Here are today’s trends to watch from Curve Market Cap:

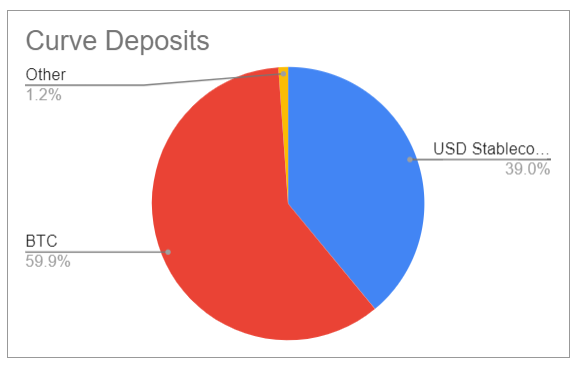

The Curve community may have a reputation as ETH-heads, but thanks to rising prices it’s technically a bitcoin dominant community.

Less than a month ago, Curve launched three new bitcoin pools, all of which remain at the bottom of the list by reserve volume.

Of these newest pools, $oBTC from BoringDAO is showing the most traction. At the moment, it’s the only BTC pool returning >1% trading fees with rewards north of 15%.

Most of this is a reflection of macro trends. In the past two months, oBTC supply has exploded, bucking the recent arson of wrapped BTC. At its current rate, oBTC could surpass imBTC on the leaderboards.

Unlike most wrapped assets, BoringDAO backs tunnel with a double-pledge model, generally holding 200% collateral on its assets. This can provide extra security in the event of black swan events, which some traders fear is impending:

Note that OpenDAO’s BTC generally goes by the tag $oBTC despite earlier going by $bBTC, which refers to Binance BTC on Curve and elsewhere.

An additional aspect working in $oBTC’s favor is the big moves by the active BoringDAO community. Among other moves, just this past week the $BOR governance token launched on Huobi and Dodo:

We wish the entire team, and all our readers, a very boring 2021!

For more info, check our live market data at https://curvemarketcap.com/ or our subscribe to our daily newsletter at https://curve.substack.com/. Nothing in our newsletter can be construed as financial advice.