For follow-up on last week’s review of Metronome Finance… make sure to check out the latest Llama Risks team deep dive on the subject:

Conic Finance Soon

By all indications, Conic Finance is launching soon. Not SOON™️, but akshual soon.

If you hold $veCRV or $vlCNC, today’s forecast calls for airdrops.

For the uninitiated, Conic Finance is automating the process of single-sided liquidity staking via omnipools. The DAO has been voting on the composition of these pools since last December.

We know some of you have been following Conic very closely. Others may have just blindly aped in for the nearly 100% CNC yields on their Curve liquidity pool. Either way, things may get interesting soon.

Conic yesterday announced that voting is complete, and they are proceeding to launch phase.

For everything Conic, make sure to subscribe to the great Conelink Substack:

From the above article, we see the final weightings for the first three pools based on DAO vote.

If you look through the above list, hopefully one bullet point stands out to you… the FRAX omnipool would have contained $BUSD. If you’ve been paying attention, this hopefully makes you do a double-take. $BUSD has been in both the news and the crosshairs lately. These votes were conducted before $BUSD got got.

Fortunately the Conic Finance team already reacted to the news and deprovisioned the $BUSD portion of the FRAX omnipool. It does demonstrate the challenge facing Conic Finance, as well as all liquidity providers generally, in protecting their returns amidst the chaotic cryptocurrency environment.

In this case, $BUSD did not immediately plummet to zero. LPs have ample time to rebalance. What would have happened in a disaster scenario, where $BUSD got “protected” all the way from $1 to $0?

War Games

What follows (and precedes) is not financial advice, but rather a quick crash course on assigning probabilities and calculating “expectation values” and “decision trees.”

Assuming Conic was getting max yields on all pools, parking your money into the FRAX omnipool would have been earning you very close to 3.14% yield — did they target π% or was this just a coincidence?

If $BUSD was simply erased, you would instantly lose 9.17% of your TVL. Bad, but not catastrophic.

If you had sat in the omnipool earning π% each year, you’d break even after about 3 years. Three years is a lifetime in DeFi, but one can use this sort of methodology to come up with a risk framework.

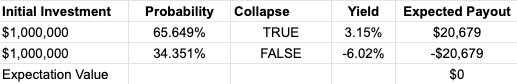

Let’s grossly simplify the scenario. We’ll assume all other assets are saifu, but you expect there’s a 5% chance that $BUSD will become worthless in the next year. In other words:

95% of the time you get a yield of 3.15%.

5% of the time you lose 9.17% of your TVL — (since you earn ~3%, we put the overall yield at about -6%).

You can calculate and sum the expectation value of each scenario to get a sense if it’s worth it. Under these odds, you would expect to make about a 2.7% return, so probability might suggest you YOLO

The breakeven point is around 33% — if you assume there’s about a one in three chance that $BUSD goes to zero in the next year, you would expect to lose money.

Now, if anybody actually thought there was a one in three chance of $BUSD becoming worthless, they’d probably steer completely clear of anything touching $BUSD. But it’s still an even bet… that’s the power of diversification.

What’s tough to grasp… if you told me there was a one in four chance of $BUSD depegging I’d also be long gone. But you’d still be slightly profitable at those odds.

Still not a good idea though. $8.5K on $1MM is just 0.8% expected return. Though there’s a chance you eke out some gains, there’s safer sources of 1% stablecoin yield. So even though this analysis is a bit crude, it’s still somewhat in line with expectations.

And indeed, it is extremely crude. In this case we’re only considering the possibility of a $BUSD hard collapse. If FRAX or USDC got “protected” you’d be out 100%. A truly comprehensive model would include a range of probabilities to cover partial depegs. Take all this into account if you want to comprehensively model this on your own.

Let’s expand this one step. The above scenario only considers the pools that are “safest,” whatever that may mean in DeFi. We’d personally put the odds of any of these pools depegging a bit lower, but your mileage may vary.

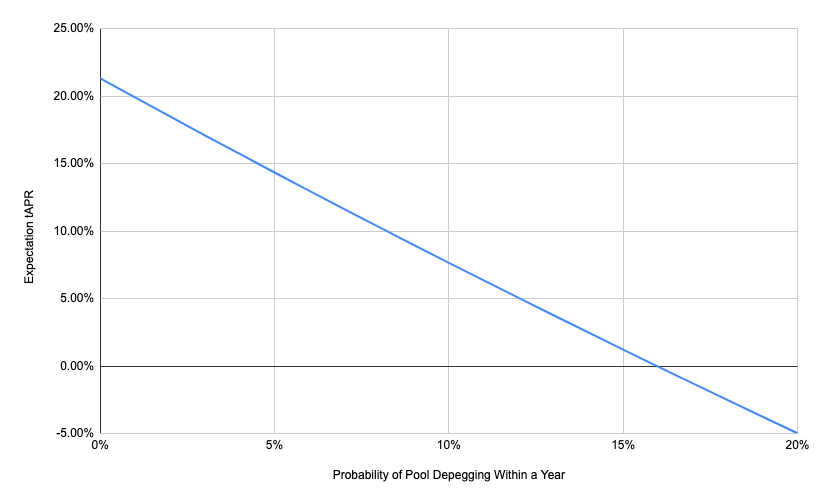

Let’s get dangerous! Imagine Conic launches a “high risk” USD-based yield pool, only containing the riskiest pools. Let’s plug in the four highest yielding pools, and we’ll assume there’s a very high risk that several pools could depeg.

21.31% yield would surely beat treasury bills, but high yield usually comes with high risk. Let’s assume any given pool has a whopping 1/4 chance of depegging completely. Commingling these probabilities, you expect it’s more likely than not that a pool depegs and you lose a lot of money.

You break even around a 15% chance of a single pool depegging.

It works out to be a linear dropoff, where you expect the full 21.31% only if you assign a 0% probability to a hard depeg.

Lots of caveats, but personally what sticks out is that I mentally ascribe the odds of USDD depegging to be somewhere at or above 100%. I’ll behave as if it’s a guaranteed loss if USDD sits in the mix. But your risk assessment may be different though.

If you want to play with this, feel free to copy the spreadsheet yourself.

For more from the Conic Forums, another good read on pricing methodology.

Disclaimers! Author has exposure to $veCRV, but not $CNC.