Impermanent Sunshine of the Lossless AMM 😎🧠

Will Yield Basis eradicate our haunting memories of impermanent loss?

“Blessed are the forgetful, for they get the better even of their trading losses”

— Impermanent Sunshine of the Lossless AMM, probably

Is there anything you’d like to forget more than your worst trades? Perhaps modern technology has the cure… and it doesn’t even involve frying your brain synapses!

Science may be close to solving impermanent loss, and you can guess who has solved it…

In truth, the members of the Curve team I chatted with were all surprised by the announcement. We heard the news through public channels like everybody else. So we’re just speculating based on what is presently available.

Unsurprisingly, we see Yield Basis is highly Curve-aligned. Their pitch deck declared 10% of its tokenomics was set aside licensing Curve technology. It’s only natural Mich would be work to the benefit of his, and everybody’s, veCRV bags.

The article also point to a variety of intersections with Curve. Specifically, Yield Basis provides high yield on blue chip cryptocurrencies like BTC and ETH, providing 2x leverage potentially without impermanent loss. One intersection the article notes with Curve is that “liquidity providers borrow additional funds in the form of crvUSD.”

One imagines the success of Yield Basis becomes an additional application which may help crvUSD in scaling, joining ranks with Resupply in the hopium reserves.

Llama Party: Resupply 🦙🎉

Grab a flute of champagne or sparkling cider and prepare to join us today for a New Years Themed Llama Party on the topic of Resupply, with Boz + Cryptovestor!

We haven’t checked prices in a while, but we are perfectly capable of guessing how the market reacted to very cool and patently good news for Curve.

Eliminating impermanent loss has long been a pipe dream. Many attempts have backfired catastrophically, leading to massive losses by LPs. However, Mich has a history of accomplishing feats that once seemed impossible.

The article suggests he believes IL can be solved by an application of the CryptoSwap AMM to actively concentrate liquidity. If you consider the past few years of TriCrypto pools to be something like training data that can be used to apply his algorithm toward the more complicated problem of leveraged versions of the asset, the evolution makes sense. Perhaps next modern science will crack memecoins…

We’ve long believed the applications of the CryptoSwap AMM are yet to fully manifest. One might argue one related example is the success we’ve seen lately with the Strategic Stablecoin Reserve supplanting 3pool by cribbing CryptoSwap’s dynamic fee structure.

Strategic Stablecoin Reserve 🪦💐

Another weekend of crazy volatility! The Trade Wars may prove gory and prolonged!

Of course, anything we can say about Yield Basis is pure speculation until such time as we actually see more code. The article also quoted that we would see “no updates till mainnet release” so all anybody can offer is just guesswork.

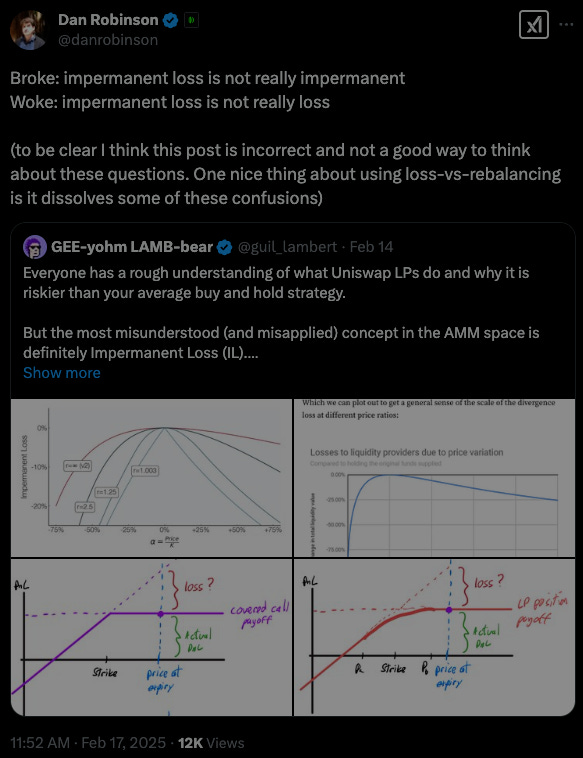

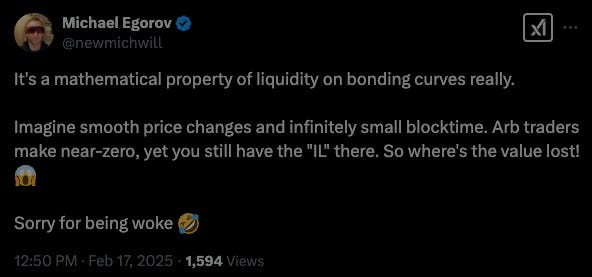

However, in hindsight, we may be able to pick up some additional clues from his recent public debate on some possibly related topics.

In the green corner, Dan Robinson of Paradigm.

In the… multicolored 4d corner… Mich from Curve…

Is this related to Yield Basis? What on earth are they talking about? And most importantly… can you profit? Perhaps…