Another weekend of crazy volatility! The Trade Wars may prove gory and prolonged!

Aave, the reigning champion of DeFi lending, enjoyed $210MM in liquidations, accruing zero bad debt in the process.

How did loans protected by LLAMMA’s Automated Loan Protection fare?

Those hoping for a redo of the legendary death spiral of ‘24 would be disappointed. Liquidation protection can do wonders.

For a rehash on the incident from last year:

June 13, 2024: Death Spiral ☠️🌀

Last night, the myriad Curve haters scored their biggest “W” to date.

The great Saint (Llama) Rat has also been chronicling in public about the experience of soft liquidation:

The note to repay a few % is the best practice when you fall into “soft liquidation” mode. It’s true that you can sit in or under your liquidation range for quite a while, but sometimes a violent upward price movement can actually be enough to liquidate you. Repaying a small amount, even a few percent, while you are in this mode can be beneficial.

For more background, Ser Rat is not actually a fan of hyperleverage, but all the same has enjoyed it as an experiment.

Emphasis on that last sentence…

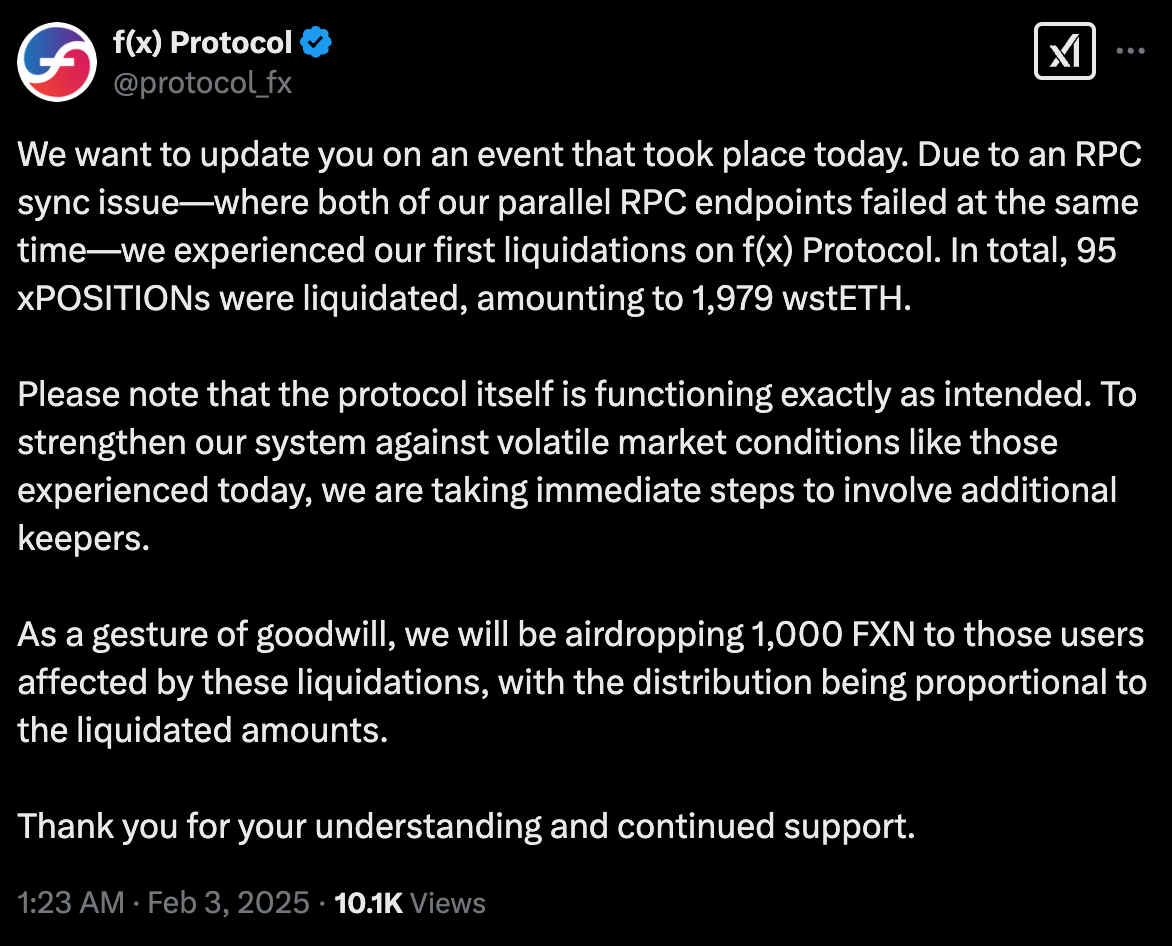

The intrepid rodent also described getting bit by the incident which affected f(x) Protocol in which dual RPCs crashed, causing some fluke liquidations. They plan to airdrop $FXN to the users affected.

The good news is the bulk of the architecture proved quite resilient in the face of the incident.

Extreme and imaginative events that defy the imagination happen constantly in DeFi. Earlier this month f(x) Protocol was also hit by an unprecedented attack in which block builders controlled three blocks in a row to execute an unusual attack. Thankfully the damage in this case was limited.

The team wrote a great and clear writeup in the aftermath that’s worth a read:

Strategic Stablecoin Reserve

At the other end of the extreme volatility, you can always flee toward the safety of stablecoins. All the risks of hacks and exploits, but with much more modest gains! Fortunately, as our industry matures, stablecoins are getting more robust and, well, stable.

A fringe benefit of parking your money in stablecoins is exposure to the US dollar, which so far has benefited from the trade wars.

The past 24 hours on Curve saw some healthy volume.

Most of these in double digits vAPY! The outlier is second place, the good ole’ 3pool. It could only muster 3.6% vAPY if the craziness of the past weekend continued for the rest of the year. Not impossible, given the occupant of the Oval Office, but even this would be below current treasuries yield.

Part of the issue is 3pool was launched in the prior generation of Curve pools. Newer pools, based on the StableSwap-NG with a dynamic fee structure, have been printing for months.

We’ve been looking into the phenomenon of high APY pools for at least half a year:

October 24, 2024: Yield of Dreams ⚾🏟️

Curve and Reserve Protocol’s USD3 agree… the next big narrative might well be yield-bearing stablecoins!

If only 3pool had been launched on this newer generation architecture, right?

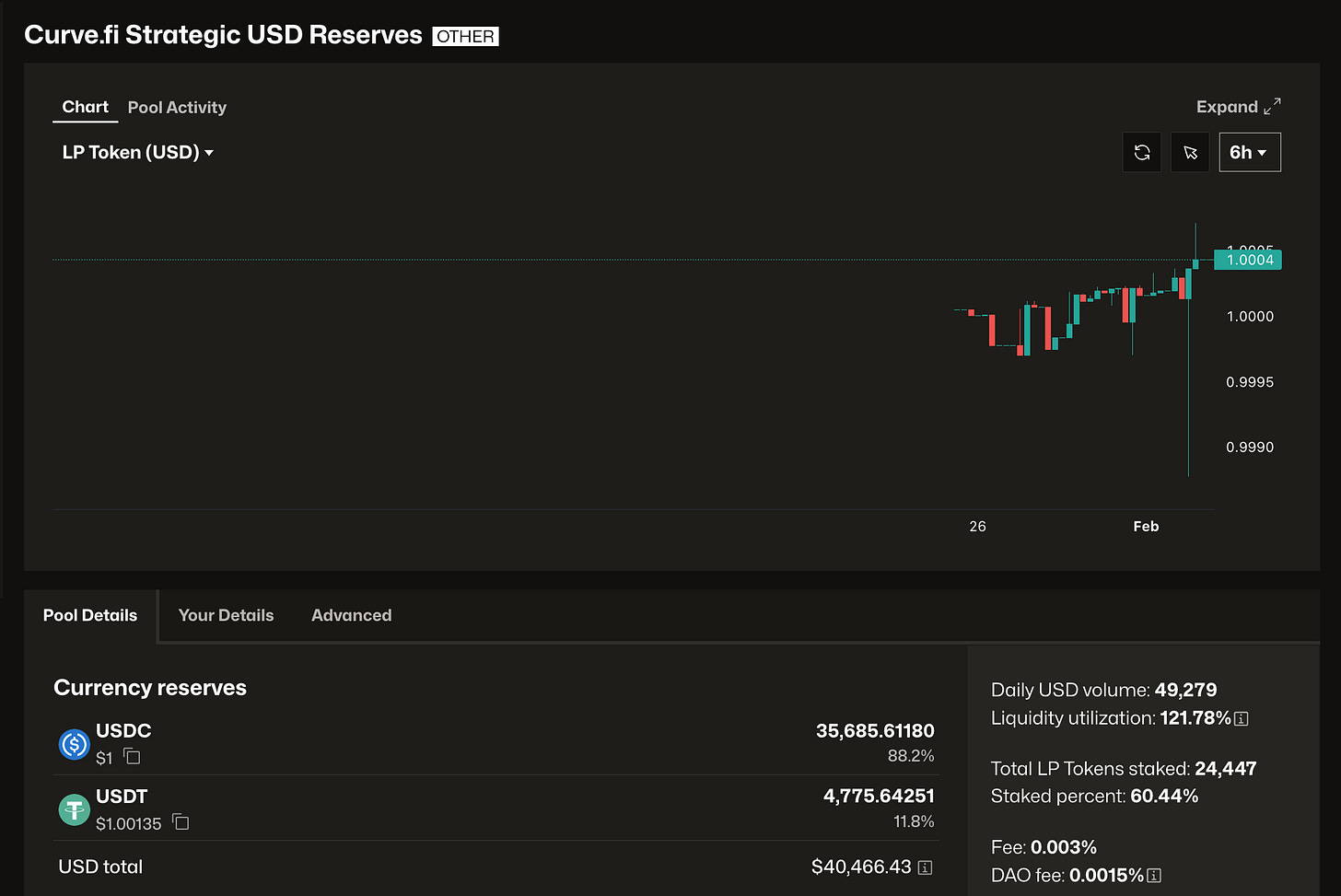

Might this have something to do with the newest sovereign wealth fund? As the markets have been wild, an interesting pool popped up on Curve recently, called the Curve Strategic USD Reserve. It resembles 3pool, but in a parallel multiverse in which $DAI said die and Do doesn’t do time:

With just $USDC and $USDT, it also sports an absurdly chaddish A parameter of 20,000. A higher A parameter can be thought of as a bet that an asset is more likely to repeg. The 3pool had carried some of the safest stablecoins and has an A parameter of 2000. The A parameter of 20,000 implies a bet that $USDT and $USDT would remain perfectly redeemable, even if Earth devolved into nuclear armageddon while getting pummeled by asteroid s.

We would, indeed, feel cozy in this pool.

DISCLAIMER: we are long the Strategic USD Reserve, aka $crv2pool!

Behind the paywall is our case for why yield farmers might also want to consider LP-ing.