A few months ago we broke down the level of Curve’s decentralization of governance:

In light of recent events, it’s worth re-emphasizing the fact that on-chain governance is especially tricky!

TokenBrice nailed this in a recent thread, highlighting lesser-known mechanisms built into the Curve DAO design to promote healthy democracy.

To work, governance needs a clear and actionable scope

Ex: @CurveFinance governors control the $CRV allocation

Governances tend to fail when the scope is not properly defined

Ex: @MakerDAO governors voting on interest rates, yield strats, vision, etc.

🧵 Quickie thread 1/5 👇

For instance, Ser Brice discusses the importance of the poorly understood “emergency DAO” in the system of checks and balances. Also little known is the existence of a time-weight decay on voting, to incentivize participants to show their cards early and avoid sudden swings.

There are also other tampering mechanisms in place on CurveDAO to make sure we don't see large result swings in the last minutes as tolerated on Maker or Uniswap governances

➡️ Reduce effective voting weight as time goes on to push large players to express votes early

3/5 👇

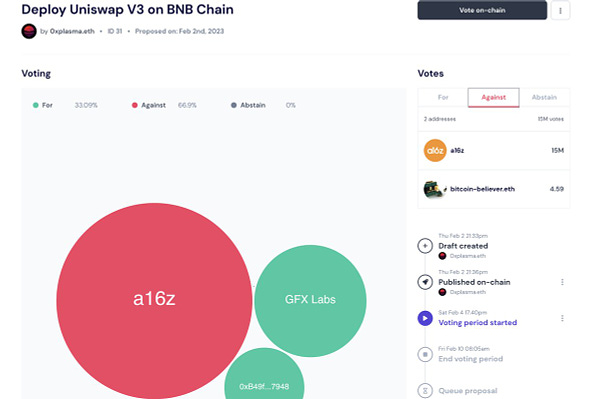

In contrast, a recent vote on a rival AMM is raising appearances of a tin-pot dictatorship.