Help us by spreading this thread on 𝕏!

Disclaimer: Author is invested in CVX, CRV, the flywheel, et al, but not Asymmetric Finance — though he may well go ape today…

Today ushers in the beginning of a new era in asymmetric warfare!

Asymmetry Finance has been preparing for today’s launch since before liquid staking… and then restaking… became the biggest buzzwords in crypto. The team released their white paper back in April 2023:

The white paper details centralization concerns within Ethereum liquid staking and briefly outlines their tokens: $safETH and $afETH (the latter of which has since been mostly redacted).

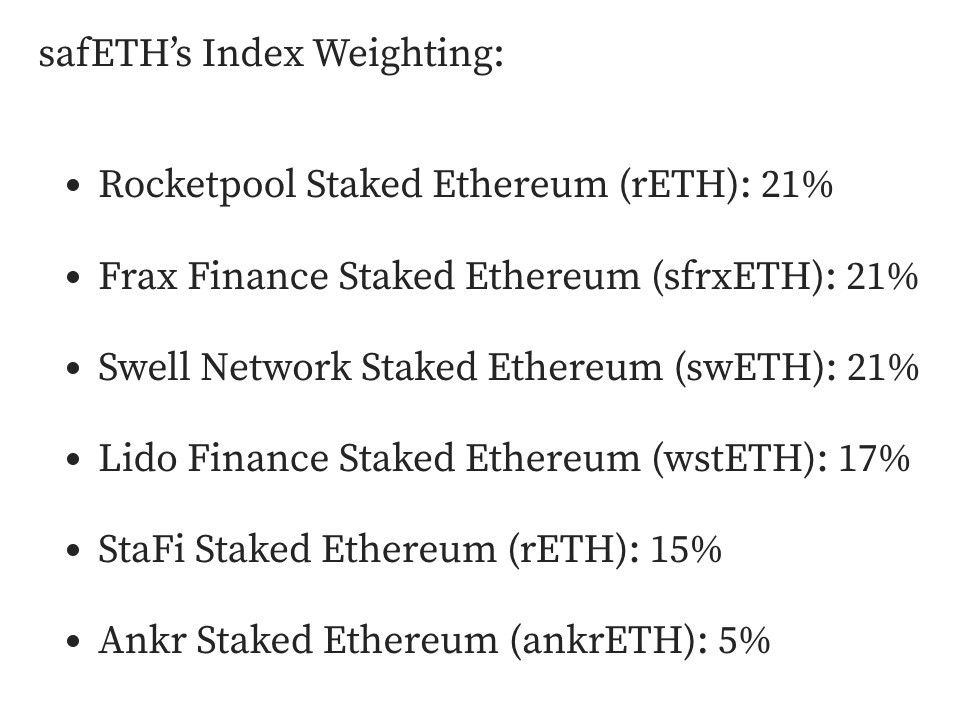

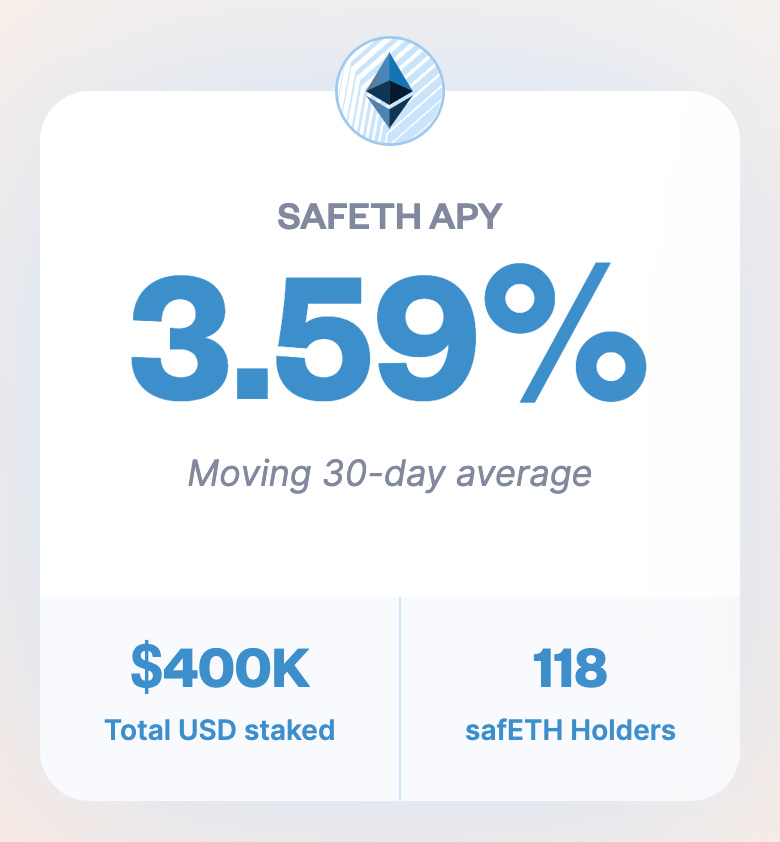

As you might imagine, $safETH is a liquid staked token intended as a saf-er, albeit less exciting, token (EDITORS NOTE: nothing is safe in the perilous world of crypto.) Users deposit $ETH for $safETH, which is backed by a basket of other liquid staked tokens.

The token has been successful in terms of safety, in that there’s been no reported hacks, scams or other issues.

The modest adoption is to be expected. Given the degenerate “bet-the-yield-farm” nature of our industry, a “safety” focused product is unlikely to light the world on fire. We consider it an encouraging sign they attracted such TVL in an era of increasing recklessness. For $safETH, Asymmetry Finance looked to cater to smaller users (whales-in-training) by boasting of competitive gas costs and low fees.

Today marks the intended launch of $afETH, (which we presume stands for Asymmetric Finance ETH), their flagship token intended to play to users’ demands for supercharged yields:

They detailed its workings in a launch thread earlier this month, which you should read to cover all matters, including the airdrop program “GEM RUSH”

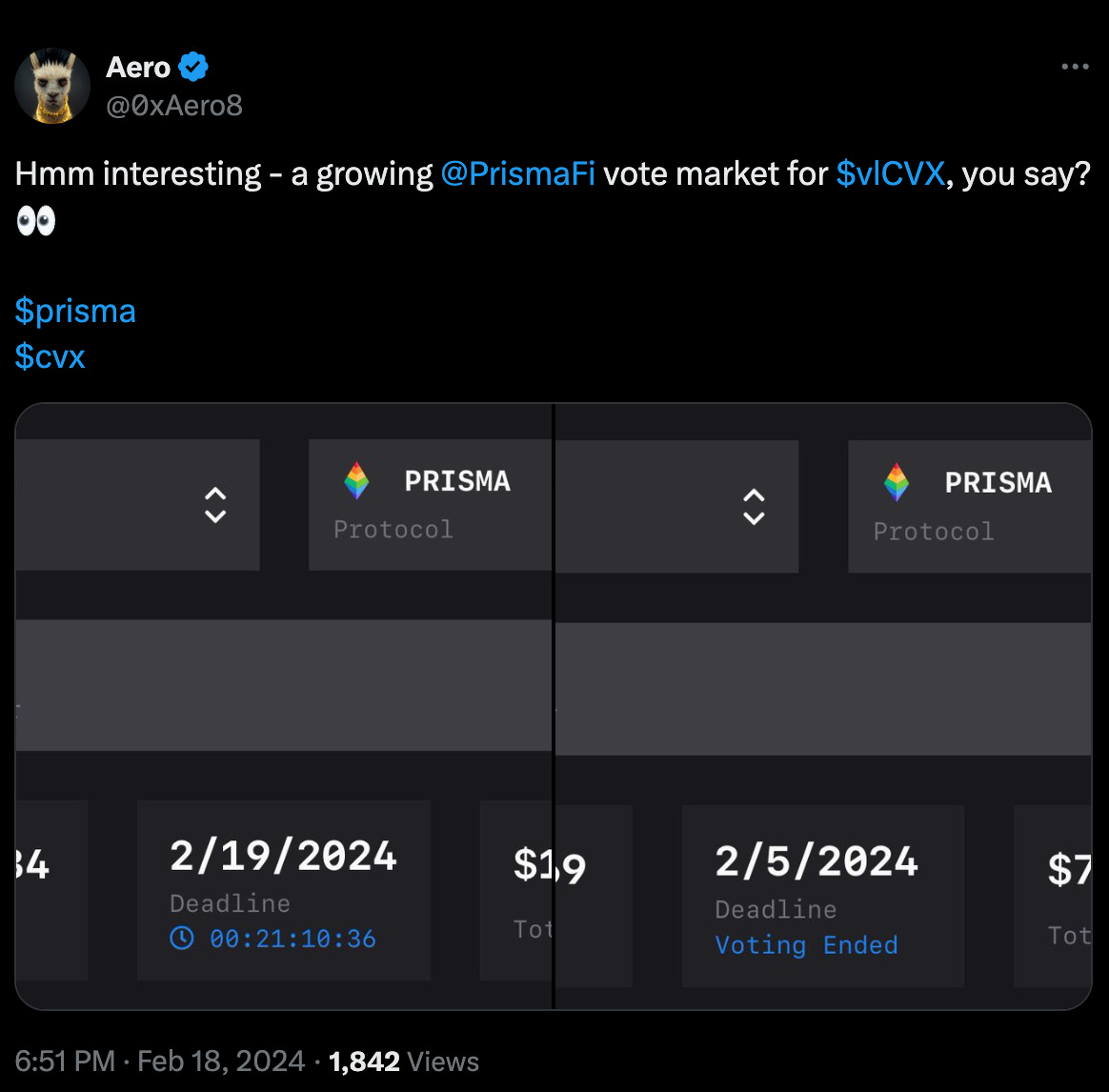

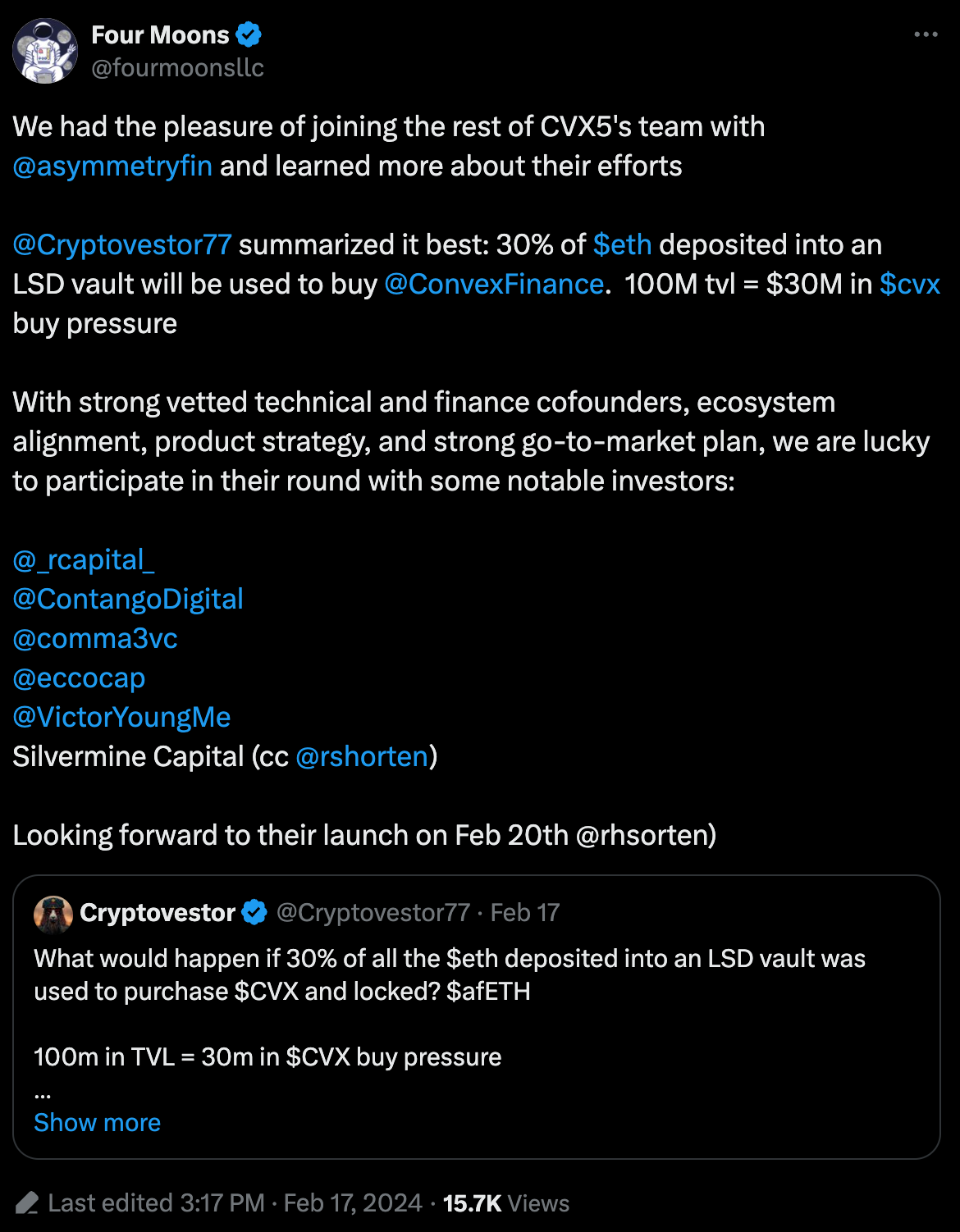

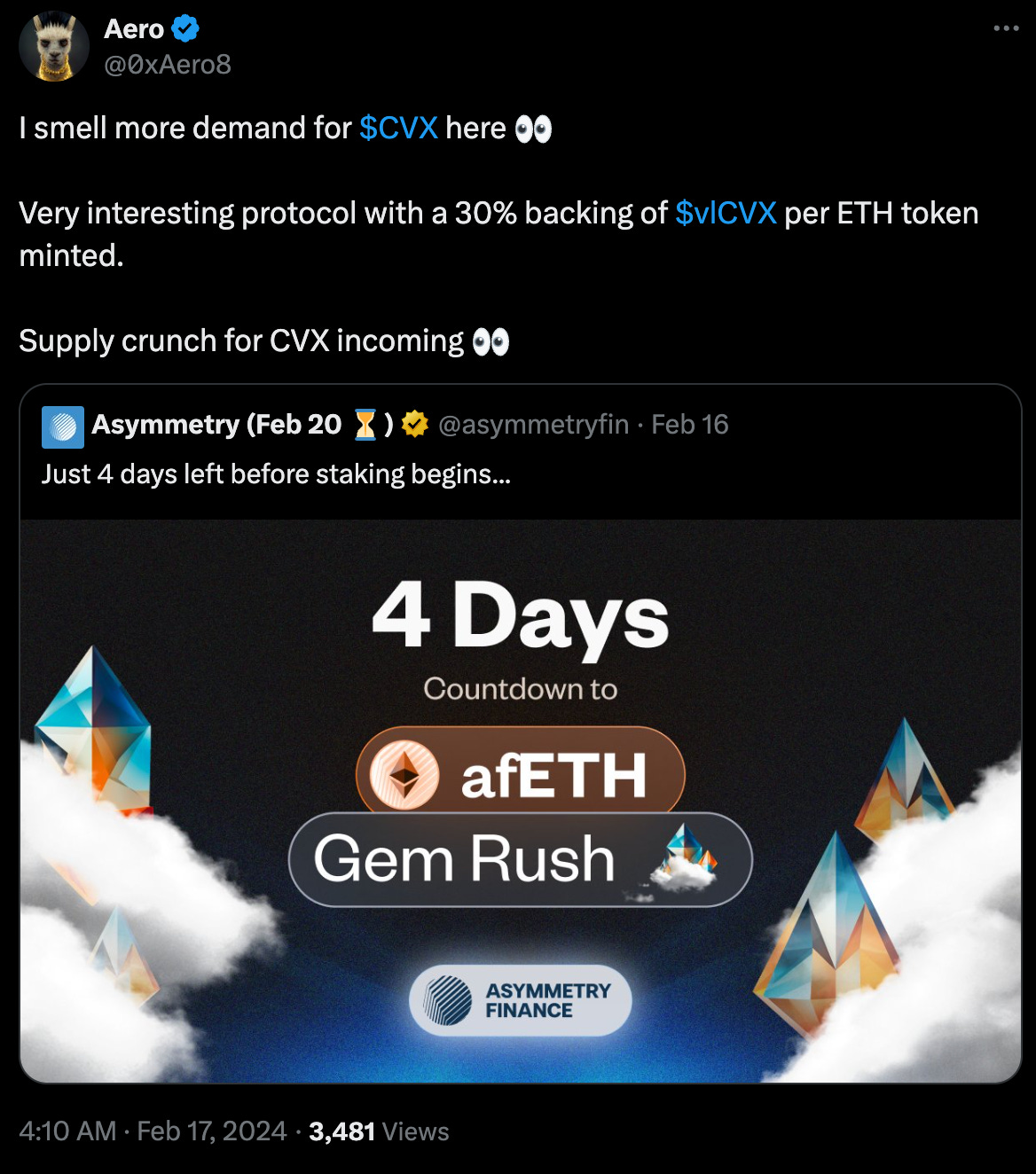

How do they plan to achieve double digit yields? The token’s composition: a hybrid composed of 70% $sfrxETH and 30% $vlCVX.

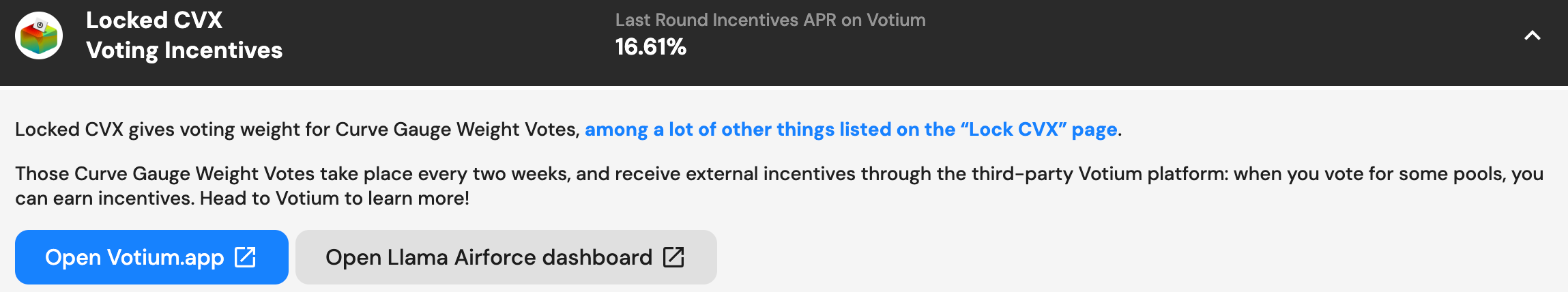

We don’t imagine readers of this blog need an education about the mechanics of how these two tokens earn “real yield.” The majority composition is $sfrxETH, which earns competitive interest rates. The remainder is autocompounded yields from $vlCVX, which earned 17% in the prior round.

Of course, it’s quite easy to see the risk factors in this easily comprehensible system. The value of $afETH, being backed 30% by $vlCVX, is of course dependent on the price of $CVX. Like most cryptocurrencies, its value is somewhat correlated with the price of $ETH, but historically altcoins dipped harder in bear markets and rose faster in bull frenzies.

So naturally there’s some inherent risks to be aware of, but given the recent pivot of market sentiment towards bullishness, we imagine a good portion of the community will see this as the right time to take such a gamble.

We could therefore have readily foreseen critics attacking the positioning of hybrid token as an ETH derivative, which might be a reasonable charge. It looks to function more like a TriCrypto LP token, or Protocol f(x)’s $fETH, and not as a pure ETH wrapper. We presume users understand these risks, though we would have been forgiving if critics complained they under-emphasized this fact.

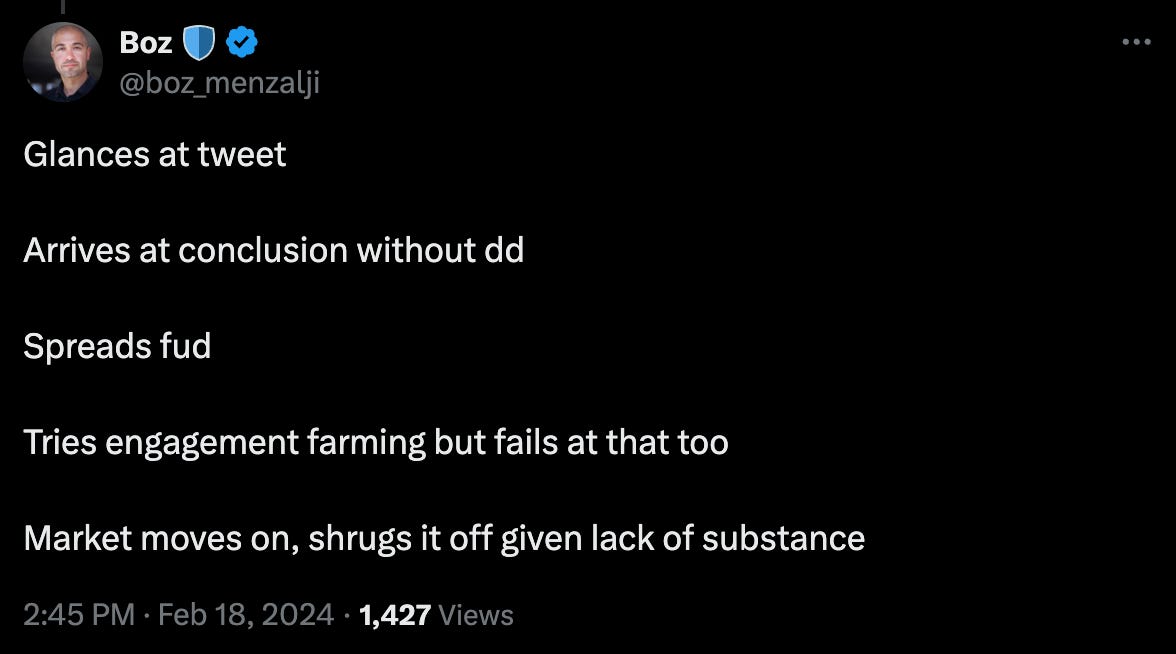

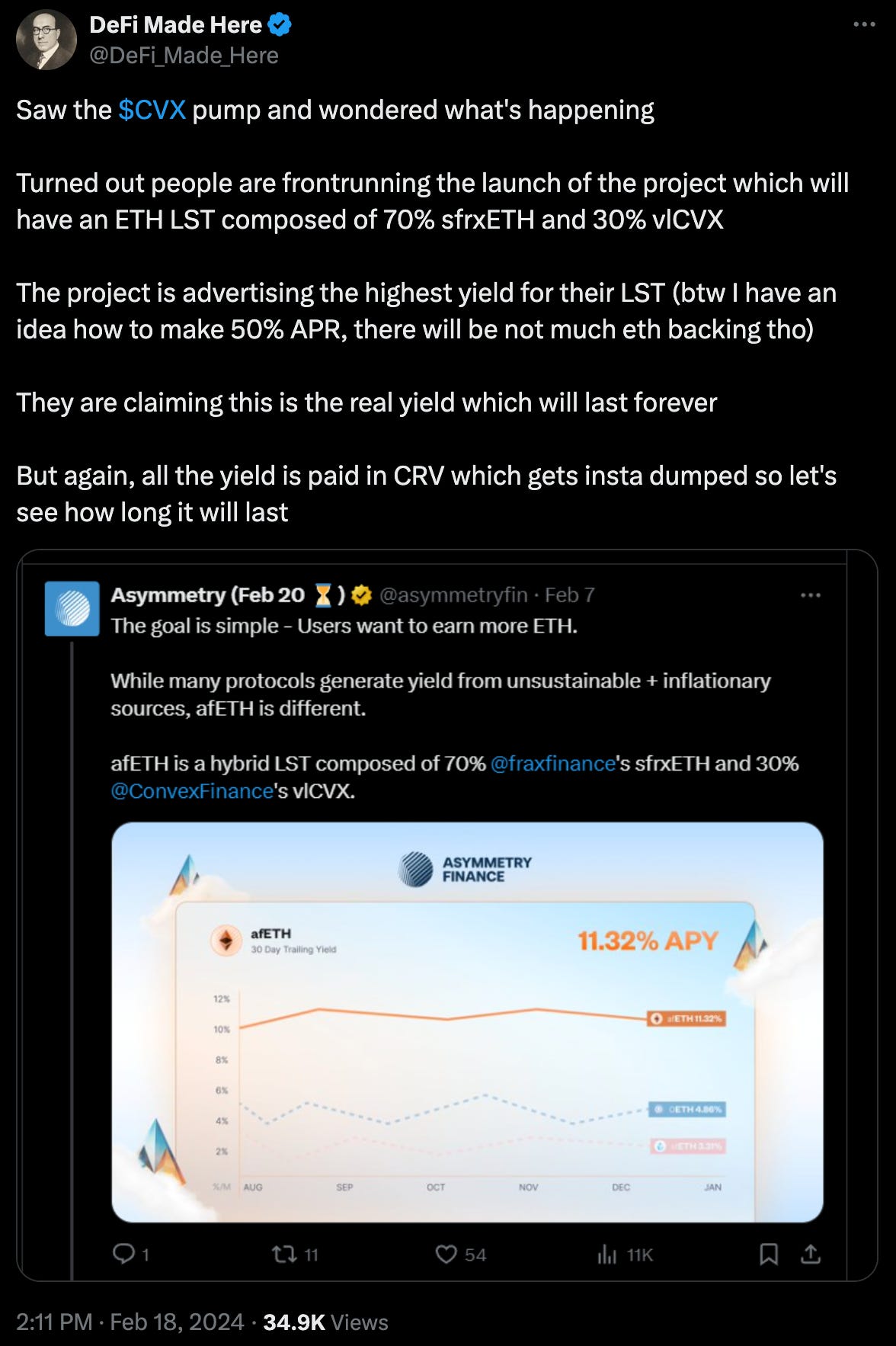

Implausibly, however, the opening salvo against the token took an odd angle.

Presuming you understand the source of $vlCVX (direct incentives), you are immediately aware that this yield is not sourced from $CRV emissions. You thus might be surprised to learn that the token model came under attack primarily for the patently false claim that the token’s “yield is paid in $CRV.” Perhaps recognizing the error, the author tried to clumsily qualify this statement later.

The original post unabashedly remains undeleted.

And why not? This is a numbers game… and it’s doin’ numbers…

It seems little coincidence the psyops all hit at the same time… see also the recent outbreak of TradingView FUD…

The tactic comes straight out of the Death Spiral00r orientation briefing: simply peddle fact-free flywheel FUD. It doesn’t matter how divorced from reality it may be… there’s always an eager audience of underinformed leftwits hungering for such content. The more outlandish, the better… you’ll easily rack up tens or hundreds of thousands of views bashing the flywheel.

Even if you’re pressured into publishing a retraction, the correction will only get only a fraction of the views, so the damage is already done.

Meanwhile, the audience for our particular brand of bookish Bildungsroman will barely rack up a few thousand views at best, and that’s if it happens to pop. For our sake, it’s an intentional strategy. We prefer to select for intelligence, and therefore narrow our potential appeal.

But if you’re in this game for eyeballs, like most in crypto, note that the easiest path is to just pledge with the dark death spiral army. It’s much, but it ain’t honest work.

We happen to prefer this status quo, in which the broader masses are stupidly misinformed, and only a small minority who bother to do the research get the good intel.

If 95% of the population is misinformed, the 5% who better understand these niches have the opportunity to profit from Information Asymmetry. It’s not just the title of this article, nor just a reference to the eponymous protocol… information asymmetry also happens to be the best source of alfa (outside of just building something yourself.)

Digressions aside, we’re not ranting about all this purely for the sake of self-aggrandizement. We’re describing the game as it’s currently played so as to properly contextualize why the ascent of CVX5 is such a BIG DEAL™️, particularly concerning the gang’s role in the launch of Asymmetry Finance.

We certainly hope somebody warned the hottest supergroup in town that if they seek stardom, then theirs is not the easiest path to widespread popularity and acclaim (though we hope to be proven wrong.)

We suspect the clever crew already figured this out though, having seen the tough slog flywheel maximalists have endured the past few years. From our vantage point, we believe the quintet appear mostly to be motivated by a pursuit of truth, a crusading spirit, and a keen appreciation of clever fundamental tokenomics.

The team shared their motivations more eloquently in a chat:

We care about increasing the value of $CVX by helping protocols onboard to the liquidity strategy offered by Curve and Convex. Information on how to take advantage of the flywheel is spread across the internet, and we can help protocols get to their "aha" moment faster by sharing what we've learned after years of obsessively following the ecosystem developments.

This means teaching them all about how Curve/Convex/Votium work together, how to think about owning vlCVX vs incentives to pay for liquidity, and connecting them to founders of other protocols to partner with. All of this is to accelerate their adoption of the Flywheel strategy for liquidity and ultimately increase the number of participants in Convex's liquidity market.

No surprise they’ve united around an unabashed fealty towards the kingmaker, token itself, the great $CVX.

It’s not a surprise to us that a grassroots crew of gigabrains would emerge from the Convex community. The discussion in the highly active #cvx-trading channel has maintained a surprisingly strong signal-to-dock ratio throughout the worst depths of the bear market. Even the frequent presence of sock puppet Willy alts has done little to dent the overall caliber of conversation, which is served up with a heavy helping of the trademark humor that makes this sector such a delight.

Clearly recognizing the awesome potential of Convex and unable to keep this intel to themselves, the CVX5 may trace their origins to the recesses of this community. They see a lot of opportunities for the protocol throughout the entire world of DeFi, and they have emerged onto the front lines in making this case.

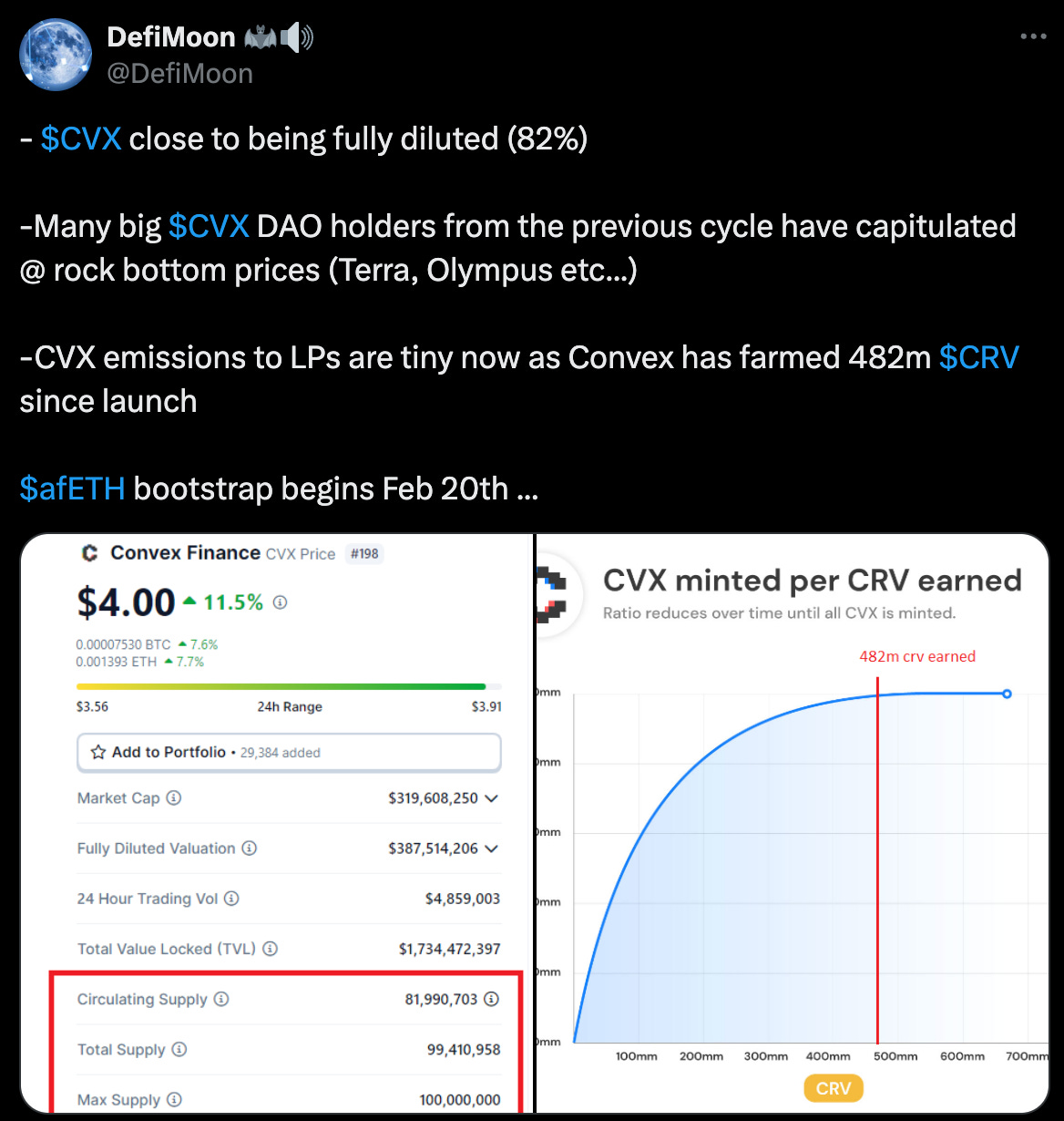

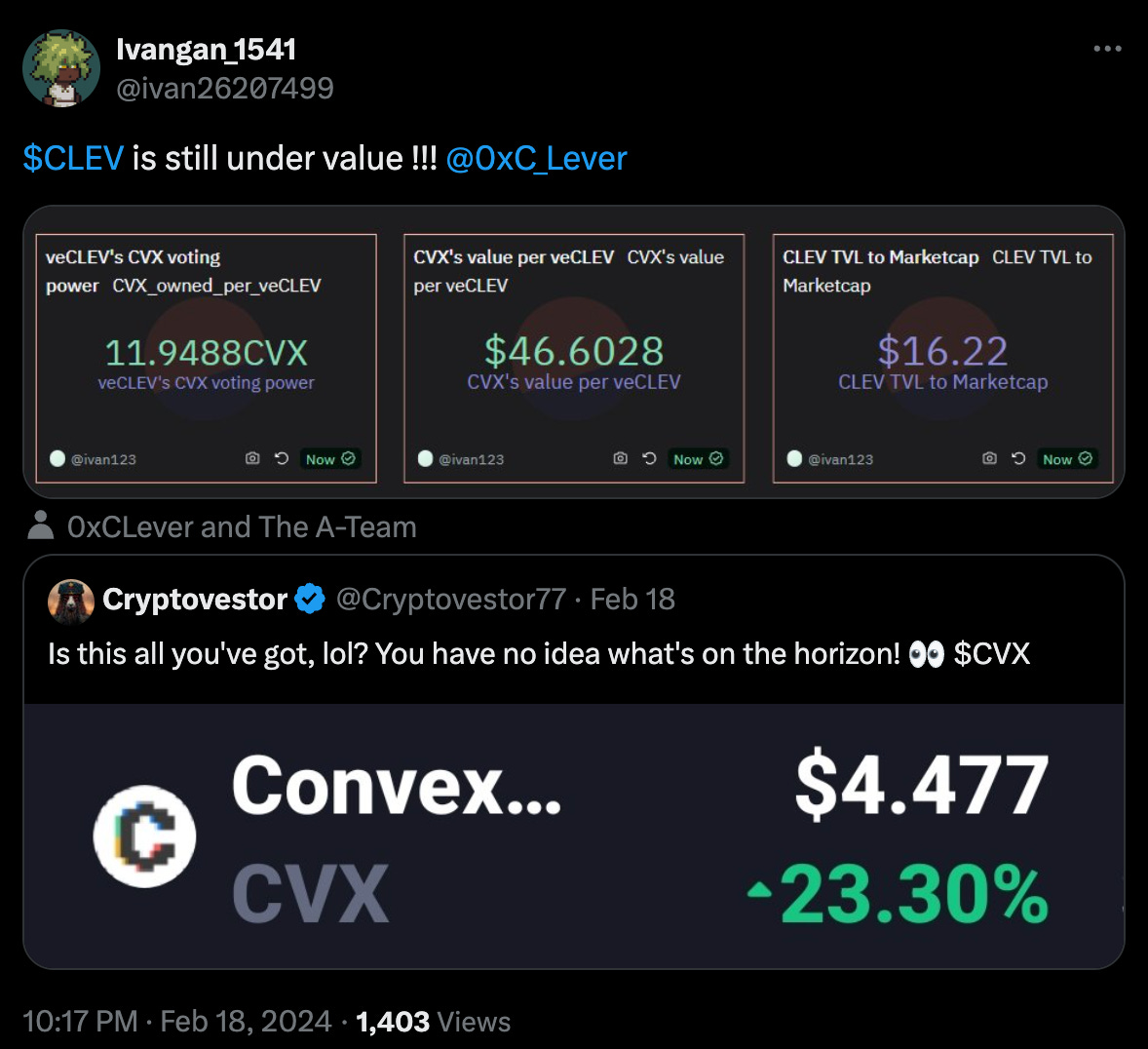

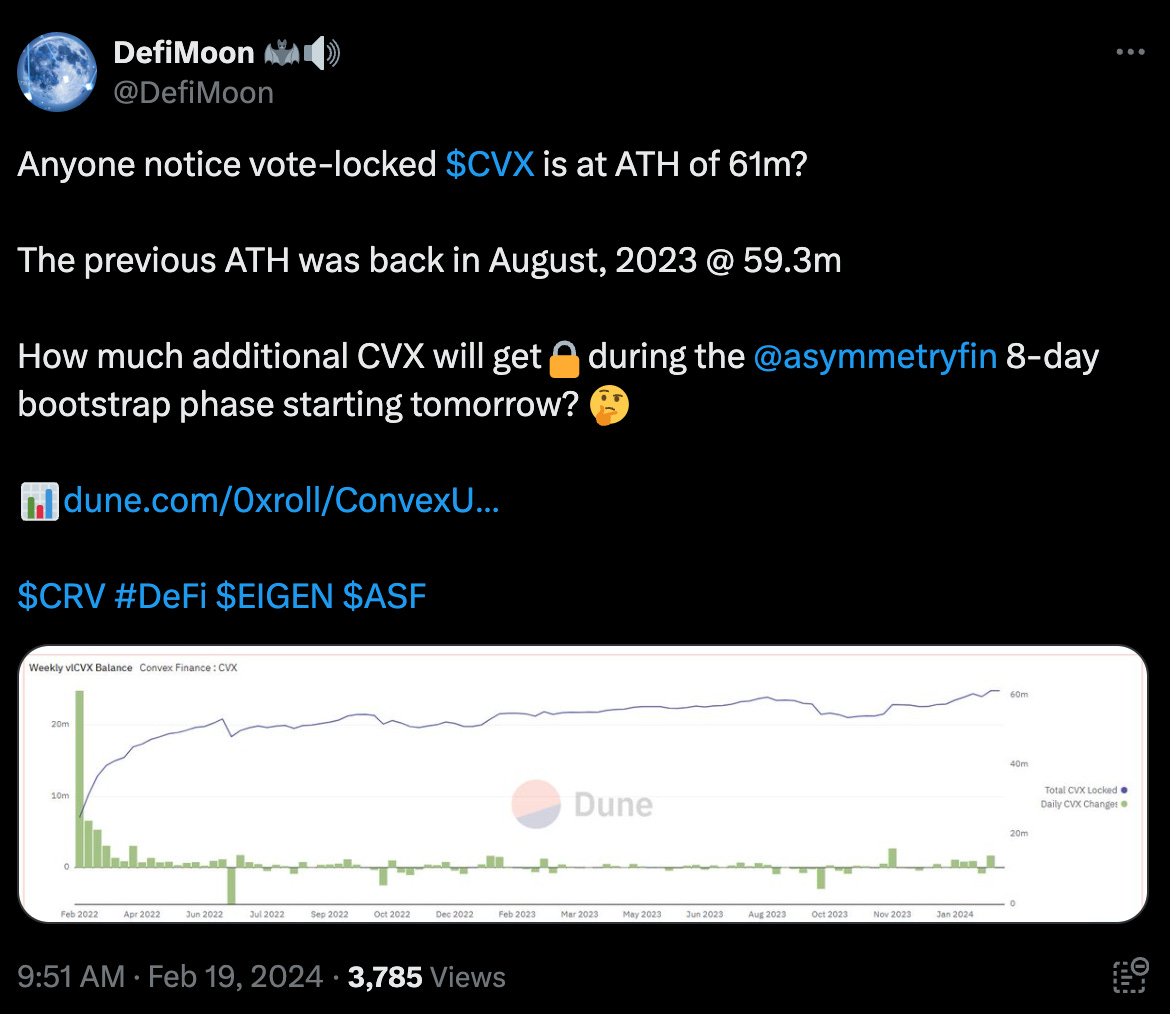

The fundamentals for $CVX have never looked stronger, particularly with the possible repercussions of a successful launch for Asymmetry Finance

It goes without saying that an increase in $CVX value could have spillover effects to other tokens as well…. $PRISMA…

$BTRFLY…

$CLEV…

Thus far, the CVX5 have been instrumental in working with the Asymmetry team, a fact corroborated by the Asymmetry CEO.

Not only has CVX5 been actively advising the project on tokenomics, the team all saw such potential they individually invested into it. They expect Asymmetry can be more than a recursive DeFi play: it has a platform to launch tantalizing future applications (including $cvxCRV peg healing, a leveraged yield strategy product, and more).

Their immediate mission is to make today’s launch of Asymmetry’s $afETH a success.

If $afETH does take off, it would create an obvious black hole for $CVX.

Given the relatively low amount of liquidity for $CVX — the obvious bull case is that Asymmetry could have an impact similar to that of the ETF on Bitcoin (Not financial advice of course… the bear case is that all of crypto is hacked and goes to zero!)

If it goes wild though, you can’t say they didn’t try to warn you…

However, as we pointed out before, the eyeballs are with the FUDsters, not the deliverers of alfa. Therefore, if you’re following the CVX5, you possess informational asymmetry… you know more than most people about what’s happening with CVX. What are you going to do with this alfa?

It goes without saying, that if you’re not following the CVX5, then you should correct that:

Which leaves the only question as where they came up with their name…

Or better yet… if you’re the founder of any protocol interested in using Curve and Convex, you should feel comfortable reaching to the CVX5 if you need help thinking through your approach.

What’s next for the CVX5? We can only speculate, but here’s our guess…