Some bad news, fam. Turns out the flywheel may be more of a death spiral, per a new thread.

As much as you’d surely like me to call them names and nitpick minor spelling mistakes, I’ll leave that to my alt accounts. On the L1 account we respect intelligent questions and critiques of Curve, because we’re all trying to figure this out together.

Overall, the thread is well researched and worth reading, even though it hasn’t convinced us to panic sell just yet.

Let’s dive in. The first several tweets point out, accurately, that v1 trading fees are quite a bit lower than the $CRV emissions. This is not really contentious. Everybody wants the boosted rewards, the trading APYs are miniscule in comparison.

Still, let’s consider the trading fees for a bit. The trading fees have been around $1MM / week for a fair amount of time. Are they stuck?

From my time observing Curve, my anecdotal take is that trading fees appear to be more correlated with the global TVL within all of DeFi, as opposed to anything Curve specific. I wasn’t able to crunch the numbers on this point in time, so this would be good fodder for future analysis. The period of flatlining Curve fees the author points out also overlaps with a period where DeFi volume overall was fairly flat.

I’d hypothesize that if we see DeFi TVL jump 10x, from ~$300B to $3T, we’d also see Curve trading fees jump by about 10x. The need to trade volume among various coins usually has more to do with traders needing some specific coin for some specific external reason. Thus, Curve’s trading activity is a better benchmark of the overall health of DeFi than anything about Curve.

An interesting side note here is that Curve does very well when prices suddenly tank. The biggest BTC price drop in this period was the plummet from $56K to $49K in the span of a day. This happened the week of December 1st, the only week trading fees hit above $2.6M. This ties somewhat to the utility of Curve as a liquidity center 0xHamZ raises, which we’ll revisit later.

In sum, the LP trading fees is a nice perk if you want to earn dollarcoins, but dollars have the worst ponzinomics, so that’s a garbage prize. The big reward is indeed the token emissions of $CRV and $CVX. This is where 0xHamZ introduces the potential of a “death spiral” — what happens if these protocol tokens lose value? Suddenly the rewards are worthless and the house of cards collapses.

It’s not a crazy concern. What would happen if Curve’s price plummeted? If LPs run away and total volume locked collapses, it could be the end of Curve.

To date, we’ve not seen this happen. Most commonly it’s not just $CRV dropping in a vacuum, usually the price of $BTC and $ETH nukes, and all altcoins take a haircut at the same time. We’ve certainly seen this play out several times. In fact, in most of these cases Curve TVL actually increased. In such a bear market, DeFi becomes an utter wasteland, and even with reduced yields, Curve becomes the best oasis.

We don’t completely dismiss 0xHamZ’s concerns on the basis of this evidence though. The scenario we have not seen play out is $CRV price nuking while the rest of the market stayed strong. We saw something similar happen to $OHM this past week, where its market share evaporated while the rest of the market stayed fairly static. We necessarily have to veer into speculation here, since we’ve never seen this exact scenario play out.

While we’re making assumptions, let’s assume it’s a random price drop — the protocol was not hacked, no sudden outflow of liquidity. It’s just business as usual but $CRV drops to $1 and stays in this range, with $CVX also dropping proportionately. This seems to be the fairest assumption — if Curve prices declined because the contracts were demonstrated insecure, that’s a whole other scenario to deal with.

The first thing to note is that the effect of the veCRV earning trading fees always serve to provide a nice built-in floor. Absent other effects, we don’t talk about a $CRV price drop to $0.01 because it’s too illogical. The trading fees alone would make this a near instant arbitrage opportunity. So even ignoring all else, there’s a guaranteed minimum if trading activity continues.

Other than trading fees, the other primary benefit of the $CRV token is the governance rights. The most obvious use case is to steer incentives to different pools. The common ape may not derive much value from this, but some protocols have real demand to attract liquidity to their Curve pool so whales can play with low slippage.

The cvxCRV factory pool is a good example. $CRV can always be locked to mint $cvxCRV, but the reverse is not necessarily true. The factory pool provides the capability of moving in reverse, ensuring a strong peg. The flywheel could break down without this peg. This is but one example — imagine what happens to Lido if their $stETH peg broke?

In the universe where $CRV price has plummeted to, say, $1, what happens? The need for protocols to keep liquidity in these pools remains mostly unchanged. What’s changed is that the LPs are getting squeezed. Their APY plummets, and in the nightmare scenario they grow fed up and leave en masse.

What’s missing in this nightmare scenario is where they move their money to get better returns. Are they cashing it out into their bank account and earning 0.05% interest? Are they going to Uniswap where they’re quite likely to actually lose money?

To date, no protocol has shown more of an obsession with attracting liquidity than Curve, to the point where some have accused Curve of overpaying for liquidity. Yet even when things turn sour, LPs have tended to ride it out with Curve.

The death spiral scenario for Curve more or less relies on a more attractive destination for liquidity. This is piece I think is missing in 0xHamZ’s thread. It’s not sufficient to prove that falling APYs are bad for LPs. There must also be a superior place to park $20B+ worth of liquidity.

Absent a better destination, LPs just suck it up and keep their money in Curve pools at reduced yields. Protocols that rely on keeping their peg still compete relative to other protocols to keep this liquidity. Perhaps given the diminished rewards, these fights may become more intense.

Some protocols might sweeten the pot by chipping in their own protocol token rewards on top of Curve emissions. Extra token rewards kept Curve LPs quite happy in the past before Convex came along. The promise of extra rewards in a bear market is enough to stop LPs grumbling and make them happy they kept their money in Curve.

Other protocols might decide the best way to keep their pool well stocked is to incentivize LPs to their pool relative to the other pools. Since $CRV is cheap in this universe, they may just buy extra $CRV to grow their share of the pie, so they go from 2% to 4%. Now… what happens to the price of $CRV if protocols start buying up supply when it’s cheap 🤔🤔🤔

So the concerns raised are fair, but the raw incentives baked into the $CRV token make us not see the need for alarm. We’re happy to keep the debate going here or on Twitter, as many other users are effectively articulating this case:

A few additional points. None of the above really gets into the effect of Convex, which serves as a bit of an amplifier. The focal point of activity for influencing emissions has moved from Curve to Convex, but the effects as described above remain the same whether this focal point is on Curve or Convex.

To the questions about if LPs find themselves overly diluted as liquidity increases, again this comes back to the protocol owners’ willingness to subsidize liquidity. If one protocol tapers off, others may step in to pick up the slack.

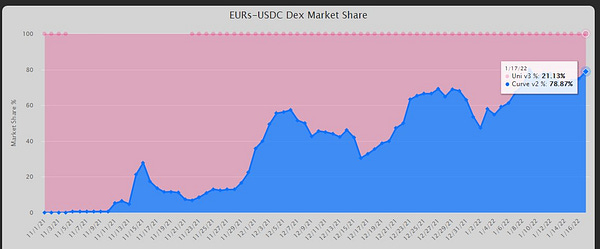

Finally, even though we more or less dismissed trading fees as being largely irrelevant except at the absolute floor, it’s not at all obvious that v2 pools won’t cause a significant increases in trading fees. Presuming v2 pools provide several high liquidity, low slippage hubs for high value transactions, Curve v2 routing may ultimately prove the most attractive option for most whale-sized trades, a large and mostly untapped market.

We know that the unique composition of v2 pools makes them uniquely attractive option for liquidity providers. Volatile pairs are terrible places to LP elsewhere, but Curve v2 pools dampen the effects of price swings. 0xHamZ claims the market for trading volatile-priced assets is not very significant.

While it’s entirely possible the size of this market is overstated, we disagree that it’s a small prize. At minimum, we think the capability to move between differentially priced assets is significantly larger than same-priced assets. If nothing else, it creates a new market for speculators who might be interested in buying relative dips in valuations.

We’d also argue that current markets don’t serve whales very well, who may need to move very large volume of funds but currently have few options to do so without heavy slippage. Curve’s focus on low slippage makes it fairly uniquely equipped to accommodate whale trades. We’ve already seen Curve coax out the whales just within v1 pools.

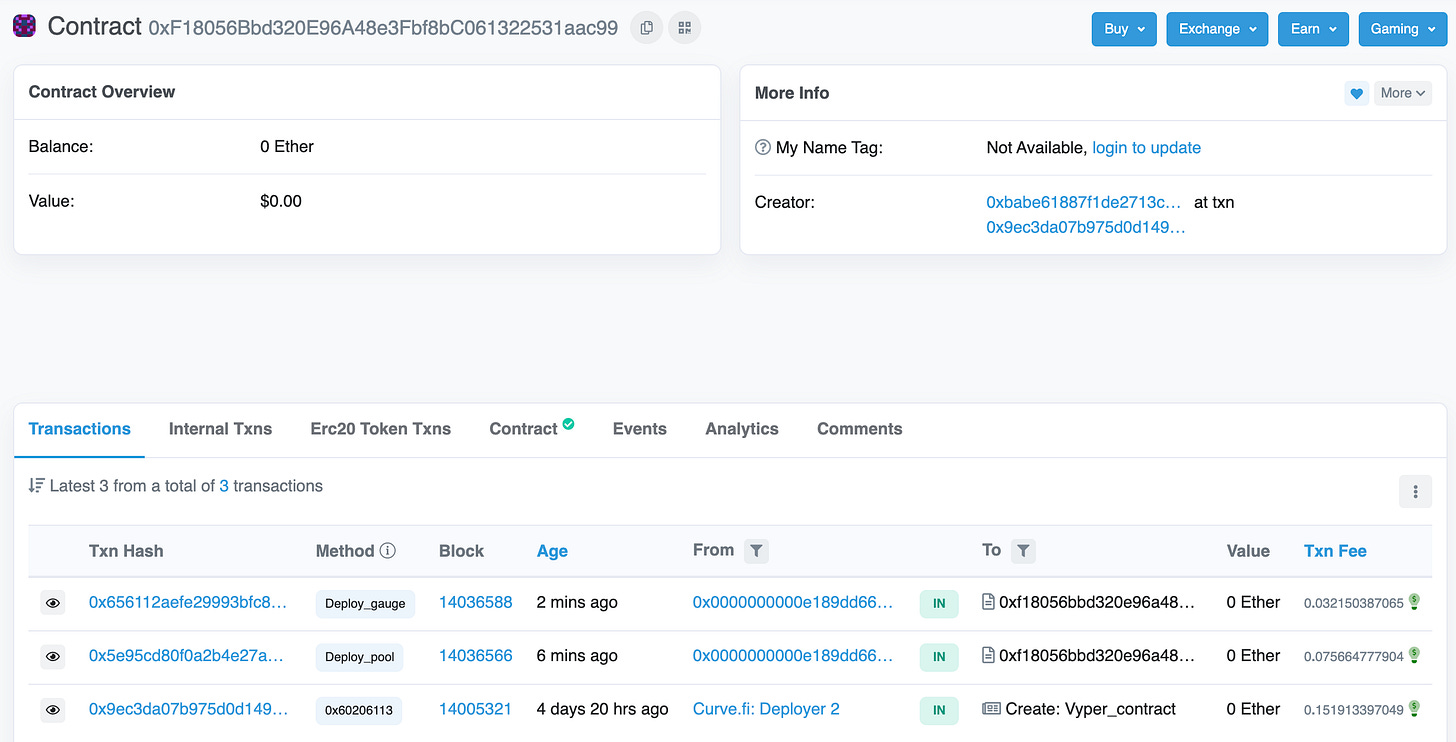

Curve v2 is in its larval stages, yet already seeing big activity emerging.

The few pools launched so far suggest that Curve is likely to become a major player in this market.

Given that math chad Michael Egorov has been fixated on solving this problem for years now, we certainly don’t plan to bet against him. The only thing missing thus far is seeing heavy usage of a v2 factory, and even this may be showing murmurs of life…