February 21, 2021: Practical Hyperbitcoinization Part 2: Flippening Companies 💼👔🕴️

Companies(<--- You are Here), Nations, Planets

Hyperbitcoinization is here! We’re doing a series on practical hyperbitcoinization. We previously introduced the concept, and this week we look at the effect of flippening companies. Upcoming releases will focus on the effect flippening nations and planets.

It’s a funny time for Bitcoin. Not too long ago, Bitcoin was touted as a great way to shift power away from corporations toward the people.

Now, the hype is about corporate America buying into Bitcoin.

Is Bitcoin trading its cypherpunk tin foil hats in order to suit up and pitch Wall Street?

Or maybe it’s more a play for vengeance? Some believe a true victory is to make your enemy see they were wrong to oppose you in the first place. The more accepted tactic is to crush your enemy totally, which may also be in the realm of plausible outcomes.

“Upon this, one has to remark that men ought either to be well treated or crushed, because they can avenge themselves of lighter injuries, of more serious ones they cannot; therefore the injury that is to be done to a man ought to be of such a kind that one does not stand in fear of revenge.”

— Niccolò Machiavelli

At any rate, we’ve reached the stage of hyper-bitcoinization where companies are beginning to put Bitcoin onto their balance sheets. In 2021, we’ve already seen Microstrategy aggressively pumping Bitcoin to corporate CFOs…

…plus Tesla’s major purchase…

According to the First Follower school of thought, this is how an avalanche starts.

Five Fortune 500 companies are rumored to use Coinbase right now.

Talent

At this current early stage of flippening companies, we’re already seeing some effects on the labor market. Talent flows to opportunity. Once upon a time this was Wall Street. Then the tech giants. Nowadays, people are interested in the companies that are reinventing money. Over the past 12 months executives moved from tech firms to Coinbase and from Coinbase to the federal government.

At the moment, Facebook still pays software engineers better than Coinbase. If the cryptocurrency markets 10x from here, would this still be the case? Facebook may be forced to launch Libra, not because it’s any good, but simply to position themselves as a blockchain company in the talent wars.

In a financial technology course I teach at a major university I survey students on their desired jobs when the graduate. Six months ago just 26% were interested in becoming blockchain developers. The newest session it rose to 70%. Fortunately they have an experienced teacher.

Confidentially, blockchain companies have asked my help in recruiting smart contract talent. They complain it’s too easy for even bad developers to find cushy jobs making a lot of money. I won’t quote the salaries they are floating, but it is eye-popping.

Balance Sheets

Of course, a lot of companies have dabbled with accepting Bitcoin payments over the years. Microsoft has had an on again, off again relationship with Bitcoin payments over the years. But few people want to spend their Bitcoin because it’s been such a great asset over the years. The French Press I bought off Overstock back in the day is nice enough, but it would be worth over $10,000 today if I’d only HEDL.

As minor as the payments angle has been, it doesn’t seem as if many companies have bothered hodling anyway. From the looks of companies holding Bitcoin on their balance sheet, it seems only a handful appear to have done. Most must have converted to cash. Whoops.

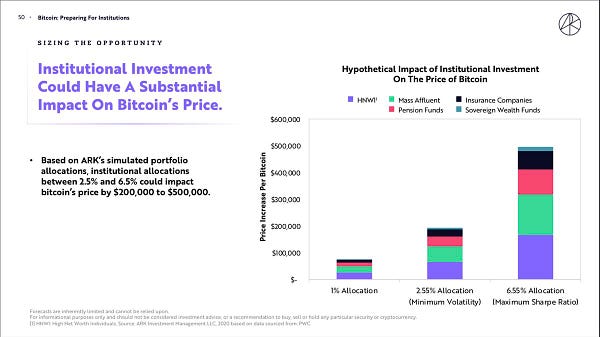

At any rate, payments no longer seems to be the angle of interest. Now it’s using Bitcoin as a corporate reserve. In particular, Bitcoiners are mostly salivating over the effect that companies getting into the game would have.

Mass Adoption

What does it look like if companies do adopt en masse? Ignoring price speculation, it’s interesting to consider simply from a distributional standpoint. Let’s assume for a second that all companies efficiently sort themselves, such that their BTC holdings are roughly equivalent to their current market cap. We’ll prorate it to Tesla’s purchase amount, not because it’s realistic (Tesla is likely on the bullish side) but because it’s a highly meme-able number.

Mind you, we’re not at all saying this scenario is likely — in fact quite the opposite. Everything from here forward falls into the “if grandma had wheels she’d be a bus” file. But it’s interesting to consider one scenario of mapping the market onto the blockchain.

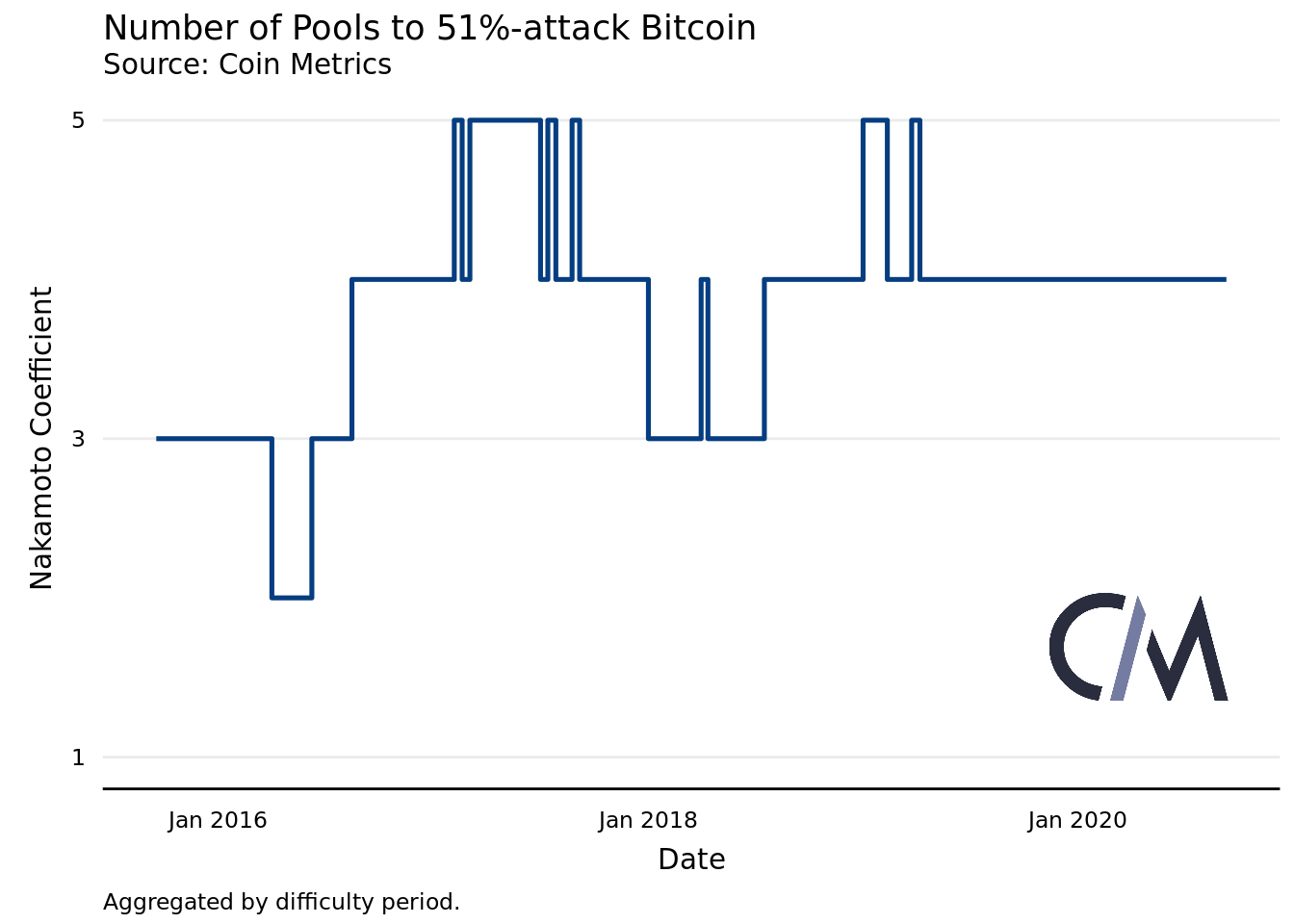

Here’s how many BTC the top players would end up if they acquired BTC relative to their market cap and pegged to Tesla’s double entry accounting:

In this universe, the number of wallets with >100K bitcoin would double from 3 to 6. The number of wallets with >10K bitcoin would jump from 95 to 137. Companies would own a little over 3 million BTC, about 15% of the total supply. As far as potential scenarios go, it’s a number not wildly out of line with some estimates of available BTC.

At these levels, companies may all hodl a lot of Bitcoin, but to what degree would it sway business decisions? Apple’s nearly 150K BTC in this scenario would be impressive, but worth just $8 billion at today’s prices, just 4% of its available cash on hand.

Of course, the price of BTC would presumably rise in this universe. It would have to hit about $1.5 million per coin before Apple’s cash on hand holdings were primarily BTC. Berkshire Hathaway would have a price target of just $800K per sqrt(rat poison).

Should BTC rise to somewhere around these marks is when we’d expect the real corporate flippening to happen. At this inflection point, acquiring more Bitcoin would become the best way move their bottom line. It would become the company’s legal responsibility to their shareholders to stack sats. We might expect companies prefer to accept payments in BTC. At the same time, companies may still prefer to pay wages in dollars, since they don’t store value very well.

Power

For a long time, Bitcoin has unfairly had a reputation as being used by crooks and thieves. If a majority of Fortune 500 companies bought Bitcoin, this would actually become true. White collar crime has been estimated to cost the US over $500 billion and 54,000 lives each year, though estimates are scarce and tricky.

We do know that many of the most hated companies in the country could suddenly become major power players within the world of Bitcoin. Companies are willing to do horribly unethical things to make a buck. Enron caused blackouts to improve their bottom line. At its height, the Dutch East India company waged wars. Why wouldn’t companies do anything they could to attack Bitcoin?

Fortunately for Bitcoin, it seems somewhat resilient to any threats. We don’t imagine any entity getting a majority interest in the market — with a market cap of $1 trillion, it would cost about $500 billion for anybody to purchase a majority interest, over twice Apple’s cash reserves.

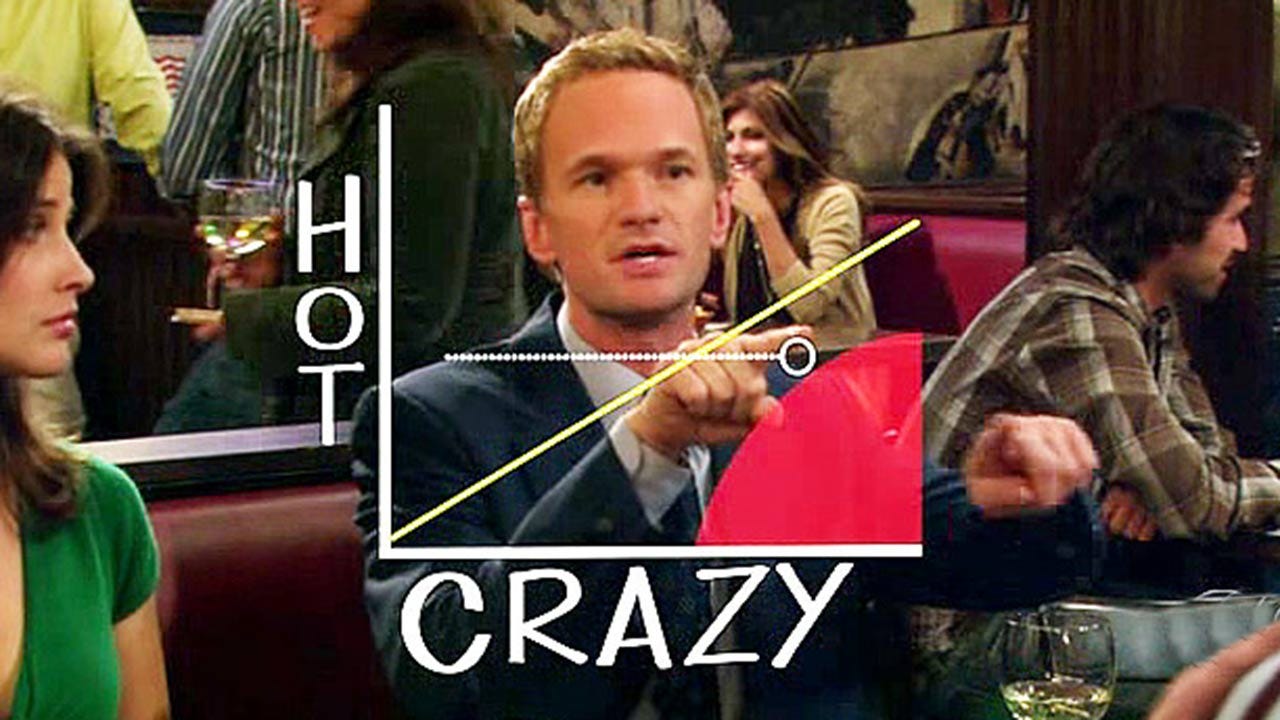

Fear of a 51% mining attack is also difficult at present. It would currently require owning 4 mining pools to implement such an attack. It’s not out of the question, but if a company managed to acquire the three largest, the bidding war for the fourth would be intense.

Could an energy giant create their own mining infrastructure? It’s also hard to imagine only one getting into this without seeing their competitors firing up mining rigs. No one energy company has procured a monopoly on the energy supply.

Then there’s the possibility of a wrench attack. Perhaps a company simply hires some goons to threaten core developers into submitting malicious code into the protocol? Anything is possible, but it’s not particularly the style of the corporate world. Generally speaking, companies in the US are more inclined to wine and dine their targets of persuasion. We’d expect a flattery operation to resemble the “sex for oil” scandal of 2008, great news for core devs!

Since corporate America tends to get away with its misdeeds, we do expect one big change would be that Bitcoin would be more legally sound.

In summary, we’d expect a corporate flippening to resemble the status quo, but with Bitcoin! Companies would still find ways to screw their customers, bitcoin would be a bit stronger, and the sun would still rise in the east.

Next up… flippening nations!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice. Author is a $CRV staker and perma-bull.