCrypto on mainnet…

…versus a transaction using MATIC / TriCrypto pairing on Polygon

Allowing TriCrypto to permissionlessly serve as a base pair on mainnet would be vital to allowing TriCrypto to become the reserve asset of DeFi.

Fortunately, anybody can scout Github and see that a repository in the Curve codebase called TriCrypto: The Next Generation is under active development.

The Next Generation of TriCrypto will add some great new features — including a factory that would allow anybody to deploy their own TriCrypto style pool containing multiple tokens, as well as gas optimizations to make it possible to execute on mainnet without breaking the bank.

The steps taken to optimize the gas are quite interesting (and will be covered in an upcoming article) — but the important thing to note is that the gas efficiency is coming, and the capability of anybody to launch their own gas-efficient TriCrypto style pool would make it possible for anybody to launch their own TriCrypto using… say… a Bitcoin and ETH paired with a stablecoin other than Tether (ie $FRAX/$LUSD/$crvUSD) or any tokens one could image.

CONCLUSION

If you’re engaged in degenerate gambling activities and ponzi schemes, and you find yourself in the market for a new reserve asset, TriCrypto’s the best game in town.

TriCrypto's reliance on bridged BTC and the questionably collateralized USDT mean that it is significantly lacking in the space of decentralization and immutability. Using crvUSD or some synthetic version of BTC would certainly help to protect the pool in exchange for capital efficiency.